Evolution of mortgage credit in January 2020

3 min Reading time

The number of credit applications decreased in January 2020 by almost 14% compared to January 2019. The corresponding total amount of these applications was also more than 10% lower.

In January 2020, the number of granted loans decreased by almost 12%. In terms of amount, approximately 14.5% less credit was granted than in January 2019.

These findings are based on the mortgage credit barometer data from the Professional Association of Credit (BVK).

Om de evolutie van het hypothecair krediet sneller te kunnen volgen, stelt de Beroepsvereniging van het Krediet (BVK) sinds begin 2009 een hypothecaire-kredietbarometer op. Deze barometer geeft elke maand de evolutie weer van het aantal en volume nieuw toegekende en aangevraagde hypothecaire kredieten van de voorbije maand, in vergelijking met dezelfde maand van het voorgaande jaar. De vermelde percentages hebben betrekking op omzeggens de totaliteit van de BVK-markt van hypothecaire kredieten. De onderliggende absolute cijfers worden op trimestriële basis vrijgegeven via een persbericht van Febelfin.

Credit Applications

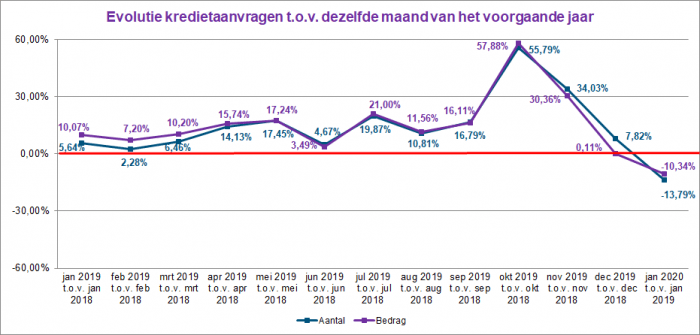

The following chart shows the evolution of credit applications, in amount and number, for the past twelve months. The monthly figures are compared to those of the same month in the previous year.

In January 2020, the number of applications for a mortgage loan decreased by almost 14% compared to January 2019. In terms of amount, there was also a decrease of just over 10% compared to the previous year.

The decrease in the number of credit applications occurred in all areas: loans for the purchase of a home (-19.5%), for the construction of a home (-19.5%), for home renovations (-7%), for purchases with renovations (-6.5%), and for other real estate purposes (-22.5%). Only the number of applications for external refinancing (+13%) saw an increase.

Granted Mortgage Loans

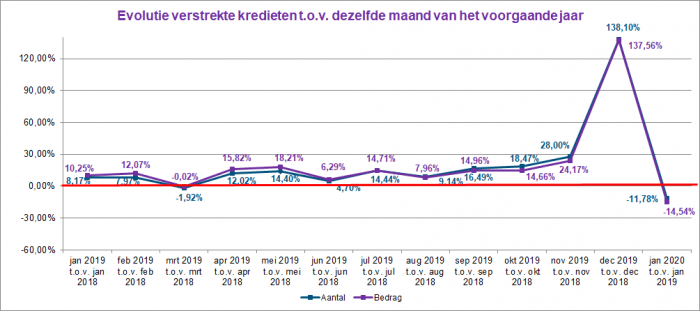

The following chart shows the evolution of granted mortgage loans, in number and amount, for the past twelve months. The monthly figures are compared to those of the same month in the previous year.

In January 2020, the number of granted mortgage credit agreements was nearly 12% lower than in January 2019. The corresponding loan amount also decreased by approximately 14.5%.

The decrease in the number of granted loans occurred in almost all areas: loans for the purchase of a home (-25.5%), for the construction of a home (-18.5%), and for purchases with renovations (-15.5%). Only loans for home renovations (+19%) and external refinancings (+19%) experienced an increase.