Banks are fully playing their role in lending to businesses

9 February 2021 - 5 min Reading time

In response to today's reports on lending to businesses, we'd like to present some key facts:

The financial sector is more committed than ever to supporting the economy and businesses. In addition to extending the payment deferrals for business loans, a commitment that goes beyond what is allowed within the European framework, banks continue to provide credit to businesses. Credit provision remained stable in 2020, despite the economic crisis we are facing.

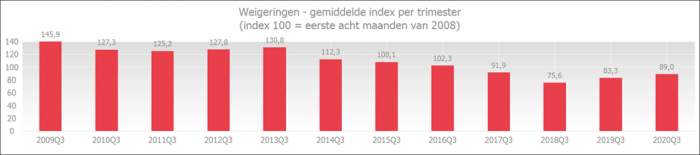

- The ongoing efforts of banks to provide credit to businesses are evident in the low rejection rate.

- The rejection rate has only slightly increased compared to the rejection rate in the third quarters of the previous two years and still remains historically low. Banks continue to provide credit fairly readily, despite the lockdown and the challenging economic situation, which is likely to negatively impact the quality of many loan applications.

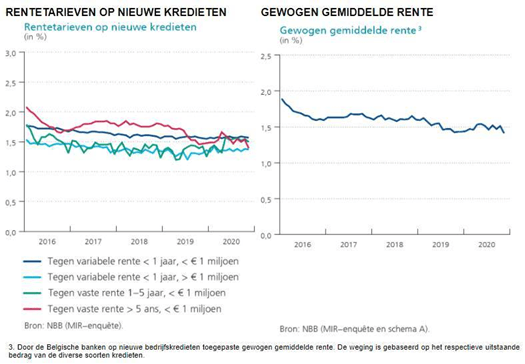

- Furthermore, this credit is being offered at very low interest rates, which are favorable to entrepreneurs. According to data from the National Bank of Belgium (NBB), the weighted average interest rate on new corporate loans in November 2020 was at a very low level, specifically 1.41% (compared to 1.52% in August 2020).

- What we have observed is that due to the economic crisis, there is reduced demand from businesses for loans, including those for financing fixed investments. This is also evident in the monthly ERMG update from the NBB (edition dated November 17, 2020), where businesses indicate that the COVID-19 crisis reduced investments by 25% in 2020. Entrepreneurs still expect a 20% decrease in investments for 2021 compared to a normal situation (ERMG update of January 2021).

Use of state guarantee loans: now and in the future

The government, in consultation with the NBB and the financial sector, has developed state guarantee schemes for new loans. The financial sector is supportive of these schemes and is also actively promoting them to entrepreneurs.

Some figures regarding the use of the guarantee schemes:

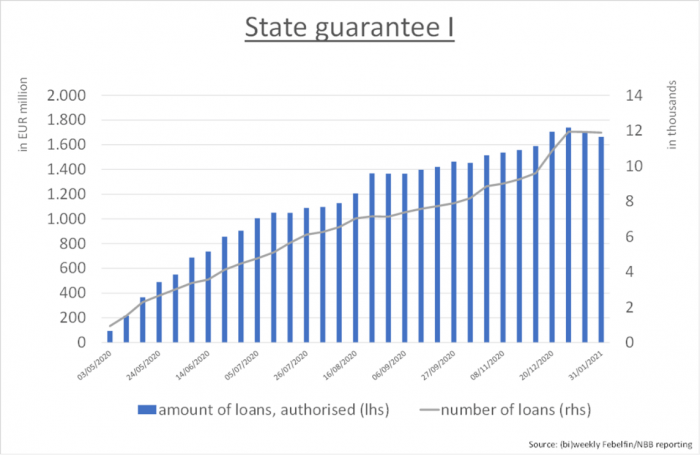

- State Guarantee Scheme I: This guarantee scheme has ended, and it was used for €1.739 billion (as of 3/01/2021) in granted amounts. This outstanding amount will gradually decrease as these loans come to maturity. This guarantee scheme could be used for loans to all businesses, for a maximum term of 1 year

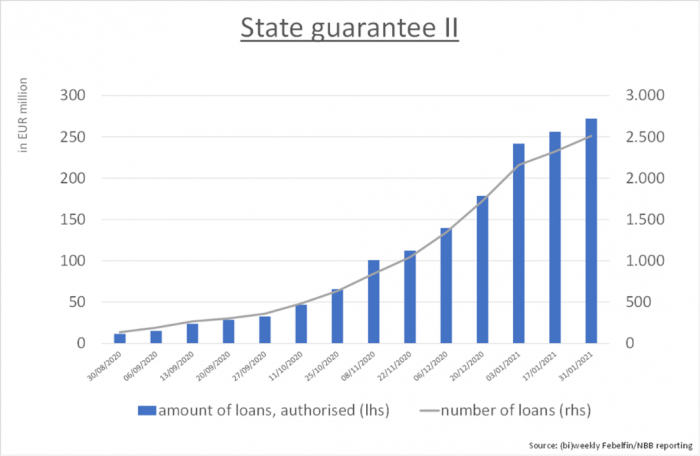

- State Guarantee Scheme II: Up to now, this guarantee scheme has been used for €272 million (as of 31/01/2021) in granted amounts. However, it is worth noting that usage doubled in the last month. This guarantee scheme can be used for loans to SMEs, with terms of more than one year up to a maximum of 5 years.

The figures indicate that the use of the second state guarantee scheme is still limited today. However, its use is on the rise, and we can expect this increase to continue in the future.

As support measures decrease and businesses restart or generate more revenue, we expect companies to require new loans again, which can be guaranteed by this second state guarantee scheme.

Additionally, loans granted under the first state guarantee scheme will come due, and a portion of them can be refinanced through the second state guarantee scheme.

Some explanations for the current limited use:

- Due to the government support received by businesses and the ability to defer many payments (VAT, social contributions, bank loan repayments), businesses affected by the COVID-19 crisis (which could potentially require state guarantees) may not immediately need credit.

- State Guarantee Scheme II only applies to SMEs, whereas State Guarantee Scheme I covered loans to all businesses. Also, the fact that State Guarantee Scheme II cannot be used for refinancing loans (except loans under State Guarantee Scheme I) limits its use.

- Entrepreneurs prefer loans with very favorable interest rates. The average interest rate for new loans was 1.41% in November 2020. For loans with State Guarantee Scheme II, businesses must pay an additional government premium of 50 basis points for loans with a term of up to 3 years and 100 basis points for loans with a term of more than 3 years up to 5 years. Businesses often seek cheaper alternatives.

- Additionally, regional guarantees are still widely used, significantly meeting the needs of businesses.

The above figures indicate that lending to businesses has remained robust during this crisis. This demonstrates that banks are fully fulfilling their societal role.

Banks will always make every effort to support businesses in lending as effectively as possible. They are also legally obligated to offer the most appropriate credit in line with the needs and profile of the business. This is the role and duty of banks, and they intend to continue fulfilling it, both now and in the future.

The sector regrets that the intensive efforts of the past months to provide individuals and businesses with the necessary support are being undermined by certain reports. We are always willing to engage in further dialogue on this matter and provide the correct context.

Focus on the Reporting Center

Febelfin established a Reporting Center at the beginning of the COVID-19 crisis. We would like to once again urge businesses to make use of it. We are happy to provide information on all questions that entrepreneurs have about the support measures in the context of this COVID-19 crisis.