Circulation of corporate loans reaches a new high despite declining demand

10 March 2020 - 5 min Reading time

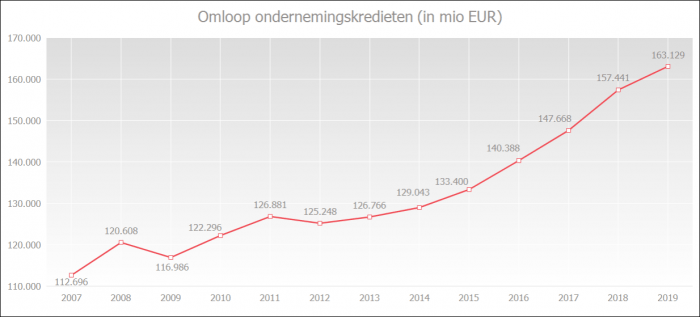

The outstanding volume of corporate loans reached a new high of 163.1 billion euros at the end of December 2019.

This new peak was achieved despite businesses applying for fewer loans in the fourth quarter of 2019 compared to the same quarter in the previous year. Despite the declining demand, banks provided more new loans in the fourth quarter of 2019.

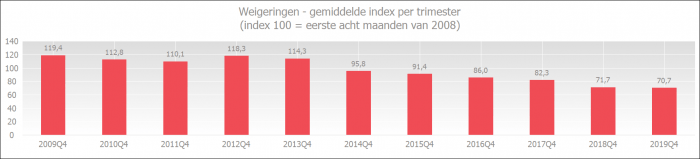

The rejection rate in the fourth quarter of 2019 was at its lowest level compared to all quarters since measurements began in 2009.

Outstanding corporate loan volume remains high

Outstanding corporate loan volume remains high, reaching a record high of 163.1 billion euros in December 2019 (including commitment lines, such as guarantee loans and documentary credits).

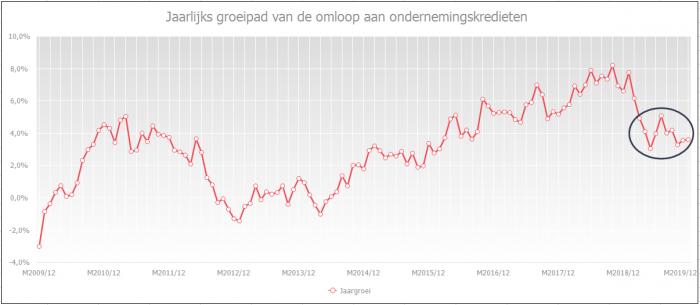

On an annual basis (comparison of December 2018 to December 2019), the outstanding volume increased by 3.6%. In September 2019, the annual growth was still 4.2%.

The graph below clearly shows that the year-on-year evolution in 2019 experienced a slowdown. Annual growth reached its provisional peak at 8.2% in October 2018.

Various uncertainties continue to weigh on credit demand

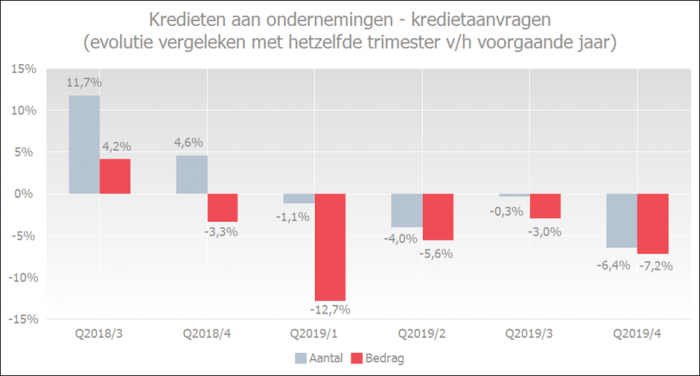

In the fourth quarter of 2019, entrepreneurs applied for 6.4% fewer loans than in the same period the previous year, marking the fourth consecutive decrease. In terms of amount, the decline was greater, at 7.2%, which is the fifth consecutive decrease.

The Bank Lending Survey (BLS), a quarterly survey by the NBB, also indicates a decrease in credit demand in the fourth quarter of 2019. The decreasing financing needs for fixed investments, mergers and acquisitions, and debt restructuring are dampening the demand for credit.

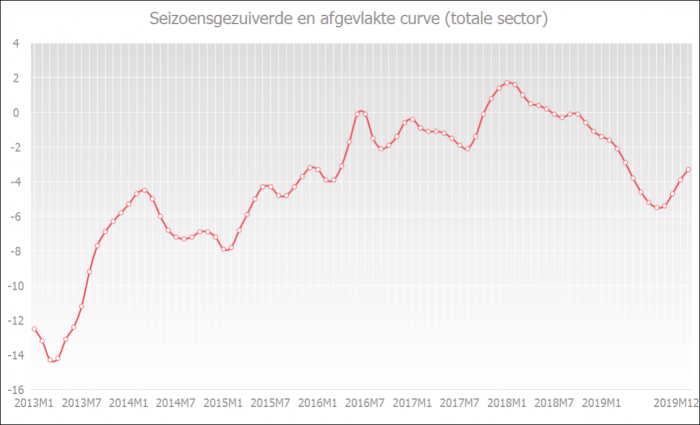

However, the Business Confidence Indicator of the NBB shows that business confidence has steadily increased since September 2019 until January 2020, followed by a slight decline in February. The seasonally adjusted and smoothed curve represents the underlying economic trend. An increase in the curve indicates an improvement in business confidence.

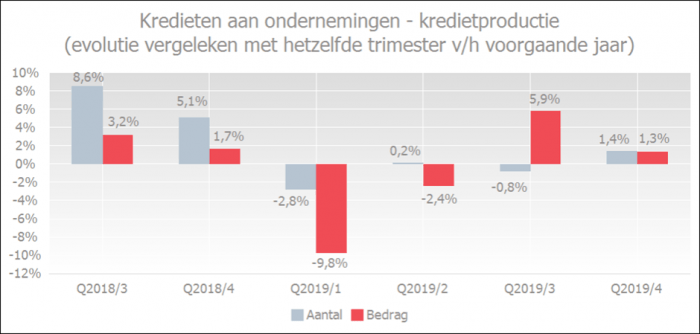

Slight increase in credit production

There was a slight increase in credit production in the fourth quarter of 2019, with a 1.4% increase compared to the same quarter the previous year. The granted amounts were 1.3% higher than in the same quarter the previous year.

Despite declining credit demand, banks have granted more new credit. Of course, the credit demand of companies and the granting of credit by banks do not always perfectly align, including a time lag. When the figures for the past four quarters of 2019 are cumulated and compared to those of 2018, both the number and amount of loans show a decrease, namely -0.5% and -1.8%.

Entrepreneurs still experience few credit obstacles

The rejection rate in the fourth quarter of 2019 has been the lowest level since measurements began in 2009.

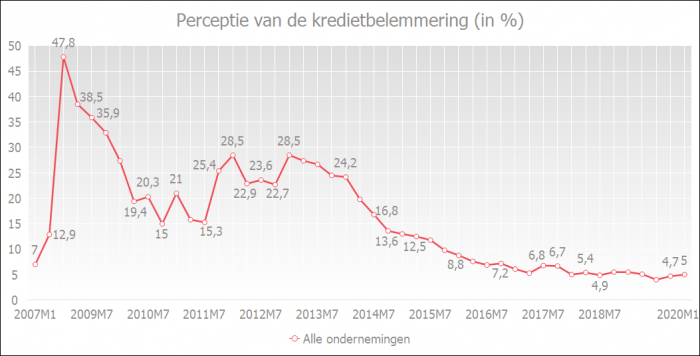

According to the National Bank of Belgium's quarterly survey, the perception of credit constraints by businesses has slightly increased but remains very low. In January 2020, 5.0% of businesses considered credit conditions as unfavorable. In October 2019, it was 4.7%, and in July 2019, it was 4.0%.

A decrease in the chart below represents the gradual improvement in the perception of credit constraints. The lower the curve, the fewer credit constraints entrepreneurs believe they are facing.

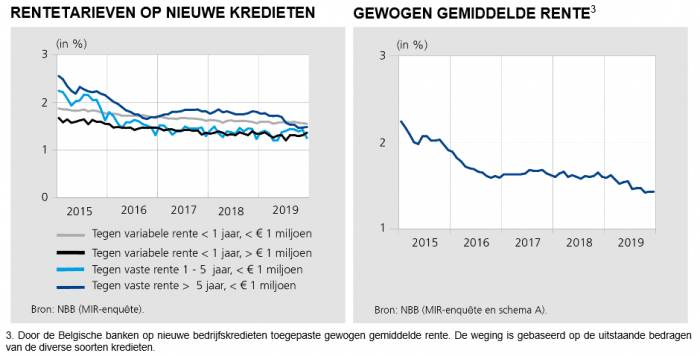

The interest rates remain favorable for business borrowers

According to data from the NBB, the weighted average interest rate on new business loans remained at the same level in December 2019 as in November 2019, namely a historically low 1.43%.