Money mules: young people remain an easy target

10 December 2024 - 8 min Reading time

Febelfin has been questioning young people about their experience with and knowledge of ‘money mules’ for several years now. A recent survey conducted by the research bureau Indiville commissioned by Febelfin reaffirms that young people remain vulnerable to act as money mules. Despite many efforts to raise awareness, still 6 in 10 young people who are offered to act as money mules would lend their bank card and PIN and make his/her bank account available in exchange for a fee. The financial sector therefore remains committed to continuous awareness raising.

IndiVille survey, 1-18 March 2024, on a representative sample of the Belgian population n: 2109 NL/FR surveys, age 16-79. Maximum margin of error: 2.1%

The role of money mules explained

A money mule is someone who makes their bank account and/or bank card & pin code available to criminals, either consciously or unconsciously, to launder money. They are often approached in their neighbourhood or via social media, email or other online platforms and promised to earn money in a quick and easy way.

This form of fraud allows criminals to deposit crime money obtained through scams into the bank account of the money mule and then withdraw it or transfer it to other accounts. In this way, the criminal organisations stay under the radar, while the money mule has to bear the severe consequences.

Legal and collateral consequences

Acting as a money mule has significant penal consequences. Since there is participation in money laundering and fraud, the money mule risks high fines and other penalties. He/she may also have to pay compensation to the victims of the scam. Moreover, there are also other consequences: for example, the bank may refuse a future credit or bank account and the money mule risks being left with a looted account.

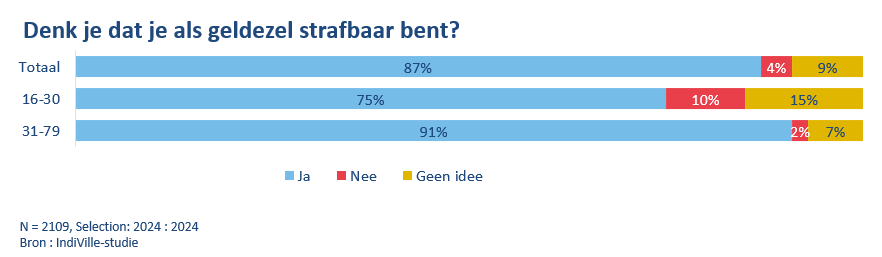

Looking at the survey figures, 10% of Belgian young people think that acting as a money mule is not punishable and 15% are in the dark about this. For the total Belgian population, these percentages are 4% and 9% respectively.

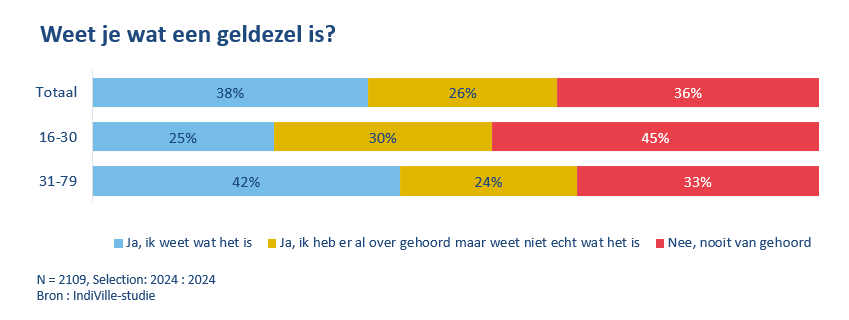

Only 25% of young people know what a money mule is

38% of the population know exactly what a money mule is and 26% have heard of it. Among 16-30-year-olds, only 1 in 4 know exactly what the phenomenon of money mules is and 30% have heard of it.

Young people easily hand over their bank card and PIN

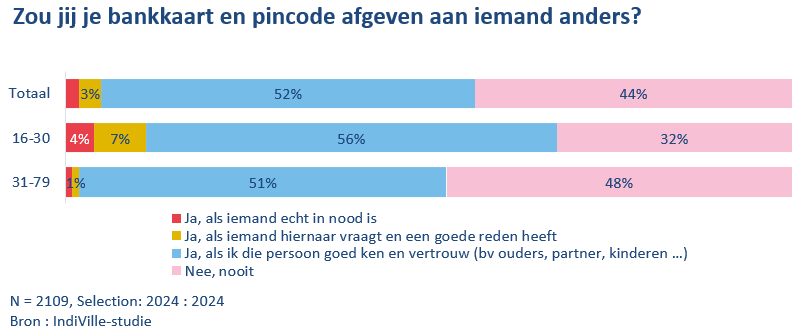

4% of the Belgian population would give his/her bank card with PIN to someone they do not know. Among young people, this share amounts to 11%. This is a slight improvement compared to last year (17%).

Acting as a money mule remains too attractive

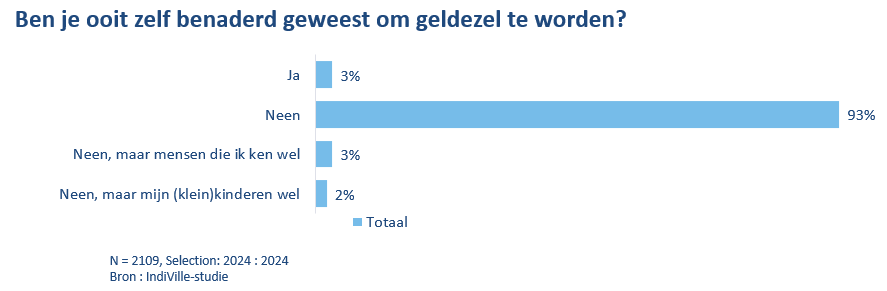

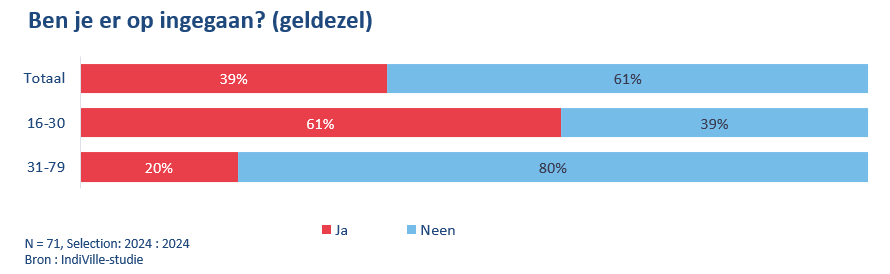

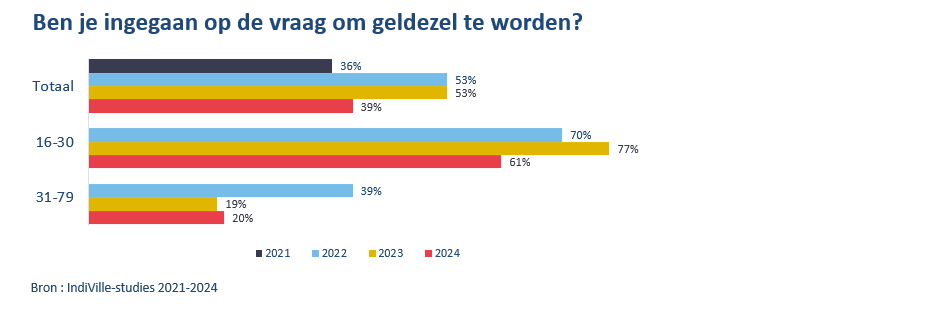

According to the survey, 3% of Belgians would have already been asked to become a money mule. 39% of those who were asked accepted the offer. Among 16-30-year-olds, 61% accepted.

This is an improvement compared to 2023 (77%), but reaffirms that they are a highly vulnerable target for this form of fraud.

If you become a money mule, you will be in trouble either way

Let us recall that making quick and easy money does not exist and is always too good to be true. It is important for young people to remember that they should never accept a request to provide their bank account and PIN in exchange for money, even if the request comes from someone they know. The chances of being caught and punished as a money mule are very high. By informing as many young people as possible, we hope to put the criminals who recruit money mules out of business as much as possible. After all, without money mules, they won't get their hands on the stolen money either. Currently, the fraudsters still remain too much out of sight.

Continuous awareness raising

Febelfin aims at continuous targeted awareness raising among young people and their entourage. In this context, we are present in schools, at teacher fairs, social media, etc. with information on money mules and regularly organise tailor-made workshops. During these interactive workshops, young people learn about the very nature of the money mules phenomenon and why it is definitely not a good idea to lend out their bank account and PIN number in exchange for money.

We also provide various types of materials to raise young people's awareness:

- Brochure on money mules for young people with all the info on the form of fraud and how to protect themselves against it

- Brochure on money mules for supervisors with useful tips and tricks for anyone who wants to contribute to raising awareness among young people

- Poster with message ‘Fast money doesn't exist’ to print out and use in schools, among other places

- Dedicated website “moremoney.be” (only in Dutch/French) with the story of Arto, who acted as a money mule, and tips to avoid falling into the trap

- Educational package (only in Dutch/French) in the form of videos in cooperation with ED TV, as well as useful teaching sheets

Want to learn more about money mules and our initiatives? Be sure to take a look at this page.