Car loans in 2023: the revival of the Belgian market for mobility financing

31 January 2024 - 4 min Reading time

The Professional Association of Credit (BVK/UPC) examined the credit landscape of the car market in 2023. In 2023, 15% more car loans were taken out compared to 2022, for a total amount of 22% higher than in the previous year. This marks the return the normality, after years of exceptional circumstances that affected the market dynamics.

Despite the absence of a traditional motor show this year, the start of the new year is still one of the most important moments for Belgians to consider buying a new or used car. It is therefore also the perfect time to look back at the credit landscape of the car market in 2023.

In 2023, an increase was seen in the number of credit agreements concluded for cars, with a total of 236,637 credits for an amount of EUR 4,555,261,000. Compared to 2022, this represents a significant increase of 15% in terms of the number of credits and 22% in terms of the total amount. Last year was consequently a year of solid growth in both new and used vehicle financing. Car loans currently represent one-third of the consumer installment loans.

Financing of new vehicles on the rise

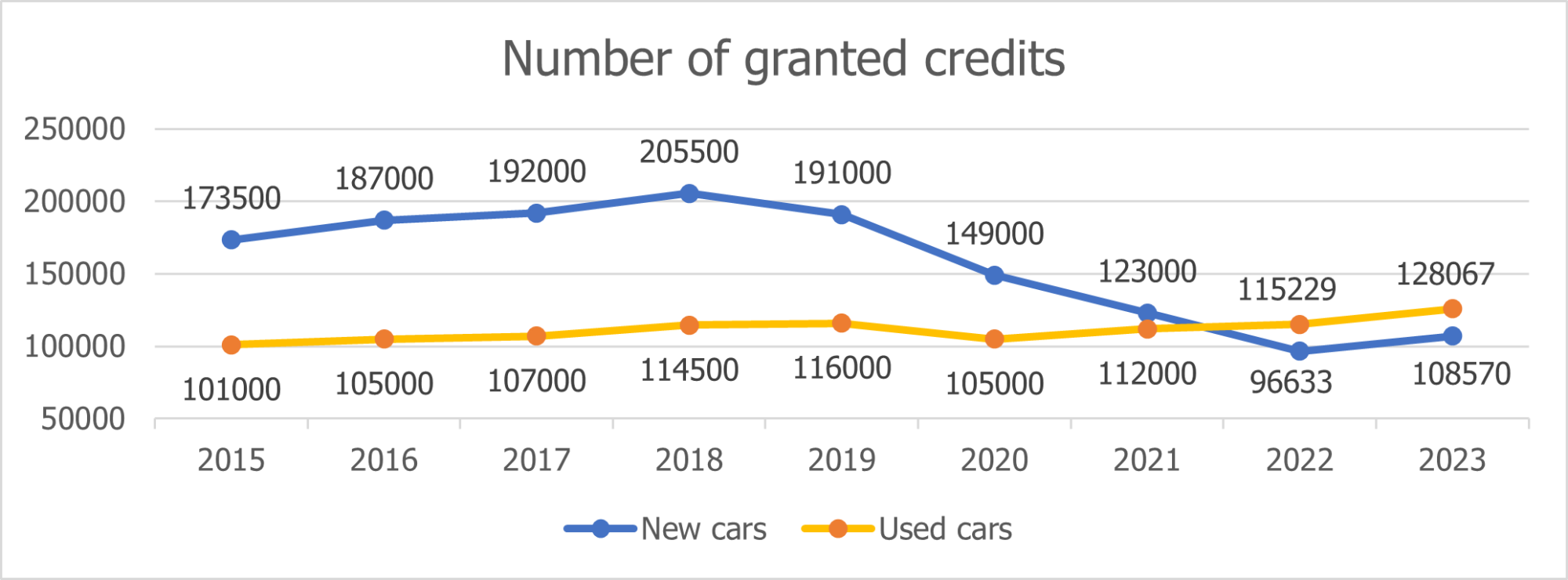

For the first time since 2018, the number of loans for new cars has increased, by 12.4% from 96,633 to 108,570 for a total value of EUR 2,426,039,000. This rise is an interesting indicator of a positive evolution of the market, as the momentum was shaken by the COVID pandemic, late deliveries and the many options for EV, hybrid or petrol cars over the past years. It is important to note that the number of credits for the purchase of new and used cars combined is still below 2020 levels.

Growing popularity of used cards

Another interesting indicator is the rise in loans granted for used cars (128,067) compared to new cars (108,570) for the second year in a row, although the amount borrowed for new cars (EUR 2,426,039,000) remains higher than the amount borrowed for used cars (EUR 2,129,222,000). Moreover, in many cases, this concerns cars less than five years old. Therefore, Belgium has a relatively young car market compared to other European countries.

"The 2023 figures demonstrate a revival of the car market in Belgium. After years of instability, we notice that the resilience of the sector indicates a future in which flexibility and sustainability become key factors in the decision-making of the consumer. With an increasing number of credits targeting sustainable offering, it comes as no surprise that electric and hybrid vehicles are becoming increasingly attractive for Belgians. Thus, consumer credits play an important role in the greening of our mobility.”

More figures about consumer credits in Belgium can be found on the website of BVK.

For more information

Visit UPC/BVK's campaign website: Home - Nederlands - Consumentenkrediet Voor Morgen (only in Dutch and French)

Read the UPC/BVK's annual report: https://www.upc-bvk.be/nl/press/annual-reports (only in Dutch and French)