In 2024, the bank switching service received 134,343 requests

15 January 2025 - 4 min Reading time

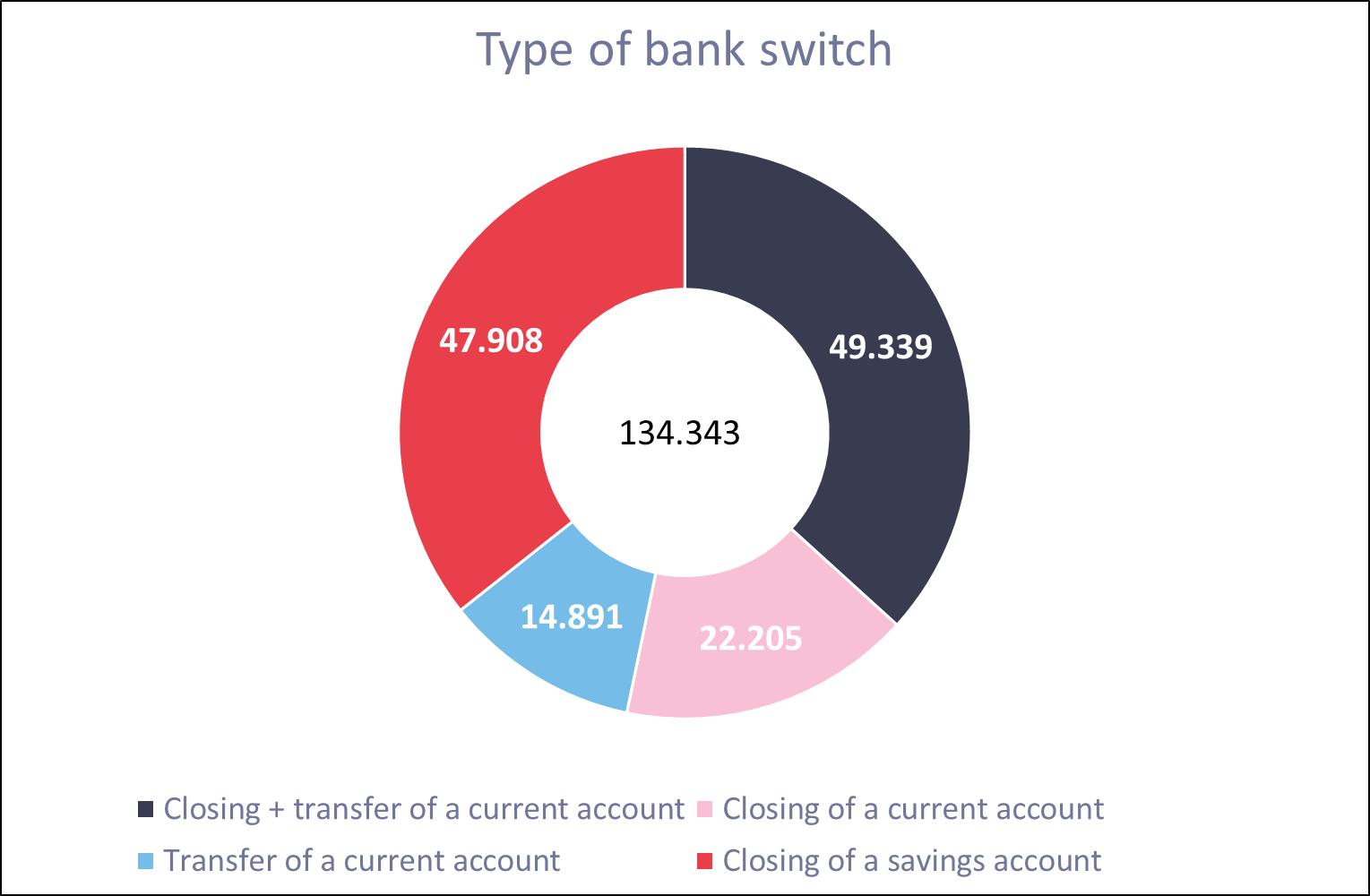

In 2024, 134,343 customers submitted a request to switch banks using the free Bankswitching service. For customers who want to switch their current and savings accounts to another bank, the bank switching service offers a quick and easy transition without interruption of payment orders.

Figures of the bankswitching service in 2024

A little more than a third (37%) used the bank switching service to close their old current account and transfer payments (such as direct debits) to the new current account. 16% of customers only transferred their payments to a new bank. In 11% of the requests, it was about closing the old current account without transferring the payments (but with transfer of the balance). In 2023, the service received 119,517 requests.

Since the launch of the bank switching service for savings accounts at the end of 2020, many customers have used it. In 2024, 47,908 customers chose to switch banks with the closing of their savings account.

Service is increasingly used

The bankswitching service offers a comprehensive service by informing not only creditors with direct debits but also initiators of recurring transfers, such as employers and benefit agencies, about the new account number. The consumers do not have to arrange anything themselves. This makes Bankswitching a very attractive service that is being used by more and more people.

This shows that competition between banks takes place. The new protocol to make savings accounts easier to compare, which came into effect early last year, also enables consumers to compare regulated savings accounts more easily and to get more information on how to switch banks easily. This has made changing banks via Bankswitching even more accessible to customers.

How the bankswitching service works for current accounts

When switching a current account, the customer only needs to contact their new bank, fill in the application form, and return it. The previous and new banks will then work together to arrange the switch. The customer also chooses the switch date on the form (at least 10 banking days later and no later than one month afterwards).

This service has the great advantage that the customer does not have to provide the new account number to creditors with direct debits and recurring payers: the banks arrange this among themselves. Creditors with direct debits and recurring payers receive a notification about the switch via the interbank Bankswitching service.

How the bankswiting service works for savings accounts

Customers can also use the bank switching service for savings accounts. The customer then asks the new bank to settle the savings account with the previous bank via Bankswitching. The new bank will arrange the settlement directly with the previous bank.

The participating banks currently offering the bank switching service for savings accounts are Argenta, Bank Van Breda & C°, Banque CPH, Belfius, Beobank, BNP Paribas Fortis, CBC Banque, Crelan, Europabank, Fintro, ING Belgium, KBC Bank, and vdk bank.

Want to learn more about Bankswitching?

All information about the free bankswitching service can be found on our Bankswitching page.