Surge in corporate loans to a new high

27 September 2022 - 5 min Reading time

The outstanding volume of corporate loans at the end of June 2022 was 6.3% higher than a year earlier, totaling 182.7 billion euros. The amount of approved loans reached an all-time high.

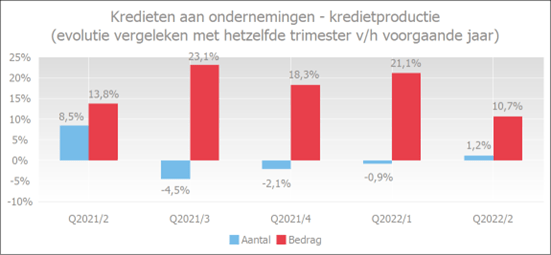

Credit production continued to rise, with both the number of loans and the loan amounts increasing. In the second quarter of 2022, 1.2% more loans were granted compared to the same period last year. The approved loan amounts were 10.7% higher than in the same quarter of the previous year.

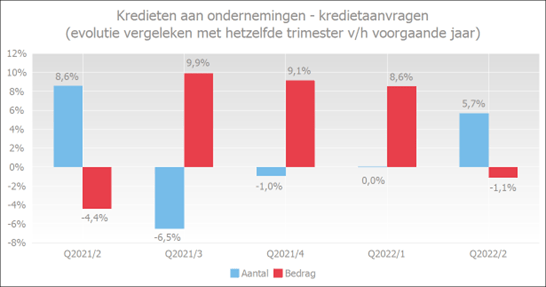

However, the trend in loan applications was slightly different. In terms of quantity, there were still more corporate loan applications in the second quarter of 2022 than in the same period in 2021, but the total amount of these requested loans decreased slightly.

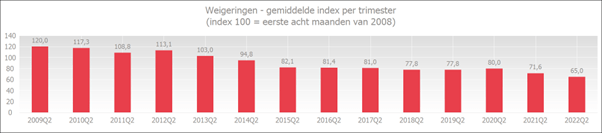

The rejection rate was at its lowest level ever for a second quarter, indicating that banks continued to grant credit smoothly. Nevertheless, companies reported experiencing greater credit constraints. This perception was likely influenced by the sharp increase in market interest rates.

Outstanding amount of corporate loans at a record high

At the end of June, the outstanding amount of drawn business credits, including commitment credits, reached a record high of 182.7 billion euros. Compared to June 2021, this outstanding amount increased by 6.3%. This annual growth was notably robust. In 2021, the annual growth rate was 4.3%, while it was only 3.4% in the COVID-19-affected year of 2020.

These are, for example, guarantee credits or documentary credits.

Credit production increases in both quantity and amount

The number of approved loans increased by 1.2% year-on-year in the second quarter of 2022. The approved loan amounts were 10.7% higher than in the same quarter of the previous year. This increase is primarily in the corporate segment, where the financing amount per case is higher than the previous year.

Demand for new credit weakens slightly in amount

In the second quarter of 2022, entrepreneurs applied for 5.7% more loans than in the same period the previous year. However, there was a slight decrease in the total amount of these loan applications.

According to the Bank Lending Survey (BLS) conducted by the four major banks, it appears that the demand for loans or credit lines by non-financial corporations decreased in the third quarter of 2022. It is expected that this trend will continue in the fourth quarter of 2022. There is notably reduced demand for loans aimed at financing investments and acquisitions.

Entrepreneurs experience more credit constraints

In the second quarter, banks have never refused loan applications at such a low percentage. The rejection rate is, therefore, at its lowest level ever for a second quarter.

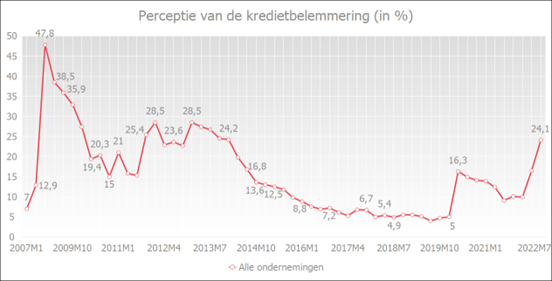

However, the quarterly survey by the National Bank of Belgium (NBB) revealed that in July 2022, more entrepreneurs perceived greater credit constraints than before. In July 2022, 24.1% of businesses considered current credit conditions unfavorable, while in January 2022, this figure was only 9.9%.

Small, medium-sized, large, and very large enterprises all believed that credit conditions had become more restrictive in July 2022.

The chart below illustrates the evolution of credit perception. A decrease indicates an easing of credit conditions, while an increase suggests that, according to businesses, it is less favorable to obtain credit.

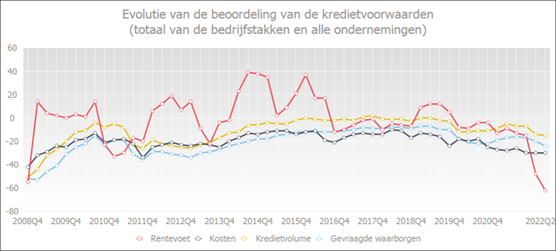

The recent increase in credit constraints experienced by entrepreneurs is mainly due to the significant rise in interest rates. The assessment of credit conditions, as shown in the graph, highlights that it is primarily the interest rate component that changes in the evaluation of credit conditions. The other three components remain relatively stable.

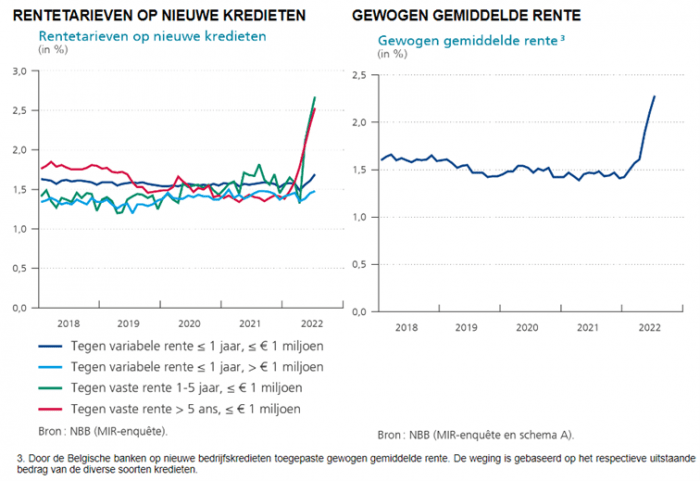

Interest rates are rising

According to NBB data, the weighted average interest rate on new corporate loans in July 2022 was 2.28% (compared to 2.11% in June 2022). Interest rates had fluctuated around 1.5% for several years, but they began to rise in February 2022.