2019 breaks all records in mortgage credit

31 January 2020 - 11 min Reading time

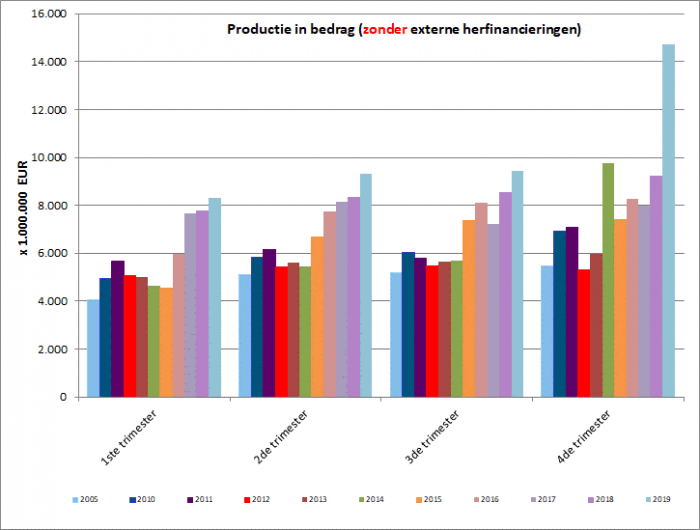

In 2019, almost 310,000 mortgage loan agreements were concluded for a total amount of almost EUR 42 billion (excluding refinancings). Lending broke all records, especially in the second half of the year. The announced abolition of the housing bonus in Flanders is of course not surprising. This is evident from the statistics on mortgage credit that the Professional Association of Credit (BVK) published today.

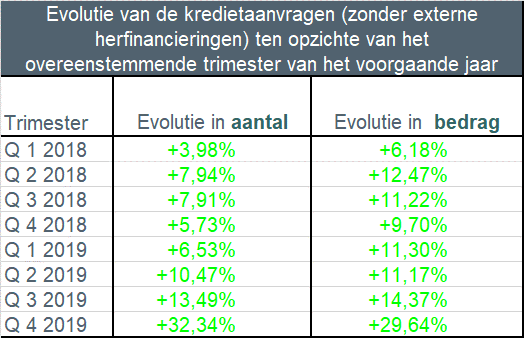

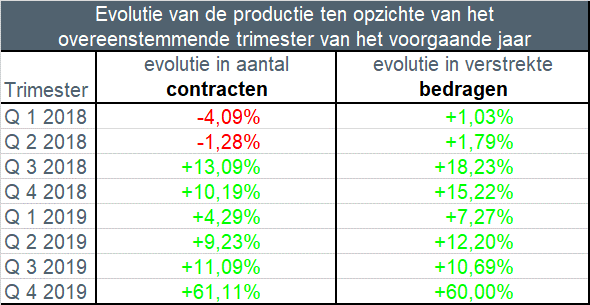

Excluding refinancings, the number of loan applications increased by almost 16% in 2019. There was also an increase in amount of almost 17%. The number of credit agreements granted increased by just over 22% compared to 2018. The corresponding amount increased by almost 24%.

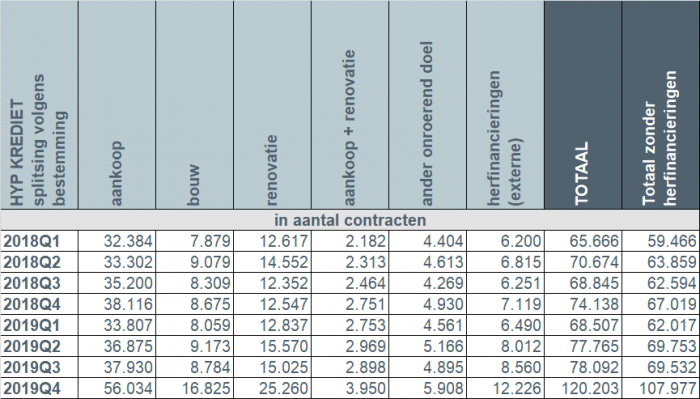

This increase in the number of loans granted occurred regardless of the destination, and especially for the construction, renovation or purchase with renovation of a home.

More specifically, in the last quarter of 2019, lending increased spectacularly. The number of loan applications, excluding refinancings, increased by more than 32% in the fourth quarter of 2019 compared to the last quarter of 2018. The amount also increased by approximately 30%.

Ultimately, approximately 108,000 mortgage loan agreements were concluded in the fourth quarter of 2019 for a total amount of approximately EUR 14.7 billion (excluding refinancings), an absolute record. This is an increase in the number of credit agreements granted by approximately 61% compared to the fourth quarter of last year. In terms of amount, 60% more credit was provided than then.

Low interest rates and changed taxation in Flanders are driving lending to unprecedented levels

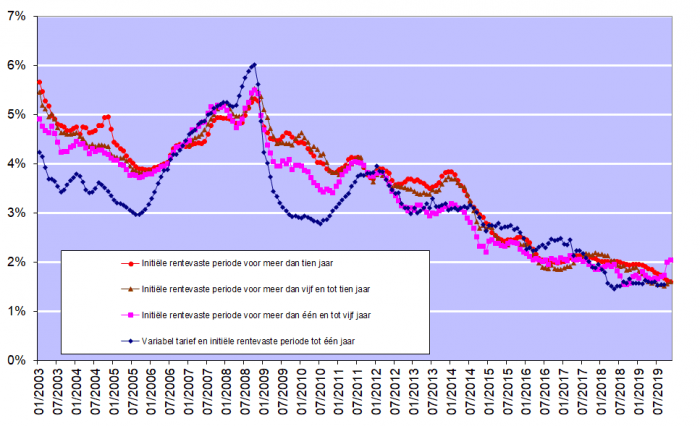

Very low interest rates for mortgage loans continued to stimulate demand throughout the year. According to figures published by the National Bank of Belgium, in November they amounted to between 1.61% (for credits with a variable interest rate and an initial interest rate fixation period for more than ten years) and 2.05% (for credits with an initial interest rate fixation period for more than one and up to five years).

But the announced abolition of the housing bonus in Flanders in particular has pushed lending to unprecedented levels in the fourth quarter.

Below you will find the most important findings for the entire year of 2019, with a specific focus on the fourth quarter of 2019 compared to the fourth quarter of 2018.

Bij deze cijfers zijn de herfinancieringen buiten beschouwing gelaten.

2019:

- The number of credit applications (excl. those for refinancing) was almost 16% higher in 2019 compared to 2018. The amount of credit applications also increased by almost 17%. 412,000 loan applications were submitted for a total amount of just over EUR 60 billion.

- In 2019, almost 310,000 mortgage loans (excl. refinancings) were ultimately granted for a total amount of almost EUR 42 billion. Mortgage loans granted increased by more than 22% in 2019. The corresponding amount increased by 23.7%.

- There has been an increase in lending across all purposes. The number of loans for the renovation of a home saw the strongest increase in percentage terms, namely +32% or 16,600 loans more than in 2018. The number of loans for the purchase of a home (+25,600) was 18.5% higher in 2019 than in 2019. in 2018. The number of loans for purchase with renovation (+2,860) increased by 29.5%, while the number of construction loans (+8,900) was 26.2% higher. The number of loans for other purposes (e.g. garage or building land) (+2,300) increased by 12.7%.

- The number of external refinancings (+8,900) increased by 33.7% in 2019 compared to 2018. In particular, just over 35,000 external refinancings were provided in 2019 for a total amount of almost EUR 4.5 billion.

Focus on the fourth quarter of 2019 compared to the fourth quarter of 2018:

- The number of credit applications (excl. those for refinancing) was almost 32.5% higher in the fourth quarter of 2019 compared to the fourth quarter of 2018. The amount of credit applications also increased by almost 30%. Nearly 120,000 loan applications were submitted for a total amount of more than EUR 17 billion.

- Mortgage loans granted increased by approximately 61% in the fourth quarter of 2019. The corresponding amount also increased by 60%. Approximately 108,000 loans were thus granted for a total amount of EUR 14.7 billion (excl. refinancings).

- December in particular broke all records: 55,000 loans were granted, an increase of 140% compared to December 2018. Twice as many loans for the purchase and purchase with renovation of a home were provided in that month than in December 2018 and even three times as many construction loans and renovation loans.

- There is an increase in lending across all purposes in the fourth quarter. The number of loans for the renovation of a home showed the strongest increase in percentage terms, namely +101% or 12,700 loans more than in the fourth quarter of 2018. The number of construction loans (+8,150) was 94% higher in the fourth quarter of 2019 than in the fourth quarter of 2019. in the fourth quarter of 2018. The number of loans for purchase with renovation (+1,199) increased by 43.5%, while the number of loans for the purchase of a home (+17,920) was 47% higher. The number of credits for other purposes (e.g. garage or building land) (+978) increased by 20%.

- The number of external refinancings (+5,107) increased by 71.7% in the fourth quarter of 2019 compared to the fourth quarter of 2018. In particular, just over 12,200 external refinancings were provided in the fourth quarter of 2019 for a total amount of approximately EUR 1.5 billion.

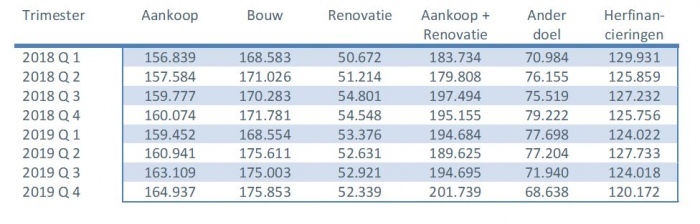

- The average amount of credits for purchase + renovation rose above EUR 200,000 for the first time. The average amount borrowed for the purchase of a home also increased slightly in the fourth quarter of 2019 to EUR 165,000. The average amount for a construction loan also stabilized in the fourth quarter of 2019 at around EUR 175,000.

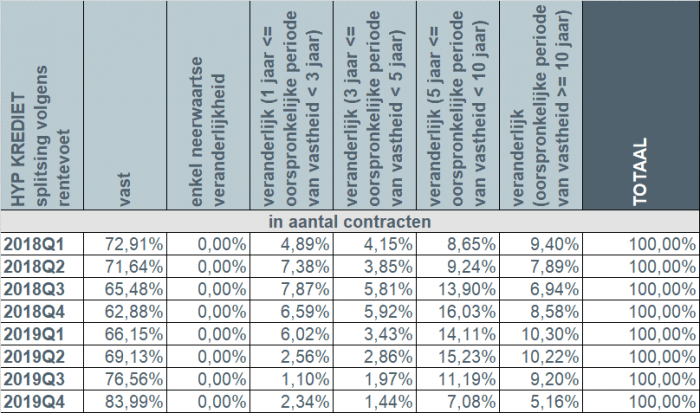

- In the fourth quarter of 2019, approximately 90% of borrowers opted for a fixed interest rate or a variable interest rate with an initial interest rate fixation period of at least 10 years. Only 2% of borrowers still opted for an annually variable interest rate.

Number of credit applications

The number of credit applications, excluding those relating to external refinancing, increased by 32.5% during the fourth quarter of 2019 compared to the same quarter of last year. The underlying amount of loan applications also increased by approximately 30%.

Nearly 120,000 loan applications were submitted in the fourth quarter of 2019 for a total amount of more than EUR 17 billion.

The number of credit applications increased for all purposes. The number of loan applications for the construction of a home (+5,704, or +54.3%) and for the renovation of a home (+12,375, or +84.5%) increased significantly. Loan applications for the purchase of a home (+10,014) increased by 18.6%, those for the purchase + renovation of a home (+685) by 13.7%, as did the number of credit applications for other purposes (e.g. garage or building land) (+429, or +6.8%).

In addition, in the fourth quarter of 2019, the number of applications for external refinancing increased by 56%.

Unprecedented number of loans granted in the fourth quarter

In the fourth quarter of 2019, the number of loans granted, excluding external refinancings, increased by just over 61% compared to the fourth quarter of 2018. The corresponding amount increased by 60%.

The total amount of loans granted in the fourth quarter thus reaches the highest level ever granted in a quarter.

Increase in the number of credits, regardless of purpose

Nearly 108,000 new loans were granted in the fourth quarter of 2019 for a total amount of approximately EUR 14.7 billion - excluding external refinancings.

The month of December in particular broke all records: 55,000 loans were granted, an increase of 140% compared to December 2018. In that month, twice as many loans were granted for the purchase and purchase with renovation of a home than in December 2018 and even three times as many construction loans and renovation loans.

Compared to the fourth quarter of last year, an increase was observed across all destinations.

The number of loans for the renovation of a home showed the strongest increase in percentage terms, namely +101% or 12,700 loans more than in the fourth quarter of 2018. The number of construction loans (+8,150) was 94% higher in the fourth quarter of 2019 than in the fourth quarter of 2019. in the fourth quarter of 2018. The number of loans for purchase with renovation (+1,199) increased by 43.5%, while the number of loans for the purchase of a home (+17,920) was 47% higher. The number of credits for other purposes (+978) increased by 20%.

In addition, the number of external refinancings also increased by 71.7% in the fourth quarter of 2019. In particular, 12,200 external refinancings were provided for a total amount of approximately EUR 1.5 billion.

Average amount of a credit for purchase with renovation of a home for the first time above EUR 200,000

The average amount of a loan for the purchase of a home + renovation rose above EUR 200,000 for the first time in the fourth quarter.

The average amount of a loan for the purchase of a home also increased slightly in the fourth quarter of 2019 to EUR 165,000.

The average amount of a loan for the construction of a home remained stable during the fourth quarter of 2019 at approximately EUR 175,000.

Nearly 9 out of 10 borrowers opt for a fixed interest rate

In the fourth quarter of 2019, almost 9 in 10 borrowers (89.2%) opted for a fixed interest rate or a variable interest rate with an initial interest rate fixation period of at least 10 years. About 8.5% of borrowers opted for a variable interest rate with an initial interest rate fixation period between 3 and 10 years. Only 2% of borrowers opted for an annually variable interest rate.

Taking into account the still very low interest rates (see graph below), Belgian consumers continue to largely opt for certainty. Only 1 in 10 still chooses a variable interest rate. But even in the event of a variable interest rate, the consumer is strongly protected by the legislation. For example, the variable interest rate after adjustment to the evolution of the applicable reference indices can never amount to more than double the initial interest rate.

Responsible mortgage lending remains the starting point

Despite the absolute record amount of mortgage loans granted in the fourth quarter of 2019 and the year 2019 as a whole, including as a result of changed tax incentives, the credit sector is and remains aware that mortgage lending must be done with great care and that responsible lending must remain the absolute starting point.

On this point, the sector is on the same page as the regulator: lenders must exercise the necessary caution to, on the one hand, prevent individual borrowers from taking out loans that are too large and, on the other hand, to safeguard financial stability in the long term.

As recently confirmed by the National Bank of Belgium on the basis of the Central Bank for Credit to Private Individuals, default indicators are improving for the third year in a row. As far as mortgage credit is concerned, the default rate remains below 1%.