Evolution of mortgage credit in February 2022

6 April 2022 - 3 min Reading time

The number of credit applications decreased by approximately 9% in February 2022 compared to February 2021. The corresponding total amount of these applications was 4.3% lower. In February 2022, the number of granted loans remained relatively stable (-0.5%). However, the loan amount increased by nearly 9% compared to February 2021.

These findings are based on the mortgage-credit barometer data from the Professional Association of Credit (BVK).

To track the evolution of mortgage credit more quickly, the Professional Association of Credit (BVK) has been compiling a mortgage credit barometer since the beginning of 2009. This barometer reports each month the changes in the number and volume of newly granted and requested mortgage credits from the previous month, compared to the same month of the previous year. The percentages mentioned relate to virtually the entirety of the BVK mortgage credit market. The underlying absolute figures are released on a quarterly basis through a press release by Febelfin.

Credit Applications

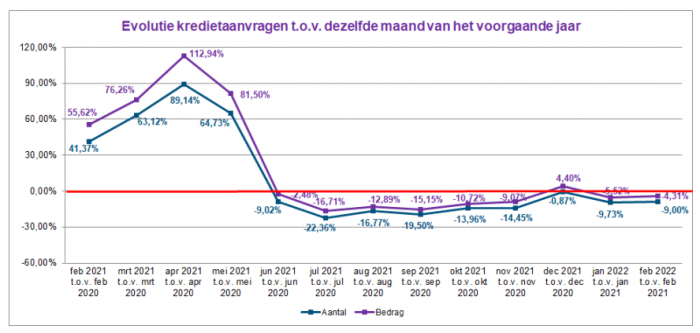

The following graph illustrates the evolution of credit applications, both in terms of amount and number, for the past twelve months. The monthly figures are compared to those of the same month in the previous year.

In February 2022, the number of applications for a mortgage loan decreased by approximately 9% compared to February 2021. The loan amount also saw a decrease of slightly more than 4% compared to the previous year.

The decline in the number of credit applications was observed in nearly all categories: loans for home purchases (-1.5%), home renovation loans (-8%), and purchases with renovation (-22.5%). The number of applications for external refinancing (-32.5%) also experienced a decline. The only category that saw an increase was the number of credit applications for home construction (+4.5%).

Granted mortgage loans

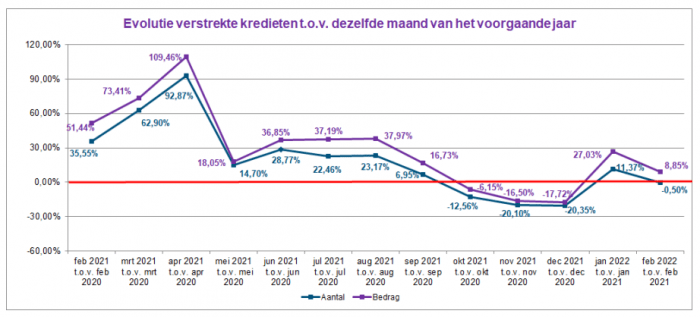

The following graph illustrates the evolution of granted mortgage loans, both in terms of number and amount, for the past twelve months. The monthly figures are compared to those of the same month in the previous year.

In February 2022, the number of granted mortgage loan agreements remained approximately stable compared to February 2021 (-0.5%). However, the corresponding loan amount increased by almost 9%.

The increase in the number of granted loans was observed in various categories: loans for home purchases (+10%), loans for home construction (+3%), and loans for purchases with renovation (+6%). The number of granted loans for home renovation (-4.5%) experienced a decrease, as did the number of external refinancing loans (-22%).