Strong impact of the coronavirus crisis on mortgage lending

24 July 2020 - 10 min Reading time

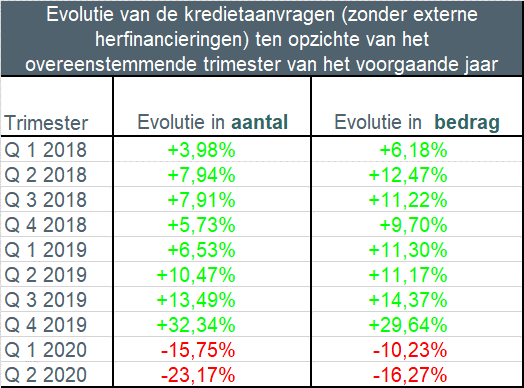

Excluding refinancing, the number of credit applications in the second quarter of 2020 decreased by 23% compared to the second quarter of 2019. There was also a decrease in the total amount by more than 16%.

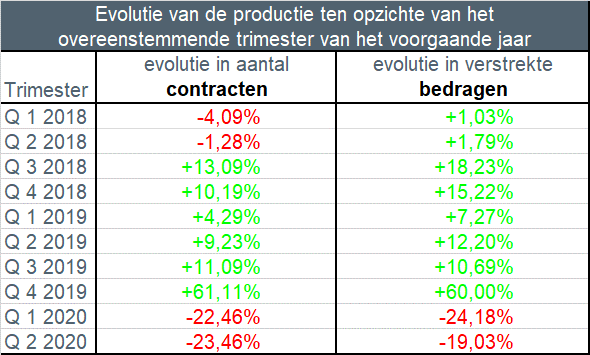

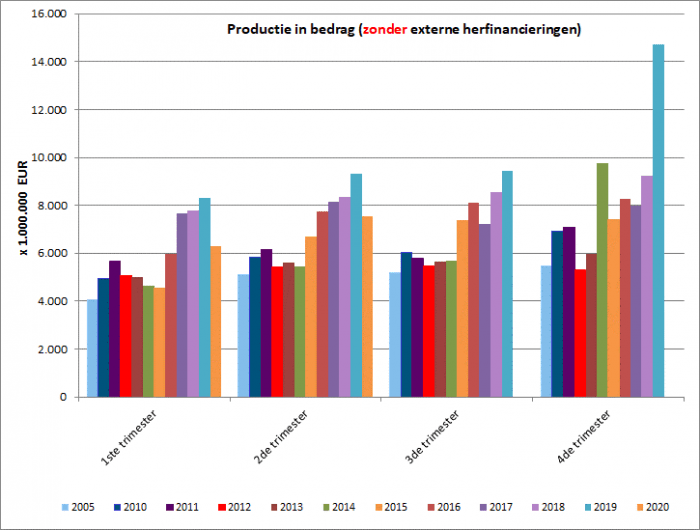

In the second quarter of 2020, nearly 53,500 mortgage credit agreements were concluded for a total amount of approximately 7.5 billion EUR (excluding refinancing). This is a decrease in the number of credit agreements by about 23.5% compared to the second quarter of the previous year. In terms of amount, there was a 19% decrease in the credit granted. These statistics are from the Mortgage Credit Barometer published today by the Professional Association of Credit (BVK).

De 58 leden van de BVK nemen samen ongeveer 90% van het totaal aantal nieuw verstrekte hypothecaire kredieten (de zogeheten productie) voor hun rekening. Het totale uitstaande bedrag aan hypothecair krediet van de BVK-leden bedraagt eind juni 2020 ongeveer 238 miljard EUR.

While the decrease in lending in the first quarter of the year was mainly due to the abolition of the housing bonus in Flanders at the end of 2019 and the many loans that were still concluded before the end of the year for that reason, the restrictive government measures related to the coronavirus crisis are largely responsible for the sharp decline in credit applications and lending in the second quarter. Its impact also varied significantly from month to month.

Feeling the impact of restrictive measures

As a result of the coronavirus crisis and the associated government measures such as the ban on non-essential travel, the closure of non-essential sectors, etc., notarial deeds in the notary office were kept to a minimum during the second quarter, although cases that had already started continued to be processed, and alternatives such as video conferencing for remote signing became available over time. Due to these measures, the number of real estate transactions also saw a sharp decline in the months of April and May.

The situation varied greatly from month to month. In April, almost half fewer credits were granted, especially for the purchase, construction, or purchase with renovation of a home. In the months of May and June, the situation somewhat recovered but still saw between 12% to 14% fewer credits granted. The increase in the number of credit applications in June may indicate a further recovery of the normal situation in the coming months

Wanneer voor het krediet een akte moet verleden worden bij de notaris, zal het pas in de statistieken worden opgenomen wanneer deze akte verleden is.

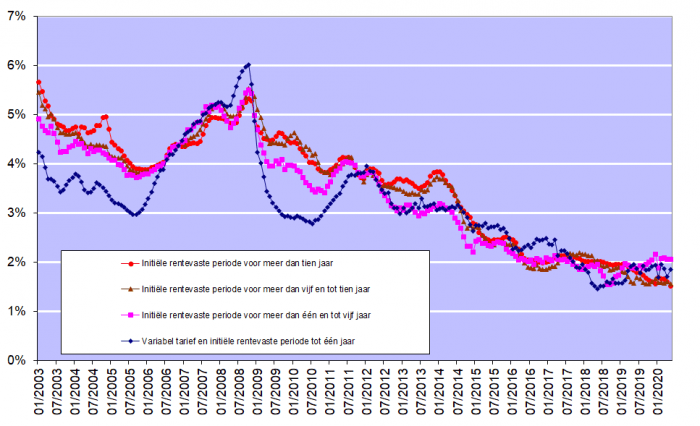

Despite the very low mortgage interest rates of recent years, these rates still applied in the second quarter of 2020. According to figures published by the National Bank of Belgium, these rates ranged from 1.52% (for variable-rate loans with an initial interest rate period of more than 10 years) to 2.06% (for loans with an initial fixed interest rate period of more than 1 year and less than 5 years).

The coronavirus crisis also had a significant impact on mortgage lending. Lockdown measures led to a very sharp decline, especially in the month of April, but the increase in the number of credit applications in June offers hope for the future.

Below are the key findings for the second quarter of 2020 compared to the second quarter of 2019:

- The number of credit applications (excluding those for refinancing) decreased by 23% in the second quarter of 2020 compared to the same quarter in 2019. The amount of credit applications also decreased by approximately 16%. However, there were still about 77,000 credit applications submitted for a total amount of just over 12.3 billion EUR. April and May saw significant declines of 40% and 32%, respectively, while June saw an increase of 24% compared to the previous year.

- The number of granted mortgage loans decreased by about 23.5% in the second quarter of 2020. The corresponding amount decreased by 19%. This means that slightly more than 53,000 loans were granted for a total amount of 7.5 billion EUR (excluding refinancing).

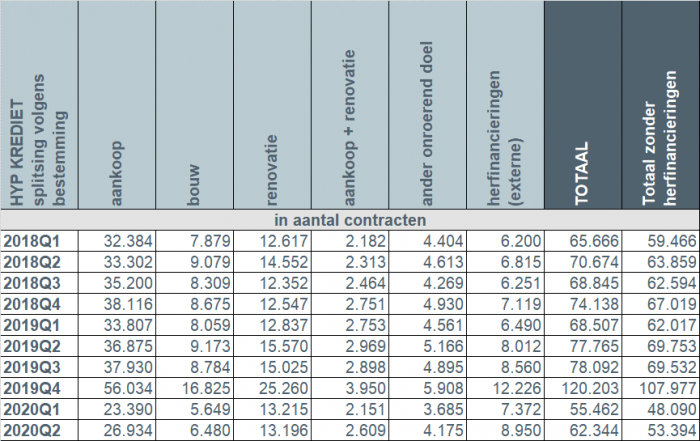

- The construction loans saw the largest percentage decrease, at -29.4% or 2,694 fewer loans than in the second quarter of 2019. The number of loans for home purchases (-9,942) decreased by 27%, while loans for purchases with renovations (-364) decreased by 12.2%. The number of building loans (-2,694) decreased by 29.4%. Loans for other purposes (-992) also decreased by 19.2%.

- Only the number of external refinancing (+938) increased by 11.7% in the second quarter of 2020. In total, nearly 9,000 external refinancings were granted for a total amount of nearly 1.2 billion EUR.

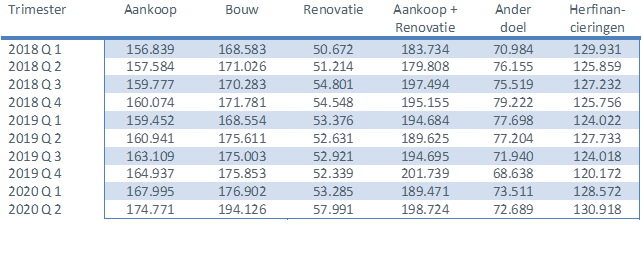

- The average loan amount for purchase + renovation increased significantly to just under 199,000 EUR. The average amount borrowed for home purchases also increased in the second quarter of 2020 to almost 175,000 EUR. The average amount for a construction loan reached approximately 194,000 EUR in the second quarter of 2020.

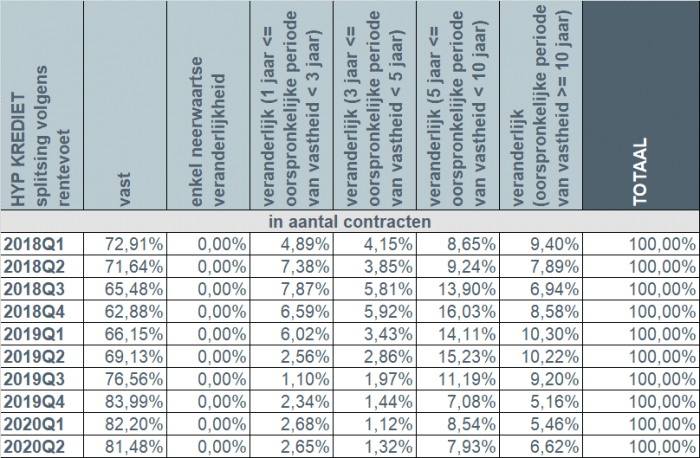

- In the second quarter of 2020, approximately 9 out of 10 borrowers once again opted for a fixed interest rate or a variable interest rate with an initial fixed-rate period of at least 10 years. In only 2.7% of cases, a credit with an annually adjustable interest rate was chosen.

Number of credit applications

The number of credit applications, excluding those related to external refinancing, saw a decrease of more than 23% during the second quarter of 2020 compared to the same quarter of the previous year. The underlying amount of credit applications also decreased by more than 16%."

The number of credit applications decreased for all purposes. Credit applications for the purchase of a home (-15,520) decreased by 27.2%, those for the purchase + renovation of a home (-761) by 14.1%. The number of credit applications for the construction of a home (-2,361, or -19.8%) and for the renovation of a home (-2,870, or -14.9%) also saw a decline, as did the number of credit applications for other purposes such as a garage, building land... (-1,834, or -25.2%). The number of applications for external refinancing also decreased by 6.5%.

Garage, bouwgrond …

April and May experienced significant declines of 40% and 32%, respectively. However, in June, there was an increase of 24% compared to June of the previous year.

Number of loans granted in the second quarter

In the second quarter of 2020, the number of loans granted, excluding external refinancing, decreased by 23.5% compared to the second quarter of 2019. The corresponding amount also decreased by 19%.

In April, there was the most significant decrease, approximately half (-46%), compared to the same month in 2019. There was also a decline in May (-13.6%) and June (-12.4%), but it was less pronounced.

As a result, the total amount of loans granted in the second quarter fell below the - still relatively high - level of 2016.

Decline in the number of loans for all purposes

In the second quarter of 2020, just over 53,000 new loans were granted for a total amount of approximately 7.5 billion EUR, excluding external refinancing.

Compared to the second quarter of the previous year, there was a decline observed for all purposes.

The number of loans for the purchase of a home (-9,942) in the second quarter of 2020 was 27% lower than in the second quarter of 2019. The number of loans for the purchase with renovation (-364) decreased by 12.2%, while the number of construction loans (-2,694) was 29.4% lower. The number of loans for other purposes (-992) decreased by 19.2%. The number of loans for home renovation also saw a decrease, specifically -15.2%, with 2,374 fewer loans than in the second quarter of 2019.

Additionally, in the second quarter of 2020, the number of external refinancing loans was the only category that experienced an increase of 11.7%. In this period, nearly 9,000 external refinancing loans were granted, totaling just under 1.2 billion EUR.

Average loan amount for home purchase + renovation increases to 199,000 EUR

The average loan amount for the purchase of a home with renovation saw a significant increase to almost 199,000 EUR in the second quarter.

The average loan amount for the purchase of a home also continued to rise in the second quarter of 2020, reaching nearly 175,000 EUR. This represents an increase of 17,000 EUR over two years.

The average loan amount for home construction saw a notable increase to 194,000 EUR in the second quarter of 2020.

Nearly 9 out of 10 borrowers opt for a fixed interest rate

In the second quarter of 2020, almost 9 out of 10 borrowers (88.1%) chose a fixed interest rate or a variable interest rate with an initial fixed-rate period of at least 10 years. About 9% of borrowers opted for a variable interest rate with an initial fixed-rate period of 3 to 10 years. Only approximately 2.7% of borrowers chose an annually adjustable interest rate.

Taking into account the still very low interest rates (see chart below), Belgian consumers continue to overwhelmingly choose certainty. However, around 12% also opt for a variable interest rate. Even in the case of a variable interest rate, consumers are highly protected by legislation. The variable interest rate, after adjustment based on the evolution of the applicable reference indexes, can never exceed twice the initial interest rate.

Responsible mortgage lending remains the priority

The credit sector is well aware that mortgage lending must be approached with great care, and responsible lending remains the absolute priority. On this point, the sector is in line with the regulator: credit providers must exercise the necessary caution to both prevent individual borrowers from taking on excessively large loans and ensure the long-term financial stability.