34% increase in the amount of eco-energy credits granted during the first 6 months of 2023

26 October 2023 - 5 min Reading time

The sector is launching a new campaign to emphasize the importance of responsible credit in the ecological transition

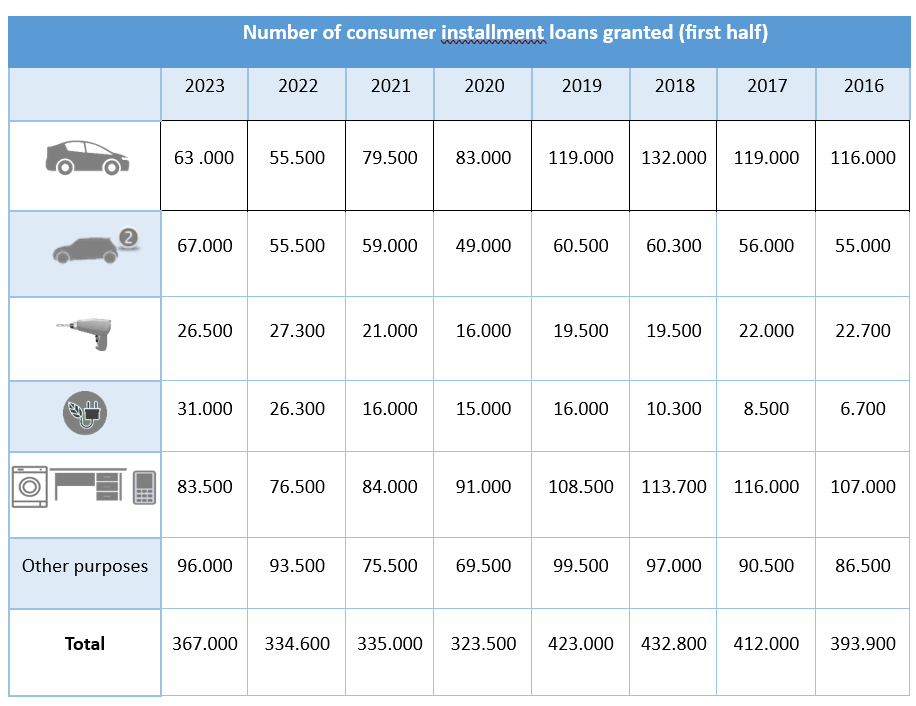

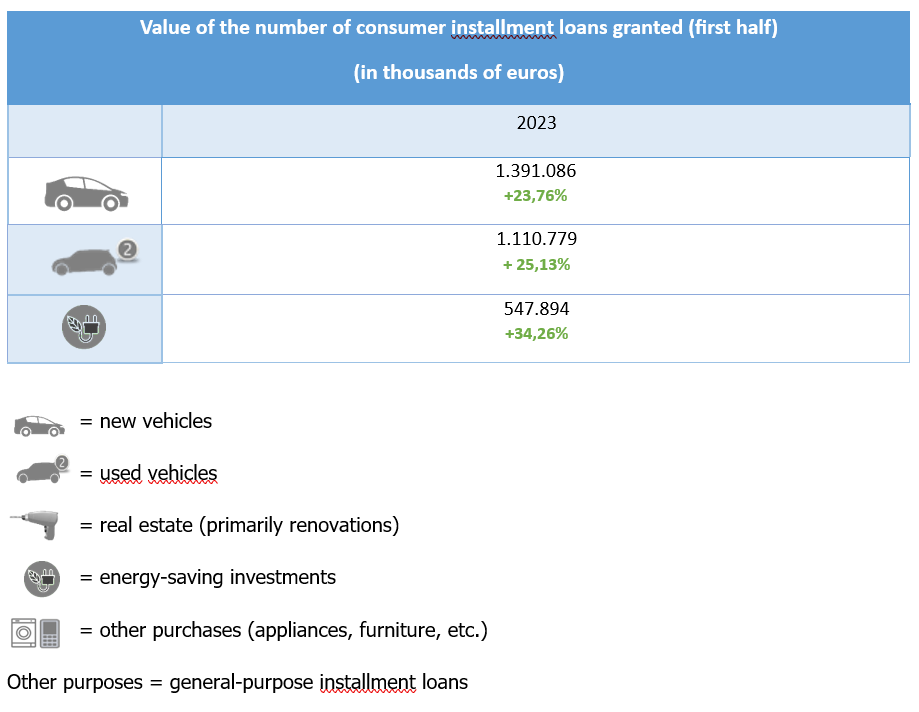

Consumer credit statistics released today by the Professional Credit Union (UPC/BVK) indicate that the total number of consumer credits granted in the first half of 2023 increased by 9.7% compared to the same period last year, while the total value of credits granted increased by 10.2% to just over 5 billion euros. In particular, the demand for eco-energy-related credits continues to grow, with the value of these credits increasing by +34%, reaching over half a billion euros. To underline the importance of consumer credit in the ecological transition, the UPC is launching an information campaign.

More than half a billion euros in credit for energy renovations.

Several factors, including the global energy crisis and new legal obligations for homeowners, have driven the demand for eco-energy renovations in recent years. This trend continues in 2023. In the first half of 2023, the number of consumer credits for energy renovations, such as insulation, heat pumps, and solar panels, increased by 17.5% compared to the same period last year, reaching 31,000 units. This is nearly three times more than five years ago (10,300). The total value of these credits increased by 34.2% compared to the first half of 2022, reaching a total of 547,894,000 euros.

Apart from housing, the mobility sector is also undergoing significant changes. The high prices of eco-friendly vehicles and their essential accessories, such as charging stations, still pose a barrier for many. Nevertheless, consumer credit bridges this gap and eases the transition to more environmentally friendly means of transportation. When considering consumer credits granted for the purchase of a new car, the figures increased during the first six months of 2023 for the first time in five years. The amount granted for the purchase of new cars increased by 23% compared to the previous year, reaching 1.39 billion euros

“Recent figures confirm that Belgians continue to increasingly take out loans for eco-friendly renovations and electric (hybrid) vehicles, and for larger amounts. It is clear that the Belgian credit sector is leading the way in assisting individuals and households in their efforts for a sustainable future.

While it's encouraging to witness such significant growth, the role of consumer credit in society is still underestimated. To change this and communicate transparently, we are pleased to launch our new information campaign and our new website: creditconsopourdemain.be (French version) or consumentenkredietvoormorgen.be (Dutch versione"

Bart Vervenne, President of the Professional Credit Union

New campaign

With this new campaign, the UPC/BVK aims to raise awareness of the importance of consumer credit in the ecological transition. Not only does this type of credit act as a catalyst by democratizing access to sustainable solutions that would otherwise be financially out of reach, but it also encourages sustainable consumption patterns. By offering favorable conditions and tailored solutions for eco-friendly investments, UPC/BVK members encourage Belgians to make environmentally friendly decisions. This, in turn, stimulates demand for environmentally friendly products and services, promoting a more sustainable market.

To reinforce this message, the UPC/BVK will also collaborate with several sector federations that subscribe to this message. In addition to highlighting the role of consumer credit in the ecological transition, the campaign also emphasizes the important role that lenders play in preventing issues during the duration of a credit.

“Throughout the duration of the credit, we serve as advisors. Unfortunately, what we observe is that in many cases of default, life events such as illness, divorce, or job loss affect people's income and their ability to repay their credit. Deferred payments or longer contract durations could help in many of these cases, but they are currently not permitted by Belgian legislation. If we want consumer credit to contribute as much as possible to the transition our society is undergoing, we need a consistent legal framework that provides certainty and protects consumers.”

Bart Vervenne, President of the Professional Credit Union

Annex: 1st half of 2023 - Consumer credit figures