Despite COVID, mortgage lending remains strong

5 February 2021 - 11 min Reading time

Despite the COVID-19 crisis and the restrictive measures imposed in 2020, mortgage lending continued to thrive.

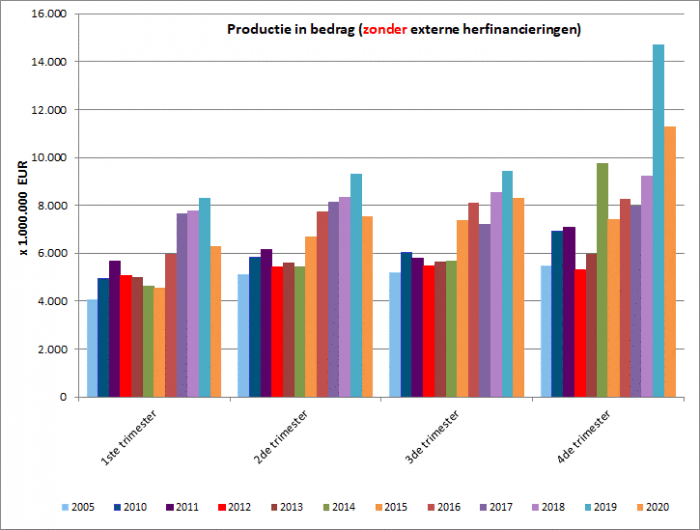

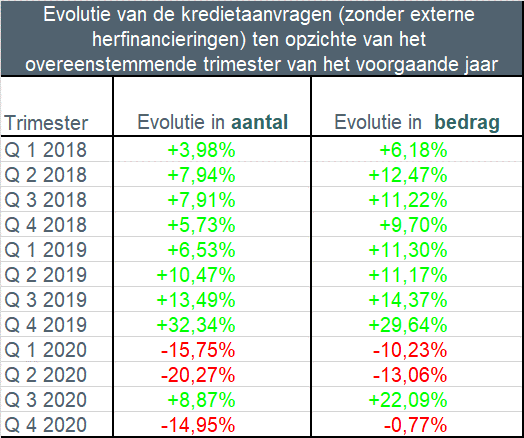

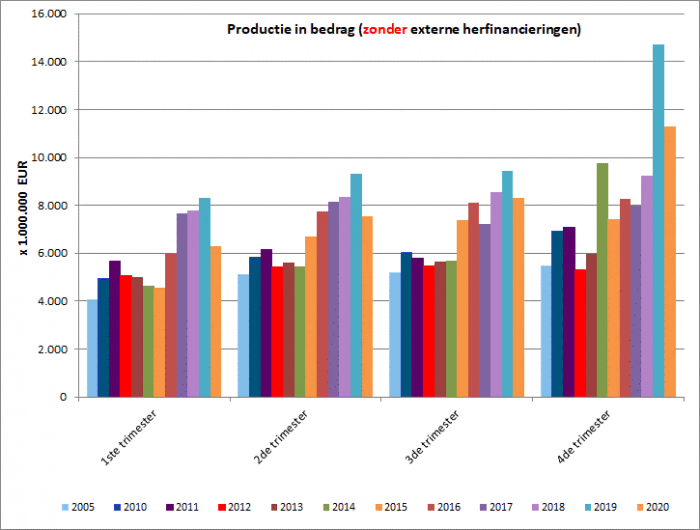

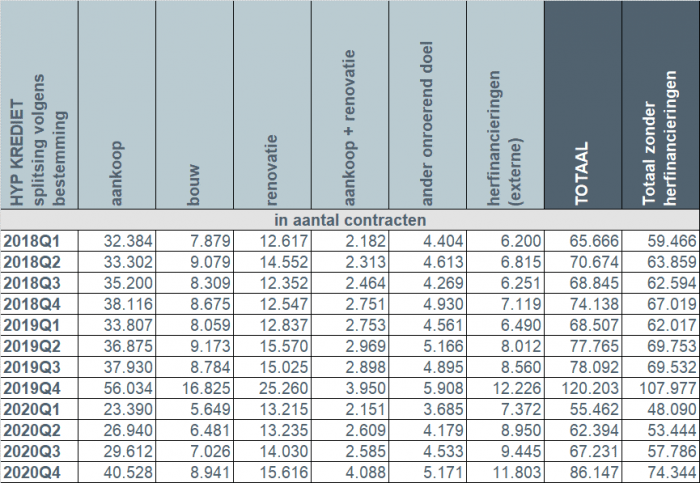

Excluding refinancing, the number of credit applications in 2020 decreased by approximately 11% compared to 2019, but it was more than 3% higher than in 2018. In terms of the amount, there was a decrease of just 0.6% compared to 2019 and even an increase of 16% compared to 2018.

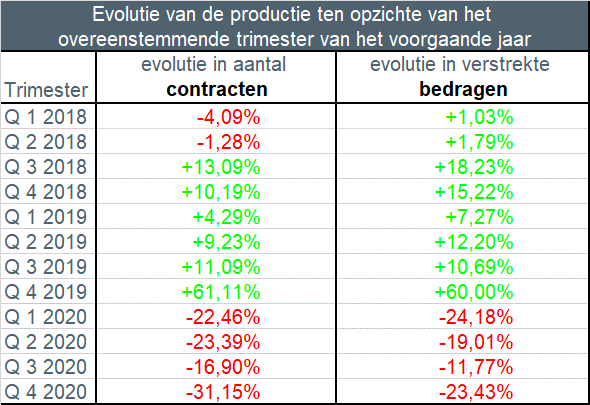

In 2020, excluding refinancing, nearly 234,000 mortgage credit agreements were concluded, totaling almost 33.5 billion EUR. While this was significantly less than in 2019, which was an exceptional year due to the impending abolishment of the housing bonus in Flanders at the end of 2019, it is challenging to compare to that year. However, the past year reached approximately the same level as 2018, which was also a record year.

Particularly in the last quarter of 2020, mortgage lending saw a rebound. More than 74,000 loans (excluding refinancing) were granted, totaling 11.3 billion EUR.

This is revealed by the statistics on mortgage lending published today by the Professional Association of Credit (BVK).

This is revealed by the statistics on mortgage lending published today by the Professional Association of Credit (BVK).

De 53 leden van de BVK nemen samen ongeveer 90% van het totaal aantal nieuw verstrekte hypothecaire kredieten (de zogeheten productie) voor hun rekening. Het totale uitstaande bedrag aan hypothecair krediet van de BVK-leden bedraagt eind december 2020 ongeveer 246 miljard EUR.

The impact of the coronavirus crisis

The abolishment of the housing bonus in Flanders at the end of 2019 and the fact that many borrowers had expedited their financing projects (purchases, construction, and renovations) by the end of that year to take advantage of the favorable housing bonus regime still in effect, led to an exceptionally high level of lending in 2019. Consequently, there was a significant decline in lending in the first quarter of 2020.

Following the subsequent COVID-19 crisis and the associated government measures such as the ban on non-essential travel, closure of non-essential sectors, and so on, mortgage lending also declined sharply in the second quarter. In the third quarter, the real estate market and demand for mortgage credit recovered. This increased demand fully materialized in the last quarter of 2020 in terms of the granted credit figures.

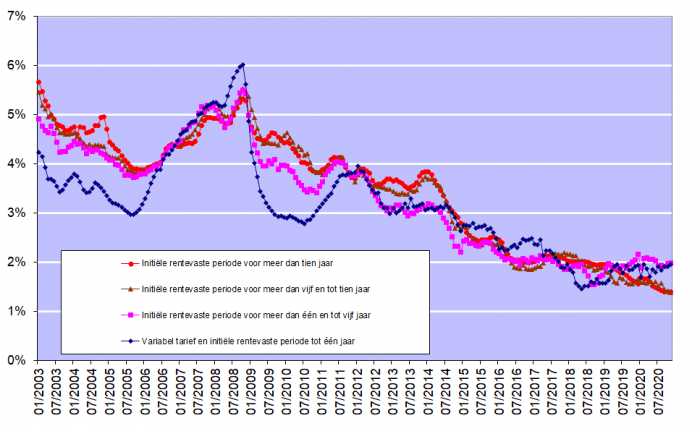

Throughout the past year, including the last quarter, borrowers continuously benefited from very low interest rates for mortgage loans. According to data published by the National Bank of Belgium, in November, interest rates ranged from 1.38% (for variable-rate loans with an initial fixed interest period of more than 5 and up to 10 years) to 1.98% (for loans with an initial fixed interest period of more than 1 year and less than 5 years).

"The coronavirus crisis has made the past year a particularly challenging one. However, despite all the obstacles it brought, the credit sector has continued to support consumers in realizing their housing projects, which have gained even more importance due to remote work and limited social interactions.”

Below you will find the key findings for the entire year 2020 with a special focus on the fourth quarter. Where necessary, comparisons will also be made with the more "typical" year 2018, given that lending in 2019 was an exceptional year for the reasons mentioned above.

These figures do not include refinancings.

Regarding the entire year 2020 :

- The number of credit applications (excluding refinancing) was 11% lower in 2020 compared to 2019, but slightly more than 3% higher compared to 2018. The amount of credit applications was barely 0.6% lower than in 2019, and even 16% higher compared to 2018. There were 368,000 credit applications submitted for a total amount of almost 60 billion EUR.

- In 2020, almost 234,000 mortgage loans were granted (excluding refinancing) for a total amount of 33.5 billion EUR. The number of granted mortgage loans in 2020 decreased by more than 24% compared to 2019, but compared to 2018, this decrease was limited to just over 7.5%. The corresponding amount decreased by 20% compared to 2019, but compared to 2018, this decrease was hardly 1%.

- Compared to 2019, there is a decrease in the number of granted loans for all purposes. This decrease is most pronounced for loans for the purchase of a home (-44,000, or -27%), construction loans (-14,750, or -34.5%), and loans for home renovation (-12,600, or -18%). The number of loans for purchase with renovation (-1,150, or -9%) and for other purposes (garage, land, etc.) (-3,000, or -14.5%) experienced a less sharp decline.

- Compared to the year 2018, the picture is more nuanced. Loans for the purchase of a home (-18,500, or -13%) and construction loans (-5,800, or -17%) still experienced a decline, as did loans for other purposes (-650, or -3.5%). However, renovation loans (+4,000, or +8%) and loans for purchase with renovation (+1,700, or +18%) saw an increase.

- In terms of amount, the picture is even more nuanced. Compared to 2018, there was only a decrease of -3.5% for loans for the purchase of a home and -6.5% for construction loans. For renovation loans, there was an increase of +18%, and for loans for purchase with renovation, there was an increase of +23%.

- The number of external refinancings (+2,300, or +6.5%) was the only category that increased in 2020 compared to 2019. Specifically, more than 37,500 external refinancings were granted in 2020 for a total amount of over 4.8 billion EUR.

1) Number of credit applications in the fourth quarter

The number of credit applications, excluding those related to external refinancing, experienced a decrease of nearly 15% during the fourth quarter of 2020 compared to the same quarter of the previous year. However, the underlying amount of credit applications barely decreased by 0.8%.

The decline in the number of credit applications was not uniform. Credit applications for the purchase of a home (-8,000) decreased by -12.5%, those for building a home (-3,750) decreased by -23%, and those for renovating a home (-7,600) decreased by -28%. On the other hand, the number of applications for credits for the purchase + renovation of a home (+1,355) increased by almost 24%, as did the number of credit applications for other purposes (such as a garage, building land) (+74, or +1%). Additionally, the number of applications for external refinancing increased again by 6%.

2) Number of granted credits in the fourth quarter

Compared to the exceptional fourth quarter of 2019, the number of granted mortgage loans in the fourth quarter of 2020 naturally decreased significantly, namely by -23.5% in quantity and -31% in amount.

Compared to the exceptional fourth quarter of 2019, the granted mortgage loans in the fourth quarter of 2020 have naturally decreased significantly, specifically by -23.5% in quantity and -31% in amount

3) Evolution of the number of loans by purpose

In the fourth quarter of 2020, slightly more than 74,000 new loans were granted, totaling approximately 11.3 billion EUR, excluding external refinancing.

Compared to 2019, this is, of course, a decrease. This includes -28% for home purchase loans, -38% for renovation loans, and even -47% for construction loans.

However, compared to the fourth quarter of 2018, there is an increase for all purposes: the number of home purchase loans (+2,412) in the fourth quarter of 2020 was more than 6% higher than in the fourth quarter of 2018. The number of loans for purchase with renovation (+1,337) saw an increase of 48.6%, as did the number of renovation loans (+3,069, or +24.5%), while construction loans (+266) were 3% higher. The number of loans for other purposes (+241) increased by nearly 5% compared to the fourth quarter of 2018.

Additionally, in the fourth quarter of 2020, the number of external refinancings remained high. More specifically, there were 11,800 external refinancings granted, totaling 1.5 billion EUR."

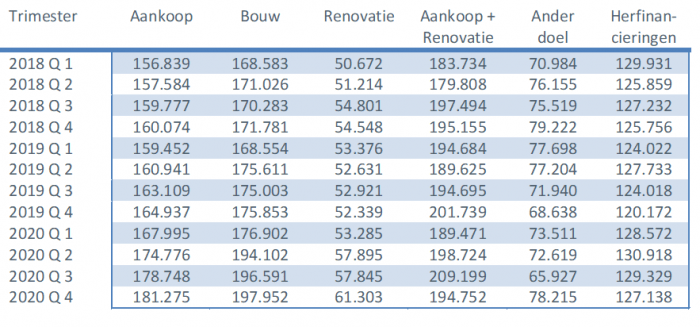

4) Average amount of a loan for home construction flirts with the 200,000 EUR threshold

The average amount of a loan for home construction saw a further increase in the fourth quarter of 2020, reaching nearly 198,000 EUR. This represents an increase of almost 30,000 EUR since the beginning of 2018.

The average amount of a loan for home purchase + renovation in the fourth quarter decreased to levels seen in previous years, at 195,000 EUR.

Similarly, the average amount of a loan for home purchase continued to rise in the fourth quarter of 2020, reaching just over 181,000 EUR. This also marks an increase of 24,000 EUR compared to the beginning of 2018."

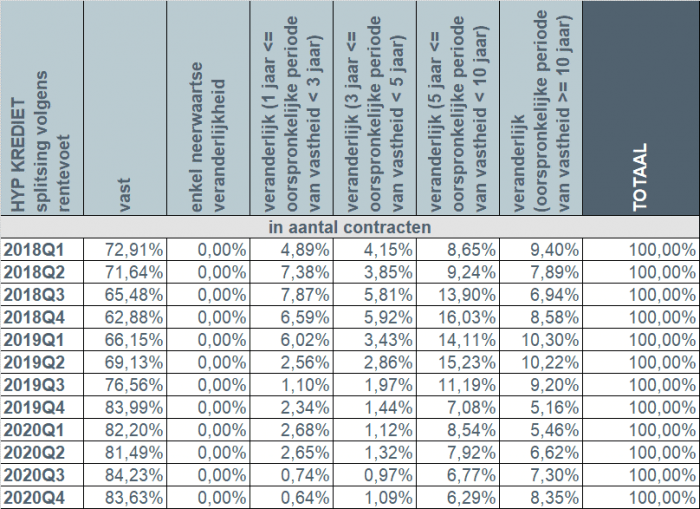

5) Fixed interest rates continue to be the preferred choice

In the fourth quarter of 2020, once again, more than 9 out of 10 borrowers (92%) opted for a fixed interest rate or a variable interest rate with an initial fixed interest period of at least 10 years. Just over 7% of borrowers chose a variable interest rate with an initial fixed interest period between 3 and 10 years. The number of borrowers opting for an annually variable interest rate fell to just 0.6%."

Considering the still very low interest rates (see chart below), Belgian consumers continue to overwhelmingly opt for security. The number of individuals choosing a variable interest rate remains low, especially in the case of an annually variable interest rate. However, even in the case of a variable interest rate, consumers are highly protected by legislation. For instance, after adjustment to the evolution of the applicable reference indices, the variable interest rate can never exceed twice the initial interest rate.

Responsible mortgage lending remains the priority

The credit sector is well aware that mortgage lending must be approached with great care, and responsible lending remains the absolute priority. On this point, the sector aligns with the regulator: credit providers must exercise the necessary caution to, on the one hand, prevent individual borrowers from taking on loans that are too large and, on the other hand, safeguard financial stability in the long run