Evolution of mortgage credit in February 2021

6 April 2021 - 3 min Reading time

The number of credit applications increased by just over 41% in February 2021 compared to February 2020. The total amount of these applications was nearly 56% higher.

In February 2021, the number of granted credits increased by about 35.5%. In terms of the amount, almost 52.5% more credit was granted than in February 2020.

However, it should be noted that the February 2020 figures were relatively low due to the abolition of the Flemish housing bonus on January 1, 2020, and the fact that many consumers had finalized their loans before the end of 2019. This is evident from the figures from the Mortgage Credit Barometer of the Professional Association of Credit (BVK).

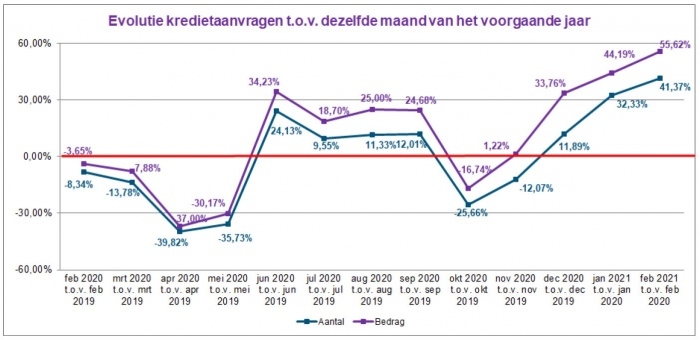

Loan applications

The following graph illustrates the evolution of loan applications, in terms of both amount and number, for the past twelve months. The monthly figures are compared to those of the same month in the previous year.

In February 2021, the number of applications for a mortgage loan increased by just over 41% compared to February 2020. In terms of amount, there was even an increase of almost 56% compared to the previous year.

The increase in the number of credit applications occurred in all areas: loans for the purchase of a home (+31%), for the construction of a home (+68%), and for home renovations (+42%). There was also an increase in the number of applications for loans for purchases with renovations (+54%) as well as external refinancing applications (+47%).

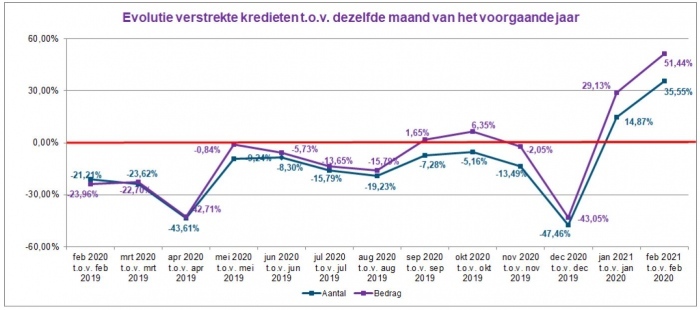

Granted mortgage loans

The following graph illustrates the evolution of granted mortgage loans, in terms of both number and amount, for the past twelve months. The monthly figures are compared to those of the same month in the previous year.

In February 2021, the number of granted mortgage loan agreements was approximately 35.5% higher than in February 2020. The corresponding loan amount also increased by just over 51%.

The increase in the number of granted credits occurred in almost all areas: loans for the purchase of a home (+40%), for the construction of a home (+50.5%), for home renovations (+22%), and for purchases with renovations (+27%). There was also an increase in external refinancing (+34%).