Sharp decline in mortgage lending in the first quarter

27 April 2023 - 10 min Reading time

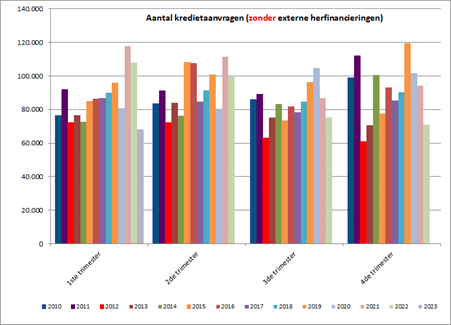

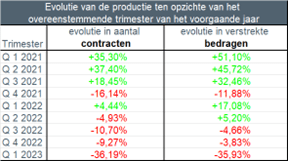

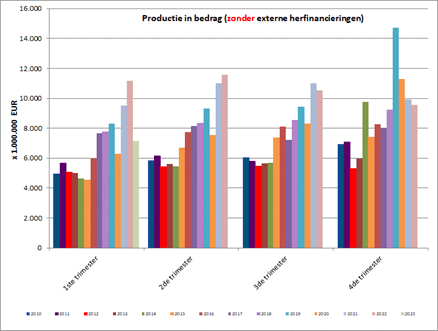

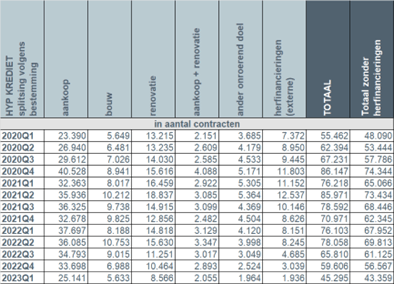

In the first quarter of 2023, just over 43,000 mortgage loan agreements were concluded for a total amount of just over 7 billion EUR (excluding refinancing). This represents a decrease in the number of loan agreements by more than 36% compared to the first quarter of the previous year. Also, the amount of credit granted decreased by approximately 36%.

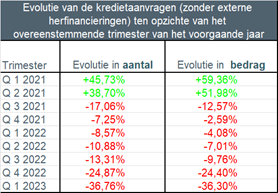

Excluding refinancing, the number of credit applications in the first quarter of 2023 also decreased by nearly 37% compared to the first quarter of 2022. In terms of amount, there was also a decrease of more than 36%. These statistics were published today by the Professional Association of Credit (BVK).

De 50 leden van de BVK nemen samen ongeveer 90% van het totaal aantal nieuw verstrekte hypothecaire kredieten (de zogeheten productie) voor hun rekening. Het totale uitstaande bedrag aan hypothecair krediet van de BVK-leden bedraagt einde maart 2023 ongeveer 273 miljard EUR.

Decreasing demand impacts credit granting

The decline in credit demand, which began to show clearly in the third quarter of 2022 and continued in the last quarter of 2022, also persisted in the first quarter of 2023. As a result, credit granting also substantially decreased.

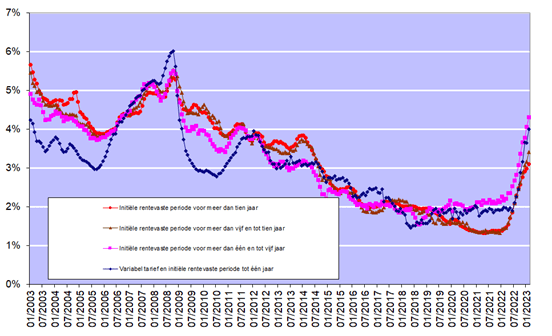

Interest rates for mortgage loans, as expected, continued to rise in the past quarter. According to figures published by the National Bank of Belgium, in February, these rates averaged 4.31% (for loans with an initial fixed interest period of more than 1 and up to 5 years) and averaged 3.11% (for loans with an initial fixed interest period of more than 10 years).

Factors such as rising interest rates have led to a decrease in demand, and consequently, a decrease in the number of loans granted," said Ivo Van Bulck, Secretary-General of the Professional Association of Credit. "The decline in credit demand also continued in the first quarter of this year and is likely to lead to a further decrease in credit granting in the second quarter of this year."

Here are the key findings for the first quarter of 2023 compared to the first quarter of 2022 (excluding refinancing):

- The number of credit applications (excluding those for refinancing) decreased by almost 37% in the first quarter of 2023 compared to the first quarter of 2022. The amount of credit applications also decreased by about 36%, with just over 68,000 credit applications submitted for a total amount of just over 12 billion EUR.

- The number of granted mortgage loans decreased by approximately 36% in the first quarter of 2023 compared to the first quarter of the previous year. The corresponding amount also decreased by about 36% compared to 2022, with a total of just over 43,000 loans granted for a total amount of just over 7 billion EUR (excluding refinancing).

- The number of loans for other purposes (garage, building land, etc.) experienced the sharpest decline compared to the first quarter of 2022 (-2,156 or -52.3%), along with the number of loans for home renovation (-6,252 or -42.2%). The decline in the number of loans for home purchase was also substantial, at -33.3% or 12,556 fewer loans than in the first quarter of 2022. This also applies to the decline in the number of loans for home construction (-2,555 or -31.2%) and loans for purchase with renovation (-1,074 or -34.3%).

- The number of external refinancing loans (-6,215 or -76.3%) saw a spectacular decrease in the first quarter of 2023, which is not surprising in the current rising interest rate environment. Consequently, fewer than 2,000 external refinancing loans were granted in the first quarter of 2023, totaling about 238 million EUR.

- The average loan amount for home purchase decreased slightly in the first quarter of 2023 to about 191,000 EUR. The average amount for a construction loan also decreased slightly in the first quarter of 2023 to 207,000 EUR. However, the average amount of loans for home purchase and renovation increased again to about 201,000 EUR after a decrease in the previous quarter.

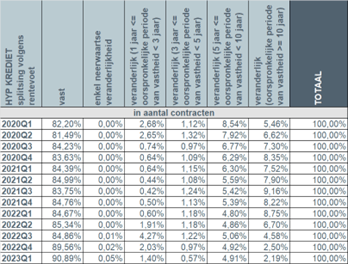

- In the first quarter of 2023, more than 9 out of 10 borrowers (93.2%) once again opted for a fixed interest rate or a variable interest rate with an initial fixed interest period of at least 10 years. In only 1.4% of cases did borrowers opt for a loan with an annually variable interest rate.

I. Number of Loan Applications at Lowest Level Since 2010

The number of loan applications, excluding those related to external refinancing, experienced a decline of nearly 37% during the first quarter of 2023 compared to the same quarter of the previous year. The underlying amount of loan applications also decreased by approximately 36%. The number of loan applications in the first quarter is thus at its lowest level since 2010.

Loan applications decreased for all purposes. Loan applications for home purchase (-15,597) decreased by -27%, those for home purchase and renovation (-2,127) decreased by -34.8%. The number of loan applications for home renovation (-10,131), as well as loan applications for other purposes (garage, building land, etc.), saw a significant decline (-3,334 or -53.4%), as did the number of loan applications for home construction (-8,418 or -52.4%). The number of external refinancing applications also saw a spectacular decline of -77.4%, which is not surprising in the current rising interest rate climate.

II. Number of Loans Granted in the First Quarter

In the first quarter of 2023, the number of loans granted, excluding external refinancing, decreased by approximately 36% compared to the first quarter of 2022. The corresponding amount also experienced a decrease of about 36%.

The declining demand for loans thus resulted in a corresponding decrease in the number of loans granted.

III. Decline Regardless of Loan Purpose

During the first quarter of 2023, just over 43,000 new loans were granted for a total amount of just over 7 billion EUR, excluding external refinancing. This represents the lowest number since 2014. In terms of amount, this is the lowest amount granted in a first quarter since 2017, except for the year 2020.

Overall, there was a decrease in the number of loans granted by about 36% compared to the first quarter of 2022, and this decline was noticeable for all loan purposes.

The number of loans for home purchase (-12,556 or -33.3%), the number of construction loans (-2,555 or -31.2%), and the number of loans for purchase with renovation (-1,074 or -34.3%) all experienced a significant decline compared to the first quarter of 2022. However, the number of loans for home renovation saw the steepest decline at -42.2%, with 6,252 fewer loans than in the first quarter of 2022, as did the number of loans for other purposes (-2,156), which saw a decline of -52.3%.

Additionally, in the first quarter of 2023, the number of external refinancing loans saw a spectacular decrease of -76.3%. Consequently, fewer than 2,000 external refinancing loans were granted, totaling about 238 million EUR.

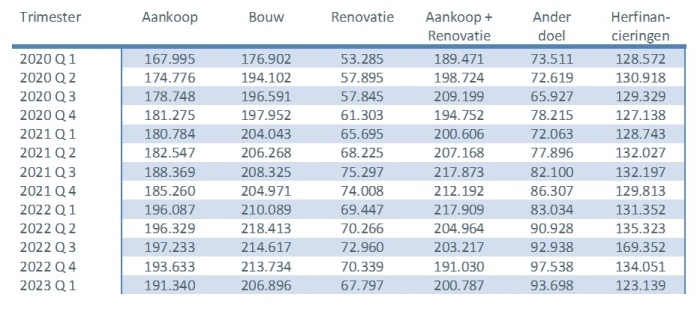

IV. Average Loan Amount Also on the Decline

The average loan amounts granted decreased slightly in the first quarter. This could be related to borrowers' reduced repayment capacity due to rising interest rates.

The average loan amount for home construction saw a slight decrease in the first quarter of 2023, amounting to 207,000 EUR.

The average loan amount for home purchase also decreased in the first quarter of 2023 to approximately 191,000 EUR.

However, the average loan amount for home purchase and renovation saw an increase, rising to about 201,000 EUR, following a decrease in the previous quarter.

V. 9 out of 10 Borrowers Opt for Fixed Interest Rate

In the first quarter of 2023, more than 9 out of 10 borrowers (93.2%) once again chose a fixed interest rate or a variable interest rate with an initial fixed interest period of at least 10 years. Approximately 5.5% of borrowers opted for a variable interest rate with an initial fixed interest period between 3 and 10 years. Less than 1.5% of borrowers opted for an annually variable interest rate.

Considering the rising interest rates (see chart below), Belgian consumers continue to overwhelmingly choose security. The number of individuals opting for a variable interest rate remains low. However, even in the case of a variable interest rate, consumers are strongly protected by legislation. The variable interest rate, after adjustment to the evolution of the applicable reference indices, can never exceed twice the initial interest rate.

Responsible mortgage lending remains the focus

The credit sector remains aware that mortgage lending must be carried out with great care, and responsible lending remains the top priority. In this regard, the sector aligns with the regulator: credit providers must exercise caution to prevent individual borrowers from taking on excessively large loans, on the one hand, and to preserve financial stability in the long term, on the other hand.