Safe payments during the holidays

16 December 2021 - 5 min Reading time

The holidays are approaching. That's also a busy sales period.

- People make their purchases both online and in physical stores, and they usually pay digitally. This has been the case in 2020 since the start of the corona crisis and that trend is continuing: people are more likely to use their cards in shops.

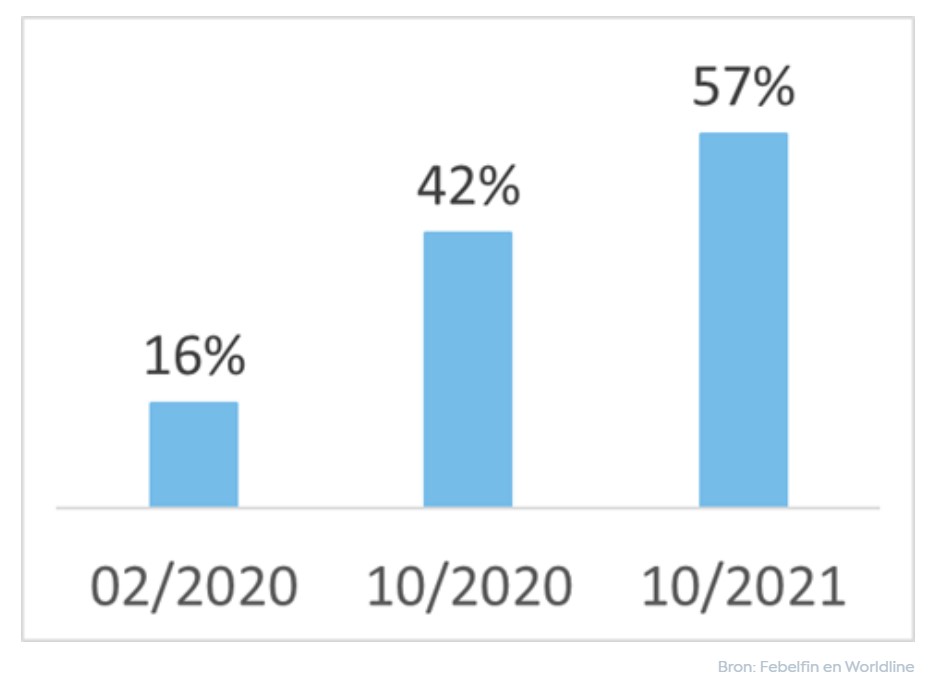

- This year, people also increasingly made contactless payments. In October 2021, we paid contactless in no less than 57% of payment transactions when people made a card payment. A huge increase if you consider that contactless payments accounted for only 16% of all card payments in February 2020.

- Febelfin is also happy to share some tips for paying securely during the holidays.

A digital and contactless 2021

2021 was another special year: we adapted and learned to live together with the coronavirus, while there was gradually more room to restart daily life. With the holidays just around the corner, a busy shopping season is starting: many people shop in online web shops, but people have also found their way back to physical stores. Recent figures show that digital payment remains the perfect way to pay easily and securely. People often pay digitally and contactless in physical stores: still completely corona-proof, and easy to use.

Cash withdrawals have been declining for several years now. With the start of the corona crisis in 2020 and the associated health measures, this decline accelerated, as shown in the graph below. Card payments, on the other hand, have more than recovered and are back above pre-corona levels.

Furthermore, contactless payment is becoming increasingly common: in October 2021 we paid contactless in no less than 57% of payment transactions with a card payment. The fact that this remains an easy and safe way to pay certainly contributes to this.

This way you pay securely for your end-of-year purchases

Digital payment is therefore a fast, easy and safe choice, whichever option you prefer (paying with the card in the store, contactless, via smartphone, a transfer or online payment). Febelfin would like to emphasize a few more tips to keep your payments safe this year.

Paying with the card in the store:

- Do not share the PIN code of your bank card with anyone and do not write it down anywhere.

- Shield the keyboard when you enter your PIN code and make sure no one can look over your shoulder.

- Have you lost your card? Or was she stolen? Then contact Card Stop immediately.

Paying with the smartphone:

- Never make payments over an unsecured Wi-Fi network.

- Use the most recent version of your payment app and make sure all updates have been made.

- Shield the keyboard when you enter your secret code and make sure no one can watch.

- Never share the code of your smartphone or banking app. Never write these down.

Online payment:

- Choose webshops that you know yourself.

- Check whether the payment zone of the website is properly secured: the web address starts with https (instead of http) and a padlock appears.

- Check the reviews of other customers and check whether the website follows all regulations: you must find information about returning goods, payment methods, ...

Phishers don't take a break

Fraudsters don't take a break during Christmas and New Year. Febelfin calls on you to remain wary of phishing messages. These may be camouflaged as beneficial year-end deals, or who knows, a fraudster on behalf of “your bank” may ask you to provide and update your bank details. Your bank and/or other institution will never ask you for your secret codes. Don't go into this.

With the tips below you can protect yourself:

- Never give your pin code or secret codes by telephone, email, text message or social media.

- Ignore messages that take you to a payment site or an app or site from your bank via a link. These may be false.

- Only make transfers in the bank's trusted app on your smartphone or via your bank's secure website.

Got scammed?

- Immediately block your bank card. Call Card stop.

- Contact your bank immediately.

- File a complaint with the police.