Credit volume remains steady despite a decrease in credit demand

7 June 2021 - 6 min Reading time

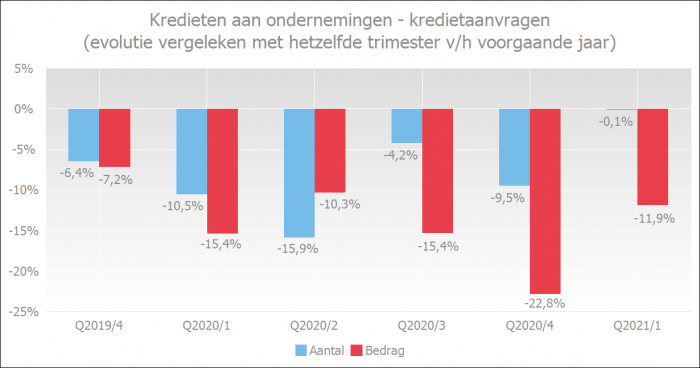

In the first quarter of 2021, there were fewer business loan applications compared to the same period in 2020. This decline was also visible in the production of new loans.

- Due to the option offered to businesses impacted by the COVID-19 crisis to postpone loan repayments and considering the support they receive from governments, businesses have less need for new loans or only require them for a limited amount. Since the rollout of the vaccination campaign and the resumption of economic activity in certain sectors, we have observed a strong increase in business confidence again, suggesting that the demand for investment loans may increase in the coming months.

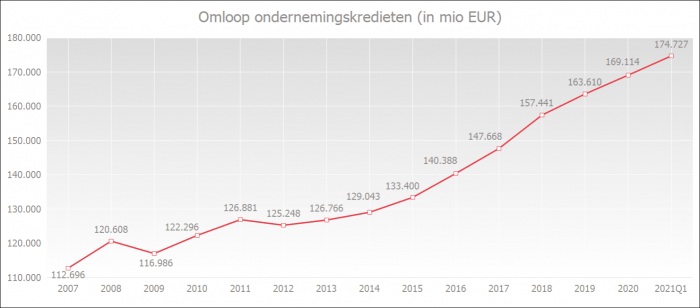

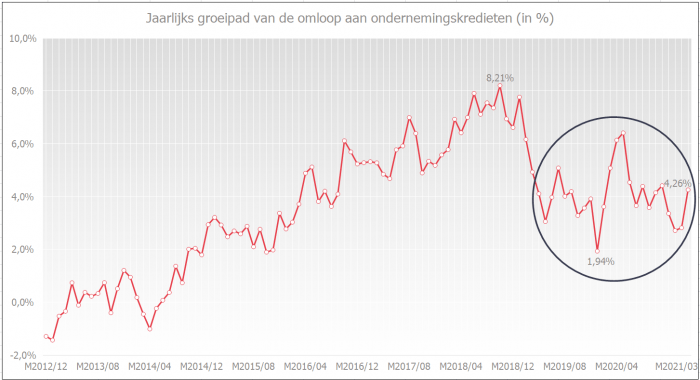

- However, the outstanding volume of business loans at the end of March 2021 was still 4.3% higher than a year earlier, reaching a record high of 174.7 billion euros. The payment deferrals have slowed down the repayment of outstanding loans.

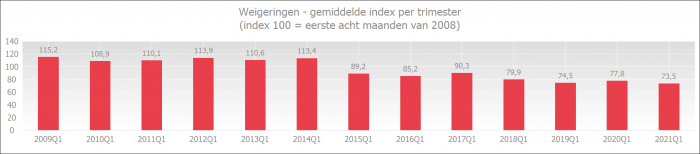

- The loan rejection rate is at its lowest level ever compared to the rejection rate for all first quarters since the start of measurements. Banks continue to provide credit smoothly despite the challenging health and economic situation, which undoubtedly has a negative impact on the quality of many loan applications.

Outstanding business loan amount at a record level

By the end of March 2021, the outstanding amount of business loans taken out (including commitment loans, such as guarantee loans and documentary credits) reached a new high of 174.7 billion euros, up from 169.1 billion euros at the end of December 2020.

On an annual basis (comparison between March 2020 and March 2021), the outstanding amount increased by 4.3%. In 2020, the annual growth rate was 3.4%.

By the end of March 2021, the outstanding amount of business loans taken out (including commitment loans, such as guarantee loans and documentary credits) reached a new high of 174.7 billion euros, up from 169.1 billion euros at the end of December 2020.

On an annual basis (comparison between March 2020 and March 2021), the outstanding amount increased by 4.3%. In 2020, the annual growth rate was 3.4%.

Businesses requesting fewer loans

In the first quarter of 2021, entrepreneurs applied for 0.1% fewer loans than in the same period last year, marking the ninth consecutive decline. In terms of amount, the decrease was greater, namely 11.9%, making it the tenth consecutive decrease.

Due to the option offered to businesses impacted by the COVID-19 crisis to postpone loan repayments and considering the support they receive from governments, these businesses have less need for new loans or only require them for a limited amount.

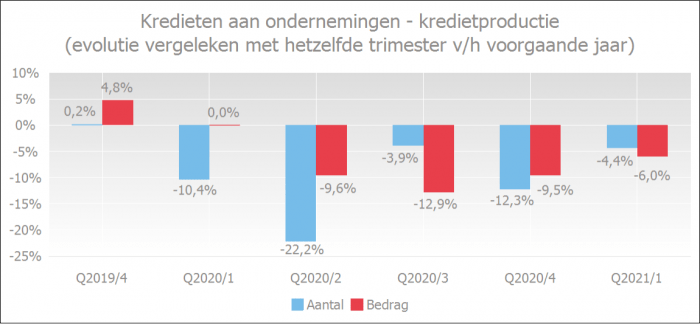

Loan production follows demand

The number of granted loans decreased by 4.4% in the first quarter of 2021 compared to the same quarter last year. The granted amounts were 6.0% lower than in the same quarter of the previous year.

Entrepreneurs continue to experience few credit hurdles

The rejection rate is at the lowest level ever compared to the rejection rate for all first quarters since the start of measurements. Given the challenging health and economic situation that undoubtedly has a negative impact on the quality of many loan applications, it is remarkable that the rejection rate is so low.

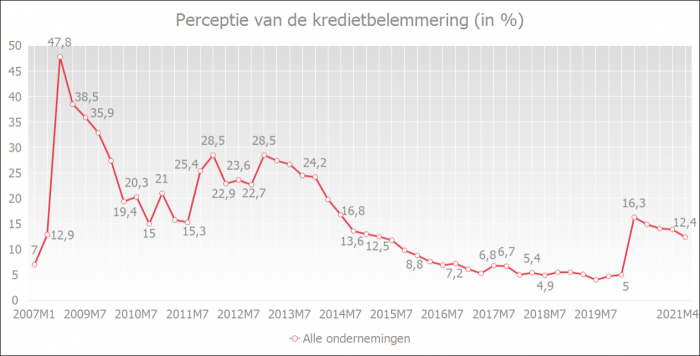

The quarterly survey by the National Bank of Belgium (NBB) shows that the perception of credit constraints by businesses has decreased in the past year. The percentage decreased from 16.3% in April 2020 to 12.4% in April 2021.

Small, medium-sized, large, and very large enterprises all found that credit conditions had evolved favorably in April 2021.

A decrease in the graph below reflects the gradual improvement in the perception of credit constraints. The lower the curve, the fewer credit constraints entrepreneurs believe they are experiencing.

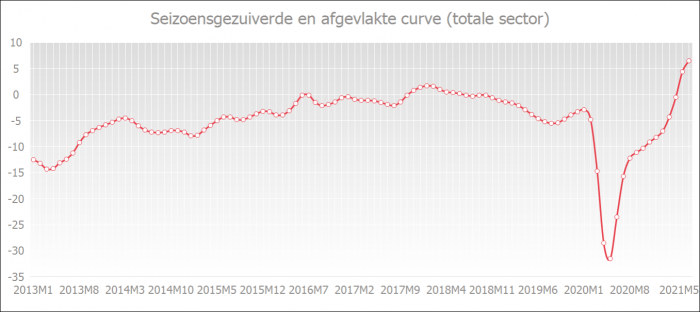

Business Confidence Is Rising

After a significant drop in business confidence at the beginning of the pandemic, we have seen a constant increase in recent months. In May 2021, business confidence reached its highest level in years. This suggests that the demand for investment loans in the coming months will (strongly) increase.

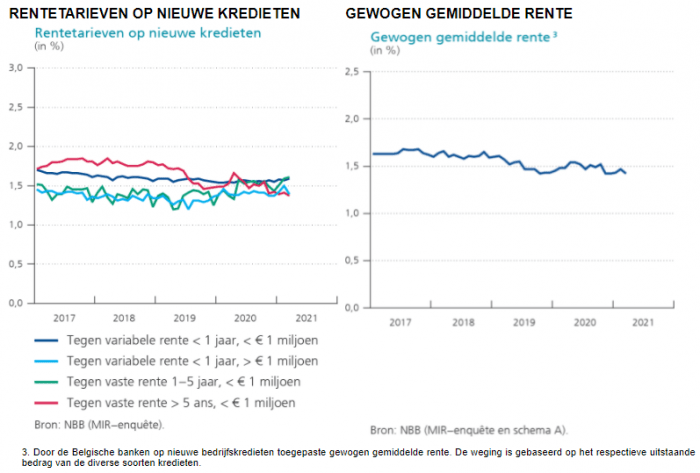

Favourable interest rates

According to data from the NBB, the weighted average interest rate on new business loans in March 2021 was at a very low level, namely 1.42% (compared to 1.47% in February 2021). Since April 2019, the weighted average interest rate has been around 1.5%.