Record in mortgage lending in the first quarter of 2022

5 May 2022 - 10 min Reading time

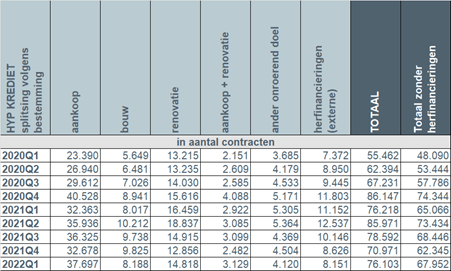

In the first quarter of 2022, nearly 68,000 mortgage credit agreements were concluded for a total amount of more than 11 billion EUR (excluding refinancing). This represents an increase in the number of credit agreements granted of approximately 4.5% compared to the first quarter of the previous year. In terms of amount, more than 17% more credit was granted than during that time. Excluding refinancing, the number of credit applications in the first quarter of 2022 decreased by approximately 8.5% compared to the first quarter of 2021. There was also a decrease in amount of about 4%.

These findings are based on mortgage credit statistics published today by the Professional Association of Credit (BVK).

The 49 members of the BVK collectively account for approximately 90% of the total number of newly issued mortgage loans (known as production). The total outstanding amount of mortgage credit held by BVK members is approximately 261 billion EUR as of the end of March 2022.

Mortgage lending continues to reach record highs

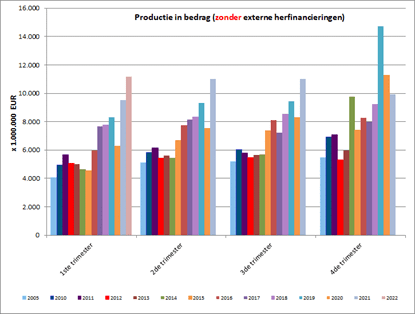

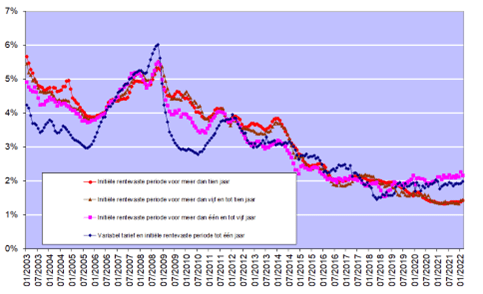

After a very strong 2021, even more mortgage credit was granted in the first quarter of 2022 than ever before in a first quarter. Interest rates for mortgage loans remained very attractive in the past quarter as well. According to figures published by the National Bank of Belgium, in February, they ranged from 1.43% (for fixed-rate loans with an initial fixed interest period of more than 10 years) to 2.16% (for loans with an initial fixed interest period of more than 1 year and up to 5 years).

“2022 also started with a strong first quarter. Never before has so much mortgage credit been granted in the first quarter. In recent months, we have noticed a decline in credit applications. This could indicate a future stabilization or decrease.”

Below are the main findings for the first quarter of 2022 compared to the first quarter of 2021:

Bij deze cijfers zijn de herfinancieringen buiten beschouwing gelaten.

Title

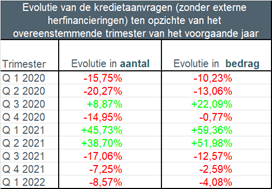

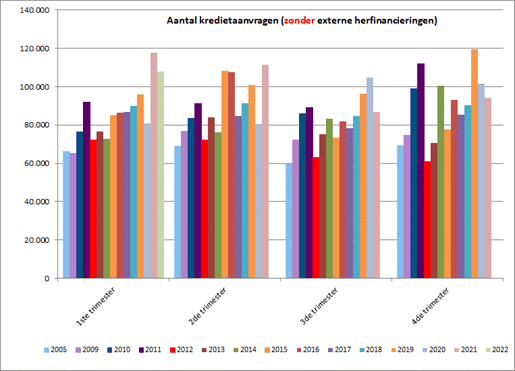

The number of credit applications (excluding those for refinancing) decreased by 8.5% in the first quarter of 2022 compared to the first quarter of 2021. The amount of credit applications also decreased by approximately 4% compared to 2021. Therefore, nearly 108,000 credit applications were submitted for a total amount of 19 billion EUR.

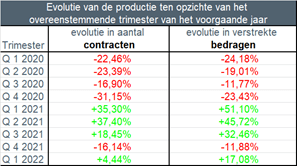

The number of granted mortgage loans increased by approximately 4.5% in the first quarter of 2022 compared to the first quarter of the previous year. The corresponding amount increased by approximately 17% compared to 2021. In total, almost 68,000 loans were granted for a total amount of more than 11 billion EUR (excluding refinancing).

The number of loans for the purchase of a home experienced the strongest percentage increase in the first quarter, namely +16.5% or 5,334 more loans than in the first quarter of 2021, along with the number of loans for purchase with renovation (+207, or +7%). The number of loans for home construction (+171) increased by just over 2%, while the number of loans for home renovation (-1,641) decreased by 10%. The number of loans for other purposes such as a garage, building land... (-1,185, or -22.3%) also decreased compared to the first quarter of 2021.

The number of external refinancings (-3,001, or -27%) decreased significantly in the first quarter of 2022. Nevertheless, more than 8,000 external refinancings were still granted in the first quarter of 2022, totaling almost 1.1 billion EUR.

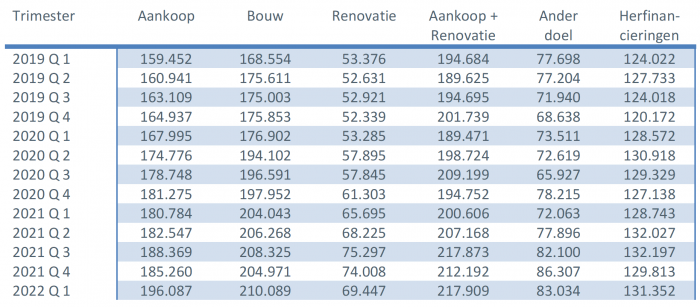

The average amount borrowed for the purchase of a home increased significantly in the first quarter of 2022 to 196,000 EUR. This represents an increase of approximately 37,000 EUR (or 23%) over the past three years. The average amount for a construction loan also increased in the first quarter of 2022 to 210,000 EUR. This is an increase of even 41,500 EUR (or 24.6%) since the beginning of 2019. The average amount of loans for purchase + renovation reached its highest level again, at around 218,000 EUR.

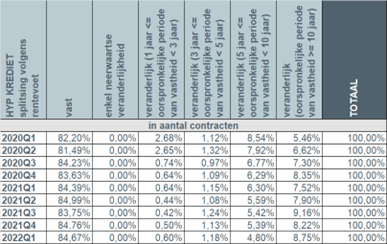

In the first quarter of 2022, more than 9 out of 10 borrowers (93.5%) once again opted for a fixed interest rate or a variable interest rate with an initial fixed interest period of at least 10 years. In only 0.6% of cases was a loan with an annually variable interest rate chosen.

I. Number of Credit Applications

The number of credit applications, excluding those related to external refinancing, decreased by 8.5% in the first quarter of 2022 compared to the same quarter of the previous year. The underlying amount of credit applications also decreased by 4%.

The number of credit applications decreased for almost all purposes. Credit applications for the purchase of a home (-2,606) decreased by 4.3%, those for the purchase + renovation of a home (-1,766) by 22.4%. The number of credit applications for home renovation (-4,200, or -16.2%), as well as credit applications for other purposes (-1,575, or -20%), experienced a significant decline. Only the number of credit applications for home construction (+42, or +0.3%) stabilized. The number of external refinancing applications also saw a sharp decline of 28.5%.

Garage, bouwgrond, …

II. Number of Granted Credits in the First Quarter

In the first quarter of 2022, the number of granted credits, excluding external refinancing, increased by almost 4.5% compared to the first quarter of 2021. The corresponding amount increased by 17%.

Never before has so much mortgage credit been granted in a first quarter.

III. Particularly an increase in the number of credits for home purchase

In the first quarter of 2022, almost 68,000 new credits were granted for a total amount of just over 11 billion EUR, excluding external refinancing.

However, compared to the first quarter of the previous year, there was not an increase in all destinations.

The number of credits for home purchase (+5,334) in the first quarter of 2022 was 16.5% higher than in the first quarter of 2021. The number of credits for purchase with renovation (+207) increased by 7%, while the number of construction credits (+171) was 2% higher. The number of credits for other purposes (-1,185) decreased by 22.3%. The number of credits for home renovation also saw a decrease, by 10% or 1,641 credits less than in the first quarter of 2021.

In addition, in the first quarter of 2022, the number of external refinancings decreased by 27%. Nevertheless, there were still more than 8,000 external refinancings granted for almost 1.1 billion EUR.

IV. Average amount of a credit for home purchase nears 200,000 EUR

The average amount of a credit for home purchase saw a strong increase again in the first quarter of 2022, reaching just over 196,000 EUR. This is an increase of approximately 37,000 EUR (or 23%) in three years.

The average amount of a credit for home construction continued to rise in the first quarter of 2022, reaching 210,000 EUR. This represents an increase of 41,500 EUR (or 24.6%) since the beginning of 2019.

The average amount of credits for purchase + renovation reached its highest level again in the first quarter, at nearly 218,000 EUR. However, this is "only" an increase of about 23,000 EUR (or 12%) since the beginning of 2019.

V. Still More Than 9 Out of 10 Borrowers Choose a Fixed Interest Rate

In the first quarter of 2022, more than 9 out of 10 borrowers (93.5%) once again chose a fixed interest rate or a variable interest rate with an initial fixed interest period of at least 10 years. In only 0.6% of cases was a credit with an annually variable interest rate chosen.

Taking into account the still very low interest rates (see graph below), Belgian consumers continue to overwhelmingly choose security. The number of individuals opting for a variable interest rate remains low, especially in the case of an annually variable interest rate. However, even in the case of a variable interest rate, consumers are highly protected by legislation. The variable interest rate, after adjustment to the evolution of the applicable reference indices, can never exceed double the initial interest rate.

Responsible Mortgage Credit Remains the Key Focus

The credit sector is and remains aware that mortgage credit must be granted with great care, and responsible lending must remain the absolute focus. On this point, the sector is in line with the regulator: credit institutions must exercise the necessary caution to maximize the avoidance of individual borrowers taking on loans that are too large, and to ensure financial stability in the long term.