Figures UCITs sector 4th quarter 2021

25 March 2022 - 8 min Reading time

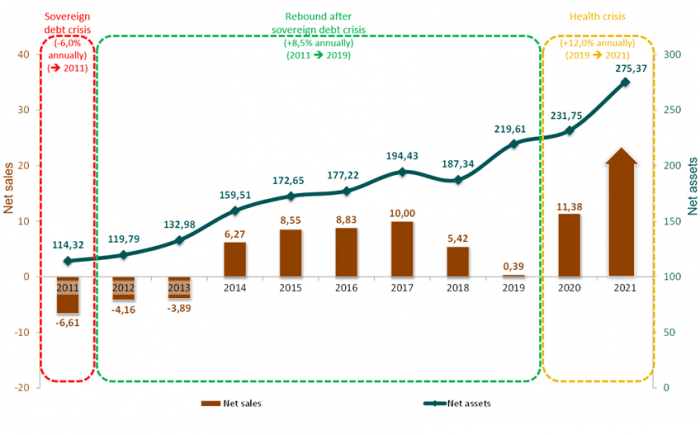

During the fourth quarter of 2021, the Belgian fund sector experienced an increase of +4.5%, primarily driven by net subscriptions. By the end of December 2021, the net assets of funds publicly distributed in Belgium amounted to 275.4 billion EUR.

- The net assets of funds mainly investing in non-fixed-income securities, such as mixed funds and equity funds, increased by +4.7% during this period. Mixed funds saw the largest absolute increase in their net assets during the fourth quarter of 2021. Within this category of mixed funds, pension savings funds witnessed a growth of 1.0 billion EUR during the period from October to December 2021.

- The net assets of funds primarily investing in fixed-income securities recorded an increase of +3.9% during the fourth quarter of 2021.

Funds investing in non-fixed-income securities experienced gains in their underlying assets' value during the fourth quarter, supplementing the net subscriptions in these funds.

Funds investing in fixed-income securities incurred losses in the value of their underlying assets during the fourth quarter. However, these losses were fully compensated by net subscriptions.

Full Year

By the end of 2020, the net assets of publicly distributed funds in Belgium amounted to 231.7 billion EUR. During 2021, the Belgian fund sector saw quarterly growth in net assets, with net subscriptions in every quarter of the year. Additionally, apart from the third quarter, there were gains in asset values in each quarter of 2021.

Due to net subscriptions and gains in asset values, the net assets of publicly distributed funds in Belgium at the end of 2021 were 18.8% higher than the previous year, amounting to 43.6 billion EUR.

First Quarter 2022 Forecast

Preliminary indications for the first quarter of 2022 suggest a decline in the net assets of the Belgian fund sector. This decline appears to be driven by uncertainty surrounding the impact of increased inflation on the global economy, possibly exacerbated by the Ukraine-Russia conflict.

Belgian Fund Market

The Belgian fund market is defined as the "net assets of funds distributed publicly in Belgium, whether Belgian or foreign." BEAMA reports on all share classes of public funds that can be marketed in Belgium.

In accordance with the list of public institutions for collective investment on the FSMA website.

BEAMA's research indicates that the net assets of publicly marketed funds in Belgium increased by 11.9 billion EUR, or +4.5%, during the fourth quarter of 2021. As a result, publicly marketed funds in Belgium represented 275.4 billion EUR by the end of December 2021.

The increase in the Belgian fund market during the October to December 2021 period was mainly explained by net subscriptions during this period.

Throughout the entire year 2021, the Belgian fund market grew by 43.6 billion EUR, or +18.8%. This increase is attributed to net subscriptions accounting for 70% of the growth and asset gains in the underlying assets making up the remaining 30%.

According to statistical data from the NBB (National Bank of Belgium), the first nine months of 2021 were marked by significant reallocations of household savings into funds. The funds held by individuals represented the fastest-growing financial asset category during this period. This observation may reflect an increasing awareness among investors regarding the opportunity cost associated with various forms of saving and investing.

Opportunity costs, also known as alternative costs, are the costs of an economic choice expressed in terms of the best foregone opportunity: it quantifies the unrealized gain from the best possible alternative in comparison to the decision ultimately made. In other words, it represents the value of what you could have gained from your next best alternative when you make a choice or decision. These costs are important in decision-making and economic analysis because they help individuals and businesses assess the true cost and benefits of their choices.

Especially in an environment of ultra-low interest rates and rising inflation, it can be beneficial to utilize other financial assets, on top of savings deposits, which, on average, offer higher returns.

The continued demand for funds observed in 2021 indicates that investors maintain confidence in the potential returns offered by funds.

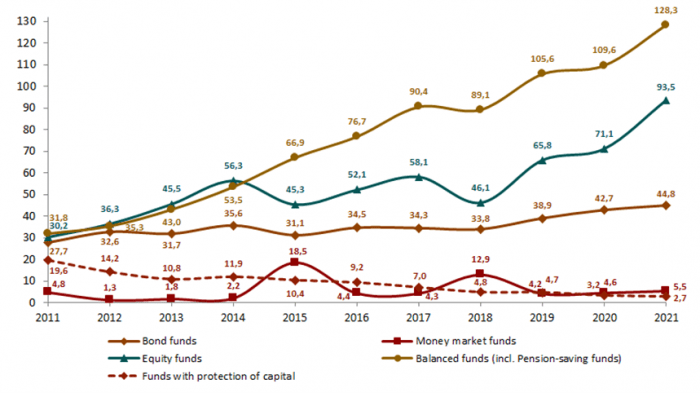

Throughout the entire year 2021, equity funds were both the strongest relative and absolute growth driver, with an increase of 31.6%, or 22.4 billion EUR.

In addition to equity funds, all other asset classes, except capital-protected funds, saw their marketed assets increase during 2021. Capital-protected funds represented the smallest asset class by the end of 2021. Preliminary indications available to BEAMA for the first quarter of 2022 suggest a decline in the net assets of the Belgian fund sector.

Funds Mainly Investing in Non-Fixed-Income Securities

Within the group of funds primarily investing in non-fixed-income securities (such as equity funds), only upward trends were recorded during the fourth quarter of 2021. These increases are attributed to net subscriptions for 2/3 of the growth and asset gains in the underlying assets for the remaining 1/3.

The assets in Belgium of equity funds increased by 4.9 billion EUR, or +5.6%, during the October to December 2021 period. This increase is almost entirely attributed to net subscriptions. As of the end of December 2021, the assets of equity funds stood at 93.5 billion EUR, surpassing their level at the end of 2019 (pre-Covid-19) by 27.8 billion EUR.

The category of mixed funds (including pension savings funds) saw an increase of 5.0 billion EUR, or +4.1%, during the fourth quarter of 2021. More than half of this increase is attributed to net subscriptions, while slightly less than half is due to asset gains in the underlying assets. This raised the marketed assets of mixed funds to 128.3 billion EUR by the end of December 2021, which is 22.7 billion EUR above their level at the end of 2019 (pre-Covid-19).

Mixed funds have enjoyed increasing popularity in recent years and have been the largest asset class since 2015. Thanks to their active asset allocation, mixed funds are well-suited for implementing risk diversification policies under MiFID II, making them an excellent choice for aligning a product with a client's risk profile.

Within the category of mixed funds, pension savings funds experienced an increase of 1.0 billion EUR, or +4.0%, during the fourth quarter of 2021. By the end of December 2021, pension savings funds represented net assets totaling 25.5 billion EUR. This marked a new record in marketed assets for pension savings funds. During the fourth quarter of 2021, pension savings funds recorded net subscriptions amounting to 314 million EUR.

Capital-protected funds maintained a status quo during the fourth quarter of 2021 and represented assets of 2.7 billion EUR by the end of December 2021.

Throughout the entire year 2021, the net assets of funds primarily investing in non-fixed-income securities increased by 22.0%, equivalent to 40.7 billion EUR.

Funds Mainly Investing in Fixed-Income Securities

Within the group of funds primarily investing in fixed-income securities, the assets of publicly marketed bond funds in Belgium increased by 0.2 billion EUR, or +0.5%, during the fourth quarter of 2021, bringing their total to 44.8 billion EUR by the end of December 2021. This increase is entirely attributed to net subscriptions.

The net assets of monetary or money market funds increased by 1.7 billion EUR, or +43.9%, during the October to December 2021 period.

This increase is primarily the result of a technical intervention in the portfolios of mixed umbrella funds. Given the indications of volatile markets during the fourth quarter, asset managers of umbrella funds exchanged a portion of their underlying bond funds and more volatile equity funds for stable monetary funds to mitigate the impact of the temporary downturn in financial markets. Furthermore, net subscriptions to monetary funds may also indicate increasing risk aversion.

Throughout the entire year 2021, the net assets of funds primarily investing in fixed-income assets increased by 6.3%, equivalent to 3.0 billion EUR.

This increase in bond funds is characteristic. After seven years of slight fluctuations, bond funds grew by 14.9%, 9.8%, and 4.9% in 2019, 2020, and 2021, respectively.

Funds under Belgian Law:

Publicly distributed funds under Belgian law:

By the end of December 2021, publicly distributed funds under Belgian law had a total managed net assets of 211.3 billion EUR. At that time, pension savings funds roughly represented 1/8th of publicly distributed funds under Belgian law.

The calculation of the average annual return of pension savings funds as of December 31, 2021, yields the following results:

- 1 year: +11.7% (note: this measurement starts relatively shortly after the Covid-19 low point).

- 3 years: +9.4%

- 10 years: +6.9%

- 25 years: +5.9%

BEAMA has developed a dashboard for pension savings funds, which is attached to this press release. This dashboard provides a concise visual representation of key figures regarding third-pillar pension savings funds and their evolution on a quarterly basis.

Non-publicly distributed institutional funds under Belgian law:

Since the implementing Royal Decrees were published in the Belgian Official Gazette on December 18, 2007, investment vehicles tailored to institutional investors can be developed in the form of "Institutional ICB with a variable number of participation rights." These institutional funds are non-public funds that must be registered with the Federal Public Service (FPS) Finance.

These institutional funds should not be confused with publicly distributed funds with non-retail share classes, which are registered with the Financial Services and Markets Authority (FSMA).

By the end of December 2021, the 111 institutional compartments under Belgian law represented 25.3 billion EUR in net assets. These funds attract many institutional investors and contribute significantly to the institutional markets in terms of financial assets and pension formation.