Rising business confidence boosts credit demand and production cautiously

6 September 2021 - 7 min Reading time

Since the rollout of the vaccination campaign and the reopening of economic activities in certain sectors, we have observed that business confidence has never been higher. This leads us to suspect that the demand for investment loans will continue to increase in the coming months.

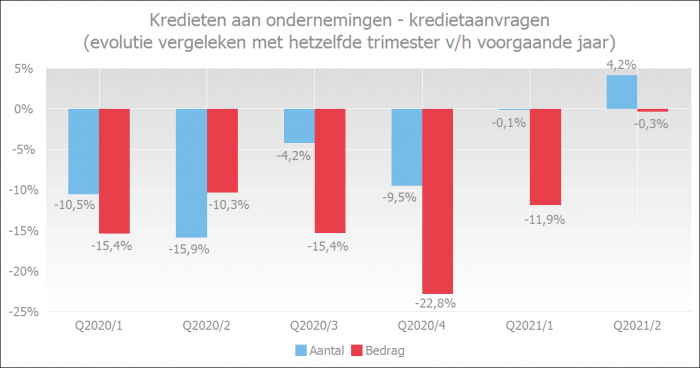

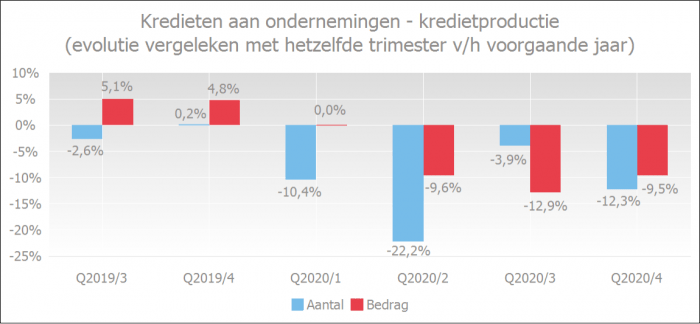

- The first signs of this were already evident in the second quarter of 2021: there was an increase in business loan applications compared to the same period in 2020. This marked the first increase in some time. Due to the opportunity provided to businesses impacted by the COVID-19 crisis to defer loan repayments until mid-2021, and considering the government support they received, these businesses had a limited need for new credit. There was a very slight decrease in terms of the loan amount, but it was much less significant than in previous quarters.

- Credit production was also on the rise again. The number of granted loans increased by 10.9% in the second quarter of 2021 compared to the same quarter the previous year. The granted amounts were 14.7% higher than in the same quarter of the previous year. The outstanding volume of business loans at the end of June 2021 was 1.1% higher than a year earlier, totaling 171.9 billion euros.

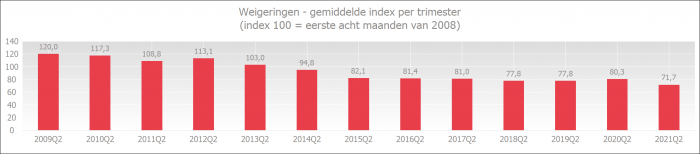

- Furthermore, entrepreneurs face few credit constraints. The refusal rate is at its lowest level ever compared to the refusal rate of all second quarters since the start of measurements. Banks continue to provide credit smoothly, despite the challenging sanitary and economic situation negatively affecting the quality of many applications.

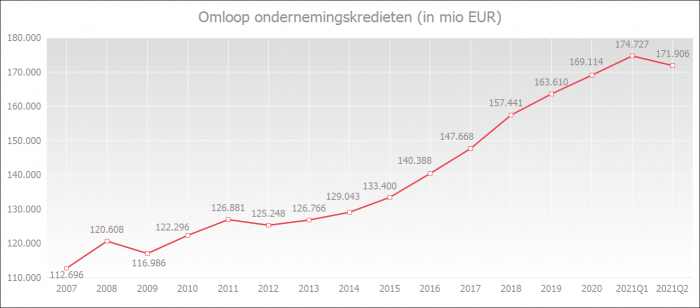

Outstanding business loan amounts remain at a high leve

At the end of June 2021, the outstanding amount of business loans (including commitment loans, such as guarantee loans and documentary credits) was 171.9 billion euros.

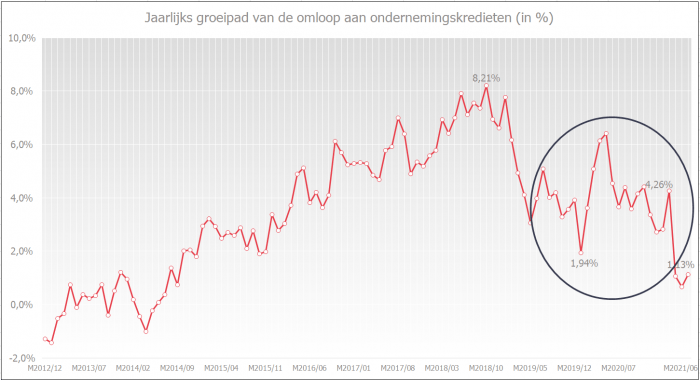

On an annual basis (comparing June 2020 to June 2021), the outstanding amount increased by 1.1%. In 2020, the annual growth was 3.4%.

In 2019, the year-on-year evolution cooled off (see the chart below) but experienced a brief peak in early 2020, especially when large enterprises withdrew a lot of cash due to the uncertain COVID-19 period. Annual growth in the second half of 2020 slowed down. In June 2021, annual growth reached 1.1%.

Entrepreneurs are cautiously seeking more credit

In the second quarter of 2021, entrepreneurs applied for 4.2% more loans than in the same period the previous year. After nine consecutive declines, this marks the first increase. In terms of the loan amount, there was still a very slight decrease, but it was much less limited than in previous quarters.

Due to the opportunity provided to businesses impacted by the COVID-19 crisis to defer loan repayments until mid-2021 and considering the support they received from governments, these businesses had a limited need for new credit.

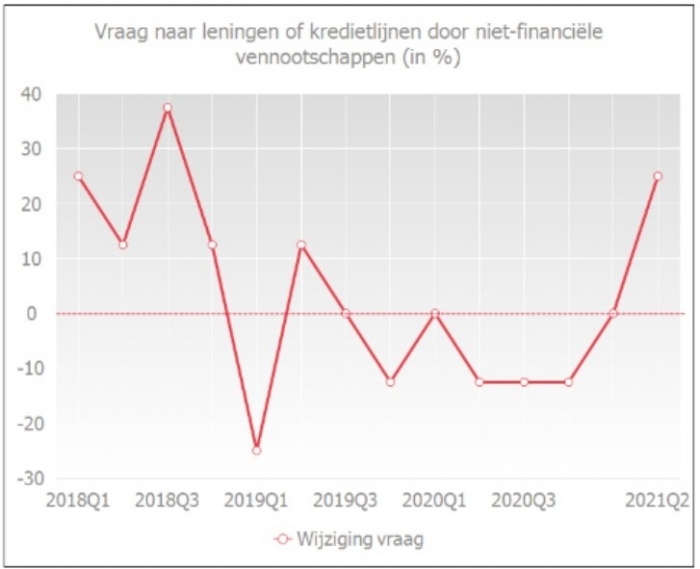

The Bank Lending Survey (BLS) conducted by the National Bank of Belgium (NBB) also indicated an increase in credit demand from businesses in the second quarter of 2021. Businesses were particularly seeking financing for fixed investments, inventory, and working capital..

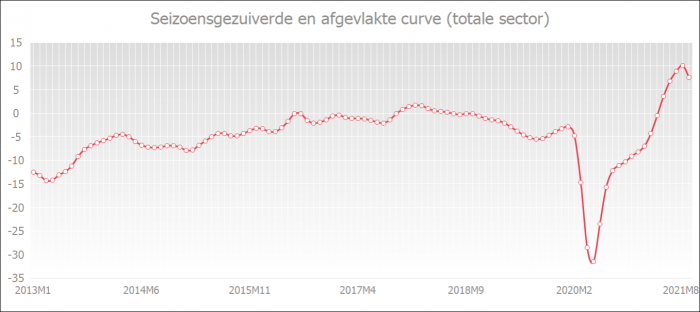

A positive (negative) percentage in the chart below corresponds to an increase (decrease) in credit demand. A zero percentage indicates stabilization.

Credit production is increasing in both quantity and amoun

The number of granted loans increased by 10.9% in the second quarter of 2021 compared to the same quarter the previous year. The granted amounts were 14.7% higher than in the same quarter of the previous year.

Entrepreneurs experience few credit obstacles

s. The refusal rate is at its lowest level ever compared to the refusal rate of all second quarters since the start of measurements. Given that the COVID-19 crisis was not yet fully resolved, it is remarkable that the refusal rate is so low.

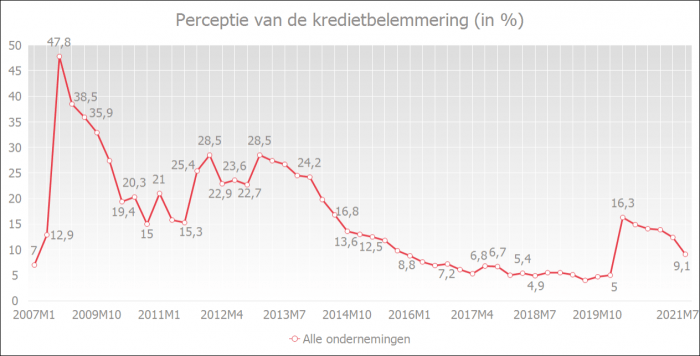

The quarterly survey conducted by the National Bank of Belgium (NBB) indicates that the perception of credit constraints by businesses has decreased over the past year. The percentage decreased from 16.3% in April 2020 to 9.1% in July 2021. The increase that occurred due to the COVID-19 crisis has been almost completely eliminated.

Small, medium, large, and very large businesses all agreed that credit conditions have evolved favorably in July 2021.

A decrease in the chart below reflects the gradual improvement in the perception of credit constraints. The lower the curve, the fewer credit obstacles entrepreneurs believe they are experiencing.

Business confidence is higher than ever

After a sharp drop in business confidence at the beginning of the pandemic, we have seen a consistent increase in recent months, except in August. In July 2021, business confidence reached its highest level in years. This suggests that the demand for investment loans in the coming months will likely increase significantly.

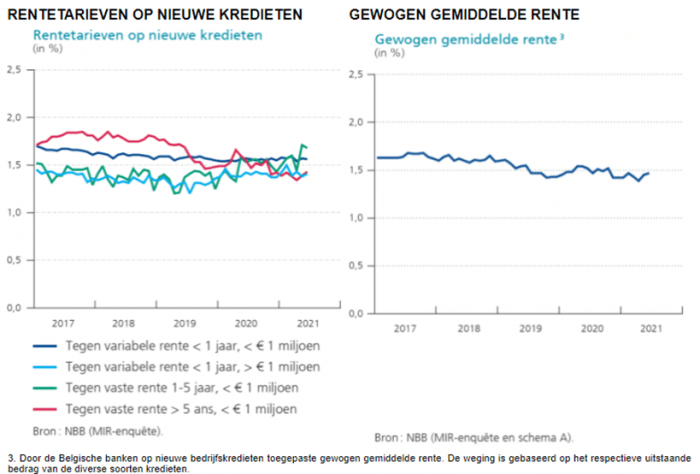

Interest rates remain favorable

According to data from the NBB, the weighted average interest rate on new corporate loans increased slightly to 1.47% in June 2021 (compared to 1.45% in May 2021). Since April 2019, the weighted average interest rate has been around 1.50%.