Febelfin coronamonitor: the latest developments in focus

8 October 2020 - 4 min Reading time

Families and businesses can rely on banking support

Banks continue to provide full support to consumers, businesses, and self-employed individuals who are facing financial pressures due to the coronavirus crisis.

In September, almost 18,000 new loans were granted to businesses for an amount exceeding 3.1 billion euros. This primarily concerns SMEs, as they account for over 16,500 of these new loans.

These figures indicate a slowdown in the production of new loans. Given the current economic situation, this is not entirely surprising. Entrepreneur confidence has decreased due to the coronavirus crisis, resulting in fewer investments across all sectors. A reduced demand for credit from businesses automatically impacts the production of new loans by banks.

Additionally, since March 31, banks have granted payment deferrals for business loans 140,362 times, totaling an underlying loan volume of 24.2 billion euros, averaging 172,732 euros per loan. More than 80% of the payment deferrals are granted to SMEs and self-employed individuals.

Apart from loans to businesses, banks have also granted over 120,664 payment deferrals to individuals for their mortgage loans since March 31, 2020. The total underlying loan volume amounts to 12.6 billion euros, averaging 104,255 euros per loan.

Between May 20 and July 31, 2020, individuals could also request payment deferrals for their consumer loans. Such deferrals were granted 7,537 times, covering an underlying loan volume of 157.6 million euros.

Extension of payment deferrals has ended

Consumers and businesses that still met the initial conditions could request an extension of their payment deferrals from their bank until the end of September. Payment deferrals can last until the end of this year at the latest. Requesting new payment deferrals and/or extending them within the framework of the agreed charters has not been possible since the end of September.

Those experiencing financial difficulties due to the coronavirus crisis are urged to contact their banker promptly so that options tailored to each situation can be explored.

Belgians are paying digitally

Since the onset of the coronavirus crisis, merchants and banks have encouraged digital payments as much as possible. Paying with a card and smartphone is an extremely secure and hygienic way to settle purchases, especially when done contactlessly. Belgians have adjusted their payment behavior accordingly and seem to maintain this new digital habit.

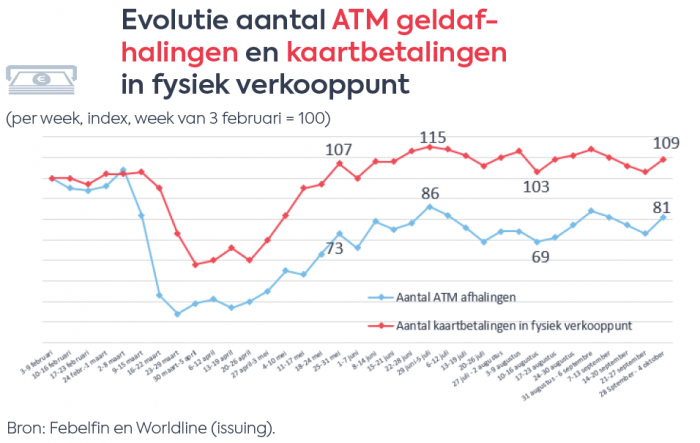

The chart below suggests that Belgians are still using cards more frequently than cash. The number of card payments on a weekly basis is now approximately 10% higher compared to February (pre-lockdown period). However, the number of ATM cash withdrawals is significantly lower (about 20%) than the pre-lockdown level.

Contactless payments also continue to grow. Today, 37% of all card payments are contactless. This represents more than double the figure since February 2020 when Belgians only used contactless payments in 16% of cases.

Febelfin encourages everyone to continue making digital payments (using cards and smartphones) as much as possible. Digital, especially contactless, payment is the most hygienic and secure way to pay now that coronavirus figures are rising again.

These figures are also available in the coronamonitor.