Figures for the UCITS sector in the second quarter of 2022

27 October 2022 - 9 min Reading time

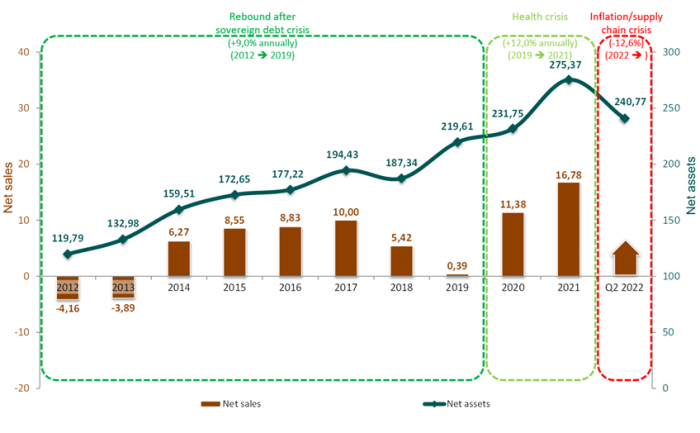

During the second quarter of 2022, the Belgian fund sector experienced a decline of -8.5%, primarily due to losses in the underlying assets. By the end of June 2022, the net assets of publicly distributed funds in Belgium amounted to 240.8 billion EUR.

- The net assets of funds primarily investing in non-fixed-income securities, such as mixed funds and equity funds, decreased by -9.0% during this period. Equity funds saw the largest relative decline in their net assets during the second quarter of 2022. Mixed funds experienced the largest absolute decline. Within the mixed funds category, pension savings funds declined by -8.5% during the period from April to June 2022.

- Het netto actief van de fondsen die hoofdzakelijk beleggen in vastrentende effecten noteerde een daling van -6,5 % gedurende het tweede trimester van 2022.

The net assets of funds primarily investing in fixed-income securities recorded a decline of -6.5% during the second quarter of 2022.

Both funds investing in non-fixed-income securities and funds investing in fixed-income securities experienced losses in their underlying assets during the second quarter.

However, funds investing in non-fixed-income securities saw net subscriptions during this period.

First Semester

At the end of 2021, the net assets of publicly distributed funds in Belgium amounted to 275.4 billion EUR. During the first semester of 2022, there was a decline in net assets in both quarters due to losses in the underlying assets. However, there were net subscriptions in each quarter, with the first quarter witnessing net subscriptions in fixed-income securities and the second quarter in non-fixed-income securities.

In summary, driven by losses in the underlying assets, the net assets of publicly distributed funds in Belgium were 12.6% lower, or 34.6 billion EUR lower, than at the end of 2021 by mid-2022.

It is important for investors to keep in mind that these losses only translate into actual capital losses when they sell their funds.

Third Quarter 2022 Forecast

Preliminary indications for the third quarter of 2022 suggest a continued decline in the net assets of the Belgian fund sector, though this decline is less severe than in the previous two quarters.

The ongoing Ukraine-Russia conflict and issues with commodity supplies continue to drive high energy and commodity prices, pushing inflation higher. As a result of persistent high inflation and recession concerns, the prices of most global stocks have declined. In response to high inflation, central banks have gradually raised interest rates, which has had a negative impact on the valuation of bonds (resulting in losses when rates rise) and (primarily growth) equities. Consequently, we are currently in an exceptional situation of positive correlation between stocks and bonds.

Under normal circumstances, the movements of bonds and stocks are negatively correlated. If one of these types of financial instruments records losses, the other type often records gains, thereby dampening the overall effect.

Furthermore, there are several signals indicating that the Covid-19 pandemic is not fully under control.

The Belgian fund market experienced an 8.5% decline during the second quarter of 2022 due to losses in the underlying assets, resulting in total assets under management of 241 billion EUR by the end of June 2022.

Belgian Fund Market

The Belgian fund market is defined as 'the net asset value of funds, whether Belgian or foreign, publicly distributed in Belgium.' BEAMA reports on all share classes of public funds that may be commercialized in Belgium.

According to the list of public collective investment institutions on the FSMA website.

BEAMA's research shows that during the second quarter of 2022, the net assets of publicly distributed funds in Belgium declined by 22.3 billion EUR, or -8.5%. This resulted in publicly distributed funds in Belgium representing 240.8 billion EUR by the end of June 2022.

The decline in the Belgian fund market during the period from April to June 2022 is entirely attributed to losses in the underlying assets during this period.

Despite significant losses in the underlying assets, there were still net subscriptions recorded in the Belgian fund market in the second quarter of 2022.

The continuing demand for funds, albeit preliminary, indicates that investors still have confidence in funds and are aware of the opportunity costs associated with various forms of saving and investing.

The year 2022 started off with significant challenges due to rising inflation affecting the global economy, ongoing warfare in Ukraine, Covid-19 problems, and a worldwide supply chain crisis. The first half of 2022 was characterized by negative price figures.

Additionally, the gradual increase in interest rates by central banks had a negative impact on the valuation of bonds and (primarily growth) stocks.

During the first semester of 2022, the Belgian fund sector declined by 34.6 billion EUR, or -12.6%. This decrease can be attributed solely to losses in the underlying assets, as there were net subscriptions of more than 6 billion EUR during the period from January to June 2022. This fact is also confirmed by the statistical data of the National Bank of Belgium (NBB).

In the first semester of 2022, equity funds were both the strongest relative and absolute decliner, with a decline of 19.3%, or 18.1 billion EUR. This decline is primarily due to losses in the underlying assets of equity funds.

Preliminary indications available to BEAMA for the third quarter of 2022 suggest a further decline in the net assets of the Belgian fund sector, albeit of a milder magnitude.

Funds Primarily Investing in Non-Fixed-Income Securities

Within the group of funds primarily investing in non-fixed-income securities (such as equity funds), only declining trends were observed during the second quarter of 2022. These declines are solely attributable to losses in the underlying assets.

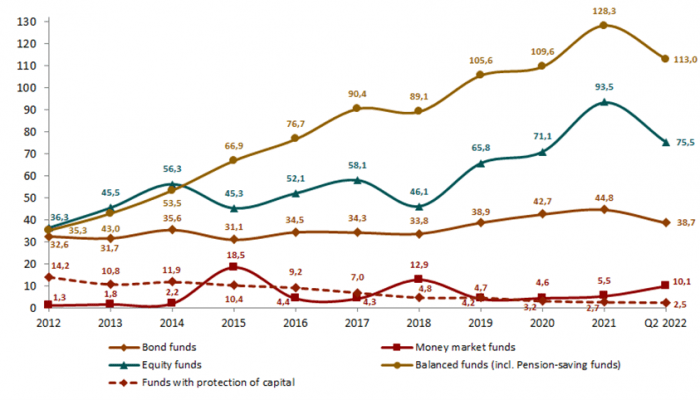

The assets in Belgium of equity funds decreased by 8.3 billion EUR, or -9.9%, during the period from April to June 2022, resulting in total assets under management of 75.5 billion EUR by the end of June 2022. This decline is entirely due to losses in the underlying assets, despite net subscriptions of 2.7 billion EUR in equity funds.

The category of mixed funds (including pension savings funds) saw a decline of 10.8 billion EUR, or -8.7%, during the second quarter of 2022. This decrease is also entirely due to losses in the underlying assets, although there were net subscriptions of more than 1.5 billion EUR in mixed funds. As of the end of June 2022, the total assets under management for mixed funds amounted to 113.0 billion EUR.

Mixed funds have gained increasing popularity in recent years, and since 2015, they have represented the largest asset class. Due to their active asset allocation, mixed funds are well-suited for implementing a risk diversification policy under MiFID II. They are excellent for aligning the product with the risk profile of clients.

Within the category of mixed funds, pension savings funds saw a decline of 2.0 billion EUR, or -8.5%, during the second quarter of 2022. Pension savings funds represented net assets of 21.6 billion EUR by the end of June 2022. During the second quarter of 2022, pension savings funds recorded net subscriptions of 81 million EUR. pensioenspaarfondsen netto inschrijvingen op ten belope van 81 miljoen EUR.

Funds with capital protection saw a decline during the second quarter of 2022 and represented assets of 2.5 billion EUR by the end of June 2022.

Over the first semester of 2022, the net assets of funds primarily investing in non-fixed-income securities declined by -14.7%, or 33.2 billion EUR.

Funds Primarily Investing in Fixed-Income Securities

Within the group of funds primarily investing in fixed-income securities, the assets of bond funds publicly distributed in Belgium declined by 3.4 billion EUR, or -8.2%, during the second quarter of 2022, resulting in total assets of 38.7 billion EUR by the end of June 2022. This decline is explained by 75% losses in the underlying assets and 25% net redemptions.

The net assets of monetary or money market funds saw a slight increase of 0.1 billion EUR, or +0.8%, during the period from April to June 2022, resulting in total assets of 10.1 billion EUR by the end of June 2022.

Over the first semester of 2022, the net assets of funds primarily investing in fixed-income securities declined by -2.9%, or 1.5 billion EUR.

Sustainable Funds (according to SFDR classification)

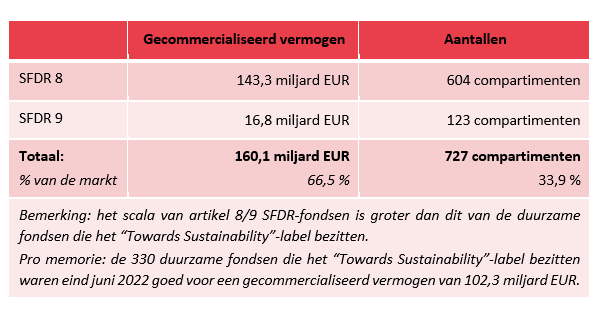

The table below provides an overview of the distribution of sustainable funds in Belgium as of the end of June 2022:

SFDR stands for Sustainable Finance Disclosure Regulation. Article 8 refers to products that promote sustainability characteristics, while Article 9 refers to products with a sustainable objective.

According to asset managers, 2/3 of the assets distributed in Belgium are classified as either Article 8 or Article 9 SFDR funds. This means that investors interested in sustainability can choose from 727 different funds.

Funds under Belgian Law

Public funds under Belgian law

Public funds under Belgian law had a total managed net asset value of 186.8 billion EUR by the end of June 2022. At that time, pension savings funds represented approximately 1/9 of public funds under Belgian law.

The calculation of the average annual return of pension savings funds as of June 30, 2022, yielded the following results:

- 1-year: -12.1%

- 3-year: +0.3%

- 10-year: +4.7%

- 25-year: +4.3%

BEAMA has developed a dashboard for pension savings funds, which is attached to this press release. This dashboard visually summarizes the key figures about third-pillar pension savings funds and their evolution on a quarterly basis in a concise manner.

Non-Public Institutional Funds under Belgian Law

Since the implementation royal decrees (KBs) were published in the Belgian Official Gazette on December 18, 2007, investment vehicles tailored to institutional investors can be developed under the form of "Institutional ICB with a variable number of units of participation." These institutional funds are non-public funds that must be registered with the Federal Public Service Finance.

These institutional funds should not be confused with public funds with non-retail share classes, which are registered with the Financial Services and Markets Authority (FSMA).

As of the end of June 2022, there were 103 institutional compartments under Belgian law, representing a total net asset value of 15.7 billion EUR. These funds attract many institutional investors, in part because they provide depth to institutional markets in terms of financial assets and pension formation.