Figures UCITs sector 2nd quarter of 2019

8 November 2019 - 6 min Reading time

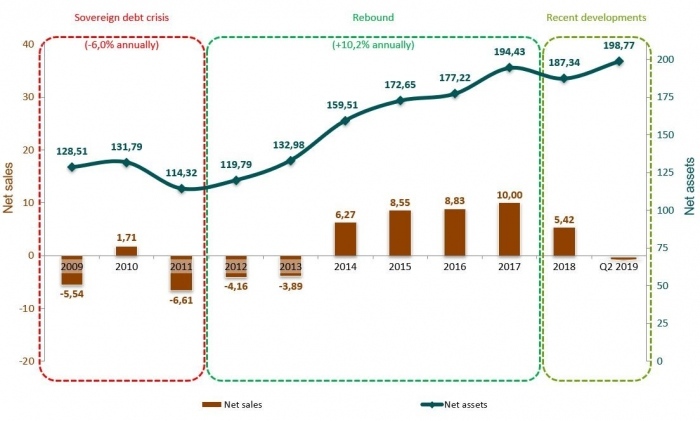

The Belgian fund sector experienced a 4.6% increase during the second quarter of 2019, primarily due to capital gains recorded from underlying assets. By the end of June 2019, the net assets of publicly distributed funds in Belgium amounted to EUR 198.8 billion.

The net assets of funds primarily invested in fixed-income securities saw an increase of 4.7% during the second quarter of 2019. Meanwhile, funds mainly invested in non-fixed-income securities, such as balanced funds and equity funds, rose by 4.6% during this period.

Within the category of mixed funds, pension savings funds continued to grow during the April to June 2019 period, recording an increase of EUR 0.5 billion. This set a new "all-time high" for net assets, reaching EUR 20.1 billion.

Monetary funds experienced the largest absolute decrease in net assets during the second quarter of 2019, mainly due to significant net redemptions linked to portfolio adjustments.

Equity funds saw the largest increase during this period, driven by a combination of net subscriptions and capital gains from underlying assets.

Belgian Fund Market

The Belgian fund market is defined as "the publicly distributed net assets of funds under Belgian and foreign law" in Belgium. BEAMA reports on all share classes of public funds that can be marketed in Belgium.

Conform de lijst van openbare instellingen voor collectieve belegging op de FSMA website.

BEAMA's research shows that the net assets of publicly distributed funds in Belgium increased by EUR 8.8 billion, or 4.6%, during the second quarter of 2019. As a result, publicly distributed funds in Belgium represented EUR 198.8 billion by the end of June 2019, approaching the "all-time high" of EUR 200.0 billion recorded at the end of September 2018.

The growth of the Belgian fund market during the April to June 2019 period can be fully attributed to positive market developments during this period, resulting in capital gains from most fund's underlying assets. The capital gains recorded during the first half of 2019 nearly compensated for the decline observed in the last quarter of 2018.

Funds Primarily Investing in Fixed-Income Securities

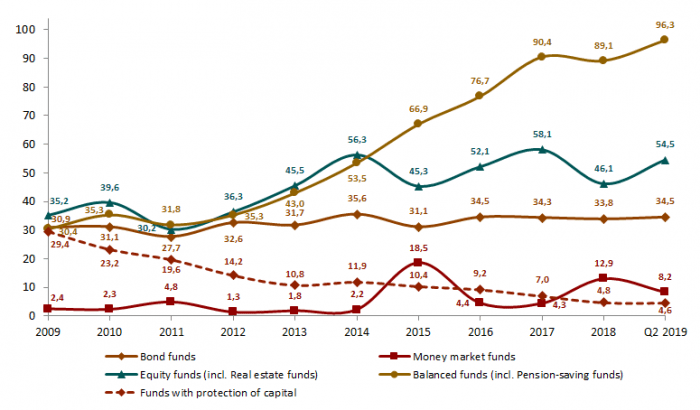

Among the group of funds primarily investing in fixed-income securities, the assets of publicly distributed bond funds in Belgium increased by EUR 3.0 billion, or 9.4%, during the second quarter of 2019, bringing the total to EUR 34.5 billion by the end of June 2019. This increase was primarily due to capital gains from underlying assets.

The net assets of monetary or money market funds decreased by EUR 1.1 billion, or 11.4%, during the April to June 2019 period. This decline was a result of technical adjustments in the portfolios of mixed asset funds. Given the positive market movements during the first and second quarters of 2019, asset managers of mixed asset funds shifted from stable monetary funds to equity funds to take advantage of the market rebound. In short, given the favorable market conditions, the capital protection of mixed asset funds is currently not necessary.

Overall, the net assets of funds primarily investing in fixed-income securities increased by 4.7% during the second quarter of 2019, resulting in a total marketed net asset value of EUR 42.7 billion by the end of June 2019.

Funds Primarily Investing in Non-Fixed-Income Securities

Within the group of funds primarily investing in non-fixed-income securities (such as equity funds), except for capital protection funds, there were only upward trends recorded during the second quarter of 2019, with 4/5 of this attributed to capital gains from the underlying assets of these funds.

Assets in Belgium for equity funds increased by EUR 4.3 billion, or 8.6%, during the April to June 2019 period. This increase was due to both net subscriptions and capital gains from the underlying assets. By the end of June 2019, the total assets of equity funds amounted to EUR 54.5 billion.

The category of mixed funds (including pension savings funds) saw an increase of EUR 2.6 billion, or 2.8%, during the second quarter of 2019. This increase was solely due to capital gains from underlying assets, as there were net redemptions. This brought the marketed assets of mixed funds to EUR 96.3 billion by the end of June 2019.

These funds have seen increasing success in recent years and have been the largest asset class since 2015. Due to their active asset allocation, mixed funds are well-suited for implementing a risk diversification strategy in the context of MiFID II, making them an excellent choice for aligning products with client risk profiles.

Within the category of mixed funds, pension savings funds increased by EUR 0.5 billion, or 2.3%, during the second quarter of 2019. Pension savings funds represented a total of EUR 20.1 billion in net assets by the end of June 2019, solidifying their "all-time high" amount.

During the second quarter of 2019, pension savings funds recorded net subscriptions totaling EUR 117 million.

Capital protection funds experienced a decline during the second quarter of 2019 and represented assets of EUR 4.6 billion by the end of June 2019. This movement was primarily due to net redemptions.

Overall, the net assets of funds primarily investing in non-fixed-income securities increased by 4.6% during the second quarter of 2019, reaching a marketed asset value of EUR 156.1 billion by the end of June 2019.

"The Belgian fund market continued to recover during the second quarter of 2019, almost entirely reversing the difficulties of the end of 2018, thanks to capital gains".

Funds Under Belgian Law

Publicly distributed funds under Belgian law

Publicly distributed funds under Belgian law had a total managed net asset value of 157.0 billion EUR at the end of June 2019. At that same moment, pension savings funds represented 20.1 billion EUR of this, which is one-eighth of the publicly distributed funds under Belgian law.

The calculation of the average annual return for pension savings funds as of June 30, 2019, yields the following results:

- 1-year return: +1.2%

- 3-year return: +4.2%

- 10-year return: +6.3%

- 25-year return: +6.3%

BEAMA has developed a dashboard for pension savings funds, which is attached to this press release as an annex. Thanks to this dashboard, key figures related to third-pillar pension savings funds and their evolution are visually presented in a concise manner on a quarterly basis.

Non-Publicly Distributed Institutional Funds Under Belgian Law

Since the implementing Royal Decrees were published in the Belgian Official Gazette on December 18, 2007, investment vehicles can be developed tailored to institutional investors in the form of "Institutional ICB with a variable number of units of participation." These institutional funds are non-public funds that must be registered with the Federal Public Service Finance.

These institutional funds should not be confused with publicly distributed funds with non-retail share classes, which are registered with the Financial Services and Markets Authority (FSMA).

At the end of June 2019, the 141 institutional compartments under Belgian law represented 16.3 billion EUR in net assets. These funds attract many institutional investors, partly because they provide depth to the institutional markets in terms of financial assets and pension formation.