Money mules: 14% of young people willing to hand over bank card and PIN to a stranger

11 December 2025 - 6 min Reading time

Febelfin conducts annual research into how young people deal with the phenomenon of money mules. The most recent study, carried out by Indiville on behalf of Febelfin*, shows that young people remain a particularly vulnerable group. Despite ongoing awareness campaigns, the risk is still high that they will lend their bank card and PIN to criminals – often without realising the consequences.

What is the role of a money mule?

A money mule is someone who makes their bank account, bank card and PIN – knowingly or unknowingly – available to criminals for money laundering. This type of fraud allows criminals to deposit illicit funds, obtained for example through phishing, into the money mule’s account. The money mule then withdraws the money or transfers it to other accounts. This keeps criminal organisations out of sight, while the money mule bears the heavy consequences.

“Without money mules, phishing cannot work. They are a crucial link in the fraud chain.”

From message to money mule: it happens faster than you might think

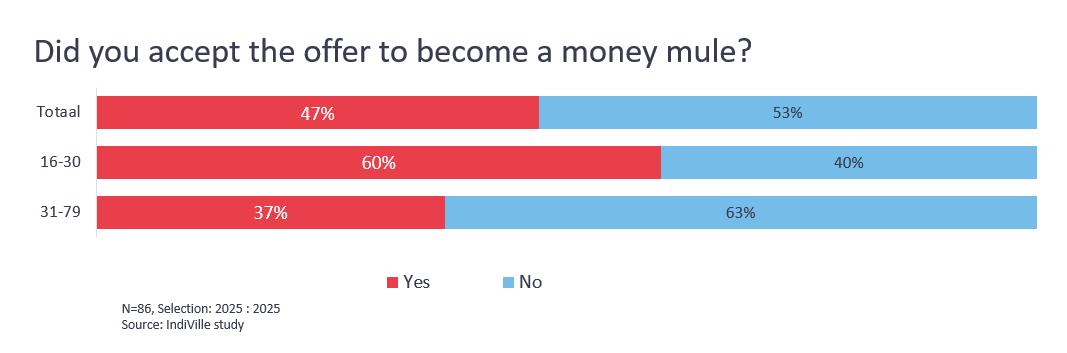

The temptation is great: young people are lured via social media, email or other online channels under the guise of quick and easy money. The research shows that 7% of young people have already been directly approached to become a money mule. Another 12% know someone who has been contacted for this. Of those who were actually approached, more than 60% accepted the offer.

Young people: an easy target

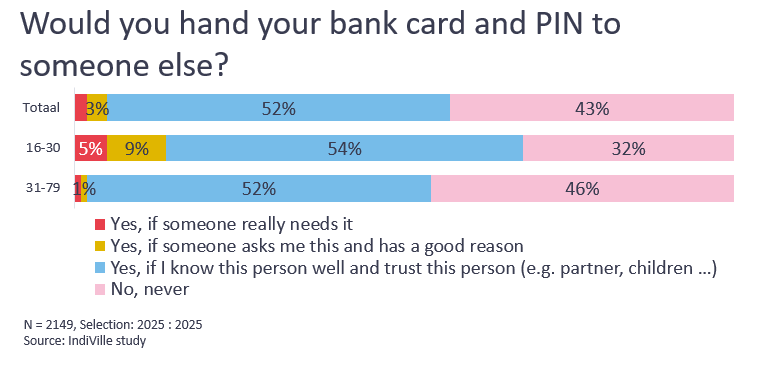

Although efforts are being made to raise awareness among young people, their vulnerability remains high. For example, 14% of young people (aged 16–30) say they are willing to hand over their bank card and PIN to a stranger. By comparison, this figure is 5% for the general population.

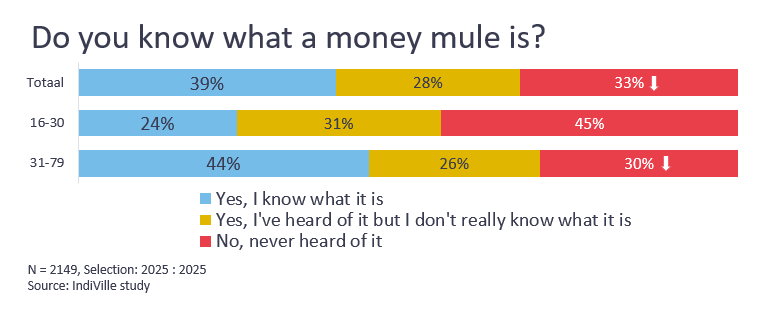

Knowledge about the phenomenon is still limited. Only 24% of young people know what a money mule is, while 45% have never even heard of it. Awareness is slightly higher among the general population, with 39% being familiar with the term.

The consequences are severe

Anyone acting as a money mule risks:

- Criminal prosecution

- Heavy fines and compensation claims

- Problems opening a bank account or applying for a loan

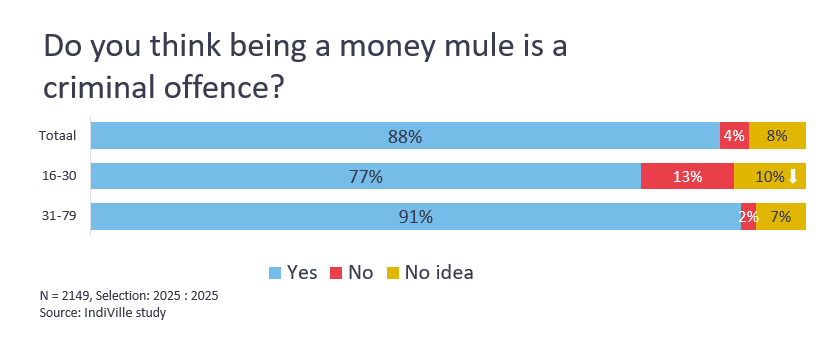

Young people are insufficiently aware of the criminal nature of this type of fraud. Although 77% of young people know that being a money mule is illegal, 13% still believe it is not. Among the general population, awareness is higher: 88% know it is a criminal offence.

Awareness remains essential

The figures show that knowledge of money mules among young people is still too low. Moreover, they are not sufficiently aware of the far-reaching risks. Awareness and education therefore remain crucial. Febelfin continues to focus on targeted campaigns, workshops and educational materials for both young people and their supervisors.

The following materials are available on our website to help raise awareness among young people:

- Workshop on money mules (only in Dutch/French) for teachers to deliver independently during lessons. The workshop promotes awareness, critical thinking and digital resilience.

- Brochure for young people with all the information about this type of fraud and how to protect themselves.

- Brochure for supervisors with practical tips and tricks for anyone who wants to help raise awareness among young people.

- Poster with the message “Easy money doesn’t exist” to print and use in schools.

- Dedicated website “moremoney.be” (only in Dutch/French) featuring Arto’s story as a money mule and tips to avoid falling into the trap.

- Educational video package in collaboration with ED TV (only in Dutch/French), supplemented with useful lesson sheets.

You can find everything about money mules and our initiatives on this page.

*IndiVille research, 20 January – 9 February 2025, on a representative sample of the Belgian population n: 2,149 NL/FR surveys, ages 16–79. Maximum margin of error: 2.1%