Figures for the UCITS sector in the 4th quarter of 2022

9 June 2023 - 8 min Reading time

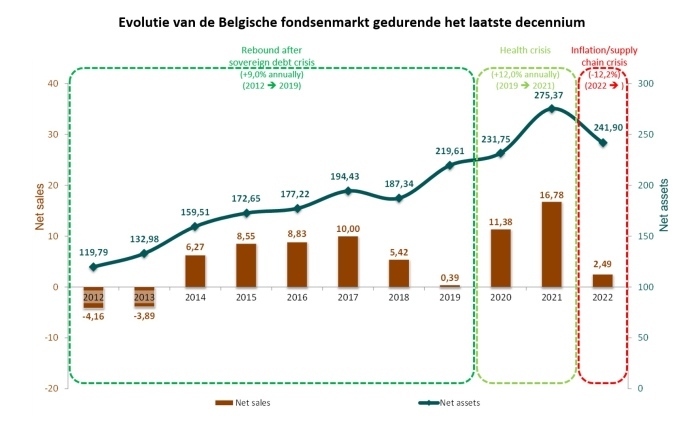

The Belgian fund sector saw an increase of +2.6% during the fourth quarter of 2022, driven by capital gains recorded in the underlying assets. By the end of December 2022, the net assets of funds publicly distributed in Belgium amounted to 241.9 billion EUR.

- The net assets of funds primarily investing in non-fixed-income securities, such as mixed funds and equity funds, increased by +3.1% during this period. Pension savings funds experienced the largest relative growth in their net assets during the fourth quarter of 2022, with mixed funds showing the largest absolute increase.

- The net assets of funds primarily investing in fixed-income securities recorded a +0.8% increase during the fourth quarter of 2022.

Funds investing in fixed-income securities saw modest capital gains in their underlying assets during the fourth quarter, which were complemented by net subscriptions.

Funds investing in non-fixed-income securities recorded capital gains in their underlying assets during the fourth quarter. These capital gains offset the net redemptions in these funds, primarily observed in mixed funds.

Full Year

By the end of 2021, the net assets of publicly distributed funds in Belgium amounted to 275.4 billion EUR. The Belgian fund sector experienced a decline in net assets during the first nine months of 2022 in each quarter due to capital losses on the underlying assets, despite net subscriptions in each quarter. However, in the fourth quarter of 2022, a recovery occurred due to capital gains on the underlying assets, somewhat offset by net redemptions during this period.

For the full year 2022, there were net subscriptions totaling 2.49 billion EUR. However, due to capital losses in the underlying assets, the net assets of publicly distributed funds in Belgium were 12.2% lower, or 33.5 billion EUR less, than at the end of 2021.

It's important to note that as an investor, these capital losses only translate into actual capital losses when you sell your funds.

Forecast for the First Quarter of 2023

Preliminary indications for the first quarter of 2023 suggest a continued recovery in the net assets of the Belgian fund sector, driven by a strong start in the stock market. However, caution is still required due to uncertainty regarding the global economic outlook, interest rates, and banking stress, leading to price fluctuations in financial products. Cooling inflation could positively impact financial markets.

"The Belgian fund market recorded a recovery of 2.6% during the fourth quarter of 2022 due to capital gains in the underlying assets, resulting in total assets under management of 242 billion EUR."

Belgian Fund Market (in accordance with the list of collective investment institutions on the FSMA website)

The Belgian fund market is defined as 'the net assets managed in Belgium of funds governed by Belgian and foreign law that are publicly distributed.' BEAMA reports on all share classes of public funds that can be marketed in Belgium.

BEAMA's research shows that the net assets of publicly distributed funds in Belgium increased by 6.2 billion EUR or +2.6% during the fourth quarter of 2022. This brought the net assets of publicly distributed funds in Belgium to 241.9 billion EUR by the end of December 2022.

The rise in the Belgian fund market during the period of October - December 2022 is entirely explained by capital gains on the underlying assets during this period.

Despite noticeable capital gains in the underlying assets, net redemptions were recorded in the Belgian fund market in the fourth quarter of 2022.

The year 2022 started off difficultly due to the impact of rising inflation on the global economy, the ongoing war in Ukraine, Covid-19 issues, and the global supply chain crisis. The first nine months of 2022 were characterized by negative price figures.

In addition, the gradual increase in interest rates by central banks initially had a negative impact on the valuation of existing bonds and (mainly growth) stocks. On the other hand, this development also creates opportunities for new bonds that can be issued with more attractive interest rates. Therefore, bonds saw more gains during the last half of 2022.

The last quarter of 2022 was characterized by a strong stock market rally, resulting in capital gains for the underlying assets.

For the entire year 2022, the assets under management (AUM) of the Belgian fund sector decreased by 33.5 billion EUR, or -12.2%. This decline is entirely attributable to capital losses on the underlying assets since there were net subscriptions of 2.5 billion EUR during the period from January to December 2022. Net subscriptions to funds are also confirmed by the statistical data from the NBB (National Bank of Belgium). Consequently, funds held by individuals represented the fastest-growing category of financial assets during this period.

The ongoing demand for funds, for now, indicates that investors still have confidence in funds and are aware of the opportunity costs associated with various forms of saving and investing.

The preliminary indications available to BEAMA for the first quarter of 2023 suggest a continued recovery in the net assets of the Belgian fund sector. However, caution is still required in the coming months due to uncertainty.

Funds Primarily Investing in Non-Fixed-Income Securities

Within the group of funds primarily investing in non-fixed-income securities (such as equity funds), generally rising trends were observed during the fourth quarter of 2022.

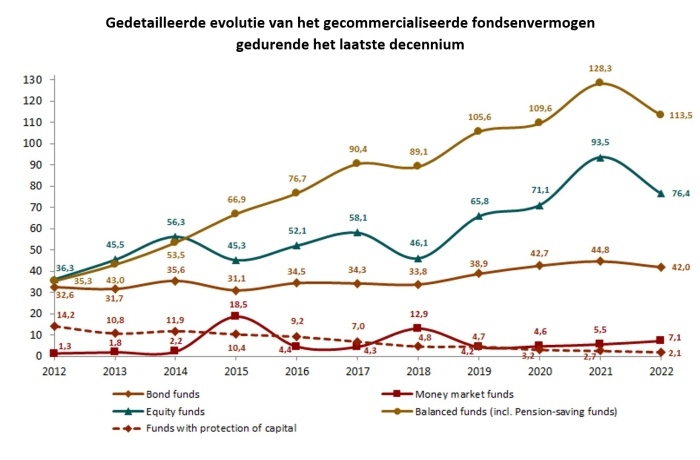

Assets in Belgium of equity funds increased by 3.0 billion EUR, or +4.1%, during the period of October - December 2022. This increase is entirely attributed to net subscriptions totaling 3.4 billion EUR. By the end of December 2022, the assets of equity funds amounted to 76.4 billion EUR.

The category of mixed funds (including pension savings funds) increased by 3.2 billion EUR, or +2.9%, during the fourth quarter of 2022. This growth is fully explained by capital gains recorded in the underlying assets. This brings the total assets under management of mixed funds to 113.5 billion EUR by the end of December 2022.

Mixed funds have seen increasing success in recent years, and since 2015, they have become the largest asset class. Due to their active asset allocation, mixed funds are very suitable for implementing a risk diversification policy under MiFID II. They are excellent for aligning the product with clients' risk profiles.

Within the category of mixed funds, pension savings funds experienced an increase during the fourth quarter of 2022, totaling 1.4 billion EUR, or +6.8%. By the end of December 2022, pension savings funds represented net assets of 22.1 billion EUR. During the fourth quarter of 2022, pension savings funds recorded net subscriptions totaling 249 million EUR.

Funds with capital protection experienced a decline during the fourth quarter of 2022 and represented assets of 2.1 billion EUR by the end of December 2022.

For the entire year 2022, the net assets of funds primarily investing in non-fixed-income securities decreased by -14.4%, equivalent to 32.3 billion EUR.

Funds Primarily Investing in Fixed-Income Securities

Within the group of funds primarily investing in fixed-income securities, the assets of bond funds publicly distributed in Belgium increased by 2.1 billion EUR, or +5.3%, during the fourth quarter of 2022, resulting in a total of 42.0 billion EUR by the end of December 2022. This increase is explained by net subscriptions accounting for 2/3 of the growth and capital gains recorded in the underlying assets accounting for the remaining 1/3.

The net assets of money market funds decreased by 1.7 billion EUR, or -19.3%, during the period from October to December 2022, bringing their total to 7.1 billion EUR by the end of December 2022. This decline is primarily attributed to net redemptions, accounting for 2/3 of the decrease.

For the full year 2022, the net assets of funds primarily investing in fixed-income securities decreased by -2.3%, equivalent to 1.2 billion EUR.

Sustainable Funds (According to SFDR Classification)

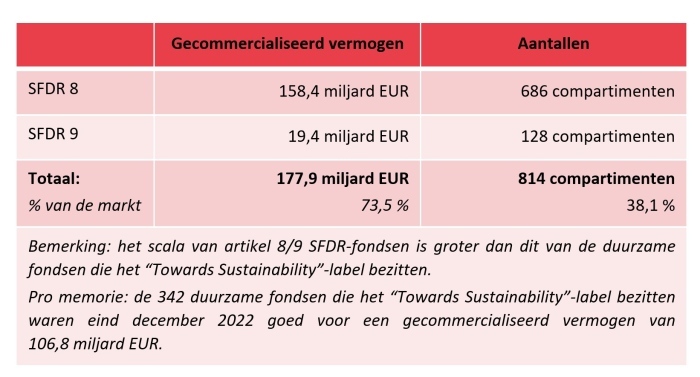

The table below provides an overview of the distribution of sustainable funds in Belgium as of the end of December 202

More than 70% of the assets distributed in Belgium are classified by asset managers as SFDR Article or SFDR Article 9 funds. Investors interested in sustainability can choose from 814 different funds.

SFDR stands for Sustainable Finance Disclosure Regulation. Article 8 refers to products that promote sustainability characteristics, and Article 9 refers to products with sustainable objectives.

Funds Under Belgian Law

Funds under Belgian law publicly distributed

Publicly distributed funds under Belgian law had a total managed net asset value of 184.0 billion EUR by the end of December 2022. At that time, pension savings funds represented almost 1/8th of publicly distributed funds under Belgian law.

The calculation of the average return of pension savings funds on an annual basis as of December 31, 2022, yields the following results:

- 1-year return: -15.9%

- 3-year return: -1.4%

- 10-year return: +3.8%

- 25-year return: +4.1%

BEAMA has developed a dashboard for pension savings funds, which is attached to this press release. This dashboard provides a concise visual representation of key figures for third-pillar pension savings funds and their evolution on a quarterly basis.

Non-Public Institutional Funds Under Belgian Law

Since the implementing royal decrees were published in the Belgian Official Gazette on December 18, 2007, investment vehicles tailored to institutional investors can be developed in the form of "Institutional ICBs with a variable number of units of participation" under Belgian law. These institutional funds are non-public funds that must be registered with the Federal Public Service Finance.

These institutional funds should not be confused with public funds with non-retail share classes registered with the FSMA (Financial Services and Markets Authority).

By the end of December 2022, the 106 institutional compartments under Belgian law had a total net asset value of 19.4 billion EUR. These funds appeal to many institutional investors and contribute depth to the institutional markets in terms of financial assets and pension provision..