Mortgage lending in 2021 back to pre-COVID levels

28 January 2022 - 12 min Reading time

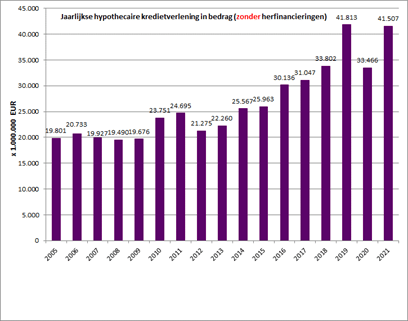

Mortgage lending fully recovered from the COVID-19 crisis in 2021, nearly reaching the levels of the record year 2019.

- Excluding refinancing, the number of mortgage loan applications in 2021 increased by approximately 11.5% compared to 2020, and it was only 0.5% below the levels of the record year 2019. In terms of the loan amount, there was even an increase of over 19% compared to 2020, and the requested amount was nearly 19% higher than in 2019.

- In 2021, excluding refinancing, almost 270,000 mortgage loan agreements were concluded for a total amount of nearly 41.5 billion EUR, just slightly less than in the record year 2019.

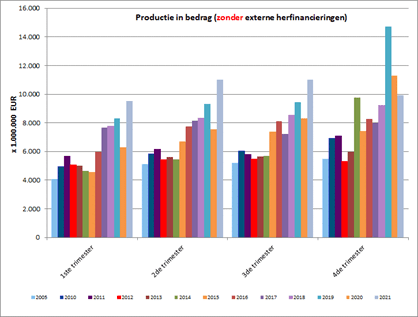

- The recovery was particularly strong in the first three quarters of 2021 when new record levels were reached consecutively.

This is evident from the statistics on mortgage credit published today by the Professional Association of Credit (BVK).

The 49 members of the BVK collectively account for approximately 90% of the total number of newly issued mortgage loans (referred to as production). The total outstanding amount of mortgage credit from BVK members amounts to approximately 258 billion EUR as of the end of December 2021.

Fully recovered from the coronavirus crisis

In 2020, the impact of the coronavirus crisis, along with the associated lockdowns, led to a noticeable decline in mortgage lending, although a rebound became evident in the second half of that year.

This robust recovery continued notably during the first three quarters of 2021, with each quarter achieving new record figures in terms of granted loan amounts. Some stabilization occurred in the fourth quarter. In this way, in 2021, almost as much credit was granted as in the peak year of 2019.

Just like in previous years, borrowers benefited from very low interest rates for mortgage loans throughout the year. According to figures published by the National Bank of Belgium, these rates ranged from 1.36% (for variable-rate loans with an initial fixed-rate period of more than 5 and up to 10 years) to 2.16% (for loans with an initial fixed-rate period of more than 1 year and less than 5 years) in November 2021.

"The mortgage lending market has fully recovered from the COVID-19 crisis. In 2021, it almost reached the figures of the record year 2019".

Key findings for the entire year 2021, with a special focus on the fourth quarter:

These figures do not include refinancing.

- The number of loan applications (excluding refinancing) in 2021 was 11.5% higher than in 2020, and just 0.5% lower than the record year 2019. The loan application amount was approximately 19% higher than in 2020, as well as compared to 2019. There were 410,000 loan applications submitted for a total amount of more than 71 billion EUR.

- In 2021, almost 270,000 mortgage loans (excluding refinancing) were granted for a total amount of 41.5 billion EUR. Compared to 2020, the number of mortgage loans increased by more than 15%, but there was a decrease of nearly 13% compared to the record year 2019. The corresponding amount increased by 24% compared to 2020 and decreased by only 0.7% compared to the record year 2019.

- Compared to 2020, there was an increase in the number of loans granted for all purposes. The increase was most pronounced for construction loans (+9,700 or +34.5%), loans for the purchase of a home (+16,800 or +14%), and loans for home renovation (+7,000 or +12.5%). The number of loans for purchase with renovation (+155 or +1.4%) and for other purposes (+2,000 or +11%) showed less pronounced increases.

- However, compared to the record year 2019, there was a decrease in the number of loans granted for all purposes. For home purchase loans, this decrease was approximately 16.5%, and for construction loans, it was about 12%. For renovation loans and loans for purchase with renovation, the decrease was around 8%.

- Compared to 2020, there was a significant overall increase in the loan amount, nearly equaling the record year 2019. There was a 44% increase for construction loans and a 19% increase for loans for home purchase. For loans for purchase with renovation, there was a 7% increase, and renovation loans saw an increase of +37%.

- The number of external refinancings (+4,900 or +13%) increased again in 2021 compared to 2020. In 2021, nearly 42,500 external refinancings were granted for a total amount of more than 5.5 billion EUR.

A focus on the fourth quarter of 2021 compared to the fourth quarter of 2020 yielded the following results. It should be noted that the comparison is made with the fourth quarter of 2020 when a strong recovery took place due to the COVID-19 pandemic's impact in the first half of 2020.

- It can be observed that in the fourth quarter of 2021, almost 95,000 credit applications were submitted, totaling slightly less than 17 billion EUR, which is not much lower in terms of amount compared to 2020 and 2019.

- In comparison to the strong fourth quarter of 2020, following the catch-up movement that occurred then, the number of granted mortgage loans in the fourth quarter of 2021 decreased overall (-16%). Comparison with the absolute record quarter Q4 2019 (due to the abolishment of the housing bonus in Flanders) is difficult, but even compared to the fourth quarter of the more "ordinary" year 2018, there is a decrease in the number of granted loans by almost 7%.

- In terms of amount, about 12% less credit was granted in the fourth quarter of 2021 compared to the fourth quarter of 2020. Comparison with the exceptional fourth quarter of 2019 is difficult, but comparing with the more "normal" year 2018 shows an increase of almost 8%.In total, more than 62,000 credits were granted for an amount of nearly 10 billion EUR (excluding refinancing).

- The number of external refinancings remained relatively high in the fourth quarter of 2021. In the fourth quarter of 2021, more than 8,600 external refinancings were granted for an amount of 1.1 billion EUR.

- The average amount of loans for purchase + renovation saw a slight decrease to 212,000 EUR after the significant surge in the previous quarter. The average borrowed amount for home purchase also decreased slightly to over 185,000 EUR in the fourth quarter of 2021. The average amount for a construction loan reached approximately 205,000 EUR in the fourth quarter of 2021.

- In the fourth quarter of 2021, once again, more than 9 out of 10 borrowers (93%) opted for a fixed interest rate or a variable interest rate with an initial period of interest rate stability of at least 10 years. In hardly 0.5% of cases, a loan with an annually variable interest rate was chosen.

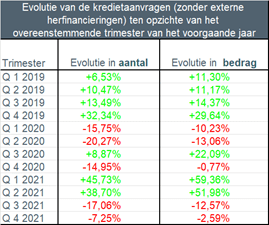

I. Number of Credit Applications in the Fourth Quarter

The number of credit applications, excluding those related to external refinancing, experienced a decrease of approximately 7% during the fourth quarter of 2021 compared to the same quarter of the previous year. However, the underlying amount of credit applications decreased less, specifically by 2.6%.

The decrease in the number of credit applications was not uniform. Credit applications for home purchases (-2,100) decreased by -3.8%, those for home purchase + renovation (-1,600) decreased by -23%, those for home renovation (-2,900) decreased by -15%, and those for other purposes such as a garage, building land... (-900) increased by 13.5%. The number of applications for home construction loans (+180) was the only one to experience a slight increase of 1.4%. The number of applications for external refinancing decreased by approximately 10%.

garage, bouwgrond, ...

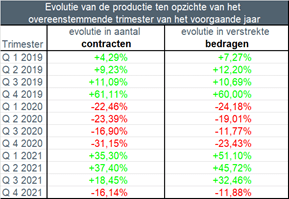

II. Number of Granted Loans in the Fourth Quarter

Compared to the strong fourth quarter of 2020, which saw a rebound following a weak first half due to the COVID-19 pandemic, the granted mortgage loans in the fourth quarter of 2021 naturally decreased significantly, namely -16% in number and -12% in amount.

Comparison with the absolute record quarter Q4 2019 (due to the announced abolition of the housing bonus in Flanders from 2020) is difficult, but even compared to the fourth quarter of the more "ordinary" year 2018, there is still a decrease in the number of granted loans by almost 7%.

In terms of amount, about 12% less credit was granted in the fourth quarter of 2021 compared to the fourth quarter of 2020. Here again, comparison with the exceptional fourth quarter of 2019 is difficult, but compared to the more "normal" year 2018, there is an increase of almost 8%.

III. Evolution of the Number of Loans by Purpose

In the fourth quarter of 2021, slightly more than 62,000 new loans were granted for a total amount of about 10 billion EUR, excluding external refinancing.

Compared to 2020, this represents a decrease of about 16% in the number of contracts and about 12% in the corresponding amount, across almost all purposes (except construction loans). Comparison with the exceptional year 2019 (due to the abolition of the housing bonus in Flanders) is difficult, but compared to the fourth quarter of the more "normal" 2018, the picture is mixed: the number of loans for home purchases (-5,438) in the fourth quarter of 2021 was more than 14% lower than in the fourth quarter of 2018. The number of loans for home purchase with renovation (-269) decreased by slightly less than 10%, just like the number of loans for other purposes (-426, or -8.6%). However, the number of renovation loans (+309, or +2.5%) and construction loans (+1,150, or +13.3%) both saw an increase compared to the fourth quarter of 2018.

Additionally, in the fourth quarter of 2021, the number of external refinancings was significantly lower than in the fourth quarter of 2020. Nevertheless, around 8,600 external refinancings were still granted, totaling 1.1 billion EUR.

IV. Strong increase in average loan amounts over the years

The average amount of a loan for home construction reached approximately 205,000 EUR in the fourth quarter of 2021. This represents an increase of about 25,000 EUR (+15.7%) over three years.

The average amount of a loan for home purchase + renovation slightly decreased to about 212,000 EUR in the fourth quarter. Despite this decrease, there has been an increase of about 17,000 EUR (+8.7%) over three years and even nearly 27,000 EUR (+14.4%) over five years.

The average amount of a loan for home purchase reached just over 185,000 EUR in the fourth quarter of 2021. Here, too, it is observed that there has been an increase of 25,000 EUR (+15.7%) over three years compared to the end of 2018.

The average amount of renovation loans saw the strongest increase: from approximately 54,500 EUR at the end of 2018 to about 74,000 EUR (+35.7%) at the end of 2021. This represents an increase of 19,500 EUR in three years. Compared to the end of 2016, over five years, there has been an increase of 29,500 EUR, or 66.4%, compared to the average amount at that time (44,477 EUR).

V. Fixed interest rate remains the preferred choice

In the fourth quarter of 2021, once again, more than 9 out of 10 borrowers (93%) opted for a fixed interest rate or a variable interest rate with an initial period of interest rate stability of at least 10 years. Just over 6% of borrowers chose a variable interest rate with an initial stability period between 3 and 10 years. The number of borrowers opting for an annually variable interest rate dropped to barely 0.5%.

Considering the still very low interest rates (see chart below), Belgian consumers continue to overwhelmingly choose security when it comes to their loans. The number of individuals opting for a variable interest rate remains low, especially when it comes to the annually variable interest rate. However, even in the case of a variable interest rate, consumers are highly protected by legislation. The variable interest rate, after adjustment to the evolution of the applicable reference indexes, can never exceed twice the initial interest rate.

Responsible mortgage lending remains the starting point

The credit sector is and remains aware that mortgage lending must be carried out with great care, and responsible lending must remain the absolute starting point. On this point, the sector aligns with the regulator: lenders must exercise the necessary caution to, on the one hand, maximize the avoidance of individual borrowers taking on loans that are too substantial and, on the other hand, to safeguard financial stability in the long term.