Evolution of mortgage credit in May 2021

29 June 2021 - 4 min Reading time

The number of credit applications in May 2021 increased by nearly 65% compared to May 2020. The corresponding total amount of these applications was even almost 81.5% higher.

- In May 2021, the number of granted loans increased by approximately 14.5%. In terms of the amount, more than 18% more credit was granted than in May 2020.

- Deze groeicijfers vinden hun verklaring in het feit dat de cijfers van mei 2020 nog laag waren ingevolge de covid-19-pandemie en de ermee gepaard gaande lockdown. Maar ook ten opzichte van mei 2019 was er een stijging van de verstrekte kredieten met 4% (+17% in overeenstemmend bedrag).

- These growth figures can be explained by the fact that the numbers in May 2020 were still low due to the COVID-19 pandemic and the associated lockdown. But even compared to May 2019, there was an increase in granted loans by 4% (+17% in corresponding amount). These findings are based on the data from the Mortgage Credit Barometer of the Professional Association of Credit (BVK).

These findings are based on the data from the Mortgage Credit Barometer of the Professional Association of Credit (BVK).

To be able to track the evolution of mortgage credit more quickly, the Professional Association of Credit (BVK) has been publishing a mortgage credit barometer since the beginning of 2009. This barometer provides a monthly overview of the evolution of the number and volume of newly granted and requested mortgage credits in the past month, compared to the same month of the previous year. The percentages mentioned relate to almost the entirety of the BVK mortgage credit market. The underlying absolute figures are released on a quarterly basis through a press release by Febelfin.

Loan applications

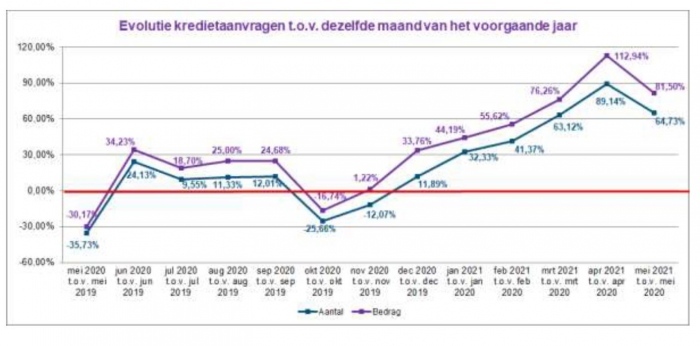

The following chart illustrates the evolution of loan applications, both in terms of amount and number, for the past twelve months. The monthly figures are always compared to those of the same month in the previous year.

In May 2021, the number of applications for a mortgage loan increased by almost 65% compared to May 2020. In terms of amount, there was even an increase of 81.5% compared to the previous year.

The increase in the number of loan applications is evident in all areas: loans for home purchases (+77.5%), loans for home construction (+83.6%), and loans for home renovation (+49.5%). The number of applications for loans for home purchase with renovation (+84.7%), as well as the number of applications for external refinancing (+46%), also saw a significant increase.

Granted mortgage loans

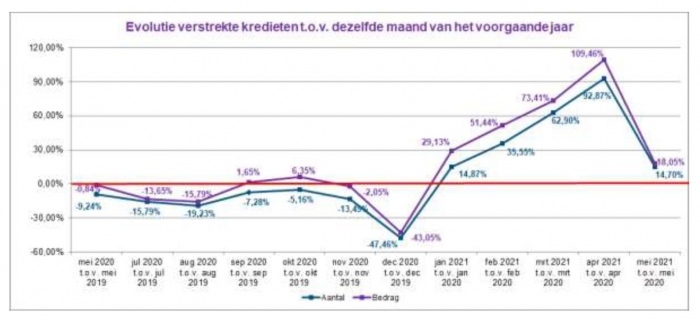

The following chart illustrates the evolution of granted mortgage loans, both in terms of number and amount, for the past twelve months. The monthly figures are always compared to those of the same month in the previous year.

In May 2021, the number of granted mortgage credit agreements was approximately 14.5% higher than in May 2020. The corresponding credit amount also increased by just over 18%. The increase in the number of granted loans occurred in all areas: loans for home purchases (+7%), loans for home construction (+24%), loans for home renovation (+30.5%), and loans for home purchase with renovation (+1%). External refinancing loans also saw an increase of (+13%).