Strong demand for mortgage credit also continues in the third quarter of 2019

24 October 2019 - 9 min Reading time

Excluding refinancings, the number of loan applications increased by 13.5% in the third quarter of 2019 compared to the third quarter of 2018. There was also an increase in amount, by 14.4%.

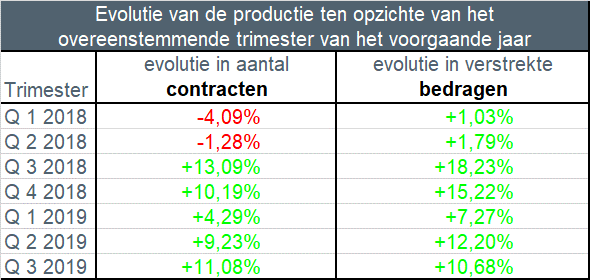

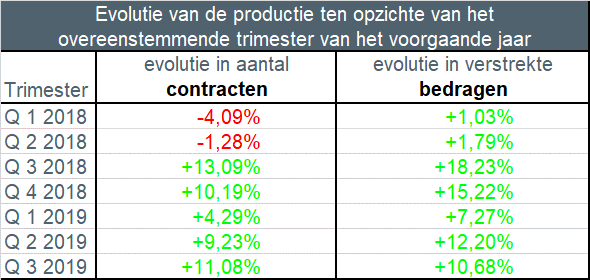

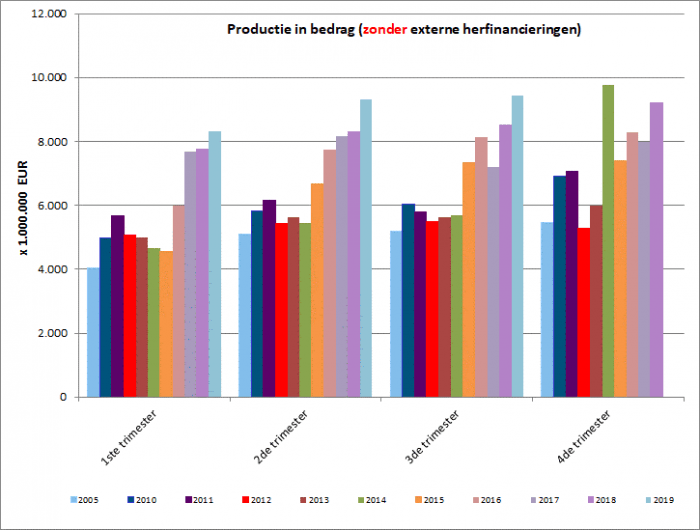

In the third quarter of 2019, approximately 69,500 mortgage loan agreements were concluded for a total amount of approximately EUR 9.4 billion (excluding refinancings). This is an increase in the number of credit agreements granted by approximately 11% compared to the third quarter of last year. In terms of amount, 10.7% more credit was provided than then. This is evident from the statistics on mortgage credit that the Professional Association of Credit (BVK) published today.

De 58 leden van de BVK nemen samen ongeveer 90% van het totaal aantal nieuw verstrekte hypothecaire kredieten (de zogeheten productie) voor hun rekening. Het totale uitstaande bedrag aan hypothecair krediet van de BVK-leden bedraagt eind september 2019 iets minder dan 226 miljard EUR.

Low interest rates continue to stimulate demand

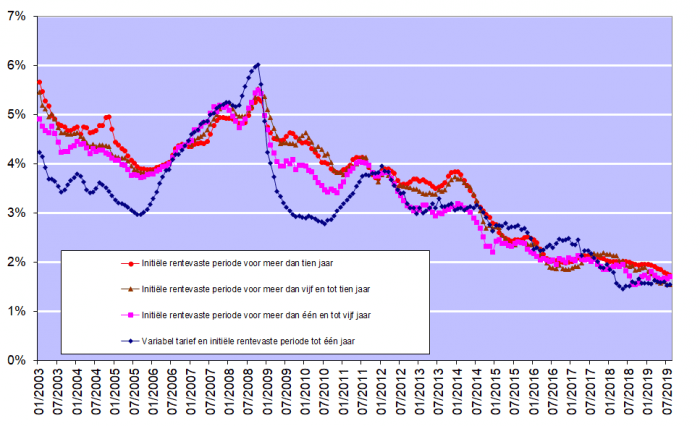

The very low interest rates for mortgage loans continue to stimulate demand. According to figures published by the National Bank of Belgium, in August these amounts were between 1.55% (for credits with a variable interest rate and an initial interest rate fixation period of up to one year) and 1.74% (for credits with an initial interest rate fixation period of more than than 10 years).

Below you will find the most important findings for the third quarter of 2019 compared to the third quarter of 2018:

Bij deze cijfers zijn de herfinancieringen buiten beschouwing gelaten.

- The number of credit applications (excl. those for refinancing) increased by 13.5% in the third quarter of 2019 compared to the third quarter of 2018. The amount of credit applications also increased by 14.4%. 96,000 loan applications were submitted for a total amount of just over EUR 14 billion.

- Mortgage loans granted increased by approximately 11% in the third quarter of 2019. The corresponding amount increased by 10.7%. Approximately 69,500 loans were thus granted for a total amount of EUR 9.4 billion (excl. refinancings).

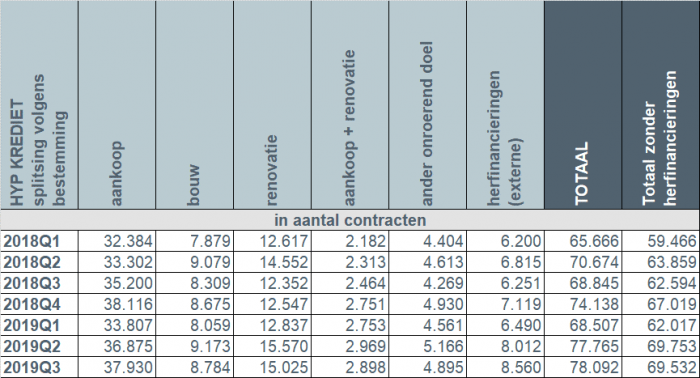

- There has been an increase in lending across all purposes. The number of loans for the renovation of a home showed the strongest increase in percentage terms, namely +21.6% or 2,673 loans more than in the third quarter of 2018. The number of loans for the purchase of a home (+2,730) was in the third quarter of 2019, 7.8% higher than in the third quarter of 2018. The number of loans for purchase with renovation (+434) increased by 17.6%, while the number of construction loans (+475) was 5.7% higher lay. The number of loans for other purposes (garage, building land) (+626) increased by 14.7%.

- The number of external refinancings (+2,309) increased by 37% in the third quarter of 2019 compared to the third quarter of 2018. In particular, just over 8,500 external refinancings were provided in the third quarter of 2019 for a total amount of slightly more than EUR 1 billion.

- The average amount borrowed for the purchase of a home increased slightly in the third quarter of 2019 to EUR 163,000. The average amount for a construction loan remained approximately unchanged in the third quarter of 2019 at EUR 175,000. The average amount of credits for purchase + renovation increased further to EUR 195,000.

- In the third quarter of 2019, approximately 86% of borrowers opted for a fixed interest rate or a variable interest rate with an initial interest rate fixation period of at least 10 years. The market share of loans with an annually variable interest rate fell further and accounted for barely more than 1% of the loans granted.

Number of credit applications

In the third quarter of 2019, the number of loans granted, excluding external refinancings, increased by just over 11% compared to the third quarter of 2018. The corresponding amount increased by 10.7%.

The number of credit applications increased for all purposes. Loan applications for the purchase of a home (+4,181) increased by 8.2%, those for the purchase + renovation of a home (+909) by 21.4%. The number of credit applications for the construction of a home (+1,686, or +17.8%) and for the renovation of a home (+4,083, or +28.5%) also increased, as did the number of credit applications for other purposes. (garage, building land, ...) (+569, or +10%).

In addition, in the third quarter of 2019, the number of applications for external refinancing increased by more than 36%.

Number of loans granted in the third quarter

In the third quarter of 2019, the number of loans granted, excluding external refinancings, increased by just over 11% compared to the third quarter of 2018. The corresponding amount increased by 10.7%.

The total amount of loans granted in the third quarter thus reaches the highest level ever in a third quarter. This was also the case in the previous trimesters.

Increase in the number of credits, regardless of purpose

Approximately 69,500 new loans were granted in the third quarter of 2019 for a total amount of approximately EUR 9.4 billion - excluding external refinancings.

Compared to the third quarter of last year, an increase was observed across all destinations.

The number of loans for the renovation of a home showed the strongest increase in percentage terms, namely +21.6% or 2,673 loans more than in the third quarter of 2018. The number of loans for the purchase of a home (+2,730) was in the third quarter of 2019, 7.8% higher than in the third quarter of 2018. The number of loans for purchase with renovation (+434) increased by 17.6%, while the number of construction loans (+475) was 5.7% higher lay. The number of credits for other purposes (+626) increased by 14.7%.

In addition, the number of external refinancings also increased by 37% in the third quarter of 2019. In particular, 8,560 external refinancings were provided for a total amount of just over EUR 1 billion.

Average amount of a credit for the purchase of a home increases to EUR 163,000

The average amount of a loan for the purchase of a home increased to EUR 163,000 in the third quarter of 2019.

The average amount of a loan for the construction of a home remained approximately unchanged during the third quarter of 2019 at EUR 175,000.

The average amount of a loan for the purchase of a home + renovation increased again in the third quarter to approximately EUR 195,000.

More than 8 in 10 borrowers opt for a fixed interest rate

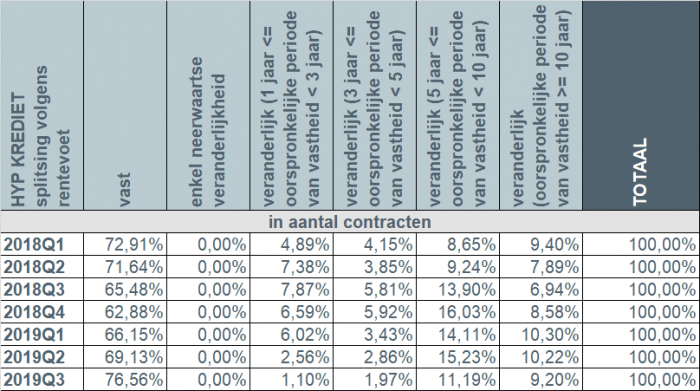

In the third quarter of 2019, 8 out of 10 borrowers (86%) opted for a fixed interest rate or a variable interest rate with an initial interest rate fixation period of at least 10 years. About 13% of borrowers opted for a variable interest rate with an initial interest rate fixation period between 3 and 10 years. As in the previous quarter, the number of borrowers who opted for an annually variable interest rate fell further to only just over 1%.

Taking into account the still very low interest rates (see graph below), Belgian consumers continue to largely opt for certainty. However, approximately 14% also opt for a variable interest rate. A very limited number still opt for an annually variable interest rate. But even in the event of a variable interest rate, the consumer is strongly protected by the legislation. For example, the variable interest rate after adjustment to the evolution of the applicable reference indices can never amount to more than double the initial interest rate.

Responsible mortgage lending remains the starting point

The credit sector is and remains aware that mortgage lending must be done with great care and that responsible lending must remain the absolute starting point. On this point, the sector is on the same page as the regulator: lenders must exercise the necessary caution to, on the one hand, prevent individual borrowers from taking out loans that are too large and, on the other hand, to safeguard financial stability in the long term.