Falling credit demand leads to first slight decrease in credit provision

27 October 2022 - 10 min Reading time

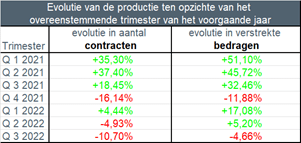

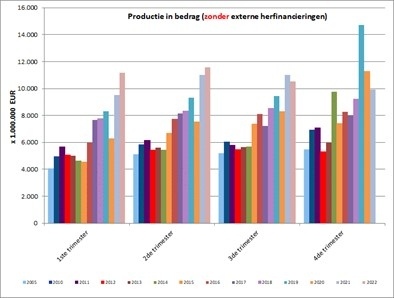

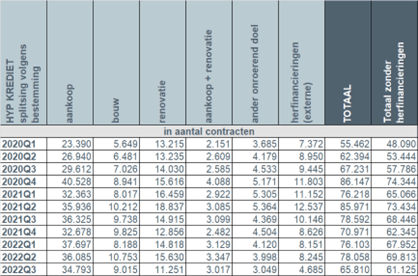

In the third quarter of 2022, just over 61,000 mortgage loan agreements were concluded for a total amount of more than 10.5 billion EUR (excluding refinancings).

This represents a decrease of almost 11% in the number of credit agreements granted compared to the third quarter of the previous year. Also, in terms of amount, slightly more than 4.5% less credit was granted than back then.

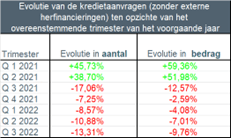

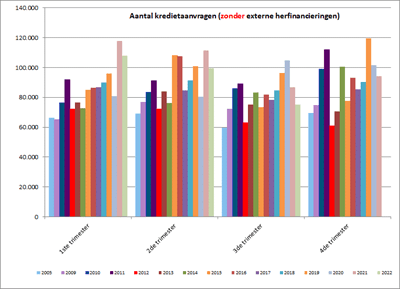

Excluding refinancings, the number of credit applications in the third quarter of 2022 decreased by more than 13% compared to the third quarter of 2021. In terms of amount, there was also a decrease of almost 10%.

These statistics are from the Credit Professional Association (BVK), which was published today.

The 49 members of the BVK collectively account for approximately 90% of the total number of newly granted mortgage loans (referred to as production). The total outstanding amount of mortgage credit held by BVK members is approximately 269 billion EUR as of the end of September 2022.

Ondanks een lichte daling blijft de hypothecaire kredietverlening op niveau

After a very strong 2021 and an equally strong first half of 2022, during which record levels of credit provision were consistently recorded, the third quarter of 2022 marks the first decrease in mortgage lending compared to the third quarter of 2021. Nevertheless, credit provision is still at a very high level, and only in the third quarter of last year was more mortgage credit granted (in amount) than in the third quarter of this year.

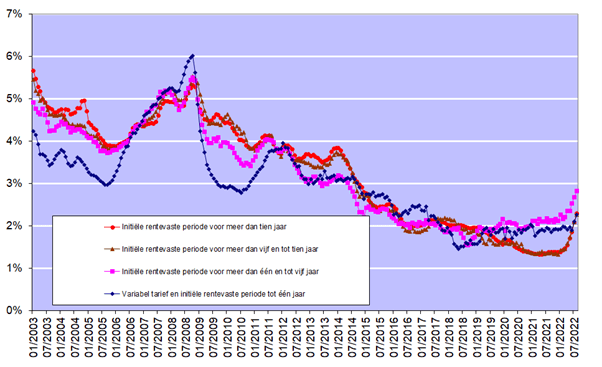

Interest rates for mortgage loans saw an expected upward trend in the past quarter. According to figures published by the National Bank of Belgium, in August, they averaged 2.27% (for loans with an initial fixed interest period of 1 year or more than 5 and up to 10 years) and averaged 2.82% (for loans with an initial fixed interest period of more than 1 year and up to 5 years).

"Overall, fewer loans were granted. This decrease is currently rather limited for loans for the purchase and construction, unlike the sharp decrease in renovation loans. The declining credit demand could also translate into a further decrease in granted loans in the coming quarter."

Below you will find the main findings for the third quarter of 2022 compared to the third quarter of 2021 (these figures exclude refinancings):

- The number of credit applications (excluding those for refinancing) decreased by approximately 13.5% in the third quarter of 2022 compared to the third quarter of 2021. The amount of credit applications also decreased by about 10% compared to 2021. Therefore, slightly more than 75,000 credit applications were submitted for a total amount of 13.5 billion EUR.

- The granted mortgage loans decreased in number by nearly 11% in the third quarter of 2022 compared to the third quarter of the previous year. The corresponding amount also decreased by about 4.5% compared to 2021. In total, slightly more than 61,000 loans were granted for a total amount of 10.5 billion EUR (excluding refinancings).

- The number of loans for other purposes (garage, building land...) saw the sharpest decline compared to the third quarter of 2021 (-1,320, or -30.2%), along with the number of loans for home renovation (-3,664, or -24.5%). The decrease in the number of loans for home purchase remained relatively limited, at -4.2%, or 1,532 loans less than in the third quarter of 2021. This also applies to the decrease in the number of loans for home construction (-723, or -7.4%) and for loans for home purchase with renovation (-82, or -2.7%).

- The number of external refinancings (-5,461, or -53.8%) experienced a spectacular decline in the third quarter of 2022, which is not surprising in a rising interest rate climate. Nevertheless, in the third quarter of 2022, almost 4,700 external refinancings were still granted, totaling more than 630 million EUR.

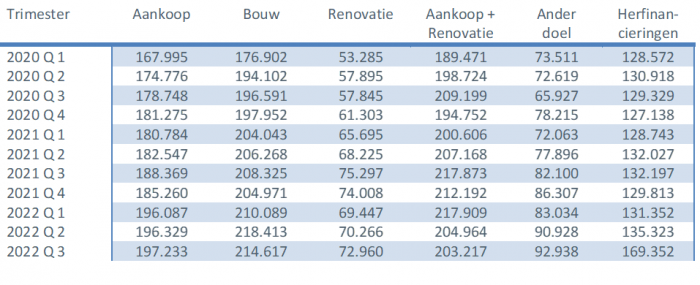

- The average borrowed amount for the purchase of a home remained approximately stable at around 197,000 EUR in the third quarter of 2022. The average amount for a construction loan decreased slightly to 215,000 EUR in the third quarter of 2022. However, this is still an increase of more than 46,000 EUR (or more than 27%) since the beginning of 2019. The average amount of loans for purchase + renovation decreased slightly to around 203,000 EUR.

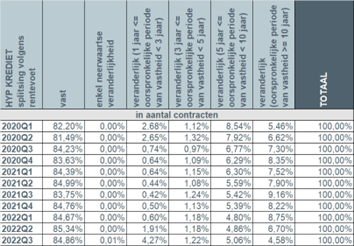

- In the third quarter of 2022, once again, nearly 9 out of 10 borrowers (89.5%) opted for a fixed interest rate or a variable interest rate with an initial fixed interest period of at least 10 years. In just over 4% of cases, borrowers opted for a loan with an annually variable interest rate.

I. Number of Credit Applications

The number of credit applications, excluding those related to external refinancing, decreased by almost 13.5% during the third quarter of 2022 compared to the same quarter of the previous year. The underlying amount of credit applications also decreased by almost 10%.

The number of credit applications decreased for all purposes. Credit applications for home purchases (-2,982) decreased by 6%, those for home purchase + renovation (-990) by 18.5%. The number of credit applications for home renovation (-3,462, or -22.4%), as well as credit applications for other purposes (garage, building land...) saw a significant decrease (-1,872, or -34.6%), along with the number of credit applications for home construction (-2,246, or -20%). The number of external refinancing applications also saw a spectacular decrease of -64%, which is not surprising in the current rising interest rate climate.

II. Number of loans granted in the third quarter

In the third quarter of 2022, the number of loans granted, excluding external refinancings, decreased by almost 11% compared to the third quarter of 2021. The corresponding amount also decreased by just over 4.5%.

Despite this decrease, credit provision remains steady.

III. Decrease regardless of loan purpose

In the third quarter of 2022, just over 61,000 new loans were granted for a total amount of just over 10.5 billion EUR, excluding external refinancings.

Overall, there was a decrease in the number of loans granted by almost 11% compared to the third quarter of 2021, and this decrease was noticeable for all purposes.

The number of loans for home purchases (-1,532, or -4.2%) saw a relatively modest decrease compared to the third quarter of 2021. The number of loans for home purchase with renovation (-82) decreased by -2.7%, while the number of construction loans (-723) experienced a decrease of -7.4%. On the other hand, the number of loans for other purposes (-1,320) saw a stronger decrease of -30.2%, as did the number of loans for home renovation, which decreased by -24.6% or 3,664 loans less than in the third quarter of 2021.

In addition, in the third quarter of 2022, the number of external refinancings decreased by 53.8%. Nevertheless, almost 4,700 external refinancings were still granted, totaling about 630 million EUR.

IV. Average loan amount remains fairly stable in the third quarter

The average loan amount for home construction saw a slight decrease and settled at 215,000 EUR in the third quarter of 2022. Nevertheless, this still represents an increase of about 46,000 EUR (or 27.3%) since the beginning of 2019.

The average loan amount for home purchase remained stable at around 197,000 EUR in the third quarter of 2022. However, this is still an increase of about 38,000 EUR (or 23.7%) in just under four years.

The average loan amount for home purchase + renovation decreased slightly to around 203,000 EUR in the third quarter.

V. 9 out of 10 Borrowers Opt for a Fixed Interest Rate

In the third quarter of 2022, approximately 9 out of 10 borrowers (89.5%) once again opted for a fixed interest rate or a variable interest rate with an initial fixed interest period of at least 10 years. About 6% of borrowers opted for a variable interest rate with an initial fixed interest period between 3 and 10 years. Just over 4% of borrowers chose an annually variable interest rate.

Considering the rising interest rates (see chart below), Belgian consumers continue to overwhelmingly choose certainty. The number of people opting for a variable interest rate remains low. However, even in the case of a variable interest rate, consumers are strongly protected by legislation. After adjustment to the evolution of applicable reference indices, the variable interest rate can never exceed double the initial interest rate.

Responsible mortgage lending remains the guiding principle

The credit sector is and remains aware that mortgage lending must be done with great care, and responsible lending must remain the absolute guiding principle. On this point, the sector is in line with the regulator: lenders must exercise the necessary caution to avoid that individual borrowers take on excessively large loans on the one hand and to preserve financial stability in the long term on the other hand.

The complete statistics on mortgage credit (2000 - 2022Q3), broken down by loan purpose and interest rate type, are available on the BVK website under the "Press & Figures" section.