During the corona crisis, entrepreneurs are fully utilizing their open lines of credit

5 June 2020 - 7 min Reading time

The record credit balance shows that the financial sector continues to support the economy.

The total outstanding credits used by businesses have never been as high as in recent months. In March 2020, it increased to reach 167.6 billion euros. Companies are thus using their existing lines of credit more than ever.

- It is clear that the coronavirus crisis has severely shaken business confidence. Due to the current economic uncertainties, companies are investing less. This is reflected in the number of new credits requested by entrepreneurs in the first three months of this year. Compared to the same period last year, requests have indeed dropped by 10.5%.

- As supply and demand go hand in hand, we see a similar trend in credit production. The number of new credits granted has decreased by 10.1%.

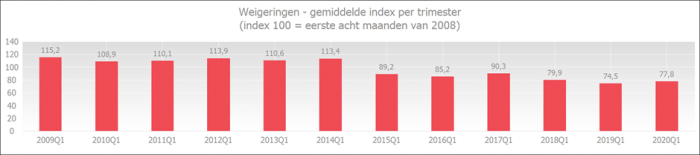

- However, the high balance, as well as the widespread payment deferrals, indicates that the financial sector continues to support the economy, particularly in these difficult times. The refusal rate also reflects this willingness. Since the beginning of the measurements in 2009, it has reached its second-lowest level for this first quarter of 2020.

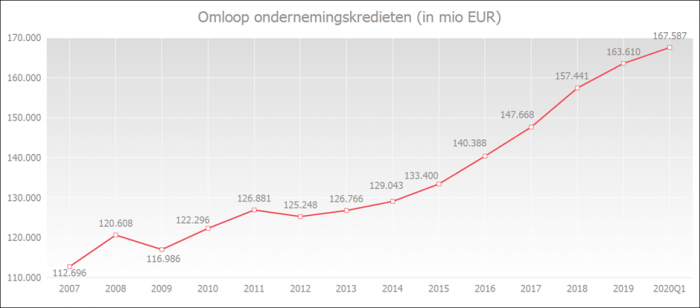

Outstanding credit to businesses remains high

In March 2020, the outstanding credits used by businesses (including commitment credits, such as guarantee credits and documentary credits) reached a record level of 167.6 billion euros.

On an annual basis (comparison between March 2019 and March 2020), the balance increased by 5.1%. In December 2019, the annual growth was 3.9%.

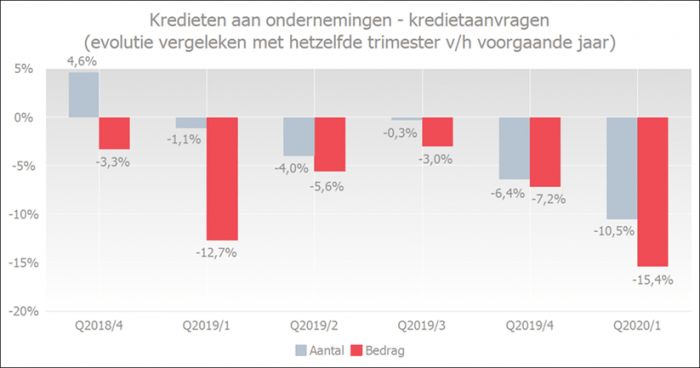

The deterioration of entrepreneurs' confidence led to a drop in the demand for new credits

In the first quarter of 2020, credit demand by entrepreneurs contracted by 10.5% compared to the same period in the previous year. In terms of amount, the decline was even greater, at 15.4%.

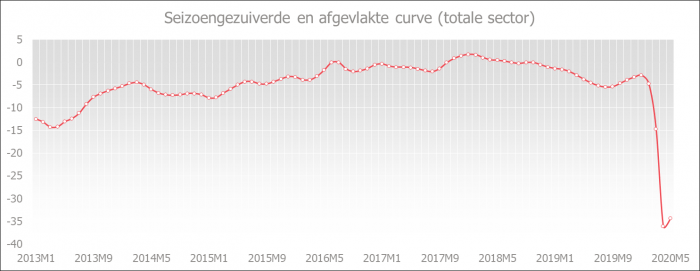

The decreased credit demand is linked to entrepreneurial confidence: the Business Climate Barometer of the National Bank of Belgium (NBB) shows that the acute Covid-19 crisis significantly lowered entrepreneurial confidence in March and April 2020. Due to the economically uncertain period, businesses are investing less, and as a result, they are requesting fewer credits.

The seasonally adjusted and smoothed curve below represents the underlying economic trend. A decline in the curve indicates a weakening of entrepreneurial confidence.

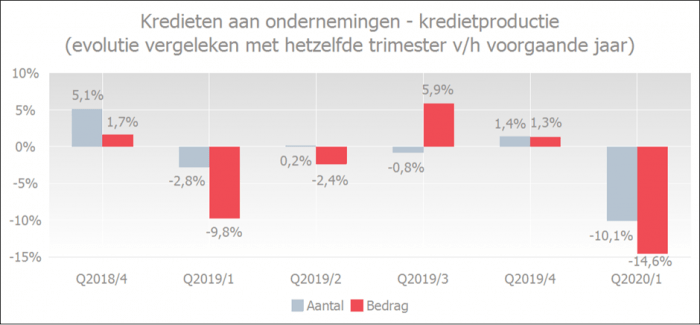

Credit production follows the decline in credit demand

The number of credits granted in the first quarter of 2020 decreased by 10.1% compared to the same quarter of the previous year. The amounts granted decreased by 14.6%.

Several factors can explain why the decrease in credit production in the first quarter of 2020 is accompanied by an increase in outstanding credits:

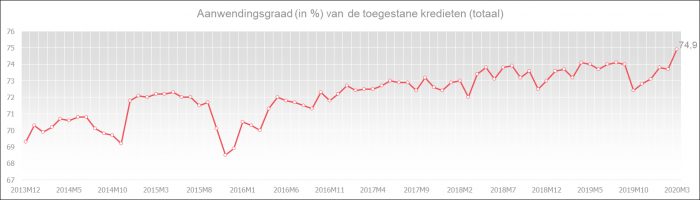

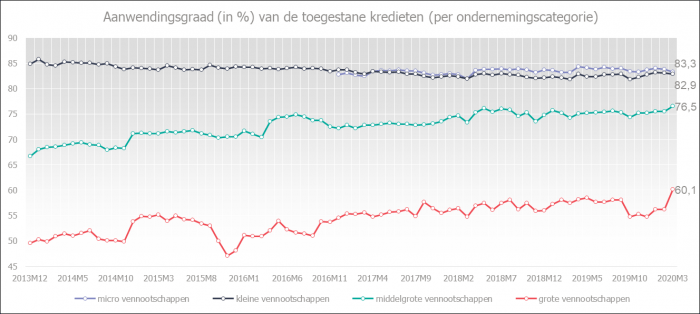

- Compared to previous quarters and years, the utilization rate of credits granted to non-financial corporations reached a record level in the first quarter of 2020. In other words, companies made intensive use of their existing lines of credit in the first quarter of 2020.

The increase in utilization rates was mainly observed among large companies.

- The base effect observed in credit production is mitigating only when considering the total outstanding credits (previously granted credits have a buffering effect on the total balance).).

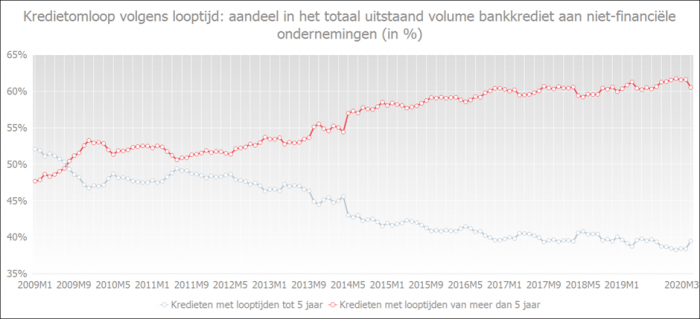

- The chart below shows that the share of long-term credits to non-financial corporations in the total is steadily increasing. Given the increased share of long-term credits, there is less "rotation" in the volume of credits, and there can also be an increase in the total outstanding credits in case of more moderate credit production.

Credit constraints experienced by entrepreneurs

The degree of refusal for the first quarter of 2020 is, compared to all first quarters, at its second-lowest level since the beginning of measurements in 2009.

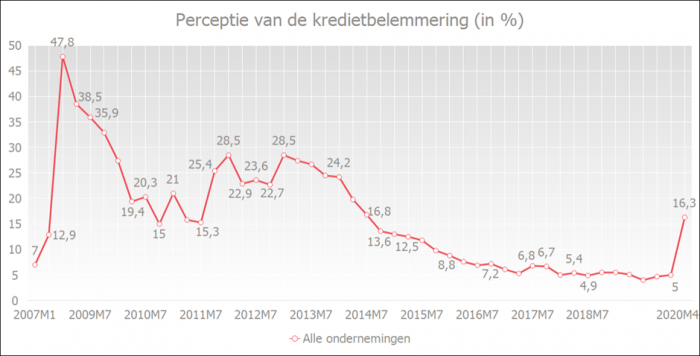

The quarterly survey conducted by the NBB shows that businesses' perception of credit constraints (i.e., how businesses perceive credit conditions, including interest rates, other banking costs, credit volume, and required guarantees) has increased. This percentage increased from 5% in January 2020 to 16.3% in April 2020, but it remains well below the levels observed during the 2008-2009 banking crisis, where it reached a peak of nearly 50%.

The perception of tightening credit conditions occurred in all categories of business size but has increased the most among very large enterprises (with more than 500 employees).

This means that the increase in credit constraint perceived by entrepreneurs does not necessarily mean that more loans are being denied.

It is more about how businesses perceive the credit conditions, especially the interest rates, other bank charges, the credit volume, and the requested collateral.

A decrease in the chart below reflects the gradual improvement in the perception of credit constraints. The lower the curve, the fewer credit constraints entrepreneurs believe they are experiencing.

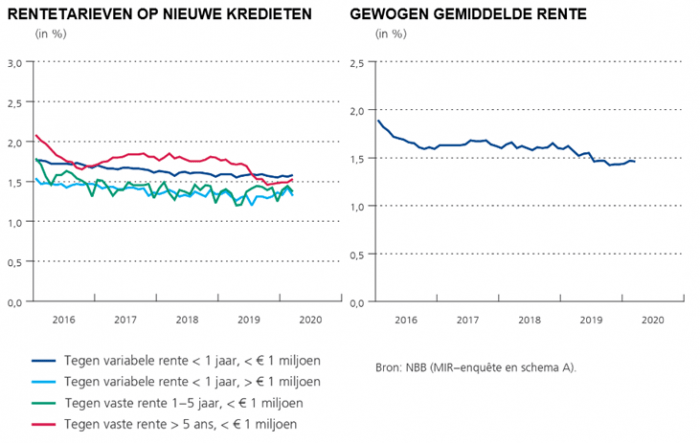

The interest rates remain favorable for business borrowers

The weighted average interest rate on new business loans remained low. According to data from the NBB, the weighted average interest rate on new business loans decreased very slightly in March 2020 to 1.46% (compared to 1.47% in February 2020