Credit volume remains stable despite decreasing credit demand

2 March 2021 - 5 min Reading time

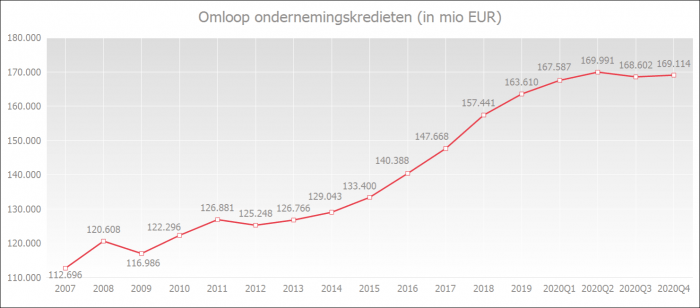

Outstanding amount of corporate loans shows slight increase

By the end of December 2020, the outstanding amount of corporate loans (including commitment loans such as guarantee loans and documentary credits) increased to a level of 169.1 billion euros, up from 168.6 billion euros at the end of September 2020 (+0.3%).

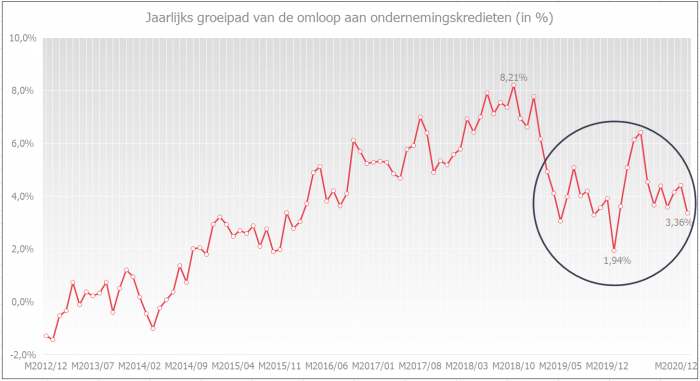

On an annual basis (comparison of December 2019 to December 2020), the outstanding amount increased by 3.4%. In 2019, the annual growth rate was 3.9%.

The graph below illustrates the year-on-year evolution in 2019, which experienced a slowdown. After a brief positive surge in early 2020, mainly driven by large enterprises drawing on their credit lines to ensure sufficient cash in this uncertain situation, the annual growth rate from June to December 2020 decreased once again.

Corporate loan applications

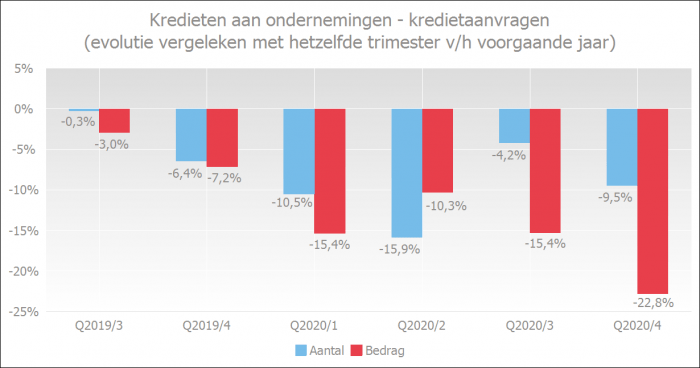

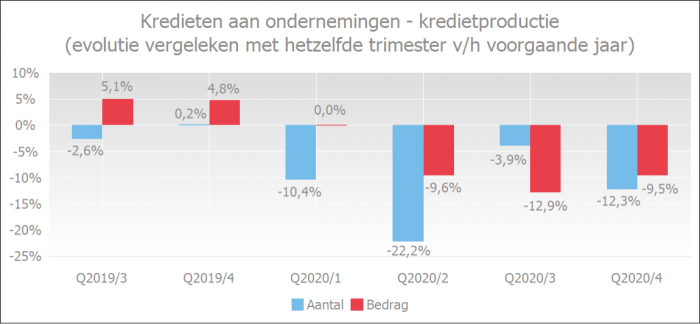

In the fourth quarter of 2020, entrepreneurs requested 9.5% fewer loans than in the same period the previous year. This marks the eighth consecutive decline. In terms of amount, the decrease was more significant, at 22.8%, representing the ninth consecutive decline.

Due to the opportunity provided to businesses impacted by the COVID-19 crisis to defer the repayment of their loans and the support they receive from governments, these businesses have less need for new loans.

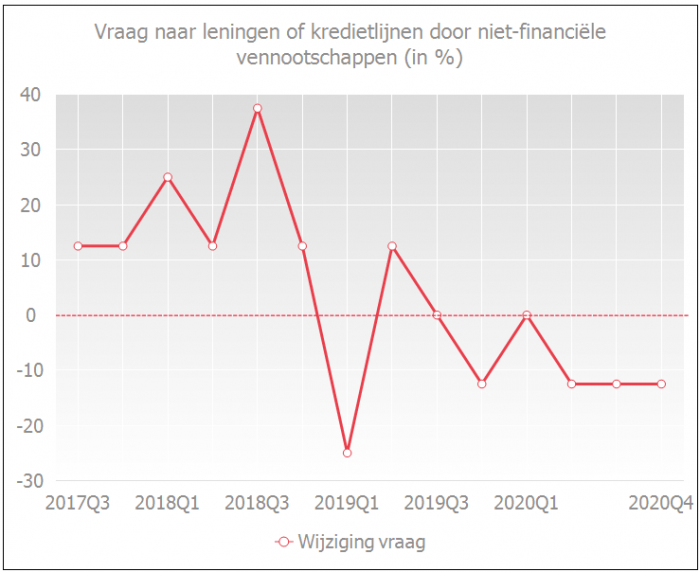

The Bank Lending Survey (BLS) conducted by the National Bank of Belgium (NBB) also indicated that there was less credit demand in the fourth quarter of 2020. There was particularly less demand from businesses for financing fixed investments, inventories, and working capital.

This is also reflected in the monthly ERMG (Enterprise Credit Demand) update by the NBB (editions of November 17, 2020, and February 16, 2021), where businesses reported that the COVID-19 crisis would have reduced investments by 25% in 2020, a 20% decrease in 2021, and a 12% decrease in 2022.

A positive (negative) percentage in the graph below corresponds to an increase (decrease) in credit demand. A zero percentage indicates stabilization

Credit production follows demand

The number of granted loans decreased by 12.3% in the fourth quarter of 2020 compared to the same quarter the previous year. The granted amounts were 9.5% lower than in the same quarter the previous year.

Entrepreneurs still experience few credit impediments

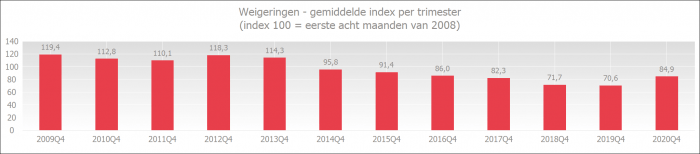

The rejection rate has slightly increased compared to the rejection rate in the fourth quarters of the three previous years but is still historically low. Given the challenging health and economic situation, which undoubtedly has a negative impact on the quality of many credit applications, it is noteworthy that the rejection rate has not risen further.

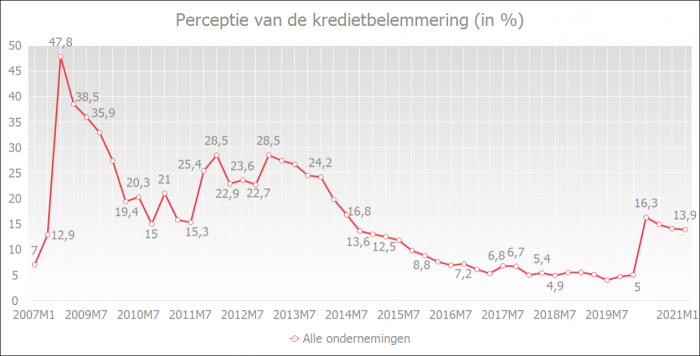

According to the quarterly survey by the National Bank of Belgium (NBB), the perception of credit impediment by businesses in January 2021 stands at 13.9%. This percentage increased from 5.0% in January 2020 to 16.3% in April 2020 and decreased to 13.9% in January 2021. Thus, the perception of credit impediment remains considerably lower than during the banking crisis of 2008-2009.

Only small businesses believed that credit conditions had evolved unfavorably in January 2021. The ERMG (Enterprise Credit Demand) study (edition of February 16, 2021) indicates that it is primarily small businesses (and self-employed individuals) that encounter difficulties in obtaining bank credit, especially when they belong to the most heavily affected industries.

A decrease in the graph below reflects the systematic improvement in the perception of credit impediments. The lower the curve, the fewer credit impediments entrepreneurs believe they experience.

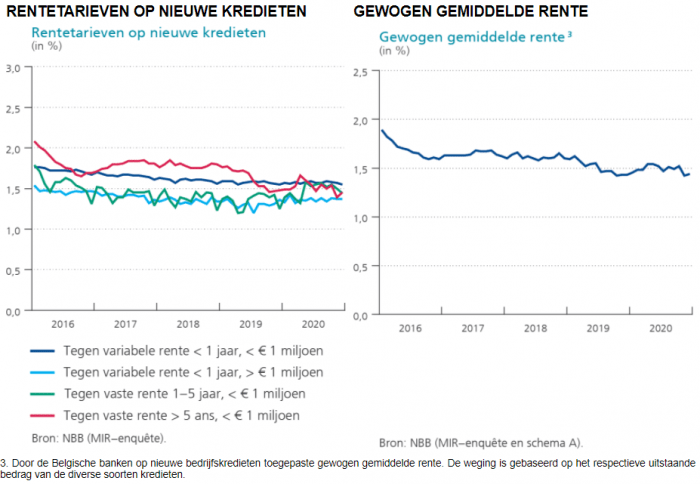

The interest rates remain favorable

According to data from the NBB, the weighted average interest rate on new business loans in December 2020 was at a very low level, namely 1.44% (compared to 1.42% in November 2020). Since April 2019, the weighted average interest rate has been hovering around 1.50%.