Record in mortgage loans granted in 2022, despite a decline in the second half

26 January 2023 - 12 min Reading time

The mortgage lending sector in 2022 had two speeds: an increase in the first half and a declining trend in the second half. Despite this decline in recent months, 2022 set a new record year.

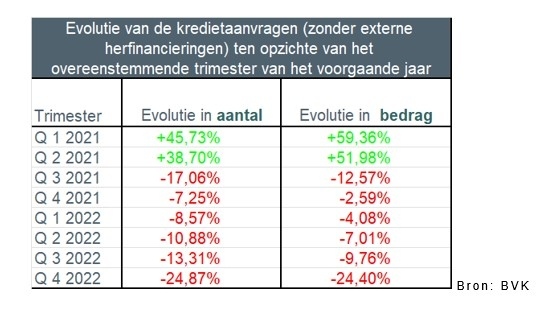

- The number of loan applications, when viewed throughout 2022, decreased by about 14% compared to 2021, excluding refinancing. In terms of the loan amounts, there was also an 11% decrease in loan applications compared to 2021. However, compared to 2019, the requested amount was still 5.6% higher.

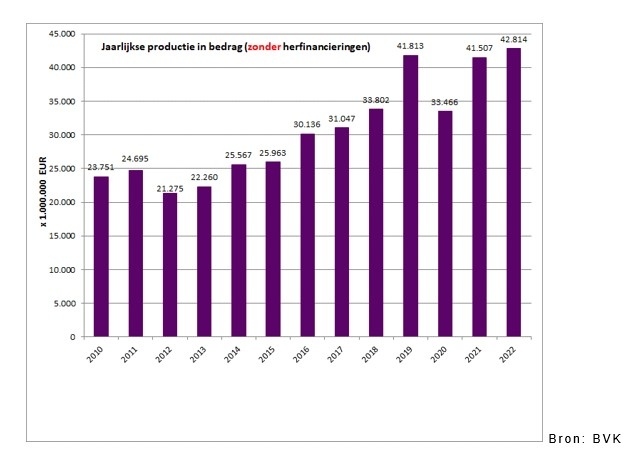

- In 2022, excluding refinancing, over 255,000 mortgage loan agreements were ultimately concluded (5% less than in 2021) for a total amount of nearly 43 billion EUR, once again setting an absolute record amount.

- The foundation for this record was laid in the first half of 2022, but a decline set in during the second half.

This information comes from the mortgage credit statistics published today by the Professional Association of Credit (BVK).

The 50 members of the BVK collectively account for approximately 90% of the total number of newly granted mortgage loans (referred to as production). The total outstanding amount of mortgage credit held by BVK members is approximately 272 billion EUR as of the end of December 2022.

Turning point in the second half

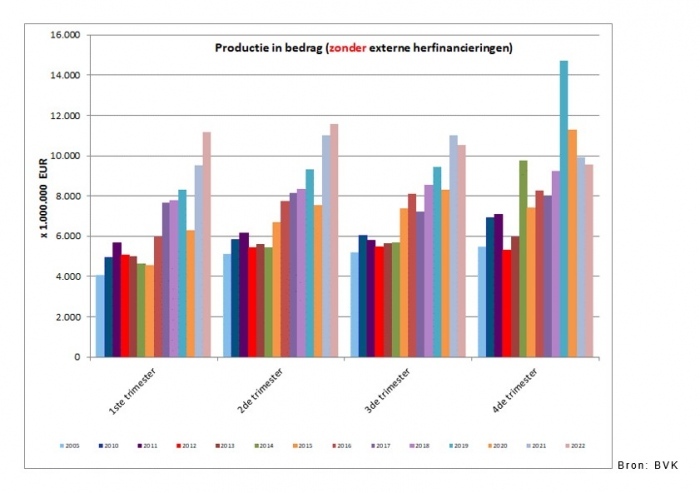

In the first half of 2022, mortgage lending continued to rise after a similarly strong 2021, with a growth of over 10% in granted loan amounts.

From the second half onward, rising interest rates and the impact of the energy crisis, among other factors, began to affect the repayment capacity and, consequently, credit granting. In terms of amount, 4% less credit was granted in the second half of 2022 compared to the second half of 2021.

Nevertheless, a record amount of mortgage credit was granted throughout 2022, despite a 5% decrease in the overall number of credit agreements compared to 2021.

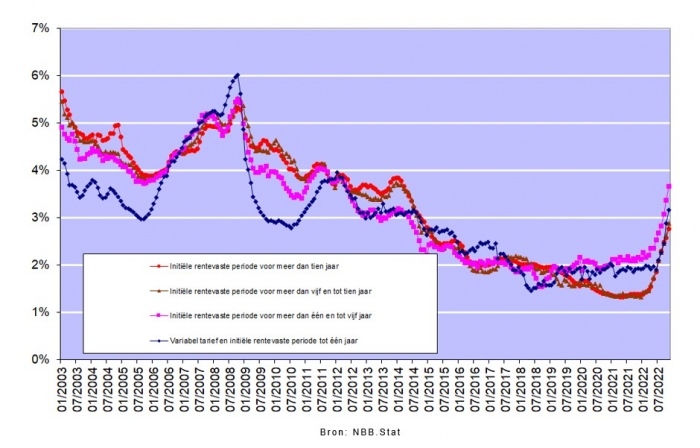

Interest rates played a significant role in the past year's evolution, especially in the second half. According to figures published by the National Bank of Belgium, interest rates in November 2022 ranged from 2.76% (for variable-rate loans with an initial interest rate period of over 10 years) to 3.67% (for loans with an initial fixed interest rate period of over 1 year and less than 5 years).

Interest rates played a significant role in the past year's evolution, especially in the second half. According to figures published by the National Bank of Belgium, interest rates in November 2022 ranged from 2.76% (for variable-rate loans with an initial interest rate period of over 10 years) to 3.67% (for loans with an initial fixed interest rate period of over 1 year and less than 5 years).

Here are the key findings for the entire year 2022, with a special focus on the fourth quarter

These figures exclude refinancings.

Regarding the entire year 2022:

- The number of loan applications (excluding refinancing) was 14% lower in 2022 compared to 2021. The amount of loan applications was approximately 11% lower compared to 2021, but it was still 5.6% higher than the peak year in 2019. There were 353,000 loan applications filed for a total amount of over 63.5 billion EUR.

- In 2022, over 255,000 mortgage loans (excluding refinancing) were granted for a total amount of nearly 43 billion EUR. Thus, the number of granted mortgage loans decreased by more than 5% in 2022 compared to 2021, and compared to the record year in 2019, there was even a decline of more than 17%. However, the corresponding amount still increased by slightly more than 3% compared to 2021 and nearly 2.5% compared to the previous record year in 2019.

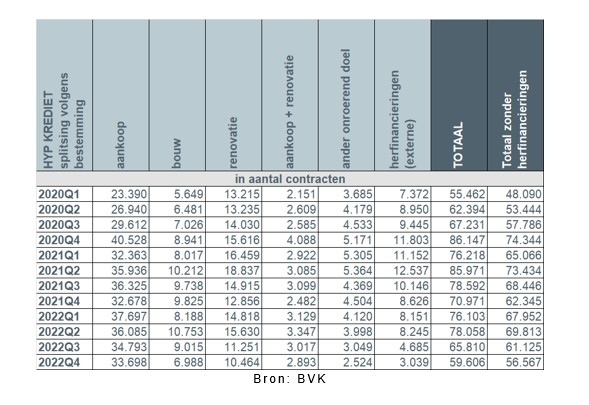

- Compared to 2021, the number of granted loans varied depending on the purpose. There was an increase in the number of loans for home purchases (+4,972, or +3.6%) and loans for home purchases with renovation (+798, or +6.9%). Construction loans (-2,848, or -7.5%), loans for home renovation (-10,904, or -17.3%), and loans for other purposes (garage, land, etc.) (-5,851, or -30%) all experienced declines.

- Compared to the record year in 2019, the decline in the number of loans granted for all purposes was more consistent. It was about 13.5% for home purchase loans and about 18.5% for construction loans. For renovation loans and loans for home purchase with renovation, this was even 24% and 33% respectively.

- In terms of amount, there was a significant increase for loans for home purchase and loans for home purchase with renovation compared to 2021. Specifically, there was an increase of just over 10% for home purchase loans and 4.4% for loans for home purchase with renovation. Construction loans decreased by -3.7%, and renovation loans decreased by -17%.

- The number of external refinancings (-18,350, or -43%) sharply decreased in 2022 compared to 2021. Approximately 24,000 external refinancings were granted in 2022 for a total amount of 3.2 billion EUR.

A focus on the fourth quarter of 2022 compared to the fourth quarter of 2021 provides the following results:.

- "It can be observed that in the fourth quarter of 2022, approximately 71,000 loan applications were submitted, totaling slightly more than 12.5 billion EUR. This represents a significant decrease both in terms of quantity and amount compared to previous years.

- In comparison with the fourth quarter of 2021, the number of granted mortgage loans in the fourth quarter of 2022 has decreased overall by 9%. This decline is even more pronounced when compared to 2020 (-24%) and 2018 (-15.6%). In comparison with the record quarter Q4 2019 (due to the abolition of the housing bonus in Flanders), the decline is even more substantial at -47.6%.

- In terms of the loan amount, there was also approximately 3.8% less credit granted in the fourth quarter of 2022 than in the fourth quarter of 2021. Compared to 2020 (-15.3%) and the exceptional fourth quarter of 2019 (-35%), there is also a decline, but when compared to the more "normal" year of 2018, there is still an increase of 3.8%.

- In total, around 56,500 loans were granted for an amount of 9.5 billion EUR (excluding refinancing).

- The number of external refinancings sharply declined in the fourth quarter of 2022. There were just over 3,000 external refinancings granted in the fourth quarter of 2022, totaling just over 400 million EUR.

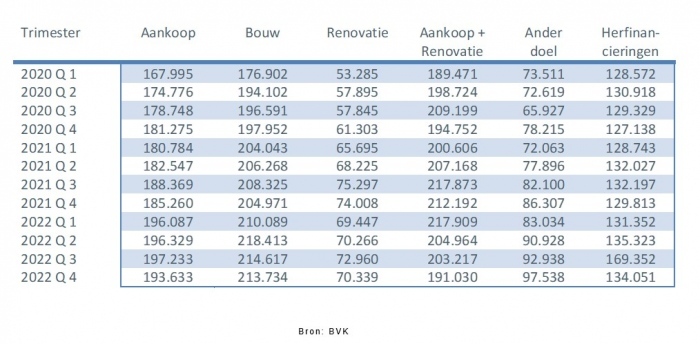

- The average amount of loans for purchase + renovation saw a notable decrease to 191,000 EUR in the fourth quarter. The average borrowed amount for home purchase also decreased slightly to just under 194,000 EUR in the fourth quarter of 2022. The average amount for a construction loan stabilized at around 214,000 EUR in the fourth quarter of 2022.

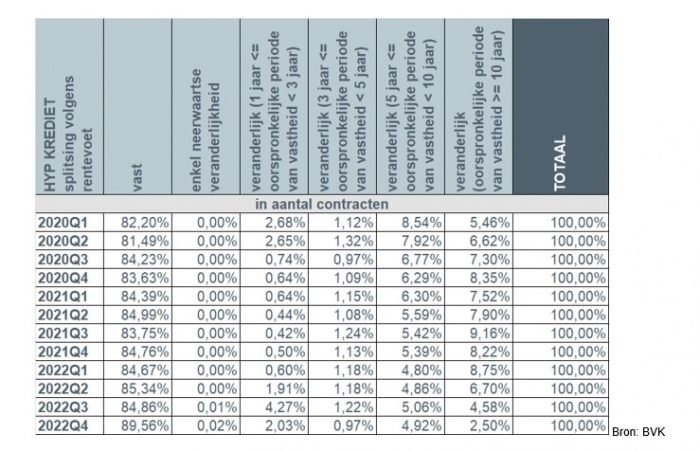

- In the fourth quarter of 2022, once again, more than 9 out of 10 borrowers (92%) opted for a fixed interest rate or a variable interest rate with an initial fixed rate period of at least 10 years. In 2% of cases, borrowers still opted for an annually variable interest rate.

Number of loan applications in the fourth quarter

The number of loan applications in the fourth quarter, excluding those related to external refinancing, saw a decrease of approximately 25% compared to the same quarter of the previous year. The underlying amount of loan applications decreased slightly less, by 24.5%.

The decline in the number of loan applications was widespread. Loan applications for home purchase (-9,750) decreased by -18%, those for home purchase + renovation (-1,655) by -30.5%, those for home renovation (-4,870) by -29.5%, and those for other purposes - such as a garage, building land... - (-2,700) by -46%. The number of applications for construction loans (-4,450) also saw a steep decline of -35%. As expected, the number of applications for external refinancing declined by more than 62%.

Garage, bouwgrond, …

Number of granted mortgage loans in the fourth quarter

In comparison with the fourth quarter of 2021, the number of granted mortgage loans in the fourth quarter of 2022 decreased by 9% in quantity and 3.8% in amount.

This decline in the number of granted loans is even more pronounced when compared to 2020 (-24%) and 2018 (-15.6%). In comparison with the record quarter Q4 2019 (due to the abolition of the housing bonus in Flanders), the decline is even more substantial at -47.6%.

In terms of the loan amount, there was also approximately 3.8% less credit granted in the fourth quarter of 2022 than in the fourth quarter of 2021. Compared to 2020 (-15.3%) and the exceptional fourth quarter of 2019 (-35%), there is also a decline, but when compared to the more "normal" year of 2018, there is still an increase of 3.8%.

Evolution of the number of loans by destination in the fourth quarter

The evolution of the number of loans by destination in the fourth quarter shows that slightly more than 56,500 new loans were granted for a total amount of approximately 9.5 billion EUR, excluding refinancing.

As previously mentioned, this represents a decrease of approximately 9% in the number of contracts and about 3.8% in the corresponding amount compared to 2021. When compared to the fourth quarter of 2021, this presents a mixed picture: the number of loans for home purchase (+1,020) was more than 3% higher in the fourth quarter of 2022 than in the fourth quarter of 2021. Also, the number of loans for home purchase with renovation (+411) increased by about 16.5%. However, the number of loans for other purposes (-1,980, -44%), renovation loans (-2,392, -18.6%), and construction loans (-2,837, -29%) saw a significant decline compared to the fourth quarter of 2021.

Additionally, the number of external refinancings in the fourth quarter of 2022 was significantly lower (-64%) than in the fourth quarter of 2021. There were still about 3,000 external refinancings granted for a total amount of just over 400 million EUR.

Strong increase in average loan amounts in recent years

The average amount of a construction loan stabilized at around 214,000 EUR in the fourth quarter of 2022. This represents an increase of about 45,000 EUR (+26.8%) since the beginning of 2019.

The average amount of a home purchase loan decreased slightly to approximately 194,000 EUR in the fourth quarter of 2022. However, it should be noted that there has been an increase of 34,000 EUR (+21.5%) in less than 4 years compared to the beginning of 2019.

The average amount of renovation loans saw the most significant increase, from approximately 54,500 EUR at the beginning of 2019 to approximately 70,500 EUR (+29%) at the end of 2022. This represents an increase of nearly 16,000 EUR in less than four years.

The average amount of a loan for home purchase + renovation in the fourth quarter experienced a relatively strong decrease to approximately 191,000 EUR. This means there was even a slight decrease in this average amount compared to the beginning of 2019 (about 3,500 EUR less, or -1.9%).

Fixed interest rates continue to be the preferred choice

In the fourth quarter of 2022, once again, more than 9 out of 10 borrowers (92%) opted for a fixed interest rate or a variable interest rate with an initial fixed rate period of at least 10 years. About 6% of borrowers opted for a variable interest rate with an initial fixed rate period between 3 and 10 years. The number of borrowers opting for an annually variable interest rate remained low at 2%.

Taking into account rising interest rates (see graph below), Belgian consumers overwhelmingly continue to choose stability, with a low percentage (2%) opting for an annually variable interest rate. However, even in the case of a variable interest rate, consumers are strongly protected by legislation. The variable interest rate, after adjusting to changes in applicable reference indexes, can never exceed double the initial interest rate.

Responsible mortgage lending remains the guiding principle

The credit sector is and remains aware that mortgage lending must be carried out with great care, and responsible lending should always be the primary focus. In this regard, the sector is in alignment with regulators, as lenders must exercise caution to prevent individual borrowers from taking on excessively large loans while also safeguarding long-term financial stability.