Credit turnover reaches a new high despite declining demand

18 December 2019 - 5 min Reading time

Companies continue to find bank financing easily for their projects

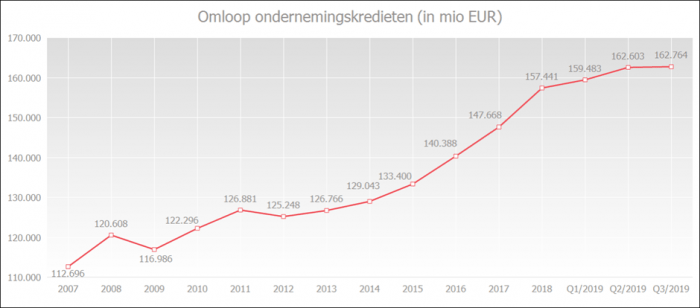

Never before has there been a higher amount of corporate loans outstanding at Belgian banks than today. According to the most recent figures, as of the end of September 2019, the total stood at 162.8 billion euros.

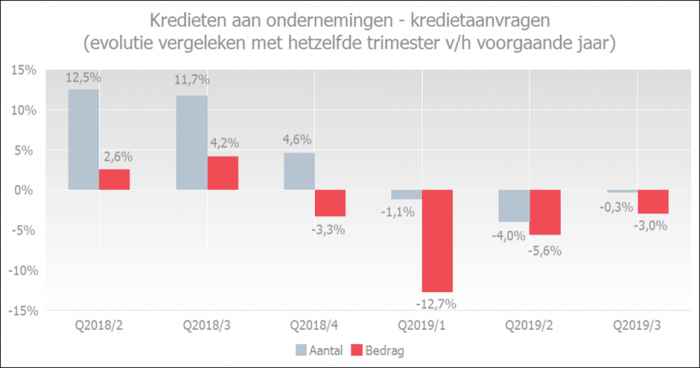

However, the growth is clearly slowing down. This is evident from the fact that in the third quarter of 2019, there were 0.3% fewer loan applications by entrepreneurs than in the same quarter of the previous year. The amount they requested is also declining, by 3%. It is mainly the historically low interest rates that are keeping the demand for loans steady. The need for financing for fixed investments seems to be decreasing, which is tempering the growth in loan demand.

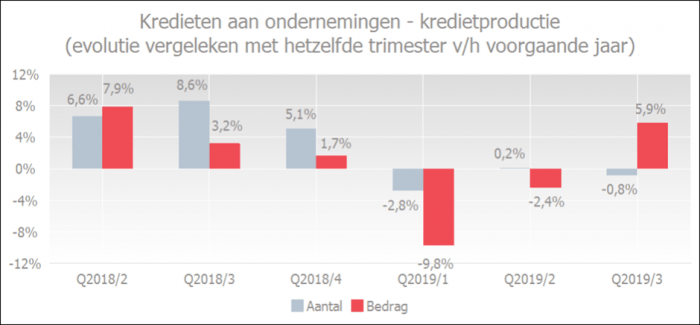

Due to the decreased demand, banks also granted fewer new loans: -0.8% in the third quarter of 2019 compared to the same quarter of the previous year. However, the granted amounts increased by 5.9%.

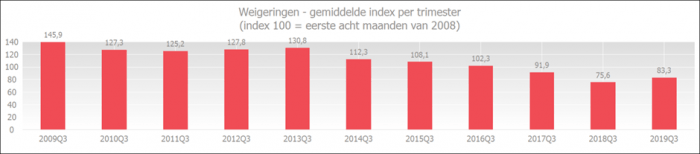

The rejection rate is still at a historically low level. In the third quarter of 2019, it was the second-lowest level of all third quarters since measurements began in 2009. This indicates that companies can still easily find bank financing for their projects.

Outstanding corporate loan amounts remain high

In September 2019, the outstanding amount of corporate loans (including commitment loans, such as guarantee loans and documentary credits) reached a record high of 162.8 billion euros.

On an annual basis (comparing September 2018 to September 2019), the outstanding amount increased by 4.2%.

Loan demand decreases

In the third quarter of 2019, entrepreneurs requested 0.3% fewer loans than in the same period the previous year. This marks the third consecutive decline. In terms of the amount requested, the decline was greater, at 3%, making it the fourth consecutive decline.

From the NBB's Bank Lending Survey (BLS), it was evident that decreasing financing needs for fixed investments were dampening loan demand, while favorable interest rates were boosting demand.

The number of loans granted decreased by 0.8% in the third quarter of 2019 compared to the same quarter the previous year. However, the granted amounts were 5.9% higher than in the same quarter of the previous year.

Entrepreneurs still experience few credit obstacles

The rejection rate remains at a low level. In the third quarter of 2019, the rejection rate was the second-lowest level of all third quarters since measurements began in 2009.

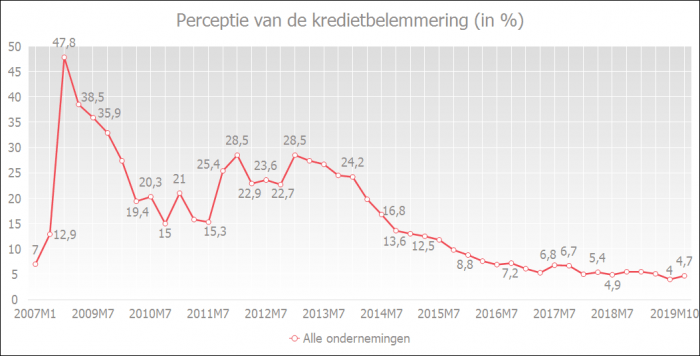

From the NBB's quarterly survey, it appears that businesses' perception of credit obstacles has slightly increased. In July 2019, 4% of companies considered the credit conditions unfavorable. In October 2019, that figure rose to 4.7%.

This puts the credit obstacles indicator at the second-lowest level since measurements began in 2003.

A decrease on the chart below reflects the gradual improvement in the perception of credit obstacles. The lower the curve, the fewer credit obstacles entrepreneurs believe they are experiencing.

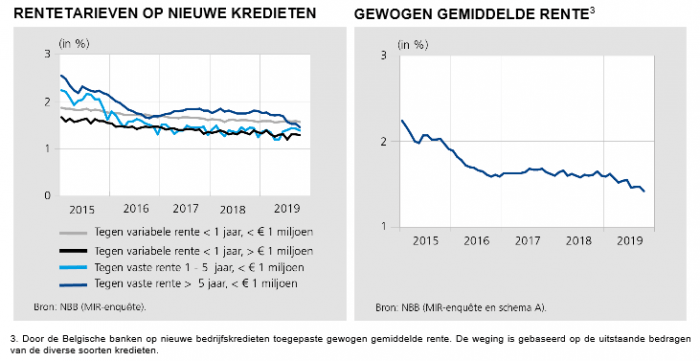

Interest rates remain favorable

According to data from the NBB, the weighted average interest rate on new corporate loans reached a new low of 1.42% in October 2019. The low interest rates continue to support the demand for loans.