Mortgage lending quietly creeps out of recession in second quarter 2024

18 July 2024 - 12 min Reading time

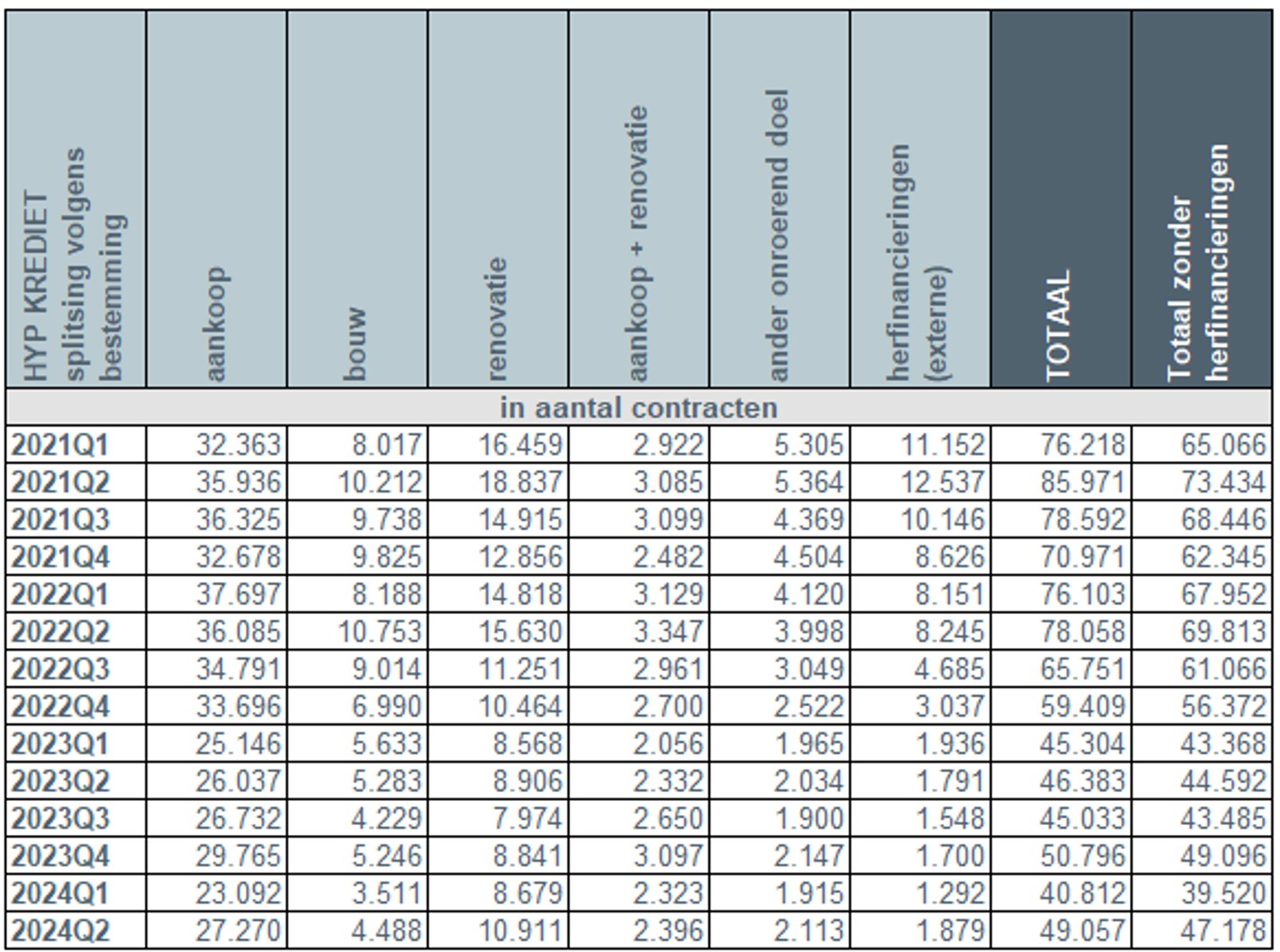

In the second quarter of 2024, just over 47,000 mortgage loan agreements were concluded for a total amount of about EUR 7.7 billion (excluding refinancings).

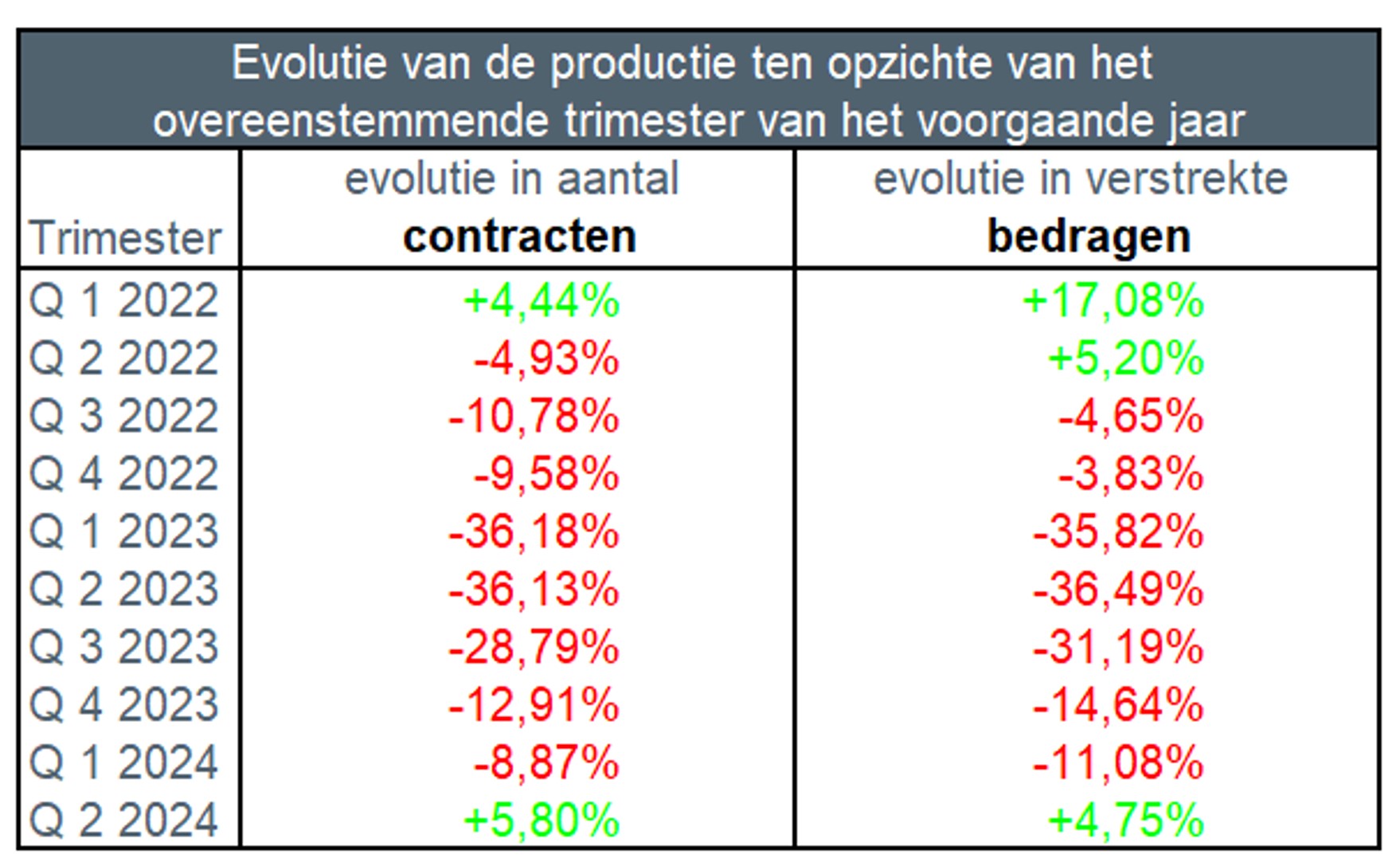

This represents a 5.8% increase in the number of credit agreements issued compared to the second quarter of last year. Also in amount, about 4.8% more credit was granted compared to last year.

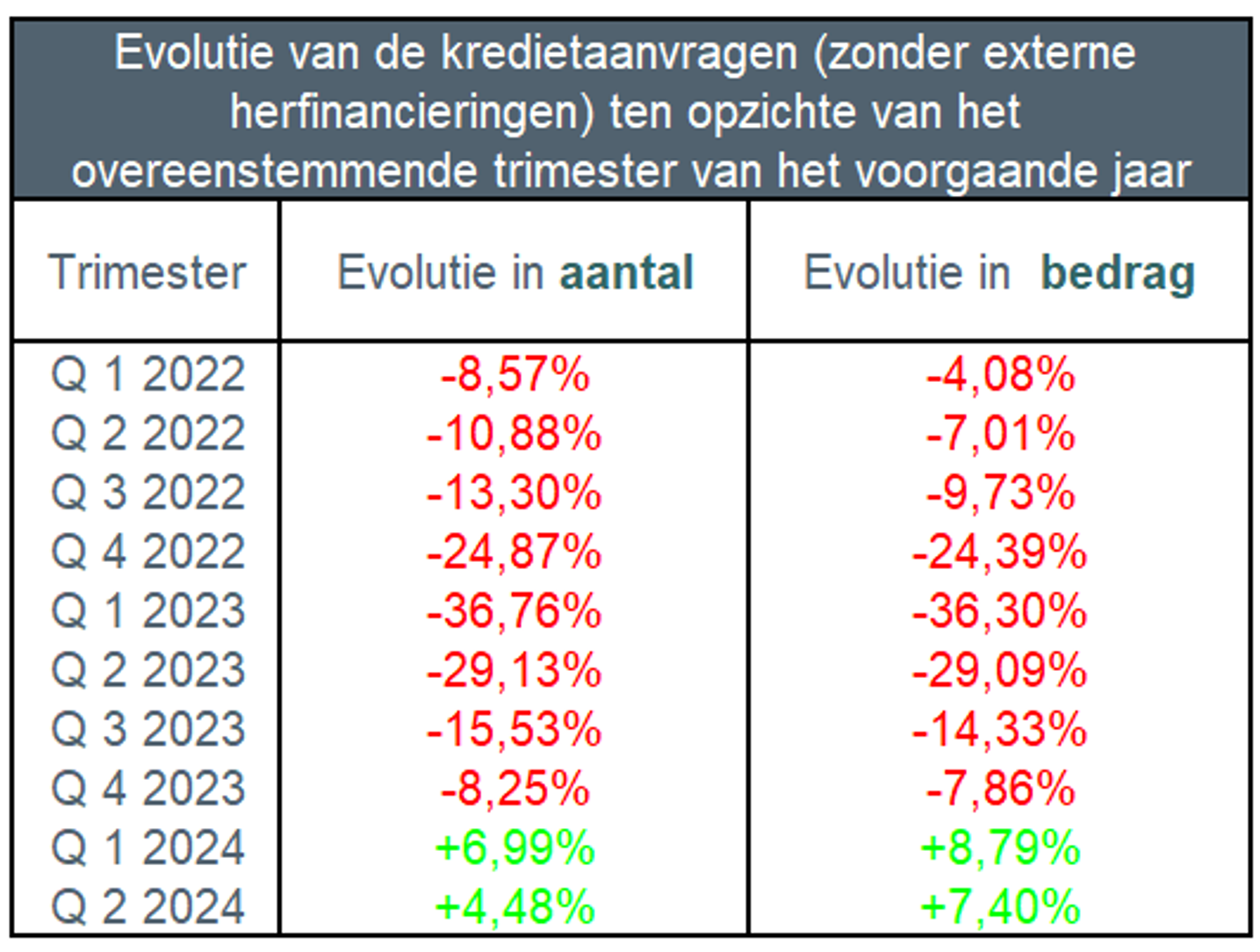

In the second quarter of 2024, the number of credit applications, excluding refinancings, increased by about 4.5%. The corresponding credit amount also increased by just over 7% during this second quarter of 2024.

This is according to mortgage credit statistics published by the Professional Credit Association (BVK).

The 48 members of BVK/UPC together account for about 90% of the total number of new mortgage loans granted (called production). The total outstanding amount of mortgage credit of BMS members at the end of June 2024 is about EUR 282 billion

The mortgage lending is slowly creeping out of the valley

The first quarter of 2024 already saw an increase in the number of loan applications compared to the same quarter last year. This upward trend also continued in the second quarter of this year, leading to an increase in lending in the second quarter compared to the same period last year.

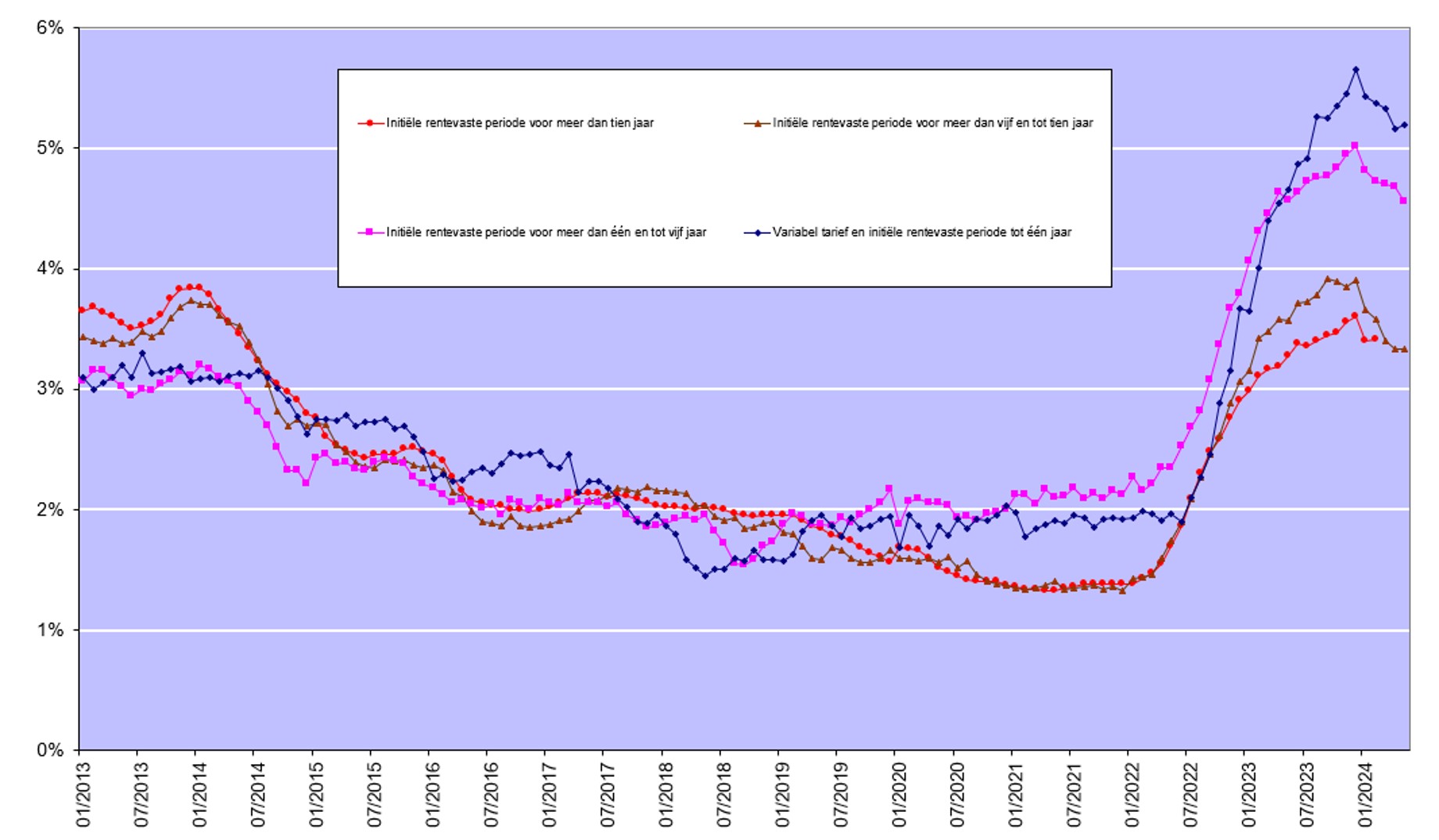

The fall in mortgage lending rates continued in the second quarter of 2024. According to figures published by the National Bank of Belgium, in May these rates fluctuated between an average of 3.14% (for loans with an initial period of fixed interest of more than 10 years) and an average of 5.20% (for loans with an initial period of fixed interest of 1 year).

"The number of loan applications increased slightly again for the second consecutive quarter. Given also the slight increase in mortgage loans granted in this second quarter, we expect the recovery to continue in the following quarters," said Ivo Van Bulck, secretary-general of the Professional Credit Association.

Below are the main findings for the second quarter of 2024 compared to the second quarter of 2023: (these figures exclude refinancings)

Bij deze cijfers zijn de herfinancieringen buiten beschouwing gelaten.

The number of credit applications (excluding those for refinancing) increased by about 4.5% in the second quarter of 2024 compared to the second quarter of 2023. The amount of credit applications also increased by 7.4% compared to 2023. Just over 73,000 credit applications were thus submitted for a total amount of just over EUR 13.5 billion.

Mortgage loans granted increased (in number) by around 5.8% in the second quarter of 2024. The corresponding amount also increased by about 4.8% compared to 2023. A total of just over 47,000 loans were granted totalling over EUR 7.7 billion (excluding refinancings).

Compared to the second quarter of 2023, the number of construction loans (-795, or -15%) was the only one to experience a decline. The number of loans for renovations rose the most (+2,005, or +22.5%) in the second quarter of 2024. An increase was also recorded in the number of credits for other purposes, such as a garage (+79, or +3.9%). The same was true for loans for purchase + remodelling (+64, or +2.7%). The number of loans for home purchase (+1,233, or +4.7%) continued its upward trend in the second quarter.

The number of external refinances (+88, or +4.9%) rose slightly again in the second quarter for a long time. As a result, around 1,900 external refinances were provided in the second quarter of 2024, totalling around EUR 261 million.

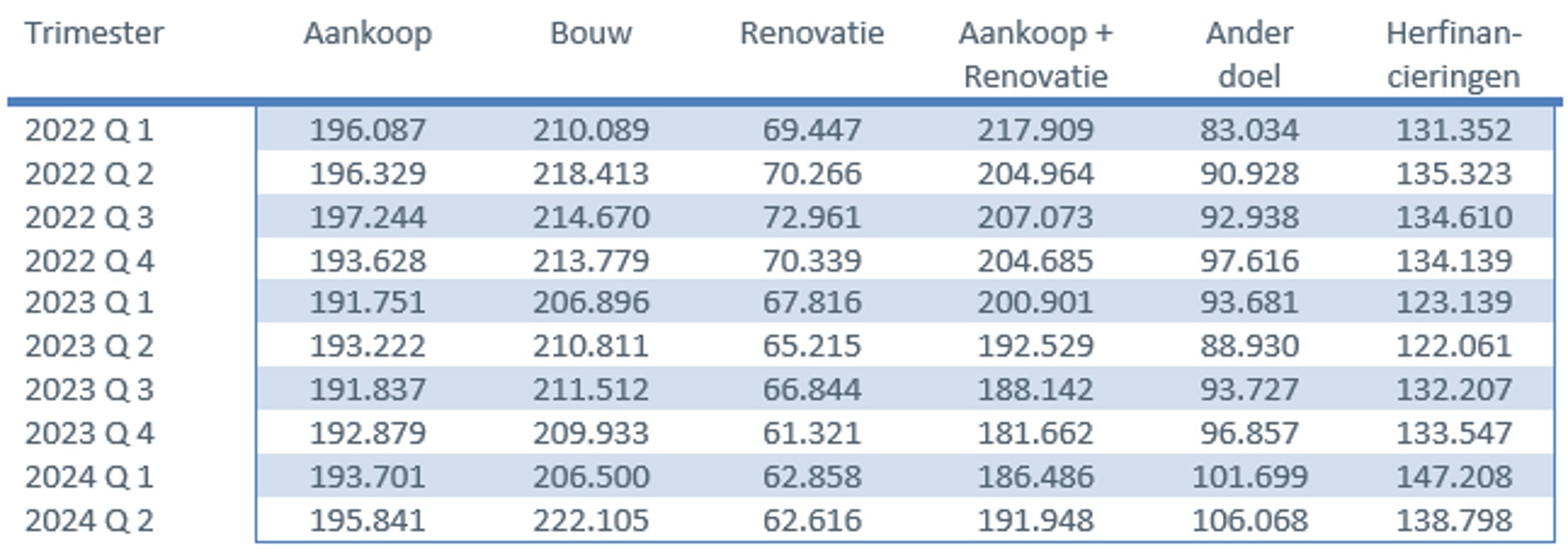

The average amount borrowed for the purchase of a home rose slightly in the second quarter of 2024 to about EUR 196,000. The average amount for a construction loan rose sharply in the second quarter of 2024 to EUR 222,000. The average amount of purchase + remodelling loans also rose in the second quarter of 2024, to EUR 192,000.

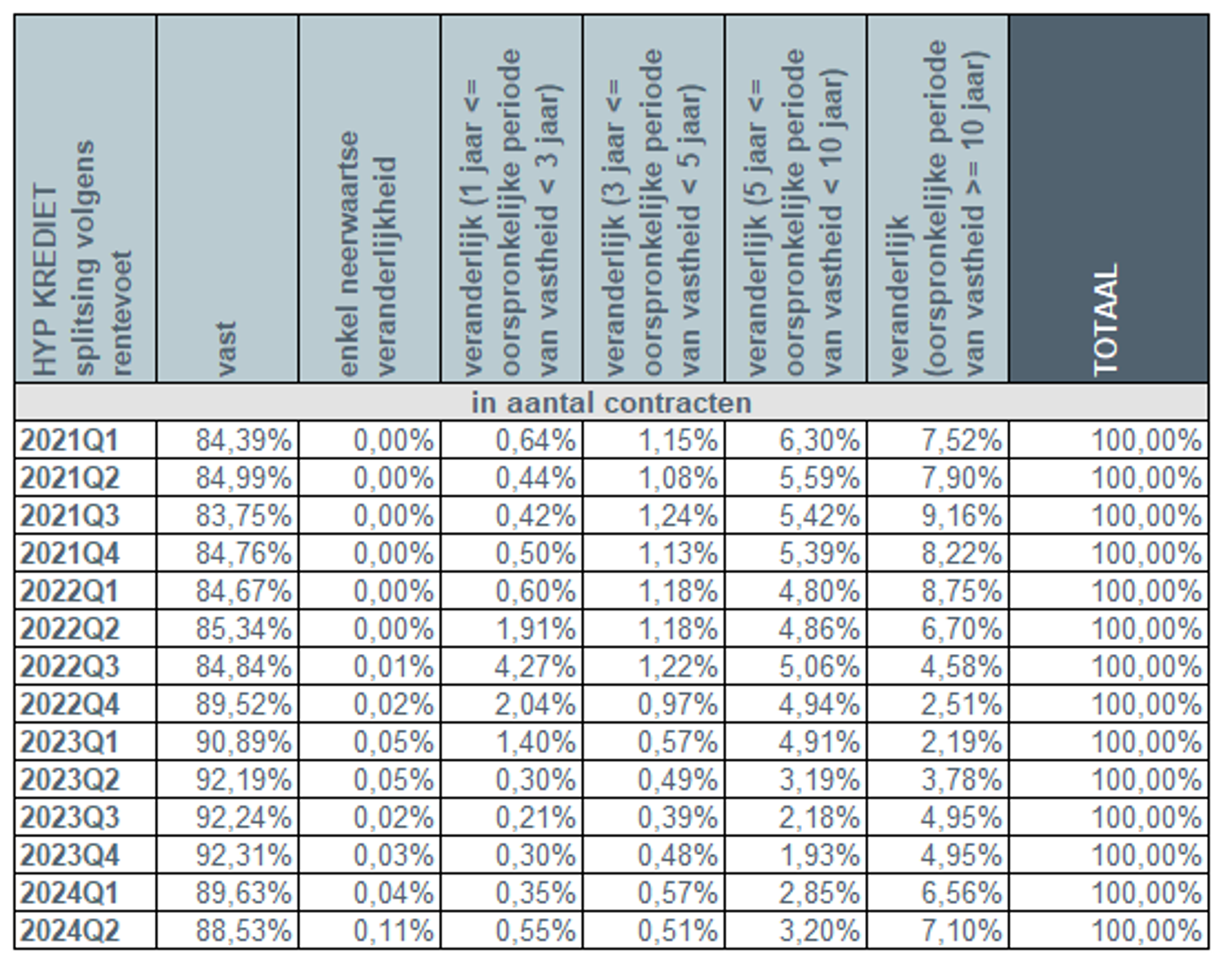

In the second quarter of 2023, around 96% of borrowers again opted for a fixed interest rate or a variable interest rate with an initial period of interest rate fixation of at least 10 years. Only 0.5% opted for a loan with an annually variable interest rate. continued in the second quarter.

Garage, bouwgrond …

I. Number of loan applications increases further

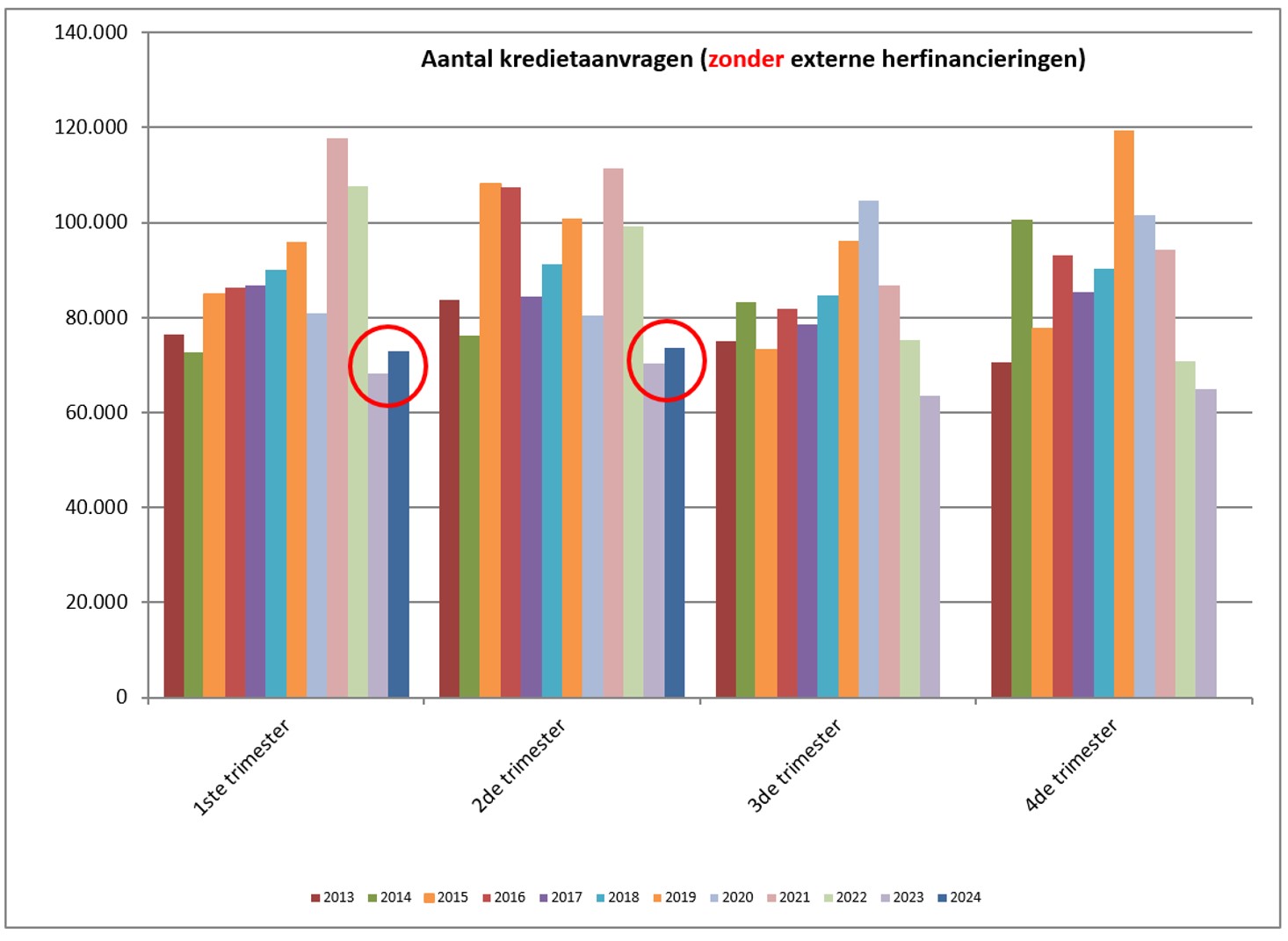

The number of credit applications, excluding those related to external refinancing, increased by about 4.5% during the second quarter of 2024 compared to the same quarter last year. The underlying amount of loan applications also increased by 7.4%. Thus, for the second consecutive quarter, the number of credit applications (not including those for external refinancing) increased, after 10 quarters of decline.

Source: BVK

The number of credit applications increased for most destinations. Credit applications for buying a home (+1,645) increased by +3.7%. The number of credit applications for renovating a home (+2,498, or +22.1%) increased the most. Credit applications for other purposes also saw an increase compared to the same quarter of 2023 (+121, or +3.9%). In contrast, the number of credit applications for the purchase + remodelling of a home (-605) fell by -13% in the second quarter, as did the number of credit applications for the construction of a home (-506, or -7.8%). The number of applications for external refinancing remained stable, rising slightly by +1.4%, or +43 applications.

Source: BVK

II. Number of loans granted in the second quarter

In the second quarter of 2024, excluding external refinancing, the number of loans granted increased for the first time in a long time by almost 6% compared to the second quarter of 2023, after eight quarters of constant decline. The corresponding amount also saw an increase of about 4.8%.

Source: BVK

Thus, rising credit demand is also quietly leading to an increase in the number of loans granted

Source: BVK

III. Loans earmarked for construction continue to fall

Just over 47,000 new loans were granted in the second quarter of 2024 for a total amount of just over EUR 7.7 billion - excluding external refinancing. The number of loans granted in the second quarter thus remains low and even the lowest number per quarter since 2014, with the exception of the year 2023.

Overall, compared to the absolute low in the second quarter of 2023, there was an increase of around 6% in the number of loans granted, excluding refinancings. This increase was noticeable for just about all destinations. Only the number of construction loans declined.

The number of loans for home purchase (+1,233, or +4.7%), home purchase and remodelling (+64, or +2.7%) and other purposes (+79, or +3.9%) increased slightly compared to the second quarter of 2023. Compared to the second quarter of 2023, the number of loans taken out for the renovation of a home (+2,005, or +22.5%) increased the most. As mentioned, only the number of construction loans experienced a decrease of -15%, or 795 loans less than in the second quarter of 2023.

The number of external refinances also increased slightly again by around 5%. Consequently, around 1,900 external refinancing operations were granted for a total amount of around EUR 261 million.

Source: BVK

IV. Average amount of credit increases

The average amounts of loans granted increased slightly for most purposes in the second quarter.

The average amount of a credit for the purchase of a home saw an increase in the second quarter of 2024, clocking in at around EUR 196,000.

The average amount of a loan for purchase + renovation also went up again, to about EUR 192,000.

Especially the average amount of a building loan saw a sharp rise in the second quarter of 2024, to around EUR 222,000 EUR.

Source: BVK

V. Still around 96% of borrowers opt for a fixed interest rate

In the second quarter of 2024, more than 9 in 10 borrowers (95.6%) again opted for a fixed rate or a variable rate with an initial period of interest rate fixation of at least 10 years. About 4% of borrowers preferred a variable rate with an initial period of interest rate fixation between 3 and 10 years. Barely 0.5% of borrowers opted for an annually variable interest rate.

Source: BVK

Taking into account the level of interest rates (see chart below), Belgian consumers therefore continue to overwhelmingly opt for security. The number of people opting for a variable interest rate remains low. But even in the case of a floating interest rate, consumers are highly protected by legislation. Thus, after adjustment to the evolution of the applicable reference indices, the variable interest rate can never exceed twice the initial interest rate.

Source: NBB Stat

Responsible mortgage lending remains the starting point

The credit sector is and remains aware that mortgage lending must be done with great care and that responsible lending must remain the absolute starting point. On this point, the industry is on the same page as the regulator: lenders must exercise the necessary caution to avoid, to the maximum extent possible, individual borrowers taking out loans that are too large, on the one hand, and to preserve financial stability in the long term, on the other.

More information

Further information can be obtained from the press office (02 507 68 31 - press@febelfin.be).

Full statistics on mortgage credit (2000 - 2024S1) broken down by destination of credit and type of interest rate are available on the BCK website (www.upc-bvk.be) under "Press & figures".