Figures UCITs sector 1st quarter 2020

14 August 2020 - 9 min Reading time

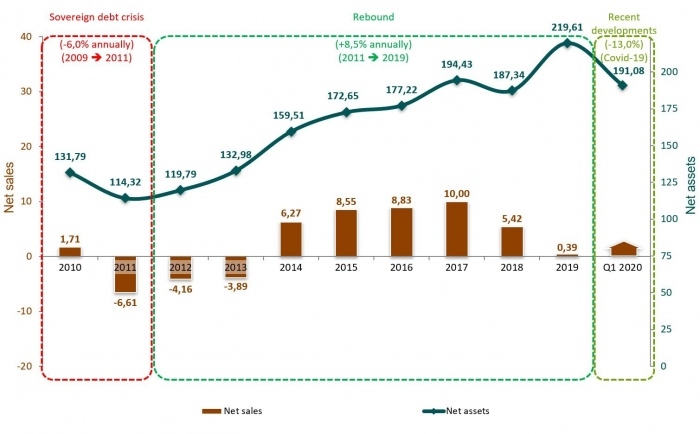

The Belgian fund sector experienced a decline of 13.0% during the first quarter of 2020 due to losses in the underlying assets caused by the impact of the Covid-19 pandemic on the global economy and financial markets. As of the end of March 2020, the net assets of publicly distributed funds in Belgium amounted to 191.1 billion EUR.

The initial signs of the impact of the Covid-19 pandemic on the Belgian fund sector appeared in February, with the impact being most pronounced during the month of March.

The net assets of funds primarily investing in fixed-income securities increased by 4.5% during the first quarter of 2020. Conversely, the net assets of funds primarily investing in non-fixed income securities, such as mixed funds and equity funds, declined by 17.3% during this period.

Within the category of mixed funds, pension savings funds experienced a decrease of 2.4 billion EUR during the January to March 2020 period. Equity funds saw the largest absolute decrease in their net assets during the first quarter of 2020, due to losses in the underlying assets and net redemptions.

Monetary funds were the only fund category to experience an increase in net assets during the first quarter of 2020, primarily due to significant net subscriptions related to portfolio technical interventions.

Forecast for the second quarter of 2020

Preliminary indications for the second quarter of 2020 suggest a noticeable recovery in the net assets of the Belgian fund sector.

Belgian fund market

The Belgian fund market is defined as the "publicly distributed net assets of funds under Belgian and foreign law" in Belgium. BEAMA reports on all share classes of public funds that can be marketed in Belgium.

Conform de lijst van openbare instellingen voor collectieve belegging op de FSMA website.

BEAMA's research indicates that the net assets of publicly marketed funds in Belgium decreased by 28.5 billion EUR or 13.0% during the first quarter of 2020. As a result, publicly marketed funds in Belgium represented 191.1 billion EUR by the end of March 2020.

The decline in the Belgian fund market during the January to March 2020 period is primarily attributed to negative market trends caused by the impact of the Covid-19 pandemic on the global economy and financial markets. These negative market trends resulted in a decrease in the value of the underlying assets of the funds.

Preliminary indications available to BEAMA for the second quarter of 2020 suggest a significant recovery in the net assets of the Belgian fund sector.

These indications are also confirmed in the recent press release from the FSMA regarding its annual report presentation. The FSMA notes that as of early June 2020, investment funds remain stable compared to the end of 2019. This is because the decline in the net assets of Belgian funds is due to the losses in the value of the underlying assets of these funds during the month of March (-16.0%), rather than significant net redemptions. During the second quarter of 2020, a significant portion of these losses was recovered.

BEAMA confirms this analysis, namely, that there was a temporary decline during the first quarter of 2020 due to losses in the value of underlying assets and that these underlying assets are recovering during the April to June 2020 period. Furthermore, there was no investor outflow during the first quarter at the market level.

Regarding potential significant redemptions, BEAMA has cooperated fully with the FSMA to monitor the situation in the Belgian fund sector, both in terms of financial market stability and consumer protection. Liquidity of the funds was monitored, and the FSMA introduced additional liquidity management tools such as swing pricing, anti-dilution levy, or redemption gates.

'Swing pricing' and 'anti-dilution levy' are liquidity mechanisms that can be employed when financial markets are under stress. These mechanisms affect the net asset value (NAV) of a fund by passing on the additional costs resulting from subscriptions/redemptions through an adjusted NAV to the relevant investors. 'Redemption gates' also serve as such a liquidity mechanism, but they operate on the size of the orders. By being able to spread large buy or sell orders over time, fund managers gain more time to trade the underlying assets at more accurate prices.

In terms of liquidity, the Belgian fund sector has weathered the initial impact of the Covid-19 pandemic well. All investor redemptions from Belgian funds that occurred in the first few months of 2020 were processed smoothly.

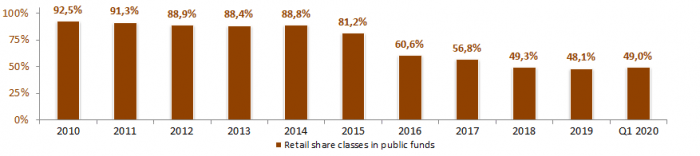

(*) BEAMA defines retail share classes as share classes that can be offered to individuals, with a minimum (initial) investment of no more than 100,000 EUR, and with no additional conditions imposed by the fund manager.

Funds predominantly investing in fixed-income securities

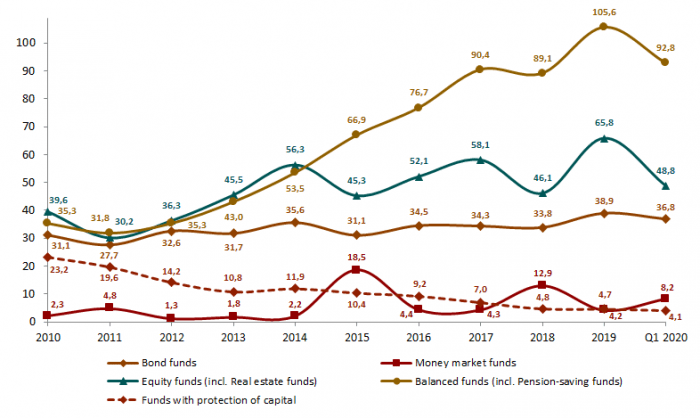

Among the group of funds predominantly investing in fixed-income securities, the assets of publicly marketed bond funds in Belgium decreased by 2.1 billion EUR or 5.3% during the first quarter of 2020, bringing them to a total of 36.8 billion EUR by the end of March 2020.

This decline is mainly attributed to the losses in the value of the underlying assets, accounting for about 90%, and net redemptions, accounting for about 10%.

The net assets of monetary or money market funds increased by 4.0 billion EUR or 95.2% during the January to March 2020 period.

This increase is primarily the result of technical interventions in the portfolios of mixed umbrella funds. Given the negative market movements during the first quarter of 2020 caused by the Covid-19 pandemic, asset managers of umbrella funds exchanged their volatile equity funds for stable monetary funds. In other words, due to the impact of the Covid-19 pandemic, the technique of bottom protection was applied once again by mixed umbrella funds.

Funds predominantly investing in non-fixed income securities

Among the group of funds predominantly investing in non-fixed income securities (such as equity funds), only declining trends were observed during the first quarter of 2020. These declines are attributed to losses in the value of underlying assets, accounting for about 80%, and net redemptions, accounting for about 20%.

The assets in Belgium of equity funds decreased by 17.0 billion EUR or 25.8% during the January to March 2020 period. This decline can be attributed to a combination of losses in the value of the underlying assets and net redemptions. As of the end of March 2020, the assets of equity funds amounted to 48.8 billion EUR.

The category of mixed funds (including pension savings funds) experienced a decrease of 12.8 billion EUR or 12.2% during the first quarter of 2020. This decrease is almost entirely attributed to losses in the value of the underlying assets. This brings the marketed assets of mixed funds to 92.8 billion EUR by the end of March 2020.

These funds have seen increasing success in recent years and have been the largest asset class since 2015. Due to their active asset allocation, mixed funds are well-suited for implementing a risk diversification policy within the framework of MiFID II, making them suitable for aligning the product with the risk profile of clients.

Within the category of mixed funds, pension savings funds experienced a decrease of 2.4 billion EUR or 11.5% during the first quarter of 2020. Pension savings funds represented net assets of 18.9 billion EUR as of the end of March 2020.

During the first quarter of 2020, pension savings funds saw net subscriptions amounting to 14 million EUR.

Funds with capital protection experienced a decrease of 0.5 billion EUR during the first quarter of 2020 and represented assets of 4.1 billion EUR as of the end of March 2020. This movement is entirely attributed to losses in the value of the underlying assets."

"Despite the impact of the Covid-19 pandemic on the net assets, investors maintained confidence in the Belgian fund market. A significant decrease in total managed assets in the first 3 months of 2020 was almost entirely due to losses in the underlying assets."

Funds under Belgian law

Funds under Belgian law

Publicly distributed funds under Belgian law had a total managed net asset value of 142.8 billion EUR at the end of March 2020. At the same time, pension savings funds represented 18.9 billion EUR of this total, accounting for 1/8th of publicly distributed funds under Belgian law.

The calculation of the average annual return for pension savings funds as of March 31, 2020, yields the following results:

- 1-year: -8.1%

- 3-year: -2.0%

- 10-year: +3.5%

- 25-year: +6.0%

BEAMA has developed a dashboard for pension savings funds, which is attached to this press release. This dashboard provides a concise visual representation of key figures for third-pillar pension savings funds and their evolution on a quarterly basis.

Non-publicly distributed institutional funds under Belgian law

Since the implementation decrees were published in the Belgian Official Gazette on December 18, 2007, investment vehicles tailored to institutional investors have been developed in the form of "Institutional ICB with a variable number of units of participation." These institutional funds are non-public funds that must be registered with the Federal Public Service for Finance (FOD Financiën).

These institutional funds should not be confused with publicly distributed funds with non-retail share classes, which are registered with the FSMA.

As of the end of March 2020, the 127 institutional compartments under Belgian law represented 15.0 billion EUR in net assets. These funds appeal to many institutional investors because they provide depth to the institutional markets in terms of financial assets and pension formation.