UCITS sector figures for the 3rd quarter of 2022

21 December 2022 - 8 min Reading time

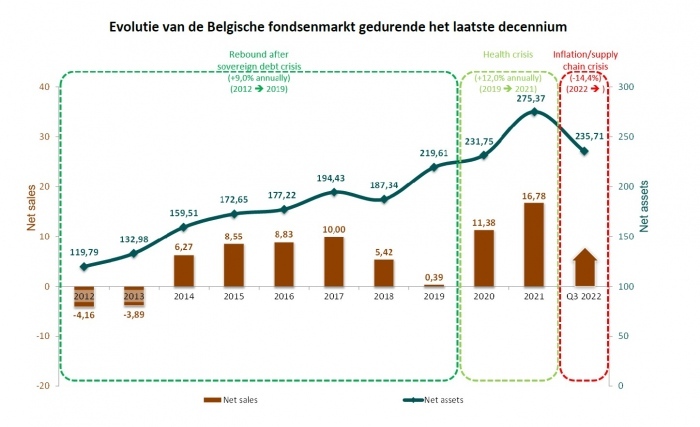

During the third quarter of 2022, the Belgian fund sector experienced a decrease of -2.1%, mainly due to losses in the underlying assets. As of the end of September 2022, the net assets of publicly distributed funds in Belgium amounted to 235.7 billion EUR.

- The net assets of funds primarily investing in non-fixed-income securities, such as mixed funds and equity funds, decreased by -2.6% during this period. Funds with capital protection experienced the largest relative decline in their net assets during the third quarter of 2022, with mixed funds showing the largest absolute decrease. Within the category of mixed funds, pension savings funds saw a decline of -4.2% during the period from July to September 2022.The net assets of funds primarily investing in fixed-income securities recorded a decrease of -0.2% during the third quarter of 2022.

Only funds investing in non-fixed-income securities suffered losses in the underlying assets during the third quarter, while funds investing in fixed-income securities saw gains in the underlying assets.

However, a different picture emerges with regard to net subscriptions. Funds investing in non-fixed-income securities experienced net subscriptions during this period, whereas funds investing in fixed-income securities experienced net redemptions during the third quarter (although this is predominantly explained by a technical correction in monetary funds).

First Nine Months

At the end of 2021, the net assets of publicly distributed funds in Belgium amounted to 275.4 billion EUR. Throughout the first nine months of 2022, there was a decline in net assets in each quarter due to losses in the underlying assets. However, there were net subscriptions in all quarters, in the first quarter for funds investing in fixed-income securities and in the second and third quarters for funds investing in non-fixed-income securities.

In summary, driven by losses in the underlying assets, the net assets of publicly distributed funds in Belgium were 14.4% lower at the end of September 2022 compared to the end of 2021, totaling 39.7 billion EUR. It's important to note that these losses only translate into actual capital losses when funds are sold.

Fourth Quarter 2022 Forecast

Preliminary indications (evolution in October and November) for the fourth quarter of 2022 suggest a slight recovery in the net assets of the Belgian fund sector due to a year-end stock market rally. However, the last weeks of December could still pose challenges following the announcements by the Federal Reserve (FED) and European Central Bank (ECB) to continue raising interest rates.

Belgian Fund Market

The Belgian fund market (in accordance with the list of collective investment institutions for public distribution on the FSMA website) is defined as 'the net assets of funds distributed publicly in Belgium under Belgian and foreign law'. BEAMA reports on all share classes of publicly distributed funds that may be marketed in Belgium.

BEAMA's research indicates that the net assets of publicly distributed funds in Belgium decreased by 2.1%, or 5.1 billion EUR, during the third quarter of 2022. As a result, publicly distributed funds in Belgium represented 235.7 billion EUR at the end of September 2022.

The decline in the Belgian fund market during the period from July to September 2022 is entirely explained by losses in the underlying assets during this period.

Despite noticeable losses in the underlying assets, there were still net subscriptions in the Belgian fund market in the third quarter of 2022. The continued demand for funds indicates that investors still have confidence in funds and are aware of the opportunity costs associated with various forms of saving and investing.

The year 2022 began very challenging due to the impact of rising inflation on the global economy, the ongoing war in Ukraine, Covid-19 issues, and the global supply chain crisis. The first nine months of 2022 were characterized by negative price figures.

In addition, the gradual increase in interest rates by central banks negatively affected the valuation of bonds and (mainly growth) stocks. However, during the third quarter of 2022, bonds appear to have gained value.

During the first nine months of 2022, the Belgian fund sector decreased by 39.7 billion EUR, or -14.4%. This decline is entirely attributed to losses in the underlying assets, as there were net subscriptions of more than 6.7 billion EUR during the period from January to September 2022. This fact is also confirmed by statistical data from the National Bank of Belgium (NBB).

Preliminary indications for the fourth quarter of 2022, available to BEAMA, suggest a slight recovery in the net assets of the Belgian fund sector driven by a stock market rally during the last quarter. However, the last weeks of December could still pose challenges following the announcements by the FED and ECB to continue raising interest rates.

Funds Primarily Investing in Non-Fixed-Income Securities

Within the group of funds primarily investing in non-fixed-income securities (such as equity funds), only declining trends were recorded during the third quarter of 2022. These declines are entirely attributed to losses in the underlying assets.

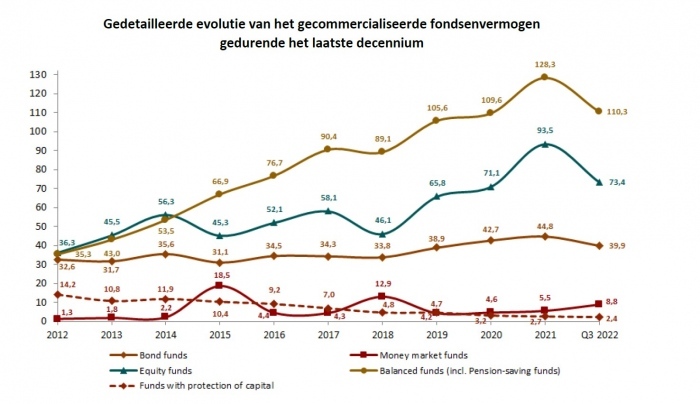

The assets in Belgium of equity funds decreased by 2.0 billion EUR, or -2.7%, during the period from July to September 2022. This decrease is entirely attributed to losses in the underlying assets, as there were net subscriptions to equity funds totaling 2.1 billion EUR. As of the end of September 2022, the assets of equity funds amounted to 73.4 billion EUR.

The category of mixed funds (including pension savings funds) recorded a decrease of 2.7 billion EUR, or -2.4%, during the third quarter of 2022. This decline is 90% attributable to losses in the underlying assets and 10% to net redemptions. Consequently, the marketed assets of mixed funds totaled 110.3 billion EUR as of the end of September 2022.

Mixed funds have seen increasing success in recent years and have been the largest asset class since 2015. Due to their active asset allocation, mixed funds are well-suited for implementing a risk diversification policy in the context of MiFID II, making them suitable for aligning the product with the risk profile of clients.

Within the category of mixed funds, pension savings funds experienced a decline of 0.9 billion EUR, or -4.2%, during the third quarter of 2022. Pension savings funds represented net assets totaling 20.7 billion EUR as of the end of September 2022. During the third quarter of 2022, pension savings funds recorded net subscriptions totaling 137 million EUR.

Funds with capital protection experienced a decline during the third quarter of 2022 and represented assets totaling 2.4 billion EUR as of the end of September 2022.

Over the first nine months of 2022, the net assets of funds primarily investing in non-fixed-income assets decreased by -16.9%, or 38.1 billion EUR.

Funds Primarily Investing in Fixed-Rate Securities

Within the group of funds primarily investing in fixed-rate securities, the assets of bond funds marketed in Belgium increased by 1.2 billion EUR, or +3.0%, during the third quarter of 2022, bringing them to a total of 39.9 billion EUR as of the end of September 2022. This increase is explained by 4/5 due to gains in the underlying assets and 1/5 due to net subscriptions.

The net assets of monetary or money market funds decreased by 1.3 billion EUR, or -12.6%, during the period from July to September 2022, resulting in total assets of 8.8 billion EUR as of the end of September 2022.

Note: Almost 60% of this decrease is attributed to a technical correction.

Over the first nine months of 2022, the net assets of funds primarily investing in fixed-rate assets decreased by -3.1%, or 1.6 billion EUR.

Sustainable Funds (According to the SFDR Classification)

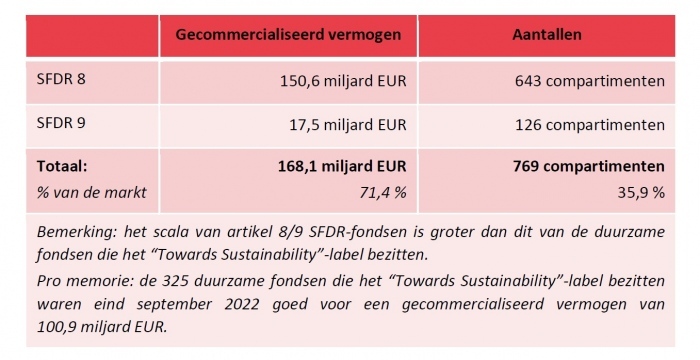

The table below provides an overview of the distribution of sustainable funds in Belgium as of the end of September 2022:

More than 70% of the assets distributed in Belgium are classified by asset managers as either SFDR Article 8 or SFDR Article 9 funds. This allows investors interested in sustainability to choose from 769 different funds.

Funds under Belgian Law

Publicly distributed funds under Belgian law

As of the end of September 2022, publicly distributed funds under Belgian law had a total managed net asset value of 182.4 billion EUR. At that time, pension savings funds represented roughly 1/9 of the publicly distributed funds under Belgian law.

The calculation of the average annual return of pension savings funds as of September 30, 2022, yields the following results:

- - 1-year: -16.9%

- - 3-year: -1.8%

- - 10-year: +3.7%

- - 25-year: +4.0%

BEAMA has developed a dashboard for pension savings funds, which is attached to this press release. This dashboard provides key figures on third-pillar pension savings funds and their evolution in a concise visual format on a quarterly basis.

Non-Publicly Distributed Institutional Funds under Belgian Law

Since the implementing royal decrees were published in the Belgian Official Gazette on December 18, 2007, investment vehicles can be developed tailored to institutional investors in the form of "Institutional UCIs with a variable number of units." These institutional funds are non-public funds that must be registered with the Federal Public Service Finance.

These institutional funds should not be confused with publicly distributed funds with non-retail share classes, which are registered with the FSMA.

As of the end of September 2022, there were 104 institutional compartments under Belgian law, with a total net asset value of 13.6 billion EUR. These funds appeal to many institutional investors and contribute to the depth of institutional markets in terms of financial assets and pension formation.