Engage in dialogue with your bank for a tailored solution on time

28 January 2021 - 7 min Reading time

Corona monitor: the latest developments in pictures

Banks continue to make every effort to support all consumers, businesses, and self-employed individuals facing financial pressure due to the coronavirus crisis. The banks commit to guiding all healthy, viable businesses with future prospects through this crisis.

- With an eye on the future, Febelfin encourages anyone facing potential payment issues to contact their bank in a timely manner. Initiate a conversation with your bank about possible individual, customized solutions. Don't wait until the payment deferrals expire. Together, you can explore a structural solution for your specific situation to navigate this challenging period as effectively as possible.

- Various options are available to offer specific, tailored solutions to businesses and self-employed individuals. Your bank is willing to discuss these options with you. Both businesses and individuals are making less use of general payment deferrals.

- As of January 17, 2021, the total number of outstanding payment deferrals for business loans was 26,161, with an underlying outstanding amount of 5.2 billion euros. For home loans, the total outstanding number was 12,467, with an underlying amount of 1.4 billion euros.

- Banks continue to play their societal role and are not sparing in providing new loans to businesses; the number of new loan approvals in December is in line with previous years.

- Digital payments continue to be the preferred method for Belgians. More than 40% of all card payments are contactless.

Seeking Individual Tailored Solutions Together: "Talk to Your Banker"

Banks continue to make every effort to support all consumers, businesses, and self-employed individuals facing financial pressure due to the coronavirus crisis.

With a focus on the future and the desire to guide as many businesses as possible through this crisis, we encourage companies to contact their bank in a timely manner, even before payment deferrals come to an end. Viable companies experiencing liquidity problems due to COVID-19 measures benefit from a structural solution tailored to their individual financial situation. A constructive discussion with the bank about a specific company's situation can provide a way out. It is important not to delay this conversation to prevent potential risks from accumulating. Febelfin specifically urges businesses to engage in this dialogue with their bank sooner rather than later.

There are various options to bridge this challenging period. Further payment deferrals on a bilateral basis and in specific cases remain an option, but the bank can also extend the duration of a loan to ease the periodic repayment burden or consider a subordinated loan. Additional loans, with or without state guarantees or regional guarantees, are also possibilities. Strengthening solvency through subordinated loans or additional equity is an option as well. A mixed formula can also be considered.

The best way to rescue a particular business from financial difficulties will be determined through bilateral discussions with the bank. The bank will approach this constructively to guide viable businesses through the crisis because bankruptcy benefits no one, including the bank.

Banks always strive to strike the right balance: on one hand, making every effort to support as many businesses and households as possible during this challenging crisis, and on the other hand, fulfilling their legal obligation of responsible lending and their societal duty to ensure that savers' money is not lost.

The banking sector is aware of its societal responsibility and will always seek a responsible solution in the interest of all parties. Banks commit to guiding all healthy, viable businesses with future prospects through this crisis. Banks are ready to help wherever possibl

Use of General Payment Deferrals for Loans Declining

The importance of an individual, tailored solution is evident from the latest figures in our corona monitor.

We observe that both businesses and individuals are making less use of the option to obtain a general payment deferral. As of January 17, 2021, the total number of payment deferrals for business loans was 26,161, with an underlying outstanding amount of 5.2 billion euros. For comparison, in September, the total number was 141,000, with an underlying amount of 24.3 billion euros.

The reduced use of the option to request general payment deferrals can be explained by the less strict general measures compared to the initial lockdown (most stores open, less temporary unemployment, etc.) and the determination by the European Banking Authority that payment deferrals may not be granted for more than 9 months. Some businesses and individuals have already reached the almost-automatic maximum.

Credit provision remains steady

The production figures for new credits to SMEs (Small and Medium-sized Enterprises) and large companies indicate that banks continue to fulfill their societal role by providing ample credit to businesses. Credit provision in December follows the same trend as in previous years: banks granted 40,827 new credits to SMEs and self-employed individuals, with an underlying amount of 2.74 billion euros. For large enterprises, the total amount of new credits reached 2.84 billion euros, totaling 3,133 credits.

Digital payments preferred

Furthermore, we continue to observe the impact of the coronavirus crisis on payment methods. Paying with a card or smartphone is a very safe and hygienic way to make purchases, especially when done contactlessly. Belgians have adapted their payment behavior accordingly and appear to be maintaining this new digital habit.

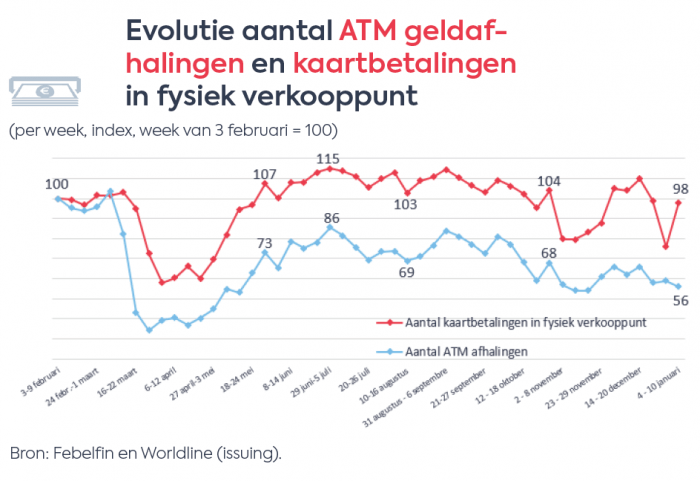

The graph below suggests that Belgians still use cards more frequently than cash for payments today.

It's not surprising that contactless payment remains important. Out of all card payments, more than 40% are contactless.

Febelfin welcomes this development and continues to urge everyone to prioritize digital payments as much as possible. It remains the most responsible way to pay during a crisis like the one we are experiencing today.

These figures are also reflected in the coronamonitor.

To guide businesses and individuals in finding tailored solutions, Febelfin has created the leaflets "Talk to your banker before it's too late."