Once again, an exceptionally high number of mortgage loans were granted in the second quarter

27 June 2021 - 9 min Reading time

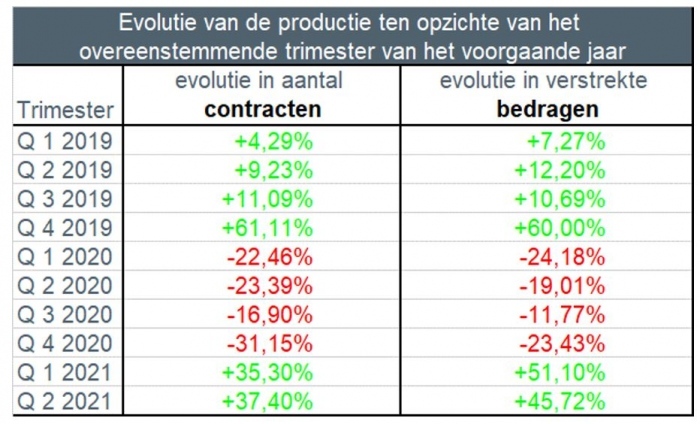

Excluding refinancings, the number of loan applications in the second quarter of 2021 increased by nearly 39% compared to the second quarter of 2020. There was also an increase in the total loan amount of approximately 52%.

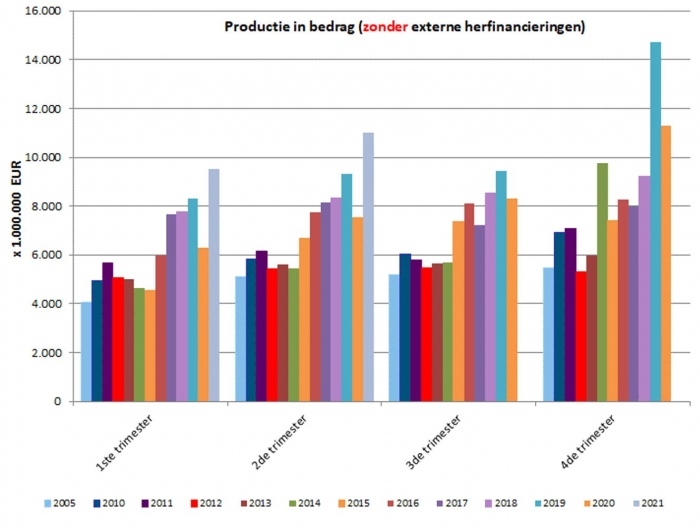

In the second quarter of 2021, nearly 73,500 mortgage loan agreements were concluded for a total amount of 11 billion EUR (excluding refinancings).

This also represents an increase in the number of granted loan agreements of about 37.5% compared to the second quarter of the previous year. In terms of the loan amount, there was an increase of just under 46% compared to that period.

It's important to note that the second quarter of 2020 was a weak quarter due to the COVID-19 pandemic and the associated lockdown during that time.

However, even when compared to the second quarter of 2019, the recent quarter has shown strong figures.

These findings are based on mortgage loan statistics published today by the Professional Association of Credit (BVK).

De 54 leden van de BVK nemen samen ongeveer 90% van het totaal aantal nieuw verstrekte hypothecaire kredieten (de zogeheten productie) voor hun rekening. Het totale uitstaande bedrag aan hypothecair krediet van de BVK-leden bedraagt eind juni 2021 ongeveer 250 miljard EUR.

The mortgage lending sector has fully recovered

The recovery of the real estate market and the demand for mortgage credit continued in the second quarter of 2021, following the strong performance in the last quarter of 2020 and the first quarter of 2021.

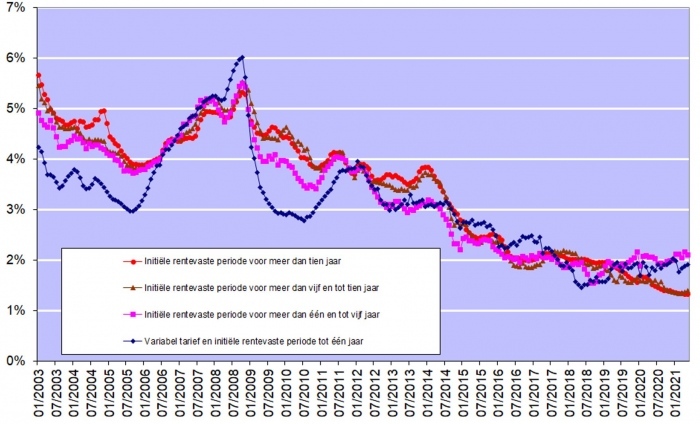

Interest rates for mortgage loans remained very attractive in the past quarter. According to data published by the National Bank of Belgium, rates in May ranged from 1.33% (for loans with a fixed interest rate and an initial fixed interest period of more than 10 years) to 2.10% (for loans with an initial fixed interest period of more than 1 year and up to 5 years).

As expected, mortgage lending follows the strong activity in the housing market. Never before has so much mortgage credit been granted in the second quarter of a year. This was already the case in the first quarter.

Here are the key findings for the second quarter of 2021 compared to the second quarter of 2020:

Bij deze cijfers zijn de herfinancieringen buiten beschouwing gelaten.

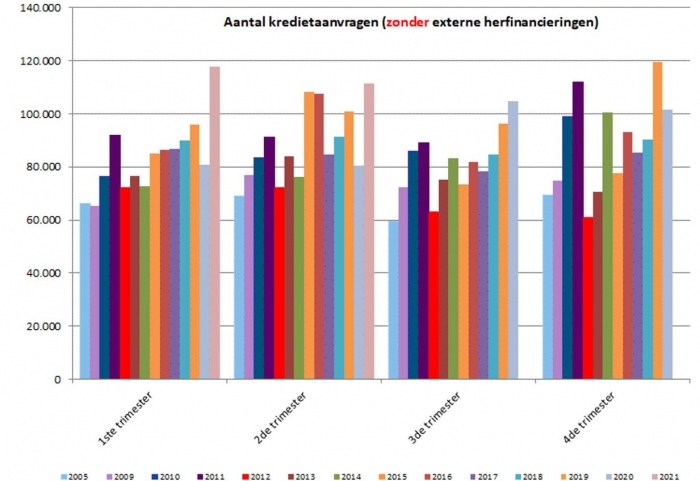

The number of loan applications (excluding refinancing) in the second quarter of 2021 increased by just under 39% compared to the second quarter of 2020. But even compared to the second quarter of 2019, there was an increase of 10.5%. The total amount of loan applications also increased by about 52% compared to 2020. This resulted in almost 111,500 loan applications submitted, totaling 19.5 billion EUR. An absolute record for a second quarter.

The number of granted mortgage loans increased by more than 37% in the second quarter of 2021 compared to the second quarter of the previous year. But compared to the second quarter of 2019, there was an increase of more than 5%. The corresponding loan amount increased by nearly 46% compared to 2020. In total, almost 73,500 loans were granted for a total amount of 11 billion EUR (excluding refinancing).

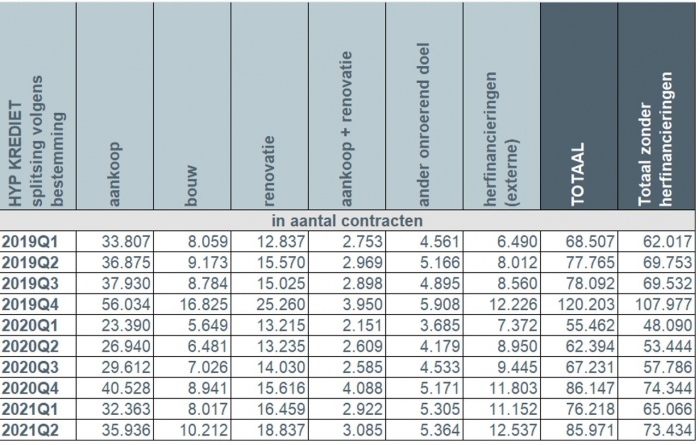

Among the different types of loans, the number of construction loans showed the strongest percentage increase in the second quarter, with a 57.5% rise, or 3,731 more loans than in the second quarter of 2020, along with the number of loans for home renovation (+5,602, or +42.3%). The number of loans for home purchase (+8,996) increased by 33.4%, while the number of loans for purchase with renovation (+476) increased by more than 18%. Even the number of loans for other purposes (+1,185, or +28.4%) (such as garages and land) increased compared to the second quarter of 2020.

The number of external refinancings (+3,587) continued to increase by 40% in the second quarter of 2021 compared to the second quarter of 2020. In the second quarter of 2021, more than 12,500 external refinancings were granted for almost 1.7 billion EUR.

The average amount for a construction loan increased in the second quarter of 2021 to 206,000 EUR. This is an increase of 38,000 EUR (or 22%) since early 2019. The average loan amount for purchase + renovation exceeded 200,000 EUR again, standing at 207,168 EUR. The average borrowed amount for home purchase remained roughly stable at around 182,500 EUR in the second quarter of 2021.

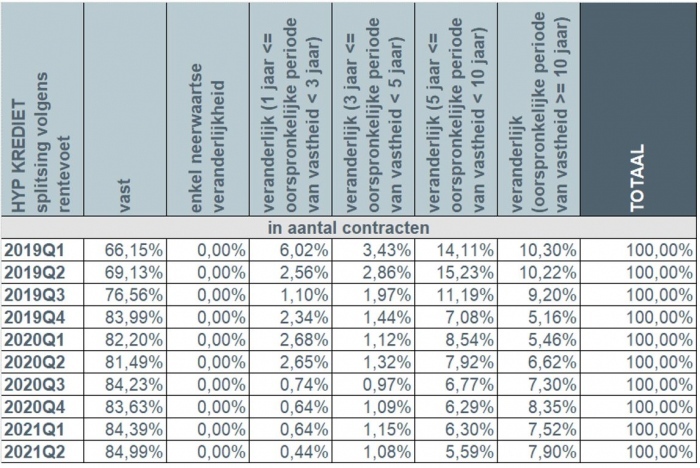

In the second quarter of 2021, more than 9 out of 10 borrowers once again opted for a fixed interest rate or a variable interest rate with an initial fixed interest period of at least 10 years. In less than 0.5% of cases, borrowers chose a loan with an annually variable interest rate.

Number of loan requests

The number of loan applications, excluding those related to external refinancing, increased by nearly 39% during the second quarter of 2021 compared to the same quarter of the previous year. The underlying amount of loan applications also increased by almost 52%.

The number of loan applications increased for all purposes. Loan applications for home purchases (+17,354) rose by 40%, those for home purchase and renovation (+2,478) increased by almost 54%. The number of loan applications for new home construction (+5,236, or +53%) and home renovation (+4,949, or +29%) also experienced significant growth, as did the number of loan applications for other purposes (+1,071, or +19.5%) (garage, land purchase, etc.). The number of external refinancing applications also saw an increase of 12%.

Never before have so many loan applications been submitted in a second quarter.

Number of loans granted in the second quarter

In the second quarter of 2021, the number of loans granted, excluding external refinancing, increased by more than 37% compared to the second quarter of 2020. The corresponding amount increased by almost 46%.

Never before has so much mortgage credit been granted in a second quarter.

Increase in the number of loans for all purposes

In the second quarter of 2021, nearly 73,500 new loans were granted for a total amount of approximately 11 billion EUR, excluding external refinancing.

Compared to the second quarter of the previous year, there was an increase observed for all purposes.

The number of loans for the purchase of a home (+8,996) was more than 33% higher in the second quarter of 2021 than in the second quarter of 2020. The number of loans for purchase with renovation (+476) increased by more than 18%, while the number of construction loans (+3,731) was 57.5% higher. The number of loans for other purposes (+1,185) increased by 28.4%. The number of loans for home renovation also saw an increase, namely +42.3%, with 5,602 more loans than in the second quarter of 2020.

Furthermore, in the second quarter of 2021, the number of external refinancings continued to show an increase of 40%. More specifically, slightly more than 12,500 external refinancings were granted for a total amount of almost 1.7 billion EUR.

Average amount of a construction loan continues to rise to 206,000 EUR

The average amount of a construction loan saw a further increase in the second quarter of 2021 and reached 206,000 EUR. This represents an increase of more than 38,000 EUR (or 22%) since the beginning of 2019.

The average amount of a loan for the purchase of a home with renovation also exceeded the 200,000 EUR mark again in the second quarter, with a significant increase to 207,168 EUR. However, this is still an increase of about 12,500 EUR (or 6.4%) since the beginning of 2019.

The average amount of a loan for the purchase of a home remained around 182,500 EUR in the second quarter of 2021. This is also an increase of 23,000 EUR (or 14.5%) compared to the beginning of 201

More than 9 out of 10 borrowers opt for a fixed interest rate

In the second quarter of 2021, once again, more than 9 out of 10 borrowers (92.9%) chose a fixed interest rate or a variable interest rate with an initial period of interest rate stability of at least 10 years. Just over 6.5% of borrowers opted for a variable interest rate with an initial period of interest rate stability between 3 and 10 years. The number of borrowers opting for an annually variable interest rate is less than 0.5%.

Considering the still very low interest rates (see chart below), Belgian consumers continue to overwhelmingly choose certainty. The number of people opting for a variable interest rate remains low, especially for the annually variable interest rate. However, even in the case of a variable interest rate, consumers are highly protected by legislation. After adjusting to the evolution of the applicable reference indices, the variable interest rate can never be more than double the initial interest rate.