After a record in 2022, the renovation credit stabilises in 2023

22 February 2024 - 4 min Reading time

Although only 15% of the Belgian houses has an EPC label A or B, the credits granted for energy saving investments slightly declined according to 2022.

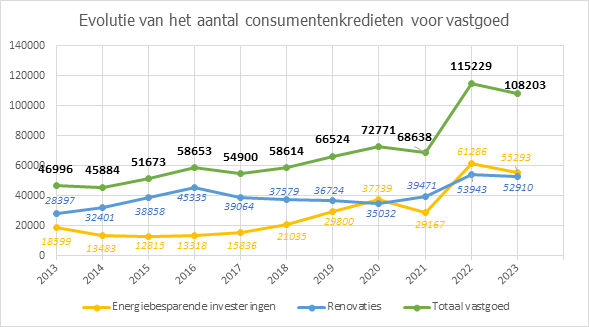

On the occasion of Batibouw, the Professional Credit Union (UPC/BVK) examined the consumer credits for renovating purposes in 2023. Last year, a total of more than 108,000 consumer credits were granted for energy saving investments or home renovations. The consumer credits for renovations however recorded a decline according to the record year 2022.

The renovation credit stabilises while the energy saving investments decrease

In 2023, a total of 108,203 new consumer credits were taken out for renovation purposes. This refers to credits that are used for financing a general renovation on the one hand and for investments in energy saving measures on the other hand. Mortgage loans for buying and/or renovating a house are not included in these numbers.

The consumer credit for renovations recorded a slight decline of 6% according to the record year 2022. The consumer credit for general renovations remained fairly stable in 2023 (decrease of -1.8% according to 2022), while credits for energy savings investments, such as the installation of a heat pump, solar panels or extra isolation fell sharply in 2023 (-9.8% according to 2022).

From an historical perspective, the number of more than 55,000 new mortgage loans for this type of investments remains however impressive. In 2016, for instance, the total number of credits for energy saving purposes only stood at about 13,000. Also according to 2021, this still represents an increase with more or less 90%.

The stabilisation of the number of granted credits for energy saving purposes stems from the combination of a higher interest rate environment and more expensive materials due to the inflation developments, and a significant decrease in energy prices. This last evolution eliminated an important incentive for consumers to adopt energy saving measures in their home.

Only 15% of private houses have an EPC score A or B

A recent internal analysis conducted by Febelfin showed that actually only around 15% of the Belgian households possess a home with at least an EPC score B. This percentage highlights the scale of the challenge we are faced with in terms of making our houses more sustainable. By 2050, the housing market should become (almost) energy neutral, which means that all houses should get an EPC score A. Therefore, investments of an estimated amount of EUR 400 billion will be necessary, an important part of which will have to be financed via credits.

To achieve this, it seems that more urgence and sensibilisation is needed. This could be made possible by providing clarity about the timelines within which the different EPC requirements should be achieved, so that owners and landlords can follow a clear pathway towards 2050 and can plan their renovations timely.

Thus, it is clear that consumer credits will keep on playing an important role in the sustainable transition, also in the future. To achieve this, policy makers need to commit to a clear and consistent regulatory framework, says Bart Vervenne, Chairman of UPC/BVK, on behalf of the Professional Association:

"In a short period of time, consumer credits have become a vital link in greening our homes. We therefore consider it important to address the negative atmosphere surrounding consumer credits. Too often, consumers are still discouraged from making investments because of unnecessary fear and misinformation. We must therefore ensure that consumers feel supported and well informed about the possibilities of consumer credits for greening their homes.

In order to allow consumer credits to contribute as much as possible to our climate goals, legal certainty is also essential. Unfortunately, this is often lacking, as recently confirmed by a ruling of the Court of Cassation. In this regard, lenders can be held fully liable for financed investments, even without direct involvement in implementation. Another stumbling block is the fact that lenders do not yet have universal access to regional EPC databases, while this information is vital to correctly inform customers about future work and financing opportunities."

Consult the annual report on the website of BVK: https://www.upc-bvk.be/nl/press/annual-reports

For more information on this subject, visit the website https://consumentenkredietvoormorgen.be/.