Strong demand for mortgage credit continues for the first half of 2019

9 min Reading time

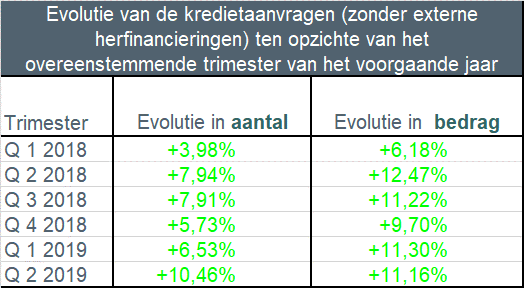

Excluding refinancings, the number of loan applications increased by 10.5% in the second quarter of 2019 compared to the second quarter of 2018. There was also an increase in amount, by 11.2%.

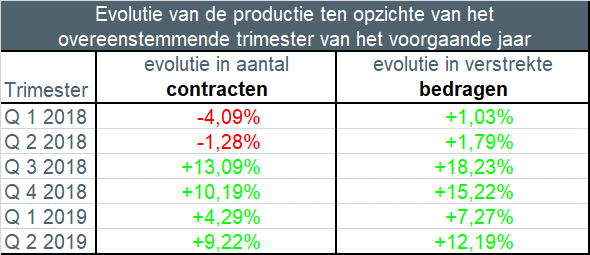

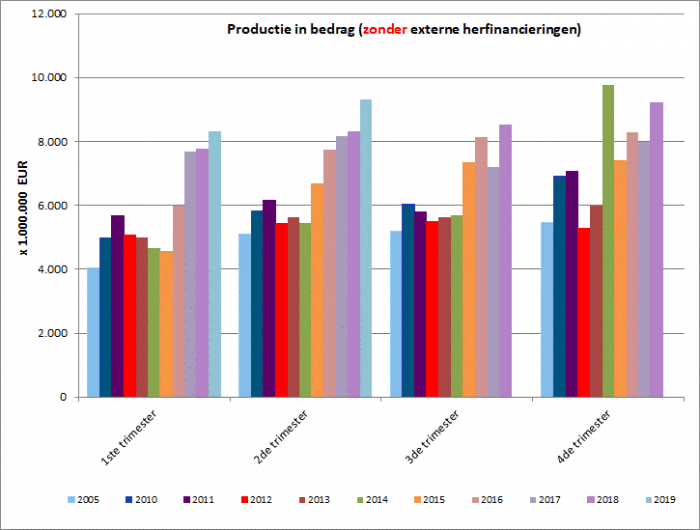

In the second quarter of 2019, almost 70,000 mortgage loan agreements were concluded for a total amount of approximately EUR 9.3 billion (excluding refinancings). This is an increase in the number of credit agreements granted by approximately 9% compared to the second quarter of last year. In terms of amount, 12.2% more credit was provided than then. This is evident from the statistics on mortgage credit that the Professional Association of credit (BVK) published today.

The 58 members of the BVK together account for approximately 90% of the total number of new mortgage loans granted. The total outstanding amount of mortgage credit of BVK members amounts to approximately 223 billion euros at the end of June 2019.

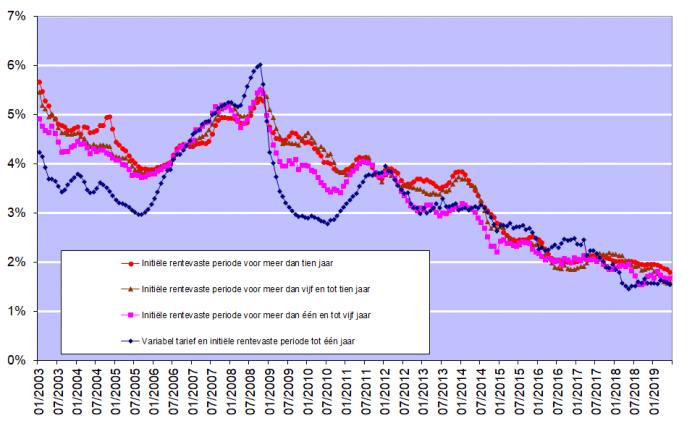

Low interest rates continue to stimulate demand

The very low interest rates for mortgage loans continue to stimulate demand. According to figures published by the National Bank of Belgium, in June they amounted to between 1.55% (for credits with a variable interest rate and an initial interest rate fixation period of up to one year) and 1.79% (for credits with an initial interest rate fixation period of more than than 10 years).

Below you will find the most important findings for the second quarter of 2019 compared to the second quarter of 2018 (these figures do not take refinancing into account):

- The number of credit applications (excluding those for refinancing) increased by 10.5% in the second quarter of 2019 compared to the second quarter of 2018. The amount of credit applications also increased by more than 11%. More than 100,000 loan applications were submitted for a total amount of EUR 14.7 billion.

- Mortgage loans granted increased by approximately 9% in the second quarter of 2019. The corresponding amount increased by just over 12%. Nearly 70,000 loans were thus provided for a total amount of EUR 9.3 billion (excl. refinancings).

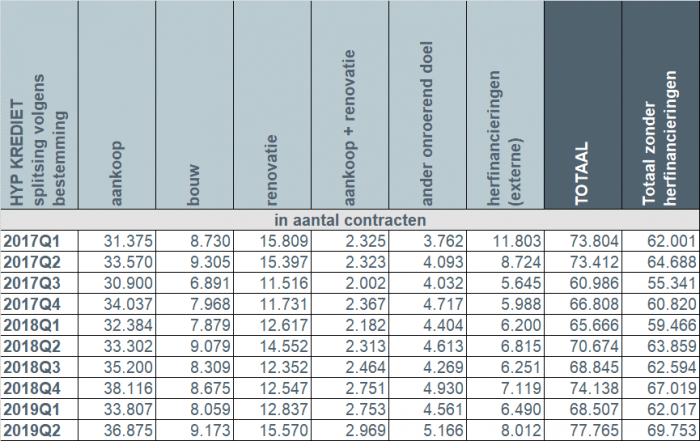

- There has been an increase in lending across all purposes. The number of loans for purchase with renovation showed the strongest increase in percentage terms, namely +28% or 652 loans more than in the second quarter of 2018. The number of loans for the purchase of a home (+3,573) was in the second quarter of 2019. 10.7% higher than in the second quarter of 2018. The number of loans for the renovation of a home (+1,018) increased by 7%, while the number of construction loans (+94) was 1% higher. The number of loans for other purposes (garage, building land, etc.) (+553) increased by 12%.

- The number of external refinancings (+1,197) increased by 17.5% in the second quarter of 2019 compared to the second quarter of 2018. In particular, just over 8,000 external refinancings were provided in the second quarter of 2019 for a total amount of just over EUR 1 billion.

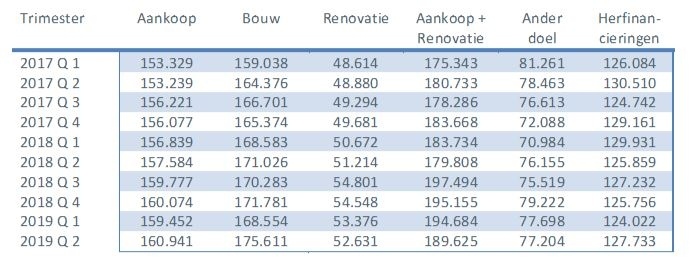

- The average amount borrowed for the purchase of a home increased slightly in the second quarter of 2019 to EUR 161,000. The average amount for a construction loan rose sharply in the second quarter of 2019 to more than EUR 175,000. The average amount of credits for purchase + renovation fell to EUR 190,000.

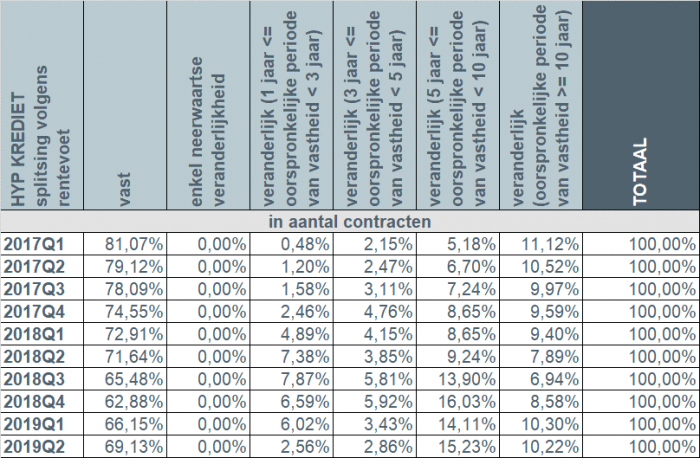

- In the second quarter of 2019, approximately 8 in 10 borrowers opted for a fixed interest rate or a variable interest rate with an initial interest rate fixation period of at least 10 years. The market share of loans with an annually variable interest rate fell further and accounted for only 2.6% of the loans granted.

Number of credit applications

The number of credit applications, excluding those relating to external refinancing, increased by 10.5% during the second quarter of 2019 compared to the same quarter of last year. The underlying amount of loan applications also increased, by just over 11%.

The number of credit applications increased for all purposes. Loan applications for the purchase of a home (+3,326) increased by 6.2%, those for the purchase + renovation of a home (+726) by 15.6%. The number of credit applications for the construction of a home (+998, or +9.2%) and for the renovation of a home (+2,527, or +15.2%) also increased, as did the number of credit applications for other purposes. (+1,967, or +37%).

In addition, in the second quarter of 2019, the number of applications for external refinancing increased by almost 24%.

Number of loans granted in the second quarter

In the second quarter of 2019, the number of loans granted, excluding external refinancings, increased by just over 9% compared to the second quarter of 2018. The corresponding amount increased by just over 12%.

The total amount of loans granted in the second quarter thus reaches the highest level ever in a second quarter. This was also the case in the previous quarter.

Increase in the number of credits, regardless of purpose

Approximately 70,000 new loans were granted in the second quarter of 2019 for a total amount of approximately EUR 9.3 billion - excluding external refinancings.

Compared to the second quarter of last year, an increase was observed across all purposes.

The number of loans for purchase with renovation showed the strongest increase in percentage terms, namely +28% or 652 loans more than in the second quarter of 2018. The number of loans for the purchase of a home (+3,573) was in the second quarter of 2019. 10.7% higher than in the second quarter of 2018. The number of loans for the renovation of a home (+1,018) increased by 7%, while the number of construction loans (+94) was 1% higher. The number of loans for other purposes (+553) increased by 12%.

In addition, the number of external refinancings also increased by 17.5% in the second quarter of 2019. In particular, 8,000 external refinancings were provided for a total amount of just over EUR 1 billion.

Average amount of a loan for the purchase of a home increases slightly to EUR 161,000

The average amount of a loan for the purchase of a home increased slightly in the second quarter of 2019 to EUR 161,000.

The average amount of a loan for the construction of a home rose sharply during the second quarter of 2019 to more than EUR 175,000.

The average amount of a loan for the purchase of a home + renovation decreased in the second quarter to approximately EUR 190,000.

8 out of 10 borrowers opt for a fixed interest rate

In the second quarter of 2019, 8 out of 10 borrowers (79.4%) opted for a fixed interest rate or a variable interest rate with an initial interest rate fixation period of at least 10 years. About 18% of borrowers opted for a variable interest rate with an initial interest rate fixation period between 3 and 10 years. As in the previous quarter, the number of borrowers who opted for an annually variable interest rate fell to approximately 2.6%.

Taking into account the still very low interest rates (see graph below), Belgian consumers continue to largely opt for certainty. However, approximately 20% also opt for a variable interest rate. A limited number opt for an annually variable interest rate. But even in the event of a variable interest rate, the consumer is strongly protected by the legislation. For example, the variable interest rate after adjustment to the evolution of the applicable reference indices can never amount to more than double the initial interest rate.

Responsible mortgage lending remains the starting point

The credit sector is and remains aware that mortgage lending must be done with great care and that responsible lending must remain the absolute starting point. On this point, the sector is on the same page as the regulator: lenders must exercise the necessary caution to, on the one hand, prevent individual borrowers from taking out loans that are too large and, on the other hand, to safeguard financial stability in the long term.