Archive publications

Fraud & security

Storytelling

Phishing and other lurking dangers

From the results of the Febelfin study in collaboration with the research agency Indiville, it appears that cybercriminals sent out a massive number of phishing messages in 2023. How is the population’s knowledge regarding online fraud? What forms of fraud are current, how ‘safe’ do we behave when making online purchases, and do we still give away our codes as easily? Where does the sector focus on? Read all about it in our storytelling.

Brochure

Payment fraud and businesses: how to prevent and recognize fraud

Nowadays, there are various types of fraud that are aimed in particular at companies and that can potentially lead to major financial losses (CEO fraud, invoice fraud, phishing, safe deposit box fraude, bank helpdesk fraud, ...) We explain how fraudsters try to mislead you and how you can harm yourself, your employees and protect your company against these types of fraud.

Interview

Someone who has access to your smartphone has access to your entire life

On October 11, the Center for Cybersecurity Belgium and the Cyber Security Coalition launched their annual awareness campaign on cybersecurity. We interviewed Miguël De Bruycker, Director of the CCB, for this occasion.

Storytelling

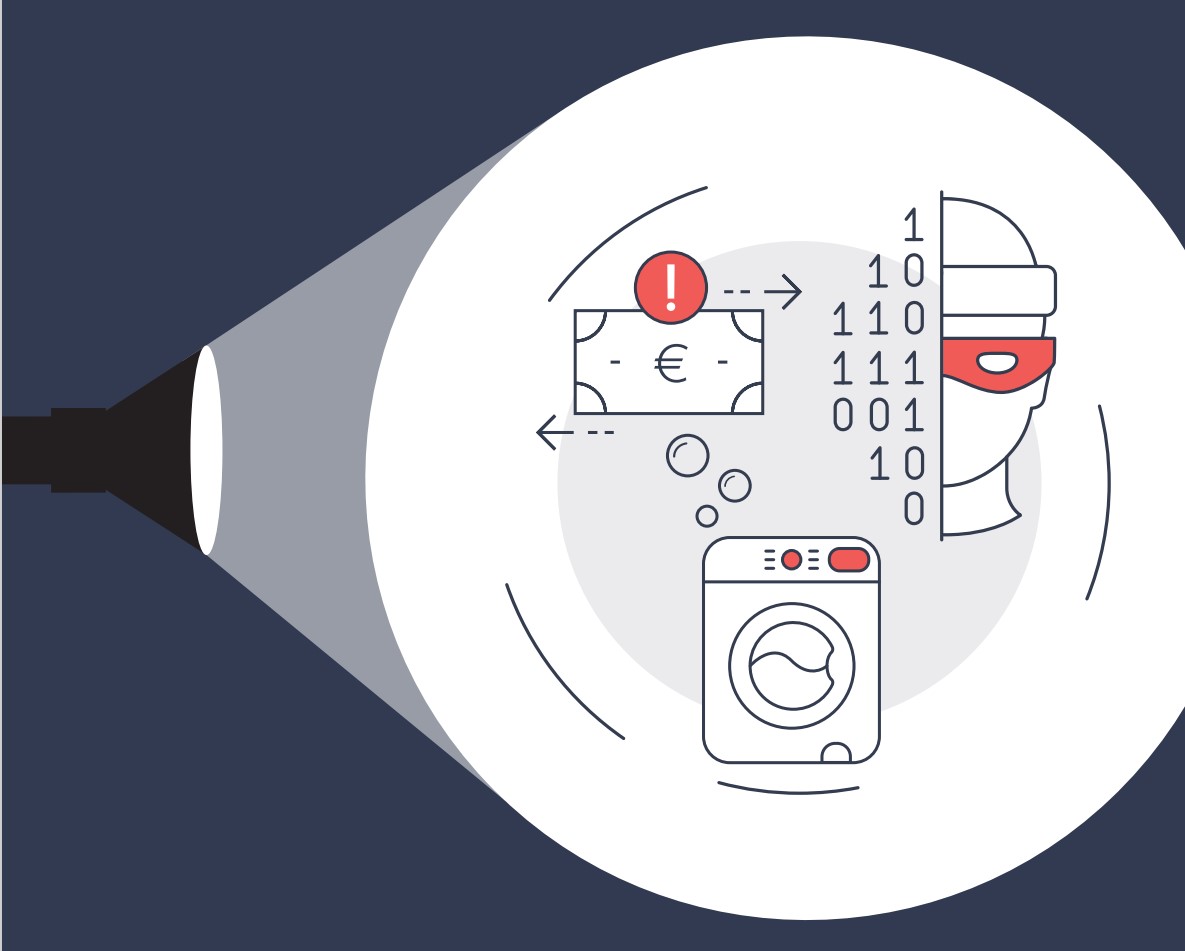

Banks: gatekeepers in the fight against money laundering

Today, banks play a pivotal role in detecting financial fraud. Financial institutions absolutely do not want to facilitate money laundering practices or inadvertently contribute to the financing of terrorism in any way. That's why combating such forms of criminal activity is at the top of their priority list. You can read about the efforts that banks make as gatekeepers in the fight against money laundering and terrorist financing in this storytelling piece.

Storytelling

Storytelling: plenty of phish in the sea

In this storytelling we explain how the banking sector is tackling phishing, and why a large fishing net is needed. Only together with all stakeholders, where everyone takes their responsibility, we can win this battle, because every fraud case is one too many.

Material raising awareness

Poster 'Money Mules' - 'Quick Money Doesn't Exist'

The poster of the "money mule" campaign is available for free download and is suitable for printing in A3 format. With this poster, we aim to warn young people about the phenomenon of 'money mules' and dispel the illusion of quick money-making.

Brochure

why does my bank ask for my identity?

When you open an account, the bank will first want to know who you are and why you want to do so. Why all these questions, because you're not a criminal, right? A understandable reaction. Understand that the bank is protecting our society in this way. Laundered fraudulent money, or funds ending up with terrorists without us noticing. We all want to avoid that, don't we? In our Febelfin brochure, you can read about how you make a difference by providing the requested information.