The number of credit applications at its lowest point in 10 years

23 October 2023 - 10 min Reading time

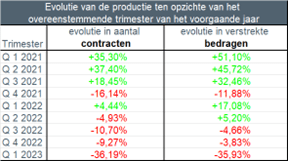

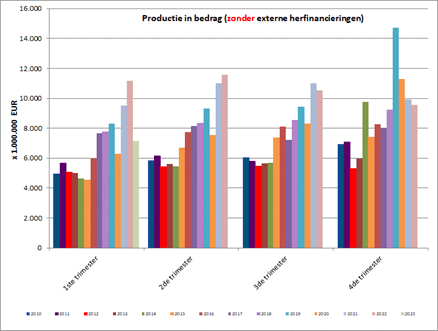

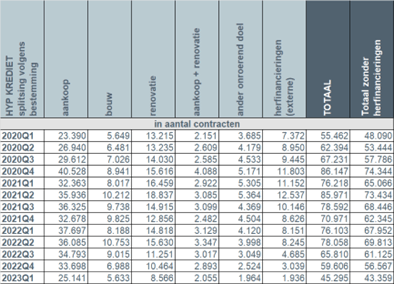

In the third quarter of 2023, approximately 43,500 mortgage contracts were concluded for a total amount of approximately 7.2 billion euros (excluding refinancing).

This represents a decrease in the number of granted credit contracts by nearly 29% compared to the third quarter of the previous year. Regarding the amount of credit granted, there is also a decrease of about 31% compared to the previous year.

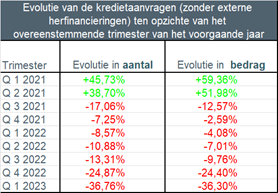

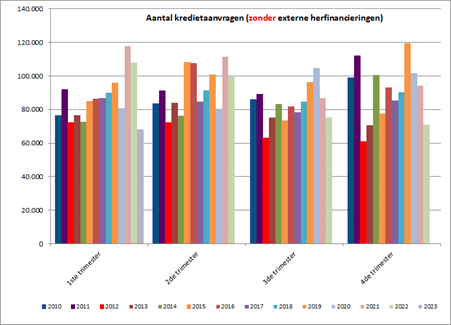

From the third quarter of 2022 to the third quarter of 2023, the number of credit applications has decreased by about 15.5%, excluding refinancing. The corresponding credit amount during the third quarter of 2023 has also decreased by approximately 14.5%.

These statistics are based on mortgage credit data published today by the Professional Credit Union (UPC/BVK).

De 50 leden van de BVK nemen samen ongeveer 90% van het totaal aantal nieuw verstrekte hypothecaire kredieten (de zogeheten productie) voor hun rekening. Het totale uitstaande bedrag aan hypothecair krediet van de BVK-leden bedraagt einde maart 2023 ongeveer 273 miljard EUR.

The number of credit applications is at its lowest point in 10 years

Comparing the numbers with those of 2022, it is evident that, as in the two previous quarters, the demand for credit remained very low in the third quarter of 2023. Consequently, the granting of credit has also substantially decreased compared to the previous year.

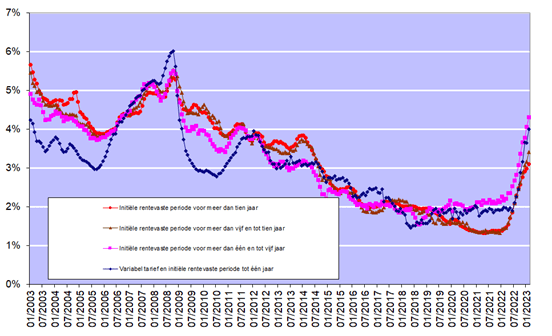

Mortgage interest rates have continued to rise over the last quarter. Based on data published by the National Bank of Belgium, these rates averaged around 5.26% (for loans with an initial fixed rate period of up to 1 year) and approximately 3.40% (for loans with an initial fixed rate period of more than 10 years) in August.

"The continuously rising interest rates and low consumer confidence, combined with real estate prices, continue to weigh on demand, leading to a decrease in the number of granted loans," said Ivo Van Bulck, Secretary-General of the Professional Credit Union.

Below are the main findings for the third quarter of 2023 compared to the third quarter of 2022 (Refinancing is not included in these figures):

- The number of credit applications (excluding refinancing) experienced a decrease of approximately 15.5% in the third quarter of 2023 compared to the third quarter of 2022. The total amount of credit applications also decreased by about 14.5% compared to 2022. This equates to slightly over 63,500 credit applications submitted for a total amount of just over 11.5 billion EUR.

- Mortgage loans granted saw a year-on-year decrease in quantity of nearly 29% in the third quarter of 2023. The corresponding total amount also decreased by approximately 31% compared to 2022. Around 43,500 mortgage loans were granted for a total amount of just over 7.2 billion EUR (excluding refinancing).

- Compared to the third quarter of 2022, the number of credit contracts for other purposes (-1,149, a decrease of -37.7%) experienced the most significant decline, as did the number of construction loans (4,786, a decrease of -53.1%). The number of renovation loans also decreased (-3,277, a decrease of -29.1%), as well as the number of loans for home purchases (8,062, a decrease of -23.2%). The number of loans for the purchase with transformation of a home (311, a decrease of -10.5%) also saw a substantial reduction.

- Similar to the previous quarter, the number of external refinancings (-3,140, a decrease of -67%) experienced a dramatic contraction in the third quarter of 2023, which is not surprising given the current climate of rising interest rates. Therefore, only about 1,500 external refinancings were recorded in the third quarter of 2023, with a total amount of approximately 200 million EUR.

- The average amount borrowed for home purchase remained stable at around 192,000 EUR in the third quarter of 2023. The average amount for a construction loan also remained stable at around 211,000 EUR in the third quarter of 2023. However, the average amount for a purchase + renovation loan continued to decrease, falling to approximately 188,000 EUR.

- During the third quarter of 2023, the vast majority of borrowers (97%) continued to opt for a fixed interest rate or a variable interest rate with an initial rate fixation period of at least 10 years. In barely 0.2% of cases, borrowers still chose loans with an annually variable interest rate.

I. The number of credit applications remains very low

The number of credit applications, excluding those related to external refinancing, experienced a decrease of approximately 15.5% in the third quarter of 2023 compared to the same quarter of the previous year. The underlying amount of credit applications also saw a decrease of about 14.5%. For the third consecutive quarter, the number of credit applications for the specified quarters (excluding refinancing) is thus at the lowest level since 2010.

The decrease in the number of credit applications has been observed for almost all purposes. The number of credit applications for home purchase (-5,439) decreased by -11.7%, that for home construction (-3,049, a decrease of -34%). The number of credit applications for home renovation (-2,459, a decrease of -20.5%) also significantly decreased, as did the number of credit applications for other purposes (-778, a decrease of -22%). Only the number of credit applications for home purchase + renovation (+41) experienced a slight increase of just under 1%. Furthermore, during the third quarter of 2023, the number of external refinancing applications continued to contract, specifically by -12%, which is not surprising given the current climate of rising interest rates.

II. Number of credits granted in the third quarter

As in the previous quarters, during the third quarter of 2023, the number of credits granted, excluding external refinancing, also experienced a decrease of approximately 29% compared to the third quarter of 2022. The corresponding amount also recorded a decline of about 31%.

The declining demand for loans thus resulted in a corresponding decrease in the number of loans granted.

III. Decrease for all credit purposes

In the third quarter of 2023, approximately 43,500 new loans were granted for a total amount of just over 7.2 billion euros – excluding external refinancing. This number is once again the lowest recorded in a third quarter in almost 20 years.

Overall, the number of loans granted decreased by about 29% compared to the third quarter of 2022. This decrease is observable for all credit purposes.

Compared to the third quarter of 2022, the number of loans taken out for home purchase (-8,062, a decrease of -23.2%), the number of loans for home construction (-4,786, a decrease of -53.1%), as well as the number of renovation loans (-3,277, a decrease of -29%) saw a significant decline. The number of loans for purchase with transformation (-311, a decrease of -10.5%) also experienced a reduction. The number of loans for other purposes (1,149) saw a decrease of -37.7%.

Furthermore, during the third quarter of 2023, the number of external refinancing applications witnessed a dramatic decrease of 67%. As a result, only about 1,500 external refinancing loans were granted, with a total amount of approximately 200 million euros.

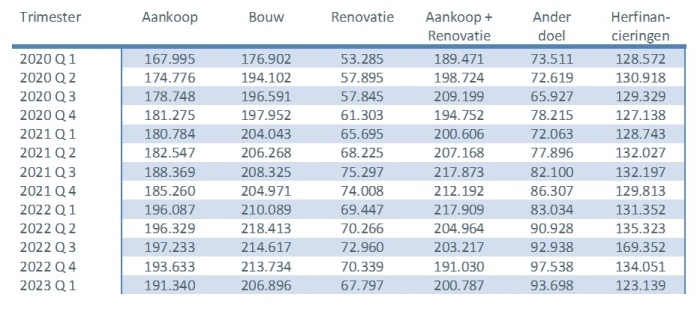

IV. Average loan amount remains stable

In the third quarter, the average amount of loans granted remained stable.

The average amount of a loan for home purchase fluctuated around 192,000 EUR during the third quarter of 2023.

The average amount of a construction loan also remained stable at around 211,000 EUR in the third quarter of 2023.

However, the average amount of a loan for home purchase + renovation saw a further decrease, falling to approximately 188,000 EUR.

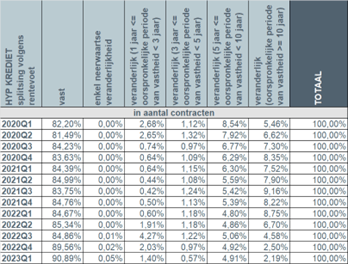

V. 97% of borrowers opt for fixed interest rate

During the third quarter of 2023, over 9 out of 10 borrowers, specifically 97%, once again chose a fixed interest rate or a variable interest rate with an initial rate fixation period of at least 10 years. Approximately 3% of borrowers favored a variable interest rate with an initial rate fixation period between 3 and 10 years. Only 0.2% of borrowers selected an annually variable interest rate.

Given the rising interest rates (see graph below), Belgian consumers continue to overwhelmingly prioritize safety. The number of people opting for a variable interest rate remains low. However, legislation also provides strong protection for consumers who choose a variable interest rate. In this way, after adjustment based on the changes in applicable reference indices, this rate can never exceed twice the initial interest rate.

Responsible mortgage lending remains the focus

The credit sector is and remains aware that great caution must govern the granting of mortgage credit and that responsible lending must remain the absolute fundamental principle. In this regard, the sector is aligned with the regulatory authorities: lenders must exercise all necessary prudence to, on the one hand, minimize individual borrowers from taking out excessive loans and, on the other hand, to preserve financial stability in the long term.