Enterprises have 157.4 billion euros in credit outstanding with Belgian banks

21 February 2019 - 5 min Reading time

At the end of 2018, Belgian businesses had outstanding loans from Belgian banks totaling 157.4 billion euros. On an annual basis, this represented an increase of 6.6%.

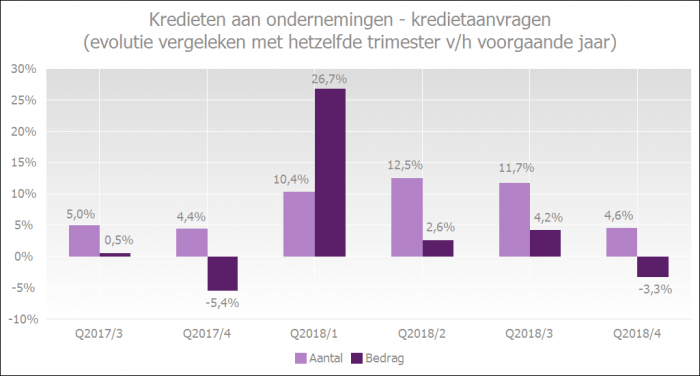

During the last three months of the previous year, businesses requested more loans compared to the same period the previous year, but these loans were for smaller amounts. Specifically, the number of loan applications increased by 4.6%, while the corresponding loan amount decreased by 3.3%.

Due to stricter regulations regarding advance corporate tax payments, businesses may have applied for more credit to finance these advance payments. These types of loan applications are typically approved relatively easily.

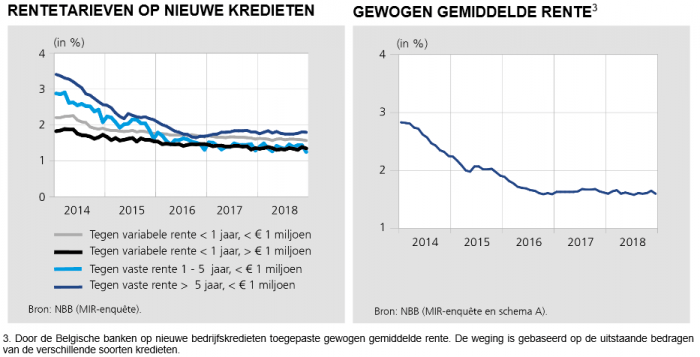

Additionally, the low interest rates have supported the demand for loans. In December 2018, the interest rate on new corporate loans dropped to 1.60%.

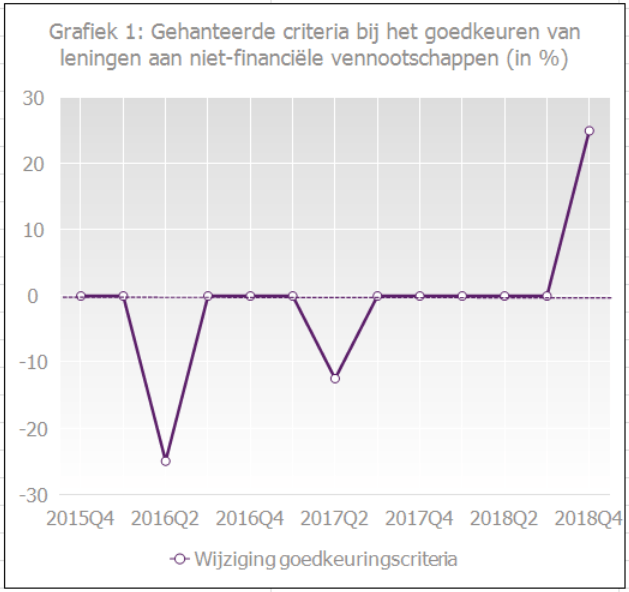

Banks reported that in the fourth quarter of 2018, they had slightly tightened their loan terms for the first time since the first half of 2013. However, the loan rejection rate remained low.

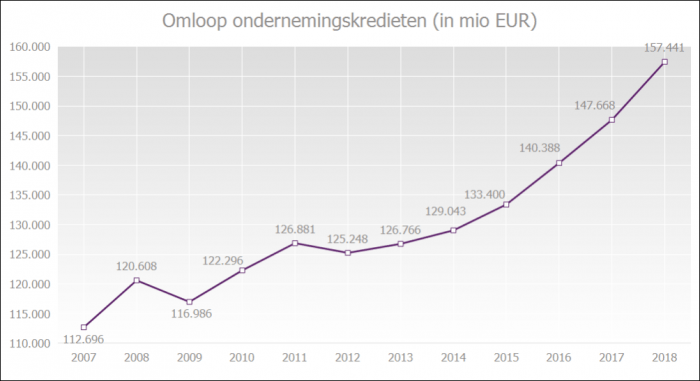

Outstanding amount of corporate loans

Outstanding business loan amounts, including commitment loans (such as guarantee loans and documentary credits), reached 157.4 billion euros in December 2018. This marked a 6.6% increase, or an additional 9.8 billion euros, compared to December 2017 (147.7 billion euros).

The demand for loans continues to be supported by low interest rates

According to data from the NBB (National Bank of Belgium), the weighted average interest rate on new business loans in December 2018 decreased by 5 basis points compared to November 2018, reaching 1.60%.

In the fourth quarter of 2018, the number of loan applications was 4.6% higher than in the same quarter of the previous year.

The stricter regulations for advance corporate tax payments may have stimulated the demand for loans, with entrepreneurs likely requesting more loans for smaller amounts to finance these payments.

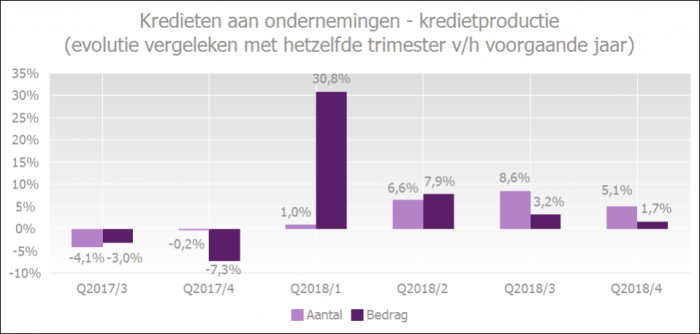

Number of granted loans

The number of granted loans increased by 5.1% in the fourth quarter of 2018 compared to the same quarter of the previous year. The associated loan amount increased by 1.7%.

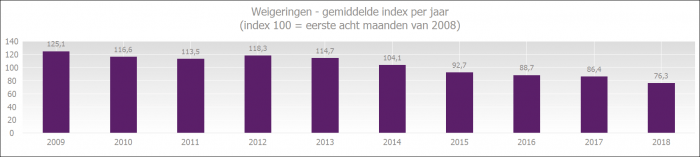

Rejection rate

Despite banks reporting a slight tightening of loan terms in the fourth quarter of 2018, the loan rejection rate for the year 2018 is at its lowest level since measurements began in 2009.

However, banks indicated in the BLS survey that they tightened their credit terms for the first time since the first quarter of 2013 in the fourth quarter of 2018.

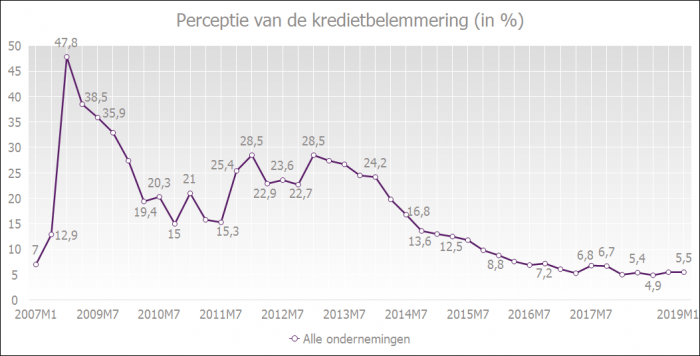

However, businesses do not seem to be significantly affected by the tightened loan conditions at this time. According to the quarterly survey conducted by the National Bank of Belgium (NBB), businesses' perception of credit constraints remains stable but historically low. In October 2018 and January 2019, only 5.5% of businesses considered the loan conditions to be unfavorable.

What is the credit barometer?

The Febelfin barometer provides information on the evolution of loan applications, credit production (new loans granted), the total outstanding loan volume, and the loan rejection rate. The barometer is compiled every three months and covers nearly the entire market.