Energy‑renovation loans are on the rise again

4 min Reading time

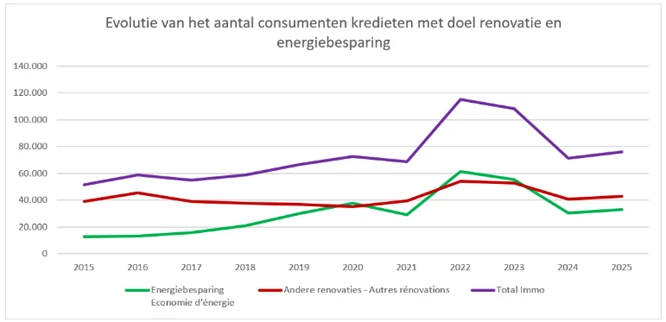

February traditionally shines a spotlight on the construction sector thanks to the annual Batibouw trade fair. In that context, Febelfin took a closer look at the evolution of consumer loans for renovation purposes in 2025. Last year, nearly 76,000 consumer loans were granted for energy‑saving investments or renovation works. This represents an increase of 6.4% in number and 15.3% in total amount compared to 2024.

Recovery of renovation loans and energy‑saving investments

In total, just under 76,000 new consumer loans were concluded for renovation in 2025. On the one hand, these are loans intended for general renovation works; on the other, for investments in energy‑saving measures. Mortgage loans for the purchase and/or renovation of a home are not included here.

Consumer loans for renovation grew again in 2025 by 6.4%, after two years of decline. Loans for other renovation works increased by +5.4% in number and +14.5% in amount compared to 2024. As for loans intended for energy‑saving investments — such as the installation of heat pumps, solar panels or additional insulation — we also observe an increase: +7.8% in number and +16.2% in amount compared to 2024.

The renewed growth of renovation loans, particularly those focused on energy efficiency, is a positive signal for the renewal of Belgium’s real‑estate stock. Nevertheless, the number of energy‑saving loans granted in 2025 — around 33,000 — remains well below the exceptionally high level of 2022, when more than 61,000 such loans were issued at the height of the energy crisis.

More consumer loans for second‑hand cars than for new ones

In 2025, consumer loans for the purchase of second‑hand cars once again proved more popular than loans for new vehicles. For the fourth year in a row, they maintain their leading position: 133,000 loans were granted for used cars, compared with 122,500 for new cars. This evolution goes hand in hand with a 0.5% increase in number and a 3.7% rise in amount for second‑hand vehicles.

The dynamics for new vehicles also remain positive, with a growth of 4.7% in number and 10.1% in amount for loans granted in 2025.

Within sustainable mobility, the share of “green” vehicles continues to grow. In 2025, 9,600 loans were granted for the purchase of a new car emitting less than 50 g/km of CO₂, and 4,000 loans for the purchase of a second‑hand car meeting the same emission standards.

"The normalisation of energy prices initially reduced concerns and cooled interest in energy‑saving loans. The discontinuation, suspension or revision of several premium schemes also had a negative impact on renovation activity, particularly for energy‑efficient projects.

Today, international geopolitical tensions and the gas tax revision — which again increases household energy bills — may rekindle interest in such renovation works. However, this will only be the case if the Regions maintain or reintroduce sufficient financial support measures for consumers.

The still‑high cost of “green” vehicles remains an important barrier for consumers, who hesitate to make this investment. On top of that, the charging‑point network is still insufficiently developed in many areas. "

Ivo Van Bulck, Director Retail Credit & Savings at Febelfin