Figures UCITS sector 3th quarter of 2023

23 February 2024 - 11 min Reading time

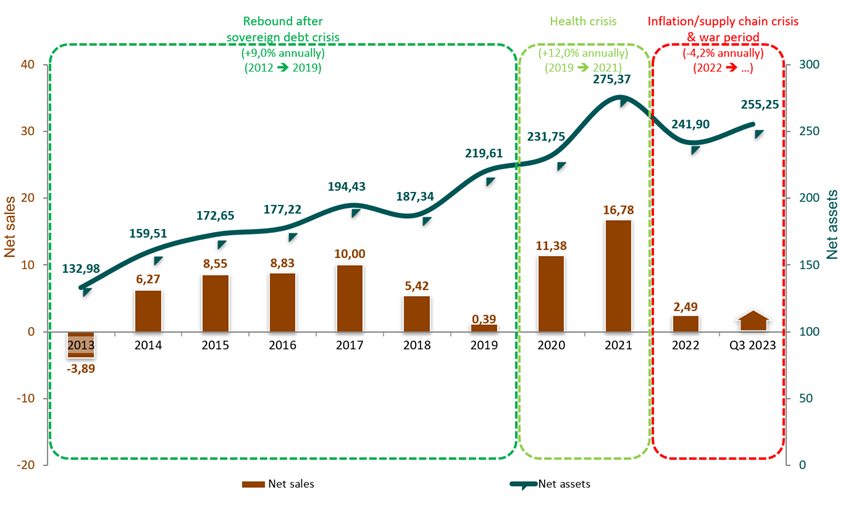

The Belgian fund sector fell down by 2,0 % in the third quarter of 2023, due to exchange losses in underlying assets. By the end of September 2023, the net assets of funds publicly distributed in Belgium amounted to EUR 255.2 billion.

- The net assets of funds investing mainly in variable-yield securities, such as mixed funds and equity funds, declined by -1.8% during this period. Funds with capital protection experienced the largest relative decline in their net assets during the third quarter of 2023. Equity funds experienced the largest absolute decline. Within the mixed funds category, pension savings funds experienced a decrease of -2.9% during the period July-September 2023.

- The net assets of funds investing mainly in fixed-income securities declined by -2.5% during the third quarter of 2023.

Both funds investing in fixed-income securities and those investing in variable-yield securities recorded exchange losses in their underlying assets during the third quarter.

A more varied picture can be observed in terms of net subscriptions. Thus, funds investing in variable-yield securities experienced net subscriptions during this period, whereas funds investing in fixed-income securities, driven by monetary funds, experienced net repayments during the third quarter.

First nine months

At the end of 2022, the net assets of funds publicly distributed in Belgium amounted to EUR 241.9 billion. The Belgian fund sector experienced an increase in net assets during the first half of 2023 in both quarters, mainly due to price gains in the underlying assets. The fall in net assets occurred only in the third quarter due to exchange losses in the underlying assets.

Over the first nine months, the net assets of the funds publicly distributed in Belgium stood at 5.5%, or EUR 13.3 billion, higher than at the end of 2022, four-fifths of which were due to price gains in the underlying assets.

Fourth-quarter 2022 forecast

Preliminary indications for the fourth quarter of 2023 point to a noticeable recovery in the net assets of the Belgian fund sector as a result of a stock market rally during the year-end (November and December).

Belgian fund market

The Belgian fund market is defined as "the net assets of funds under Belgian and foreign law publicly distributed in Belgium". In this regard, BEAMA reports on all share classes of public funds that may be commercialised in Belgium.

In accordance with the list of public institutions for collective investment on the FSMA website.

BEAMA research shows that during the third quarter of 2023, the net assets of funds publicly commercialised in Belgium fell by EUR 5.1 billion, or -2.0%. As a result, funds publicly commercialised in Belgium represented EUR 255.2 billion at the end of September 2023.

The decrease in the Belgian fund market during the period July-September 2023 is fully explained by exchange losses in the underlying assets during this period.

Despite the noticeable exchange losses in the underlying assets, slight net subscriptions were recorded in the Belgian funds market in the third quarter of 2023.

The, for now, sustained demand for funds suggests that Belgian investors currently still retain confidence in funds and are aware of the opportunity costs associated with the various forms of saving and investing.

The year 2023 started well, despite the downfall of Silicon Valley Bank during the first quarter. Yet, quietly, more and more uncertainty regarding the resilience of the global economy to current interest rate levels emerged in the markets. Continued volatility in equity markets, combined with concerns about global economic growth, translated into increased investor caution.

Despite these volatile market conditions, the Belgian fund sector increased by EUR 13.3 billion, or +5.5%, during the first nine months of 2023. This increase is 4/5th due to price gains in the underlying assets, and 1/5th due to net subscriptions amounting to EUR 2.7 billion during the period January-September 2023. This evolution is also confirmed by the NBB's statistical data.

Evolution of the Belgian fund market over the last decade

The preliminary indications that BEAMA has available for the fourth quarter of 2023, point to a noticeable recovery of the net assets of the Belgian fund sector driven by a stock market rally during the last quarter.

Funds investing predominantly in variable-yield securities

Within the group of funds investing predominantly in variable-yield securities (e.g. equity funds), only declining trends were recorded during the third quarter of 2023.These decreases are entirely due to exchange losses in the underlying assets.

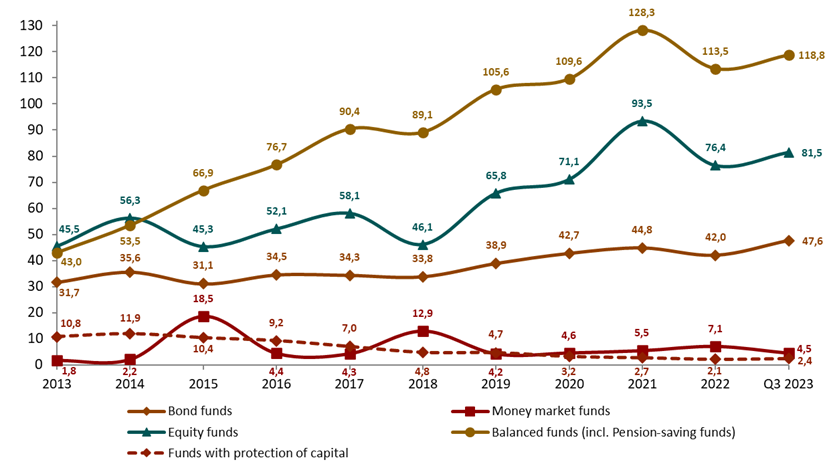

Equity funds' assets in Belgium fell down by EUR 2.0 billion, or -2.4%, in the period July-September 2023. This decline is almost entirely due to exchange losses in the underlying assets. At the end of September 2023, the equity funds' assets amounted to EUR 81.5 billion.

Detailed evolution of commercialised fund assets over the last decade

The mixed funds category (including pension savings funds) decreased by EUR 1.6 billion, or -1.4%, during the third quarter of 2023. This decline is entirely due to exchange losses in the underlying assets, as net subscriptions amounted to EUR 1.3 billion. The commercialised assets of the mixed funds therefore stood at EUR 118.8 billion at the end of September 2023.

The mixed funds have been increasingly successful in recent years and are the largest asset class since 2015. Due to their active asset allocation, mixed funds are well suited for a risk diversification policy under MiFID II: they lend themselves well to matching the product to clients' risk profile.

Within the mixed funds category, pension savings funds experienced a decline during the third quarter of 2023 amounting to EUR 0.7 billion, or -2.9%. The pension savings funds represented net assets of EUR 22.9 billion at the end of September 2023. During the third quarter of 2023, pension savings funds recorded net subscriptions amounting to EUR 140 million.

The funds with capital protection fell down during the third quarter of 2023 and represented assets of EUR 2.4 billion at the end of September 2023.

Over the first nine months of 2023, the net assets of funds investing predominantly in variable-yield assets increased by +5.4%, or EUR 10.3 billion.

Funds investing predominantly in fixed-income securities

Within the group of funds investing predominantly in fixed-income securities, the assets of bond funds commercialised in Belgium fell very slightly by EUR 0.1 billion, or -0.1%, during the third quarter of 2023, bringing them to EUR 47.6 billion at the end of September 2023. The exchange losses in the underlying assets remained very modest, and, in addition, very slight net subscriptions were noted.

The net assets of the monetary or money market funds declined by EUR 1.3 billion, or -22.2% during the period July - September 2023, bringing them to an amount of EUR 4.5 billion at the end of September 2023.

Over the first nine months of 2023, net assets of funds investing predominantly in fixed-income assets rose +6.1%, or EUR 3.0 billion.

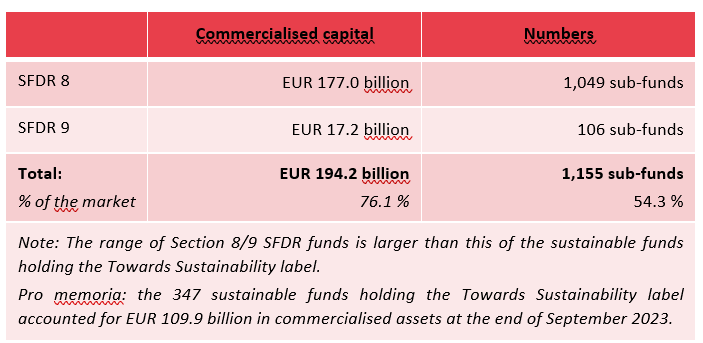

Sustainable funds (according to the SFDR-classification)

The table below summarises the distribution of sustainable funds in Belgium at the end of September 2023:

SFDR = Sustainable Finance Disclosure Regulation.

Section 8 = products that promote sustainability features;

Section 9 = products with a sustainability objective.

More than 3/4th of the assets distributed in Belgium are, according to the asset managers, classified as a SFDR Article 8 or an SFDR Article 9 fund. In this regard, investors interested in sustainability can choose from 1,155 different funds.

Funds under Belgian law

Publicly distributed funds under Belgian law

Public funds under Belgian law accounted for total net assets under management of EUR 191.0 billion at the end of September 2023. At that same moment, the pension savings funds represented roughly 1/8th of the public funds under Belgian law.

The calculation of the average return of the pension savings funds on an annual basis as at 30 September 2023 provides the following results:

- At 1 year: +6.5%

- At 3 years: +0.5%

- At 10 years: +3.4%

- At 25 years: +3.5%

BEAMA has developed a dashboard for pension savings funds which is attached to this press release. Thanks to this dashboard, key figures surrounding third pillar pension savings funds and their evolution are visually presented on a quarterly basis in a concise manner.

Non-publicly distributed institutional funds under Belgian law

Since the implementing Royal Decrees were published in the Belgian Official Gazette on 18 December 2007, investment vehicles can be developed tailored to institutional investors in the form of "Institutional UCI with a variable number of units". These institutional funds are non-public funds that must be registered with the FPS Finance.

These institutional funds should not be confused with the public funds with non-retail share classes, which are registered with the FSMA.

At the end of September 2023, the 102 institutional sub-funds under Belgian law accounted for EUR 23.1 billion in net assets. These funds attract many institutional investors, partly because they add depth to the institutional markets in financial assets and pension accrual.

These and other statistics concerning the UCI sector, are available on the BEAMA website (https://www.beama.be/) under the heading 'Statistics'.