Figures UCITs‑sector 4th quarter 2019

20 May 2020 - 10 min Reading time

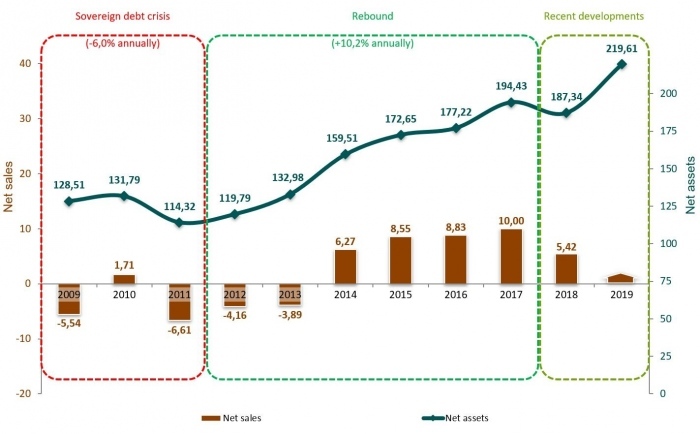

The Belgian fund sector saw an increase of 8.8% during the fourth quarter of 2019 due to gains in asset values and net subscriptions. By the end of December 2019, the net assets of publicly distributed funds in Belgium amounted to EUR 219.6 billion.

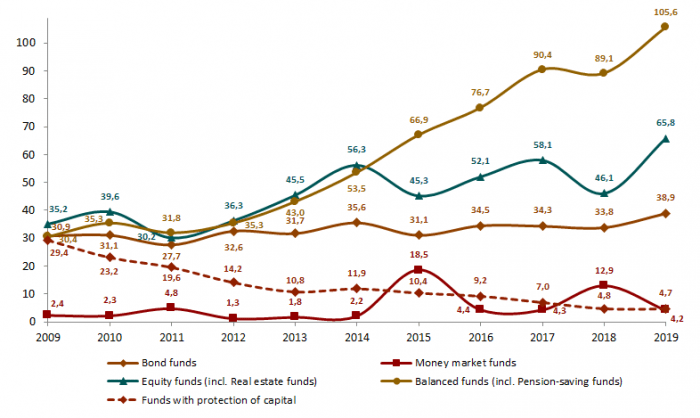

The net assets of funds mainly investing in fixed-income securities rose by 3.7% during the fourth quarter of 2019. On the other hand, the net assets of funds primarily investing in non-fixed income securities, such as balanced funds and equity funds, increased by 10.1% during the same period.

Among mixed funds, pension savings funds continued to grow during the period from October to December 2019, with an increase of EUR 0.9 billion, reaching an "all-time high" net asset value of EUR 21.3 billion by the end of 2019.

Monetary funds were the only fund category to experience a decline in net assets during the fourth quarter of 2019, mainly due to significant net repayments related to portfolio technical interventions.

Equity funds showed the largest absolute increase during this period, driven by a combination of net subscriptions and gains in underlying asset values. Equity funds also had the largest relative increase, growing by 16.6%.

Full Year

At the end of 2018, the net assets of publicly distributed funds in Belgium amounted to EUR 187.3 billion.

The Belgian fund sector experienced continuous growth in net assets throughout 2019 across all quarters, with a strong performance in the final quarter. By the end of 2019, the net assets of publicly distributed funds in Belgium were 17.2% higher than the previous year.

It is worth noting that the last quarter of 2018 saw a decline in net assets, primarily due to temporary losses in asset values. However, this temporary decline was recovered during the first half of 2019.

2020 Outlook

Preliminary indications for the first quarter of 2020 point to a clear decline in net assets in March due to the impact of Covid-19 on the global economy and financial markets. The Belgian fund sector expects that the positive results of 2019 will be temporarily offset by the end of the first quarter of 2020.

The Belgian fund market has a commercialized asset base of nearly EUR 220 billion as of the end of 2019, marking a historic record.

Belgian Fund Market

The Belgian fund market is defined as the "net assets of funds publicly distributed in Belgium under Belgian and foreign law." BEAMA reports on all share classes of publicly distributed funds that can be marketed in Belgium.

According to the list of public institutions for collective investment on the FSMA website.

BEAMA's research shows that the net assets of publicly commercialized funds in Belgium increased by EUR 17.7 billion, or 8.8%, during the fourth quarter of 2019. This led to publicly commercialized funds in Belgium reaching EUR 219.6 billion by the end of December 2019, surpassing the previous "all-time high" of the previous quarter.

The increase in the Belgian fund market during the period from October to December 2019 is primarily attributed to positive market developments during this period, accounting for approximately 55%, and net subscriptions, accounting for approximately 45%.

Over the entire year 2019, the net assets of publicly distributed funds in Belgium increased by 17.2%, equivalent to EUR 32.3 billion.

In all quarters of 2019, the funds recorded gains in the values of their underlying assets. These positive movements, except for the first quarter, were complemented by net subscriptions.

On an annual basis, it can be stated that the 17.2% increase is attributed to more than two-thirds gains in asset values and slightly less than one-third net subscriptions.

The gains in asset values in 2019 completely compensated for the significant decline in the last quarter of 2018 and also contributed to additional growth in net assets.

Net subscriptions throughout 2019 indicate that, like in the four preceding years, investors sought out funds to invest their savings.

In 2019, equity funds were the fastest-growing category with an increase of 42.6%. This category was followed by mixed funds and bond funds, which recorded increases of 18.5% and 14.9%, respectively.

Monetary funds experienced a significant decline in 2019 due to these funds being included in the portfolios of mixed funds during the last quarter of 2018 as part of a bottom protection strategy and then gradually replaced with equity and bond funds during 2019.

Funds with capital protection saw a slight decrease in their commercialized assets by 1.9% during 2019, reaching a state of equilibrium.

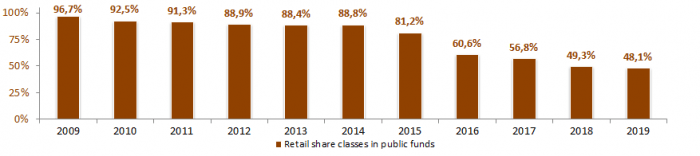

Evolution of the Belgian Fund Market Over the Last Decade

BEAMA defines retail share classes as share classes that may be offered to individuals, with a minimum (initial) investment not exceeding EUR 100,000 and with no additional conditions imposed by the fund manager. During the first half of 2016, technical refinements were made to BEAMA's statistics accordingly.

Funds Primarily Investing in Fixed-Income Securities

Within the group of funds primarily investing in fixed-income securities, assets of publicly commercialized bond funds in Belgium increased by EUR 4.4 billion, or 12.9%, during the fourth quarter of 2019, resulting in total assets of EUR 38.9 billion by the end of December 2019.

This increase is primarily explained by net subscriptions accounting for approximately two-thirds and gains in asset values accounting for approximately one-third.

The net assets of monetary or money market funds experienced a decrease of EUR 2.9 billion, or 40.5%, during the period from October to December 2019.

This decline was due to a technical intervention in the portfolios of mixed fund investment vehicles. Given the positive market developments during 2019, asset managers of mixed funds gradually replaced their underlying stable monetary funds with equity funds, among others, to benefit from the market recovery. In short, given the favorable stock market conditions, the bottom protection strategy of mixed fund investment vehicles is currently not applicable.

As a whole, the net assets of funds primarily investing in fixed-income assets increased by 3.7% during the fourth quarter of 2019, resulting in total commercialized net assets of EUR 43.1 billion by the end of December 2019.

Over the entire year of 2019, the net assets of funds primarily investing in fixed-income assets decreased by 7.8%, or EUR 3.6 billion. This decline is entirely attributable to the reduction of monetary funds, which were substantially sought after by mixed fund investment vehicles during the last quarter of 2018 for bottom protection.

Funds Primarily Investing in Non-Fixed-Income Securities

Within the group of funds primarily investing in non-fixed-income securities (such as equity funds), only upward trends were recorded during the fourth quarter of 2019. These increases are attributed to an equal combination of net subscriptions and gains in asset values.

The assets in Belgium of equity funds increased by EUR 9.4 billion, or 16.6%, during the period from October to December 2019. This increase is attributed to a combination of net subscriptions and gains in asset values. By the end of December 2019, the assets of equity funds amounted to EUR 65.8 billion.

Funds primarily investing in fixed-income securities

Within the group of funds primarily investing in fixed-income securities, the assets of bond funds publicly distributed in Belgium increased by EUR 4.4 billion, or 12.9%, during the fourth quarter of 2019, bringing their total to EUR 38.9 billion by the end of December 2019.

This increase is largely explained by approximately two-thirds of net subscriptions and one-third by gains in asset values.

The net assets of monetary or money market funds saw a decline of EUR 2.9 billion, or 40.5%, during the period from October to December 2019.

This decline resulted from a technical intervention in the portfolios of mixed fund investment vehicles. Given the positive market trends during 2019, asset managers of mixed funds gradually replaced their underlying stable monetary funds with equity funds, among others, to benefit from the market's resurgence. In short, due to the favorable stock market conditions, the bottom protection strategy for mixed fund investment vehicles is not currently relevant.

As a whole, the net assets of funds primarily investing in fixed-income securities increased by 3.7% during the fourth quarter of 2019, resulting in total commercialized net assets of EUR 43.1 billion by the end of December 2019.

Over the entire year of 2019, the net assets of funds primarily investing in fixed-income securities decreased by 7.8%, equivalent to EUR 3.6 billion. This decline is entirely attributed to the reduction of monetary funds, which had been substantially sought after by mixed fund investment vehicles during the last quarter of 2018 for bottom protection.

Funds primarily investing in non-fixed-income securities

Within the group of funds primarily investing in non-fixed-income securities (such as equity funds), only rising trends were recorded during the fourth quarter of 2019. These increases can be attributed equally to net subscriptions and gains in asset values.

The assets in Belgium of equity funds increased by EUR 9.4 billion, or 16.6%, during the period from October to December 2019. This increase can be attributed to a combination of net subscriptions and gains in asset values. By the end of December 2019, the assets of equity funds amounted to EUR 65.8 billion.

Funds Under Belgian Law

Publicly distributed funds under Belgian law

Publicly distributed funds under Belgian law had a total managed net asset value of EUR 161.2 billion at the end of December 2019. At the same time, pension savings funds represented EUR 21.3 billion of this total, accounting for 1/8th of the publicly distributed funds under Belgian law.

The calculation of the average annual return for pension savings funds as of December 31, 2019, yielded the following results:

- 1 year: +15.0%

- 3 years: +4.1%

- 10 years: +5.6%

- 25 years: +6.6%

BEAMA has developed a dashboard regarding pension savings funds, which is attached to this press release. Thanks to this dashboard, key figures related to third pillar pension savings funds and their evolution are visually presented in a concise manner on a quarterly basis.

Non-publicly distributed institutional funds under Belgian law

Since the implementing royal decrees were published in the Belgian Official Gazette on December 18, 2007, investment vehicles can be tailored to institutional investors under the form of "Institutional ICB with a variable number of units." These institutional funds are non-public funds that must be registered with the Federal Public Service for Finance.

These institutional funds should not be confused with publicly distributed funds with non-retail share classes, which are registered with the Financial Services and Markets Authority (FSMA).

At the end of December 2019, the 127 institutional compartments under Belgian law represented EUR 15.9 billion in net assets. These funds attract many institutional investors and contribute significantly to the institutional markets in terms of financial assets and pension provision.