Statistics UCITs sector 1st quarter 2021

5 September 2021 - 7 min Reading time

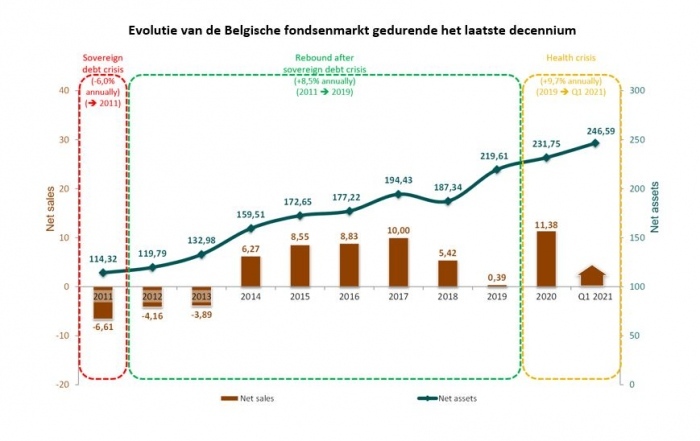

During the first quarter of 2021, the Belgian fund sector experienced an increase of 6.4%, primarily driven by approximately 70% from capital gains realized by the underlying assets and about 30% from net subscriptions. As of the end of March 2021, the net assets of publicly distributed funds in Belgium amounted to 246.6 billion EUR.

The net assets of funds primarily investing in non-fixed income securities, such as mixed funds and equity funds, rose by 8.4% during this period. Equity funds saw the largest increase in their net assets during the first quarter of 2021. Within the category of mixed funds, pension savings funds recorded an increase of 1.1 billion EUR during the period from January to March 2021.

The net assets of funds primarily investing in fixed-income securities decreased by 1.6% during the first quarter of 2021.

COVID-19 Pandemic: One Year Later

The decline in the Belgian fund sector during the first quarter of the previous year, due to the impact of the COVID-19 pandemic on the global economy and financial markets, is now fully behind us. Since the end of March 2020, the Belgian fund sector has grown by 55.5 billion EUR, with 42.2 billion EUR resulting from capital gains generated by the underlying assets.

2021 Outlook

Preliminary indications for the second quarter of 2021 suggest a continued growth in the net assets of the Belgian fund sector.

Belgian Fund Market

The Belgian fund market is defined as 'the publicly distributed net assets of funds under Belgian and foreign law' in Belgium. BEAMA reports on all share classes of publicly distributed funds that may be marketed in Belgium.

According to the list of public collective investment institutions on the FSMA website.

BEAMA's research shows that during the first quarter of 2021, the net assets of publicly marketed funds in Belgium increased by 14.8 billion EUR, or 6.4%. As of the end of March 2021, publicly marketed funds in Belgium represented 246.6 billion EUR.

The growth of the Belgian fund market during the period from January to March 2021 is mainly explained by positive market developments during this period, accounting for approximately 70%, and net subscriptions, accounting for approximately 30%.

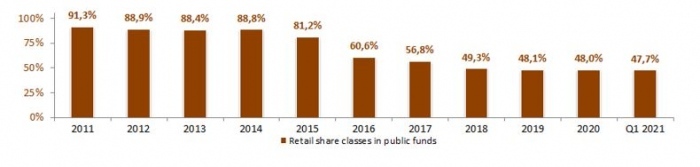

Percentage of retail share classes in the Belgian fund market:

BEAMA defines retail share classes as share classes that may be offered to individuals, with a minimum (initial) investment not exceeding EUR 100,000, and with no additional conditions imposed by the fund manager. Therefore, technical refinements were made to BEAMA's statistics during the first half of 2016.

Preliminary indications available to BEAMA for the second quarter of 2021 suggest a continued growth in the net assets of the Belgian fund sector.

Funds Mainly Investing in Non-Fixed Income Securities

Within the group of funds primarily investing in non-fixed income securities (such as equity funds), with the exception of capital-protected funds, only upward trends were observed during the first quarter of 2021. These increases are attributed to capital gains realized by the underlying assets (68%) and net subscriptions (32%).

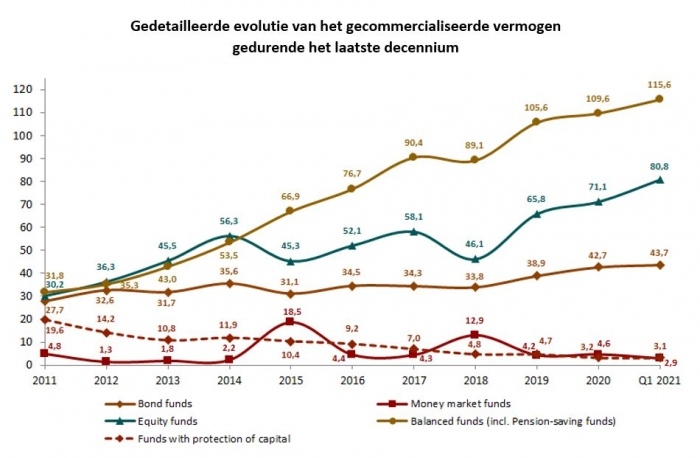

The assets in Belgium of equity funds increased by 9.7 billion EUR, or 13.6%, during the period from January to March 2021. This increase is mainly attributed to capital gains realized by the underlying assets (over 60%) and net subscriptions (almost 40%). As of the end of March 2021, the assets of equity funds amounted to 80.8 billion EUR. This puts equity funds 14.9 billion EUR above their level at the end of 2019 (pre-COVID-19).

The category of mixed funds (including pension savings funds) recorded an increase of 6.0 billion EUR, or 5.5%, during the first quarter of 2021. Approximately 75% of this increase is attributed to capital gains realized by the underlying assets. This brings the publicly marketed assets of mixed funds to 115.6 billion EUR by the end of March 2021, which is 10.0 billion EUR above their level at the end of 2019 (pre-COVID-19).

Mixed funds have experienced increasing success in recent years and have been the largest asset class since 2015. Due to their active asset allocation, mixed funds are well-suited for implementing a risk diversification policy under MiFID II, making them excellent for aligning the product with clients' risk profiles.

Within the category of mixed funds, pension savings funds recorded an increase of 1.1 billion EUR, or 4.8%, during the first quarter of 2021. Pension savings funds represented net assets of 23.3 billion EUR as of the end of March 2021. This establishes a new record for publicly marketed assets by pension savings funds.

During the first quarter of 2021, pension savings funds recorded net subscriptions of 138 million EUR.

During the first quarter of 2021, funds with capital protection experienced a decrease of 0.1 billion EUR and represented assets of 3.1 billion EUR as of the end of March 2021. This movement is attributed to net redemptions.

Funds Mainly Investing in Fixed-Income Securities

Within the group of funds mainly investing in fixed-income securities, the assets of publicly marketed bond funds in Belgium increased by 1.0 billion EUR, or 2.3%, during the first quarter of 2021, bringing their total to 43.7 billion EUR as of the end of March 2021.

This increase is entirely explained by net subscriptions.

The net assets of monetary or money market funds decreased by 1.7 billion EUR, or 37.9%, during the period from January to March 2021.

This decline is mainly due to technical interventions in the portfolios of mixed umbrella funds. Given the positive market movements in previous quarters, asset managers of umbrella funds gradually replaced their underlying stable monetary funds with bond funds and more volatile equity funds to take advantage of the recovery in financial markets. In other words, the technique of capital protection was increasingly set aside by mixed umbrella funds during previous quarters due to the financial market's recovery.

Funds under Belgian Law

Publicly Distributed Funds under Belgian Law

As of the end of March 2021, publicly distributed funds under Belgian law had a total managed net asset value of 184.5 billion EUR. At that moment, pension savings funds accounted for 23.3 billion EUR of this, representing more than 1/8th of publicly distributed funds under Belgian law.

The calculation of the average annual return of pension savings funds as of March 31, 2021, yields the following results:

- On 1 year: +23.6% (please note: this measurement starts just after the COVID-19 low point)

- On 3 years: +4.4%

- On 10 years: +5.4%

- On 25 years: +6.2%

BEAMA has developed a dashboard for pension savings funds, which is attached to this press release as an appendix. This dashboard provides key figures on third-pillar pension savings funds and their evolution in a concise visual format on a quarterly basis.

Non-Publicly Distributed Institutional Funds under Belgian Law

Since the implementation regulations were published in the Belgian State Gazette on December 18, 2007, investment vehicles tailored to institutional investors can be developed under the form of "Institutional ICB with a variable number of units of participation." These institutional funds are non-public funds that must be registered with the Federal Public Service (FPS) Finance.

These institutional funds should not be confused with publicly distributed funds with non-retail share classes, which are registered with the Financial Services and Markets Authority (FSMA).

As of the end of March 2021, the 118 institutional compartments under Belgian law represented 17.9 billion EUR in net assets. These funds appeal to many institutional investors, partly because they provide depth to the institutional markets in terms of financial assets and pension formation.