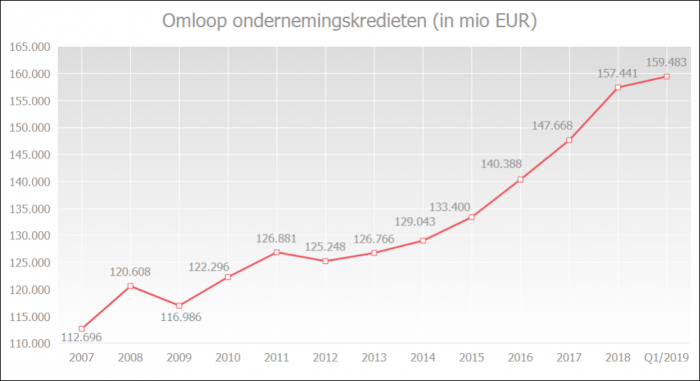

Annual growth slows down but banks still provide a record of nearly 160 billion EUR to businesses

24 July 2019 - 6 min Reading time

By the end of March 2019, Belgian banks had set a new record for credit to businesses, totaling 159.5 billion euros. This represents a year-on-year increase of 4.9%.

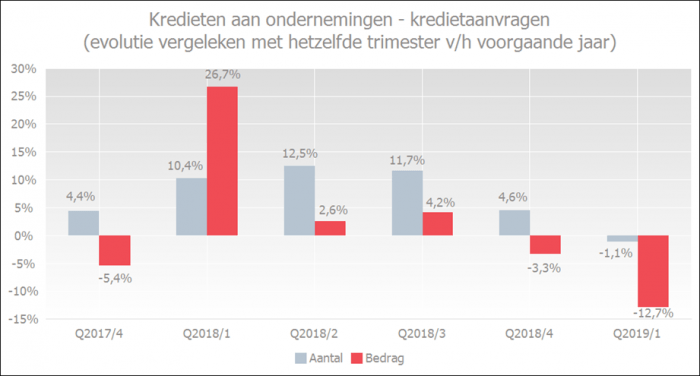

However, this increase was not reflected in the number of credit applications. Businesses had less need for financing, and in the first quarter of 2019, they applied for 1.1% fewer credits than in the same period in 2018. The corresponding amount even decreased by 12.7%. This is primarily due to an exceptionally high amount of credit applications in the same period the previous year.

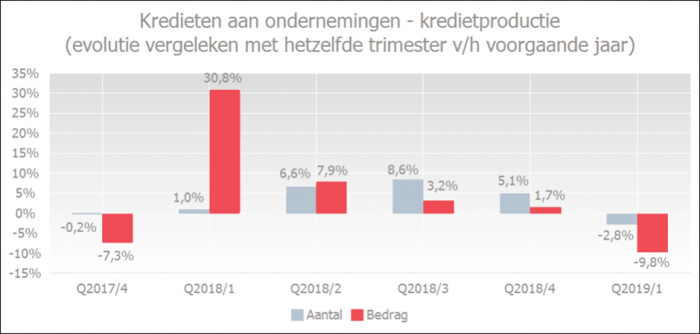

Credit production is in line with credit requests: a decrease of 2.8% in quantity and 9.8% in amount.

Businesses are increasingly taking on long-term credits and are making intensive use of existing credit lines. This explains why the total credit to businesses can approach a record while credit production experiences more moderate growth.

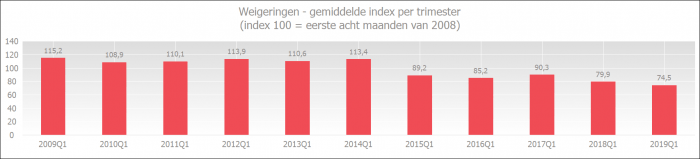

Businesses reported that they experience fewer credit impediments than before. The refusal rate for the first quarter of 2019 is the lowest level since the start of measurements in 2009, compared to all first quarters.

Outstanding amount of corporate loans remains high

The amount of outstanding corporate loans (including commitment loans, such as guarantee loans and documentary credits) remained high in the first quarter of 2019, totaling 159.5 billion euros in March 2019.

On an annual basis (comparison between March 2019 and March 2018), the outstanding amount increased by 4.9%.

Businesses request less credit; issuance of new credits decreases

In the first quarter of 2019, entrepreneurs applied for 1.1% fewer credits than in the same period the previous year. In terms of amount, there was a significant decrease of 12.7%, which can be explained by an exceptionally high amount of credit applications in the same quarter the previous year.

Number of granted loans decreased by 2.8% in the first quarter of 2019 compared to the same quarter the previous year. The decrease in amount of 9.8% can be attributed to an exceptionally high amount of credit production in the first quarter of 2018.

There are several elements that can explain why the reduction in credit production in the first quarter of 2019 can coexist with an increase in the total credit volume, even though this increase has also lost strength.

- It is statistically logical that the base effect observed in credit production only has a tempered effect on the entire credit volume (previously granted credits have a buffering effect on the total volume).

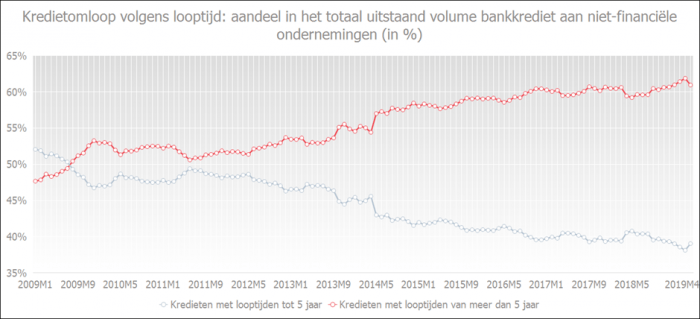

- The graph below also shows that the share of long-term credits to non-financial companies in the total is increasing. Due to the greater importance of long-term credits, there is less 'rotation' in the credit volume, and there can also be an increase in the total credit volume with more moderate credit production.

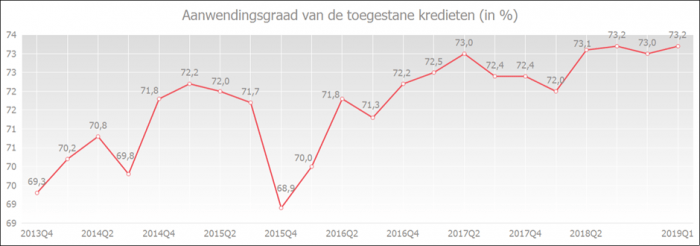

- Usage rate of credits granted to non-financial companies remains high compared to previous quarters and years. Companies are therefore making intensive use of their existing credit lines in the first quarter of 2019.

Companies experience few impediments when applying for credit.

The refusal rate for the first quarter of 2019 is the lowest level since the start of measurements in 2009, compared to all first quarters.

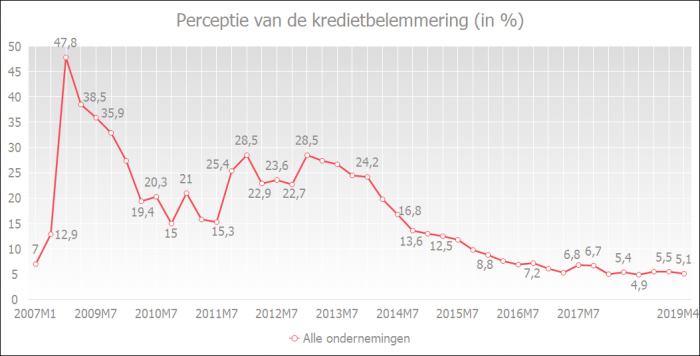

Belgian companies reported in the NBB's periodic survey that they experience fewer credit impediments. The perception of credit impediments remains historically low. In April 2019, 5.1% of companies considered the credit conditions unfavorable. This places the credit impediment indicator at the second lowest level since measurements began in 2003.

A decrease in the graph below indicates the gradual improvement in the perception of credit impediments. The lower the curve, the fewer credit impediments entrepreneurs believe they experience.

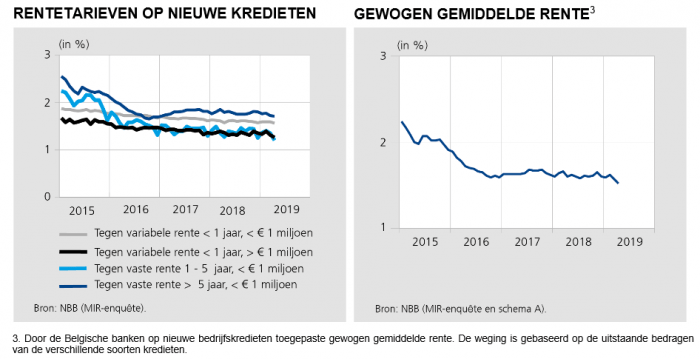

Companies borrow at favorable rates

Despite favorable rates, companies had less need for financing in the first quarter of 2019, leading to a decrease in credit demand. In April 2019, the weighted average interest rate on new corporate loans reached a new low of 1.52%.

Because companies want to enjoy these low rates for a longer period, they primarily request bank loans with a long term (more than 5 years). However, in 2018, they again took on more short-term credit (up to 1 year). This is likely due to stricter regulations on advance payments of corporate tax and a greater need for funding for actual business operations.