Predicted decline in mortgage loans in the first quarter of 2020

29 April 2020 - 10 min Reading time

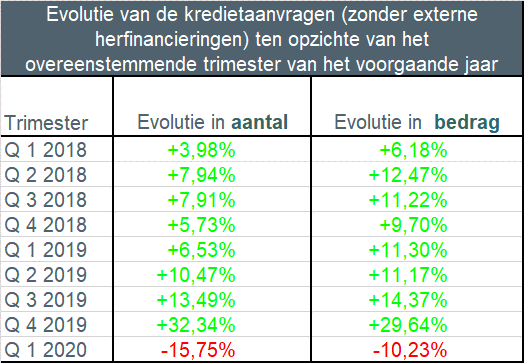

Excluding refinancings, the number of loan applications fell by almost 16% in the first quarter of 2020 compared to the first quarter of 2019. There was also a decrease in amount of approximately 10%.

The restrictive government measures regarding the corona crisis have a limited impact on these figures, as they came into effect from the second half of March.

Wanneer voor het krediet een akte moet verleden worden bij de notaris, zal het pas in de statistieken worden opgenomen wanneer deze akte verleden is. In de tweede helft van maart zijn er geen aktes meer verleden door de regeringsmaatregelen inzake de coronacrisis. De impact van de corona-crisis op de cijfers van verstrekte kredieten zal evenwel pas in de komende maanden echt duidelijk worden.

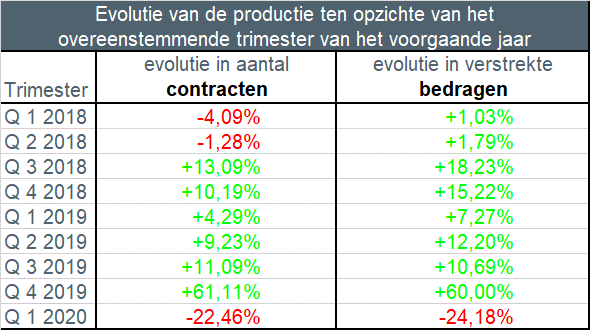

In the first quarter of 2020, approximately 48,000 mortgage loan agreements were concluded for a total amount of approximately EUR 6.3 billion (excluding refinancings). This is a decrease in the number of credit agreements granted by approximately 22.5% compared to the first quarter of last year. In terms of amount, 24.2% less credit was provided than then. This is evident from the statistics on mortgage credit that the Professional Association of Credit (BVK) published today.

In the first quarter of 2020, approximately 48,000 mortgage loan agreements were concluded for a total amount of approximately EUR 6.3 billion (excluding refinancings). This is a decrease in the number of credit agreements granted by approximately 22.5% compared to the first quarter of last year. In terms of amount, 24.2% less credit was provided than then. This is evident from the statistics on mortgage credit that the Professional Association of Credit (BVK) published today.

Abolition of the housing bonus in Flanders affects the figures

The abolition of the housing bonus in Flanders at the end of last year and the fact that many borrowers consequently completed their financing projects (purchase, construction and renovation) early at the end of 2019 in order to be able to benefit from the favorable housing bonus regime in Flanders with certainty at the time. have led to a sharp decline in lending in the first quarter of 2020.

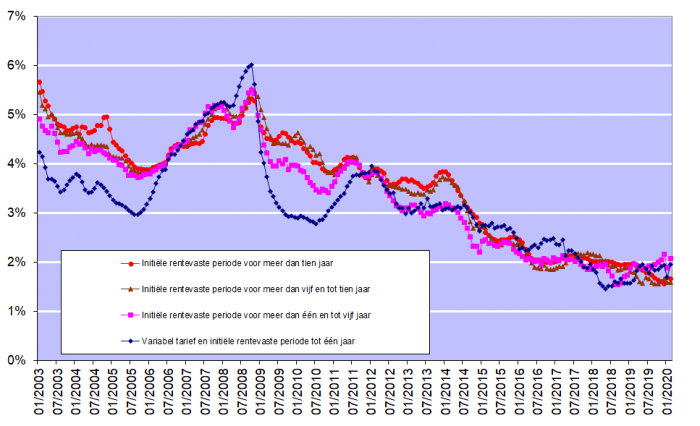

The very low interest rates for mortgage loans of recent years were still applicable in the first quarter of 2020. According to figures published by the National Bank of Belgium, they amounted to between 1.59% in February (for loans with a variable interest rate and an initial interest rate fixation period between 5 and 10 years) and 2.07% (for loans with an initial interest rate fixation period of more than 1 year and less than 5 years).

Below you will find the most important findings for the first quarter of 2020 compared to the first quarter of 2019:

Bij deze cijfers zijn de herfinancieringen buiten beschouwing gelaten.

- The number of credit applications (excluding those for refinancing) fell by almost 16% in the first quarter of 2020 compared to the first quarter of 2019. The amount of credit applications also fell by approximately 10%. Some 81,000 credit applications were still submitted for a total amount of just over EUR 12.5 billion.

- Mortgage loans granted fell by approximately 22.5% in the first quarter of 2020. The corresponding amount decreased by 24%. Approximately 48,000 loans were thus granted for a total amount of EUR 6.3 billion (excl. refinancings).

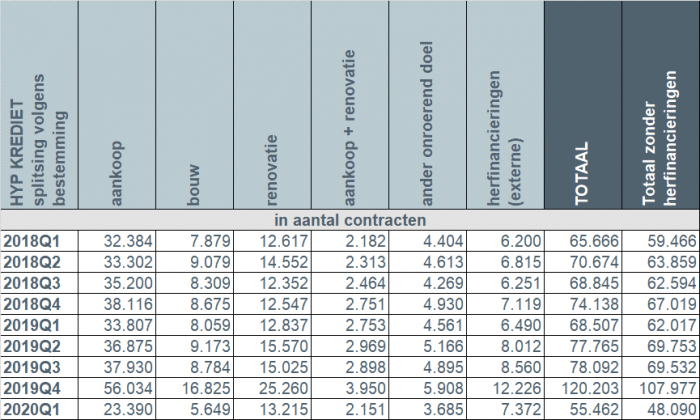

- Compared to the fourth quarter of 2019, this is even a decrease of more than half.

- The number of loans for the purchase of a home saw the largest decline in percentage terms, namely -30.8% or 10,417 fewer loans than in the first quarter of 2019. The number of construction loans (-2,410) fell by 29.9%, while the number of loans for purchase with renovation (-602) fell by 21.9%. The number of loans for other purposes (garage, building land, ...) (-876) fell by 19.2%. Only the number of loans for the renovation of a home (+378) increased by approximately 3% in the first quarter of 2020 compared to the first quarter of 2019.

- The number of external refinancings (+882) increased by 13.6% in the first quarter of 2020 compared to the first quarter of 2019. More specifically, approximately 7,400 external refinancings were provided in the first quarter of 2020 for a total amount of slightly less than EUR 1 billion.

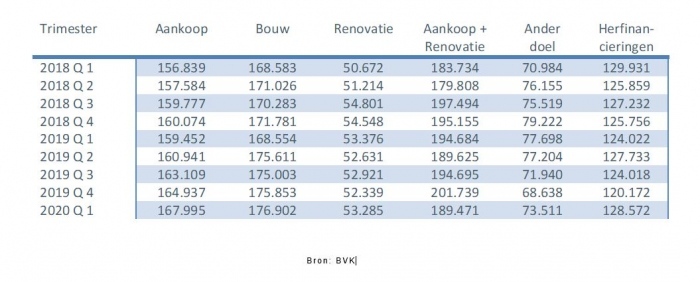

- The average amount borrowed for the purchase of a home increased further in the first quarter of 2020 to EUR 168,000. The average amount for a construction loan reached almost EUR 177,000 in the first quarter of 2020. In contrast, the average amount of credits for purchase + renovation fell to just under EUR 190,000.

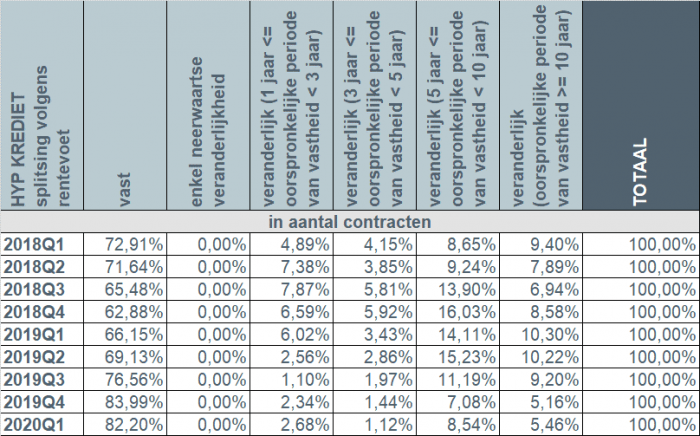

- In the first quarter of 2020, approximately 9 out of 10 borrowers again opted for a fixed interest rate or a variable interest rate with an initial interest rate fixation period of at least 10 years. Only in 2.7% of cases was a credit with an annually variable interest rate opted for.

Number of credit applications

The number of credit applications, excluding those relating to external refinancing, fell by almost 16% during the first quarter of 2020 compared to the same quarter of last year. The underlying amount of credit applications also fell by more than 10%.

The number of credit applications fell for almost all purposes. Loan applications for the purchase of a home (-10,221) fell by 18.7%, those for the purchase + renovation of a home (-719) by 13.4%. The number of credit applications for the construction of a home (-1,934, or -16.8%) and for the renovation of a home (-1,258, or -7%) also fell, as did the number of credit applications for other purposes (- 990, or -15.3%).

Garage, bouwgrond, ...

In addition, in the first quarter of 2020, only the number of applications for external refinancing increased by almost 20%.

Number of loans granted in the first quarter

In the first quarter of 2020, the number of loans granted, excluding external refinancings, decreased by 22.5% compared to the first quarter of 2019. The corresponding amount decreased by 24.2%.

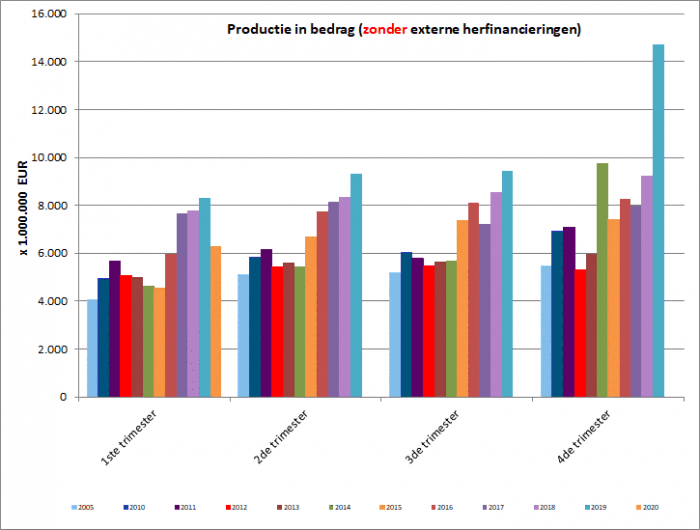

The total amount of loans granted in the first quarter has therefore fallen back to the – still high – level of 2016, after three extremely strong years.

Decrease in the number of credits for most purposes

Approximately 48,000 new loans were granted in the first quarter of 2020 for a total amount of approximately EUR 6.3 billion - excluding external refinancings.

Compared to the first quarter of last year, a decrease was observed for almost all purposes.

The number of loans for the purchase of a home (-10,417) was 30.8% lower in the first quarter of 2020 than in the first quarter of 2019. The number of loans for purchase with renovation (-602) fell by 21. 9%, while the number of construction loans (-2,410) was 29.9% lower. The number of loans for other purposes (-876) fell by 19.2%.

Only the number of loans for the renovation of a home increased, namely +2.9% or 378 more loans than in the first quarter of 2019.

In addition, the number of external refinancings also increased by 13.6% in the first quarter of 2020. In particular, almost 7,400 external refinancings were provided for a total amount of almost EUR 1 billion.

Average amount of a credit for the purchase of a home increases to EUR 168,000

The average amount of a loan for the purchase of a home increased to EUR 168,000 in the first quarter of 2020. This is an increase of EUR 11,000 in two years.

The average amount of a loan for the construction of a home increased slightly further in the first quarter of 2020 to EUR 177,000.

The average amount of a loan for the purchase of a home + renovation fell in the first quarter to just over EUR 189,000.

Nearly 9 out of 10 borrowers opt for a fixed interest rate

In the first quarter of 2020, almost 9 in 10 borrowers (87.5%) opted for a fixed interest rate or a variable interest rate with an initial interest rate fixation period of at least 10 years. About 10% of borrowers opted for a variable interest rate with an initial interest rate fixation period of between 3 and 10 years. The number of borrowers who opted for an annually variable interest rate was limited to approximately 2.7%.

Taking into account the still very low interest rates (see graph below), Belgian consumers continue to largely opt for certainty. However, approximately 12% also opt for a variable interest rate. A very limited number still opt for an annually variable interest rate. But even in the event of a variable interest rate, the consumer is strongly protected by the legislation. For example, the variable interest rate after adjustment to the evolution of the applicable reference indices can never amount to more than double the initial interest rate.

Responsible mortgage lending remains the starting point

The credit sector is and remains aware that mortgage lending must be done with great care and that responsible lending must remain the absolute starting point. On this point, the sector is on the same page as the regulator: lenders must exercise the necessary caution to, on the one hand, prevent individual borrowers from taking out loans that are too large and, on the other hand, to safeguard financial stability in the long term.