Figures UCITs sector 2nd quarter of 2024

30 October 2024 - 12 min Reading time

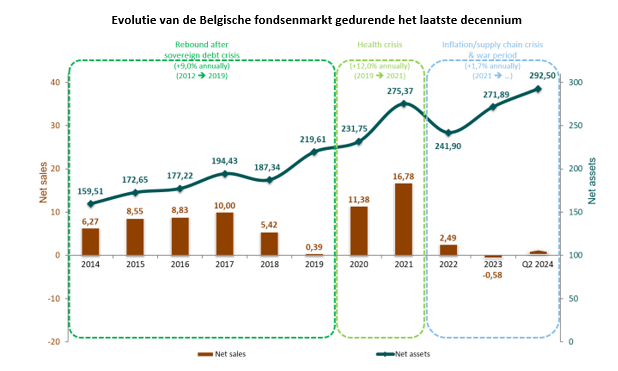

'The Belgian fund market saw an increase of 1.6% during the second quarter of 2024 due to price gains in underlying assets, complemented by net subscriptions, and consequently reaches commercialised assets of EUR 292 billion. ’

Marc Van de Gucht - Director general BEAMA

The Belgian fund sector recorded an increase of +1.6% during the second quarter of 2024 and this was mainly due to price gains recorded in underlying assets, complemented by minor net subscriptions. At the end of June 2024, the net assets of funds publicly distributed in Belgium amounted to €292.5 billion.

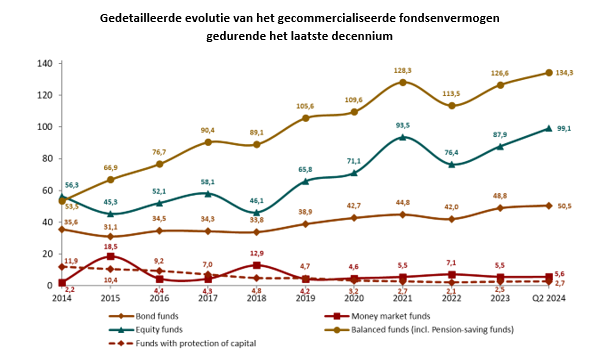

- The net assets of funds investing mainly in non-fixed income securities, such as mixed funds and equity funds, increased by +1.8% during this period. Funds with capital protection saw the largest relative increase in their net assets during the second quarter of 2024. Equity funds experienced the largest absolute increase. Within the mixed funds category, pension savings funds experienced almost a status quo situation compared to the situation at the end of March 2024.

- The net assets of funds investing mainly in fixed-income securities recorded an increase of +1.1% during the second quarter of 2024.

Funds investing in non-fixed-income securities registered price gains in their underlying assets during the second quarter, but, on the contrary, saw slight net redemptions.

Funds investing in fixed-income securities followed the opposite picture. Thus, they recorded price losses in their underlying assets during the second quarter but saw significant net redemptions in return.

First half

At the end of 2023, the net assets of funds publicly distributed in Belgium amounted to EUR 271.9 billion. The Belgian fund sector experienced an increase in net assets during the first half of 2024, mainly due to price gains recorded by underlying assets, and to a lesser extent complemented by net subscriptions. As a result, the net assets of the funds publicly distributed in Belgium were 7.6%, or EUR 20.6 billion, higher at the end of June 2024 than at the end of 2023, and more than 95% of this evolution is attributable to price gains recorded by the underlying assets.

Third-quarter 2024 forecast

Preliminary indications for the third quarter of 2024 point to continued growth in the net assets of the Belgian fund sector.

Belgian fund market (as per the list of public undertakings for collective investment on the FSMA website)

The Belgian fund market is defined as ‘the net assets of funds under Belgian and foreign law publicly distributed in Belgium’. In this regard, BEAMA reports on all share classes of public funds that may be commercialised in Belgium.

BEAMA research shows that the net assets of funds publicly distributed in Belgium increased by EUR 4.7 billion, or +1.6%, during the second quarter of 2024. As a result, funds publicly distributed in Belgium represented €292.5 billion at the end of June 2024.

The increase in the Belgian fund market during the period April-June 2024 is predominantly attributable to price gains recorded in underlying assets during this period, complemented by slight net subscriptions.

The sustained demand for funds indicates that Belgian investors currently still retain confidence in funds and are aware of the opportunity costs associated with the different forms of saving and investing.

The evolution of the Belgian fund market in the first half of 2024, which mainly consists of internationally diversified investment portfolios, cannot be separated from the global economic context and geopolitical tensions.

Inflation in the European Union declined further in the first half of 2024 from the peak recorded in 2022. This decline is mainly due to falling energy prices. Projections for eurozone inflation, according to the ECB, reach 2.5% in 2024, and foresee a further decline in 2025 and 2026 to 1.9%.

A fall in inflation generally leads to a rise in the prices of both equities and bonds.After all, when inflation falls, central banks will often cut interest rates to stimulate the economy. Added to this, lower interest rates make it easier for companies to borrow money and invest in their businesses on the one hand, and make newly issued bonds less attractive as they offer lower yields than existing bonds on the other hand. Furthermore, lower inflation is accompanied by increased purchasing power for consumers, which is beneficial for companies and their valuation.

These price increases (= price gains in underlying assets) were also observed in the funds marketed in Belgium.

In addition, financial markets and investors anticipated planned interest rate cuts by central banks around the world, resulting in increased demand for fixed-income securities. This effect is also noticeable on the Belgian funds market given the net subscriptions in funds investing mainly in fixed-income securities.

The strong growth of the Belgian funds market in the first half of 2024 is therefore due to rebounding equity and bond markets. This enabled all asset classes to record positive results during the period January-June 2024.

Thus, the Belgian fund sector increased by EUR 20.6 billion, or +7.6% during the first half of 2024. Over 95% of this increase can be attributed to price gains recorded by underlying assets, and for the remainder to net subscriptions in funds investing mainly in fixed-income securities. This rise is also confirmed by the NBB's statistical data.

The preliminary indications, which BEAMA has at its disposal for the third quarter of 2024, point to continued growth in the net assets of the Belgian fund sector.

Funds investing primarily in non-fixed income securities

Within the group of funds investing primarily in non-fixed-income securities (e.g. equity funds), only rising trends were recorded during the second quarter of 2024. These increases are due to price gains recorded by the underlying assets.

The assets of equity funds in Belgium increased by EUR 2.7 billion, or +2.8%, in the April-June 2024 period. This increase is entirely due to price gains recorded in the underlying assets. At the end of June 2024, equity funds' assets amounted to EUR 99.1 billion.

The mixed fund category (including pension savings funds) experienced an increase of EUR 1.3 billion, or +1.0%, during the second quarter of 2024. Just over 50% of this increase can be attributed to price gains recorded by underlying assets and just under 50% to net subscriptions amounting to EUR 0.6 billion. This brought the commercialised assets of the mixed funds at the end of June 2024 to EUR 134.3 billion.

Mixed funds have enjoyed increasing success in recent years and have been the largest asset class since 2015. Thanks to their active asset allocation, mixed funds are well suited to pursuing a risk diversification policy under MiFID II: they lend themselves perfectly to matching the product to the clients' risk profile.

Within the mixed funds category, pension savings funds experienced almost a status quo situation during the second quarter of 2024 given their increase amounting to EUR 25 million, or +0.1%. Pension savings funds represented net assets amounting to EUR 25.7 billion at the end of June 2024. During the second quarter of 2024, the pension savings funds recorded net redemptions amounting to EUR 60 million.

Funds with capital protection experienced an increase during the second quarter of 2024 and represented assets of EUR 2.7 billion at the end of June 2024.

Over the first half of 2024, the net assets of funds investing primarily in non-fixed income assets increased by +8.7%, or EUR 19.0 billion.

Funds investing primarily in fixed-income securities

Within the group of funds investing predominantly in fixed-income securities, the assets of bond funds distributed in Belgium increased by EUR 0.6 billion, or +1.1%, during the second quarter of 2024, bringing them to EUR 50.5 billion at the end of June 2024. This increase is entirely due to net subscriptions.

The net assets of monetary or money market funds experienced a slight increase of EUR 0.1 billion, or +1.2% during the April-June 2024 period, resulting in an amount of EUR 5.6 billion at the end of June 2024.

Over the first half of 2024, the net assets of funds investing primarily in fixed-income assets increased by +3.0%, or EUR1.7 billion.

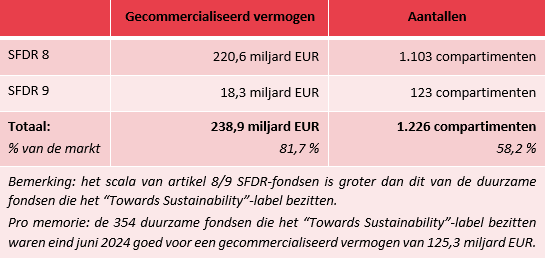

Sustainable funds

The table below summarises the distribution of sustainable funds (according to the SDFR classification) in Belgium at the end of June 2024:

SFDR = Sustainable Finance Disclosure Regulation.

Article 8 = products promoting sustainability features;

Article 9 = products with a sustainable objective.

More than 4/5th of the assets distributed in Belgium are, according to asset managers, classified as an SFDR Article 8 or an SFDR Article 9 fund. In this respect, investors interested in a certain level of sustainability can choose from 1,226 different funds.

Funds under Belgian law

Publicly distributed funds under Belgian law

Public funds under Belgian law represented total net managed assets of EUR 219.3 billion at the end of June 2024. At the same time, the pension savings funds in this category represented roughly 1/8th of the public funds under Belgian law.

The calculation of the average return of the pension savings funds on an annual basis as per 30 June 2024 yields the following result:

- At 1 year: +7.2%

- At 3 years: -0,3 %

- At 10 years: +3.6%

- At 25 years: +3.7%

BEAMA has developed a dashboard table for pension savings funds, which is annexed to this press release. Thanks to this dashboard table, key figures concerning third pillar pension savings funds and their evolution are visually presented on a quarterly basis in a concise manner.

Non-publicly distributed institutional funds under Belgian law

Since the implementing decrees were published in the Belgian Official Gazette on 18 December 2007, investment vehicles can be developed to suit institutional investors under the form of ‘Institutional UCI with a variable number of units’. These institutional funds are non-public funds that must be notified to the FPS Finance.

These institutional funds should not be confused with the public funds with non-retail share classes, which are notified to the FSMA.

At the end of June 2024, the 104 institutional sub-funds under Belgian law accounted for EUR 27.1 billion in net assets. These funds appeal to many institutional investors, partly because they add depth to the institutional markets in terms of financial assets and pension formation.

More info?

More information can be obtained from the representation for BEAMA:

Mr Marc Van de Gucht, Director-General BEAMA

(02 507 68 72 - marc.van.de.gucht@febelfin.be)

At the BEAMA services(info@beama.be)

Or via Febelfin's general press contacts:

Febelfin press office

(02 507 68 31 - press@febelfin.be)

These and other statistics concerning the UCI industry, are available on the BEAMA website (https://www.beama.be/) under the ‘Statistics’ section.