The consumer credit market continued to suffer from the COVID-19 crisis in 2021 but experienced fewer overdue payments

8 February 2022 - 5 min Reading time

Consumer credit lending through installment loans continued to be affected by the COVID-19 pandemic in 2021 and remains below the 2019 levels.

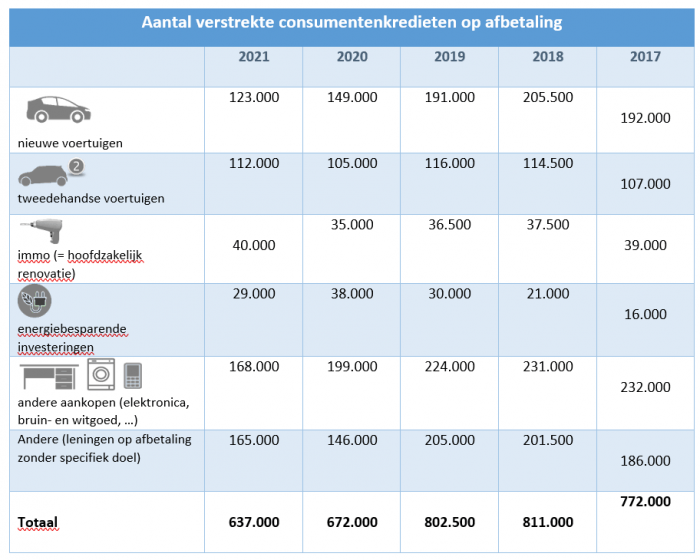

The number of consumer credit installment loans granted by BVK members decreased by approximately 5% in 2021 compared to 2020 and is 21% below the 2019 levels.

In 2021, the number of consumer credit installment loans, regardless of their purpose, never recovered to pre-pandemic levels, except for renovation loans.

Despite the health crisis, the number of overdue payments continues to decrease.

These findings are based on the statistics on consumer credit published today by the Professional Association of Credit (BVK).

I. Number of granted consumer credit installment loans, by purpose in 2021

According to data from the Professional Association of Credit, which represents 95% of the market, the number of granted consumer credit installment loans decreased by 5% in 2021 compared to the previous year and by 21% compared to 2019, a year unaffected by the COVID-19 pandemic.

The largest variation in the number of loans by purpose is related to energy-saving investments (-24%), a decrease that should be considered in light of the strong increase in 2020 (+27%) compared to 2019.

The number of loans for the purchase of new vehicles decreased by 17% compared to 2020 and by 36% compared to 2019. These fluctuations can be explained by the impact of the pandemic on vehicle production, leading to a globa shortage, but also by changes in consumer habits, particularly due to teleworking, which resulted in less frequent car usage*.

Febiac, Analysis of the Belgian car market in 2021, available at www.febiac.be

According to a VAB survey, consumers also seem to hesitate about which type of new car to purchase (internal combustion engine, hybrid, or electric), causing them to postpone their purchases. The destination of used vehicles shows smaller fluctuations, with an increase of 7% compared to 2020 and a decrease of 3% compared to 2019.

For other types of purchases, such as household appliances and furniture, a decrease of 16% is observed compared to the previous year and a decrease of 25% compared to the year before the health crisis. The number of installment transactions without a specific purpose increased by 13% compared to 2020 but is still 20% below the number recorded in 2019.

Only consumer loans for real estate purposes, especially for renovation, increased despite the coronavirus, particularly by 14% compared to the previous year and by 10% compared to 2019. In this context, it should be noted that the granting of mortgage credit returned to pre-pandemic levels in 2021.

Renovation loans can take the form of 'consumer credit' (when there is no mortgage guarantee).

II. Consumer Credit: An Economy-Driving Force with Fewer Stumbles

In 2021, outstanding installment transactions amounted to approximately 22.5 billion euros, with a total of about 2.2 million loans. These figures highlight the essential importance of this financial product for the economy and for consumers, allowing them to realize their projects.

And the lending and repayment of these loans are becoming less problematic.

The Central for Credits to Individuals of the National Bank of Belgium reports on loans to individuals (mortgage and consumer loans): "Despite the COVID-19 crisis, the number of overdue payments has decreased for the fifth consecutive year." Specifically, the number of defaults on consumer loans decreased by 5% compared to 2020 and by 9% compared to 2019.

The National Bank of Belgium adds: "These figures cannot, of course, be viewed separately from the support measures that the government took in 2020 to provide the economy with the necessary oxygen in these exceptional circumstances and to protect both businesses and households as effectively as possible."

Therefore, by supporting responsible lending, the government can pave the way for numerous economic growth opportunities. It is essential that the legislative context allows for thoughtful and responsible lending.